Every week, we’ll profile a high yield investment fund that typically offers an annualized distribution of 6-10% or more. With the S&P 500 yielding less than 2%, many investors find it difficult to achieve the portfolio income necessary to meet their needs and goals. This report is designed to help address those concerns.

The revelation that China’s DeepSeek AI solution may be as robust as ChatGPT yet only a fraction of the cost has shaken the tech sector. The anticipated U.S. tech dominance and surge in potential earnings may not actually come to fruition and that’s why we saw such a correction in tech stocks, NVIDIA in particular, earlier this week. Tech valuations were already a bit stretched prior to this and the overconcentration of this sector in the major averages made it vulnerable to a sharp correction like this. There are still a fair number of unknowns here, but it sure looks like the landscape has changed.

The BlackRock Science & Technology Trust (BST) is one of the largest closed-end funds in the marketplace and uses a covered call approach to investing in the tech sector. The use of written call options should help mitigate some of the fund’s overall risk exposure, but given the current circumstances in the tech and AI spaces, it’s worth revisiting this fund to see how exposed it might be to current conditions.

Fund Background

BST’s objective is to provide income and total return through a combination of current income, current gains and long-term capital appreciation. The fund will invest mostly in the equity securities issued by U.S. and non-U.S. science and technology companies in any market capitalization range, selected for their rapid and sustainable growth potential. As part of its strategy, it also intends to write covered call options on a portion of the stocks in its portfolio.

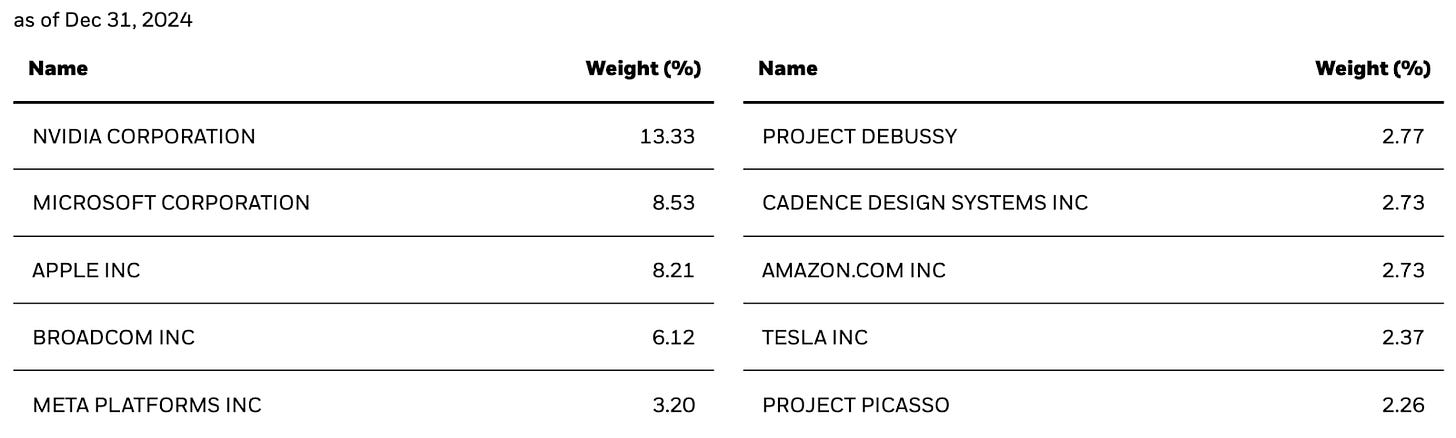

The fund’s flexibility in investing across market caps is a good thing, although in reality, the fund is a few things. It’s mostly U.S. investments, so you’re not getting a lot of global exposure. It’s also almost entirely two groups - large-caps and private equity. That actually makes BST a fairly unique fund despite a mandate that suggests it’s something broader. That raises some questions of whether or not this is something of a closet index fund with a covered call overlay. In some sense, that may be giving a lot of investors what they want - the magnificent 7 with a yield of 7-8%. It’s certainly worked in attracting interest.

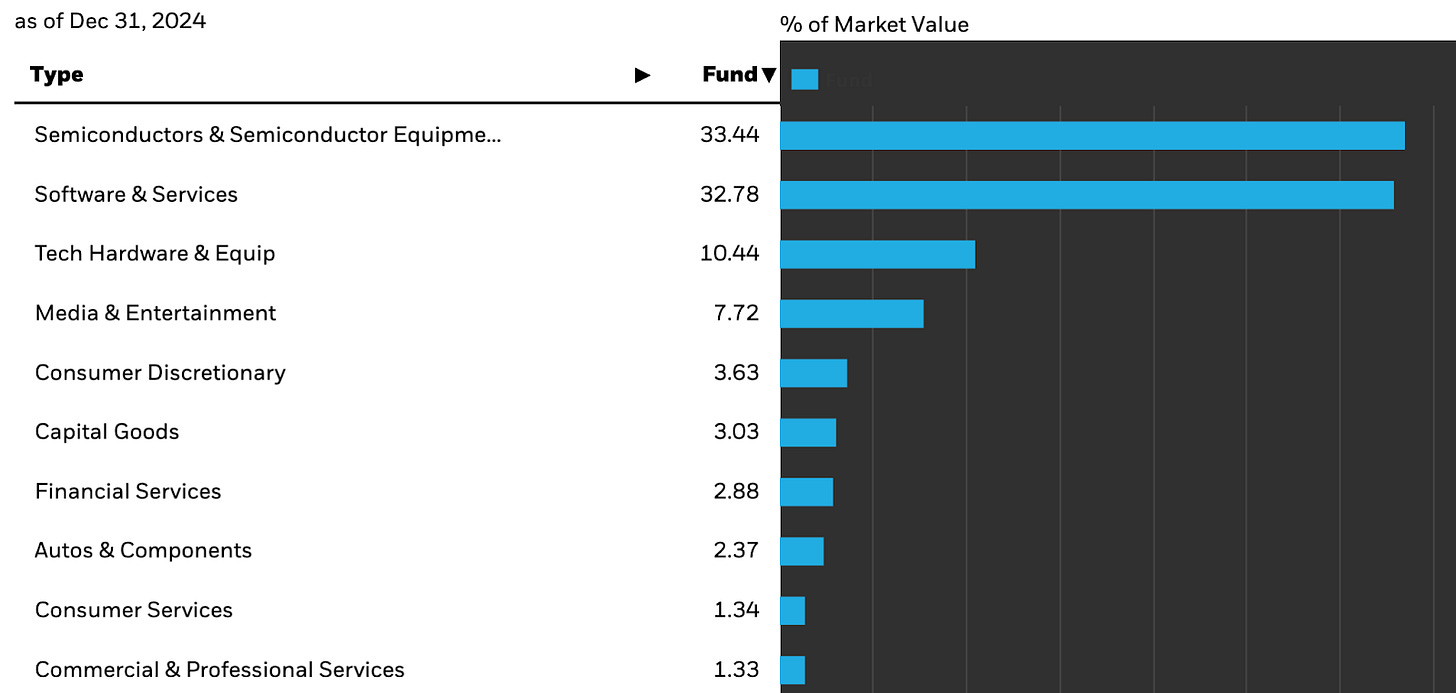

This portfolio is slightly more diversified than what you’d find in a traditional U.S. tech ETF, but not much. Software and semiconductors dominate as you’d expect, but the bottom third of the portfolio is a little more spread out. At a high level, I don’t think you’re getting substantially different tech exposure, just something that expands its definition of science & technology somewhat.

Six of the fund’s top 9 holdings are magnificent 7 names with only Alphabet being absent from the top 10 (it is in the portfolio, just a little further down the list). Broadcom is essentially just one step outside the mag 7, so the fund’s exposures should feel very familiar.

Project Debussy and Project Picasso are code names for private equity investments and have been in BST’s portfolio for a while. Blackrock’s clout in the industry is certainly of benefit here in allowing access to a mostly unavailable asset class. Those are obviously riskier investments and present some liquidity risk, but they do give BST more of a unique feel.

BST was launched in October 2014. Since its inception, the fund has returned a total of 293%, which translates to just under 15% annually.

A 15% annual return from a covered call fund is fairly impressive. At a 7-8% distribution rate, that obviously means there’s been more than enough in capital gains to cover the distribution and that’s reflected in the 100%+ gain in the fund’s NAV over time. BST only has a 33% covered call overlay, so investors are still getting a fairly substantial amount of share price upside in addition to the yield. That’s history though. If tech is about to experience a mean reversion in valuations or operating environment in general, those distributions could be having a tougher time getting filled.