Every week, we'll profile a high yield investment fund that typically offers an annualized distribution of 6-10% or more. With the S&P 500 yielding less than 2%, many investors find it difficult to achieve the portfolio income necessary to meet their needs and goals. This report is designed to help address those concerns.

The high yield fixed income market has been showing surprising resilience despite recent economic headwinds. Despite concerns about rising inflation and potential central bank policy shifts, below investment grade bonds have maintained relatively stable spreads. The appetite for yield remains strong in this environment, with investors seemingly willing to accept additional credit risk in exchange for higher income potential. The high yield sector, particularly in the higher-quality BB to B range, has become an increasingly attractive area for income-focused investors trying to navigate the current interest rate environment.

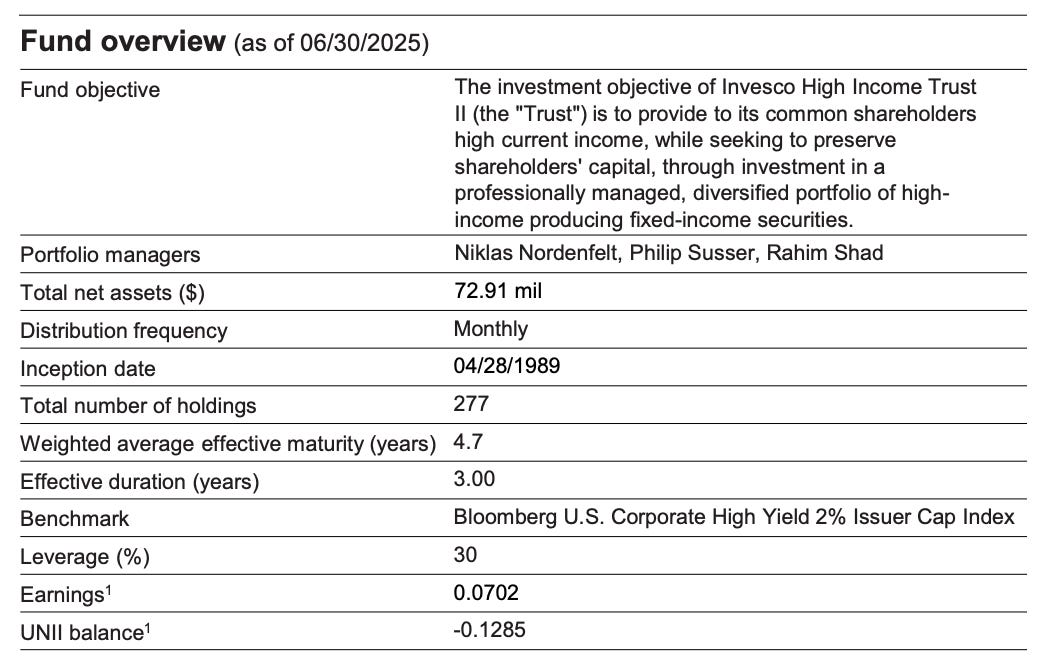

The Invesco High Income Trust II (VLT) offers investors exposure to this segment of the fixed income market with a focus on generating substantial income. This closed-end fund concentrates primarily on below investment grade securities while employing professional management to navigate credit risks. Could VLT be the right vehicle for income-seeking investors in today's challenging yield environment?

Fund Background

VLT's investment objective is to provide high current income, while seeking to preserve shareholders' capital through investment in a professionally managed diversified portfolio of income-producing fixed income securities. It invests in a diversified portfolio composed primarily of fixed-income securities rated below investment grade (those rated between BB and C or the equivalent, if unrated by S&P).

VLT's focus on the below investment grade market provides investors with enhanced yield potential, but naturally comes with increased credit risk. The fund's management team employs active credit selection to mitigate some of these risks, though volatility will inevitably be higher than investment-grade alternatives. The fund's diversification across more than 300 securities helps reduce issuer-specific risk, which is particularly important in the high yield space.

The fund is well diversified with 6 different sectors getting allocations of at least 8%. There’s a pretty good mix across cyclical, defensive and growth areas of the market, but the overall allocation would indicate more exposure to sensitive areas of the economy.