Every week, we’ll profile a high yield investment fund that typically offers an annualized distribution of 6-10% or more. With the S&P 500 yielding less than 2%, many investors find it difficult to achieve the portfolio income necessary to meet their needs and goals. This report is designed to help address those concerns.

I’ve been pounding the table about the potential of deregulation for a little while now. While the Trump tariffs continue their on-and-off status that seems to change every couple days, deregulation could be the one thing that keeps the economic expansion going while pulling attention away from debt, deficits and dollar signs. Trump probably wants the optics of tariffs more than anything, but if his goal is simply creating an economic growth tailwind, deregulation might be his best bet.

That means focusing on sectors and themes that could benefit from regulation. Near the top of the list is healthcare & biotech. That’s why I think the BlackRock Health Sciences Term Trust (BMEZ) is an intriguing option. Outside of its focus on a potential deregulation winner, the fund recently switched to a 12% managed distribution yield program. This big combination of potential growth and high yield could be really attractive right now.

Fund Background

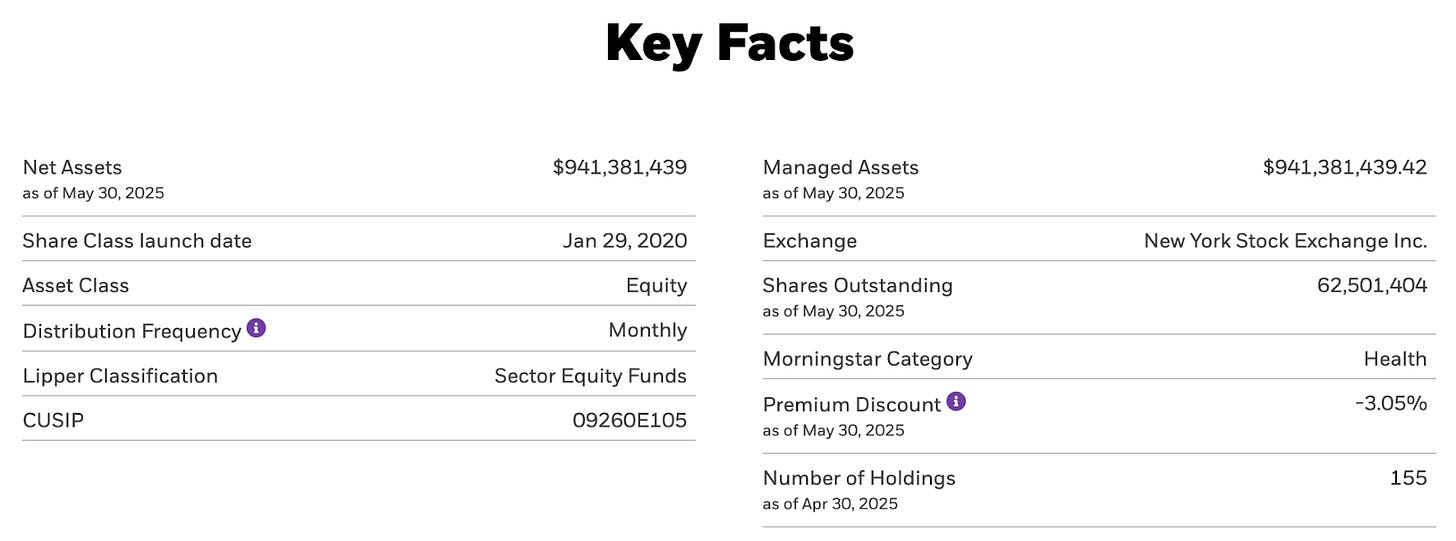

BMEZ’s investment objective is to provide total return and income through a combination of current income, current gains and long-term capital appreciation. It will typically invest most of its assets in the equity securities of companies principally engaged in the health sciences group of industries and equity derivatives with exposure to the health sciences group of industries. BMEZ utilizes an option writing strategy in an effort to generate current gains from options premiums and to enhance risk-adjusted returns.

BMEZ is interesting in that it’s an all-cap healthcare fund that can invest in private companies. You don’t usually see that in the fund space and it gives it a unique twist, especially in an industry with so many small and emerging companies. The fund’s 12% managed distribution yield may improve investor interest, but it runs the risk of being unsustainable over the long-term. The covered call overlay is just on 24% of assets, so the fund still maintains a fair amount of share price appreciation potential should this sector really begin to run.

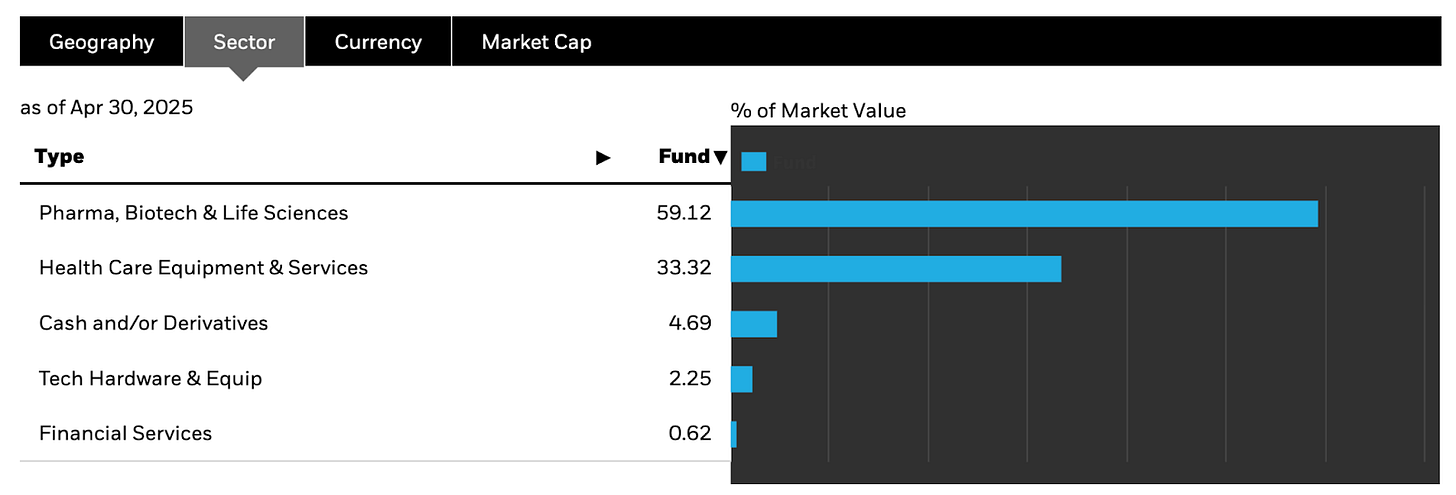

BMEZ makes a larger bet on the biotech side of healthcare than does many of its healthcare fund counterparts. That alone can make the fund a bit more volatile, but it still maintains a healthy allocation to some of the core pharmaceutical and healthcare services sub-industries. Overall, there’s a fairly good balance here, but one that provides a little more exposure to the growth side of the equation.

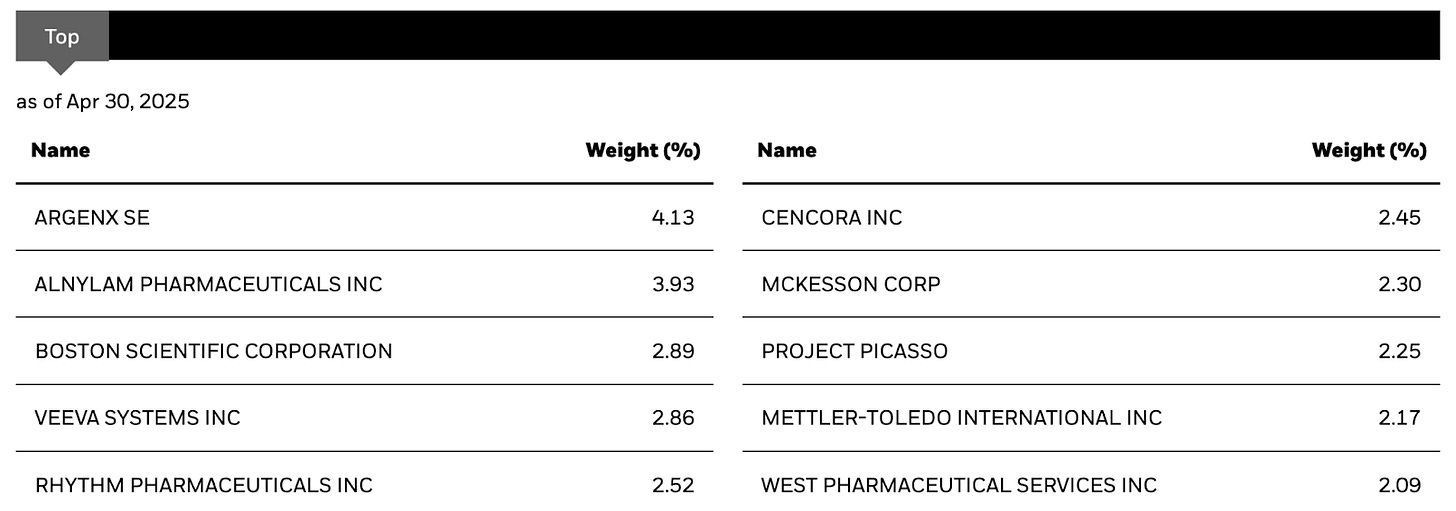

The top 10 holdings are a mix of well-known names and some up-and-comers. Boston Scientific is a big healthcare & biotech developer, not to be confused with Boston Dynamic that makes the dog robots, as is McKesson. Project Picasso is one of the fund's privately-held companies. Right now, approximately 8-10% of the fund’s assets goes to private companies. While these companies often have a lot of upside potential, they typically go bust at a high rate and their valuations usually involve some guesswork.

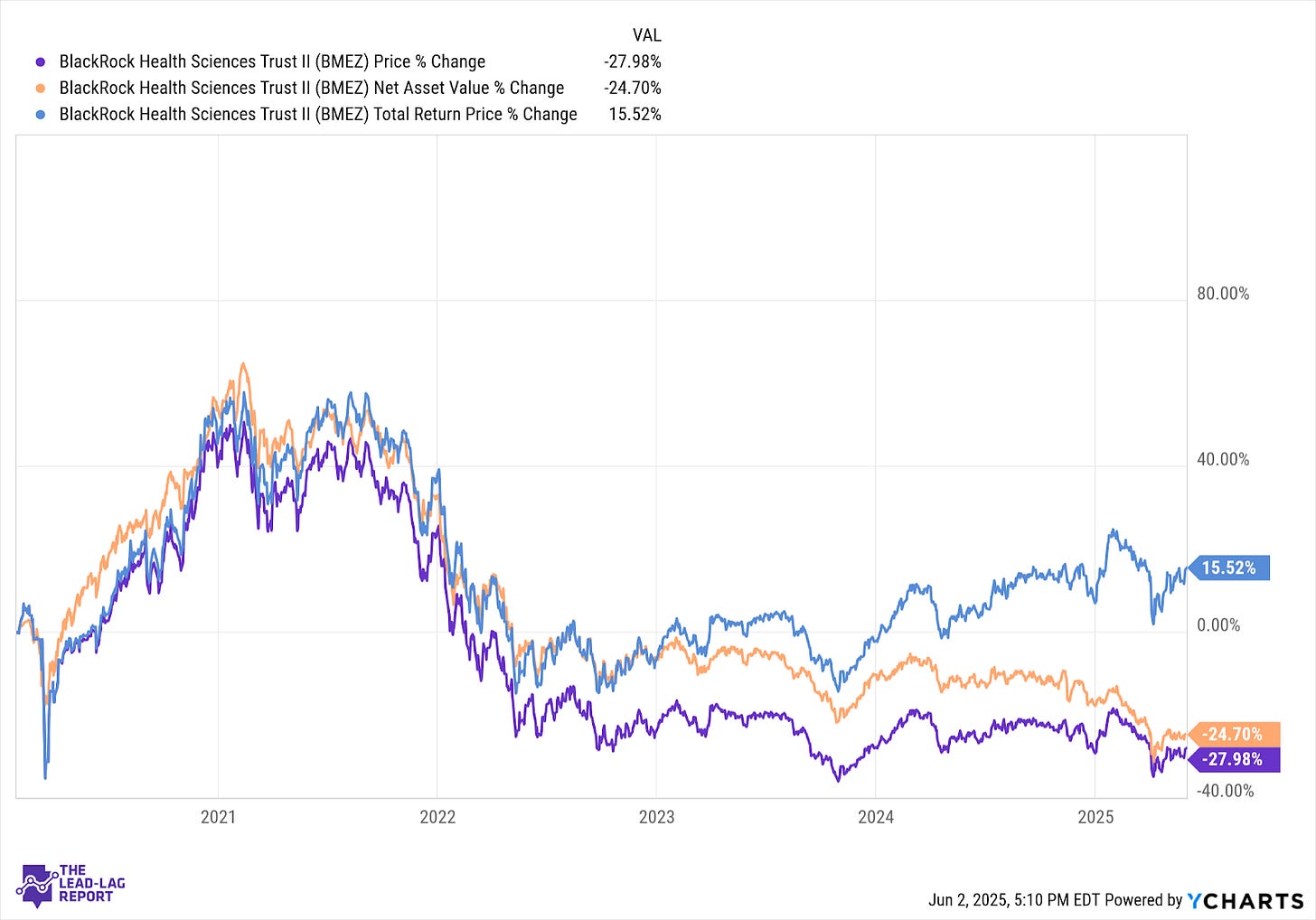

Since its inception in January 2020, BMEZ has generated a total return of 15%. That translates to an average annual return of around 3%.

There aren’t many funds that had more unfortunate timing for their launch. The fund did, however, recover quite nicely over the following year, but the past four years haven’t been kind to healthcare and biotech stocks. Following 2022’s bear market, it was all tech, mega-cap, growth and the magnificent 7. Healthcare still has a good long-term future, especially in a deregulatory environment, but investors just haven’t spent a lot of time scooping up stocks in the more defensive sectors.

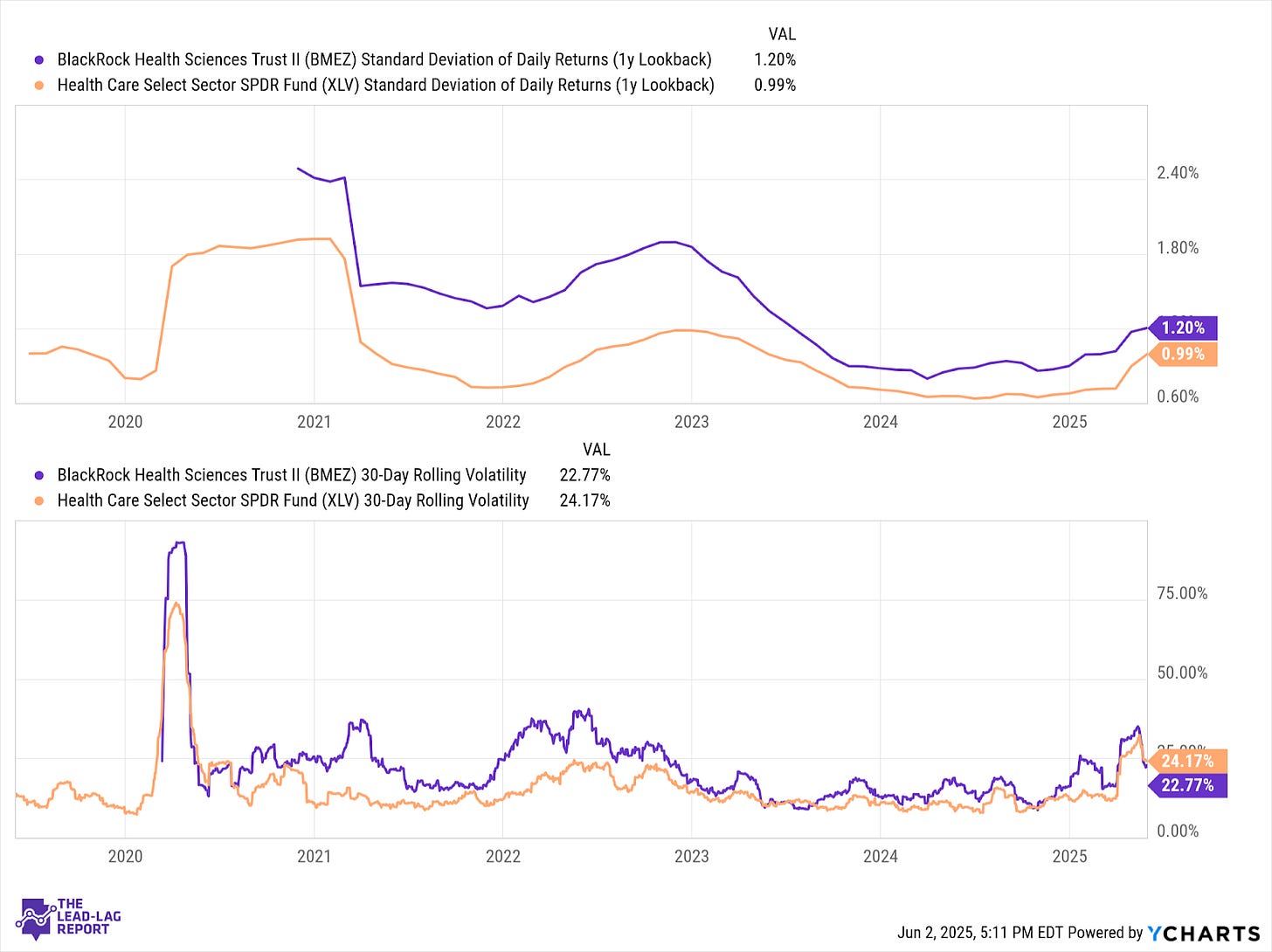

BMEZ’s modest covered call strategy is somewhat more volatile than the broader healthcare sector, but not by much. The written call overlay helps to moderate some risk, but the heavier tilt to biotechs, more speculative and smaller companies serves to ratchet it back up. Overall, there’s a reasonable level of risk for what you’re buying and the lack of leverage is probably a good idea for this space.

Special Announcement

DISCLAIMER – PLEASE READ: This is sponsored advertising content for which Lead-Lag Publishing, LLC has been paid a fee. The information provided in the link is solely the creation of Merk Investments. Lead-Lag Publishing, LLC does not guarantee the accuracy or completeness of the information provided in the link or make any representation as to its quality. All statements and expressions provided in the link are the sole opinion of Merk Investments and Lead-Lag Publishing, LLC expressly disclaims any responsibility for action taken in connection with the information provided in the link.

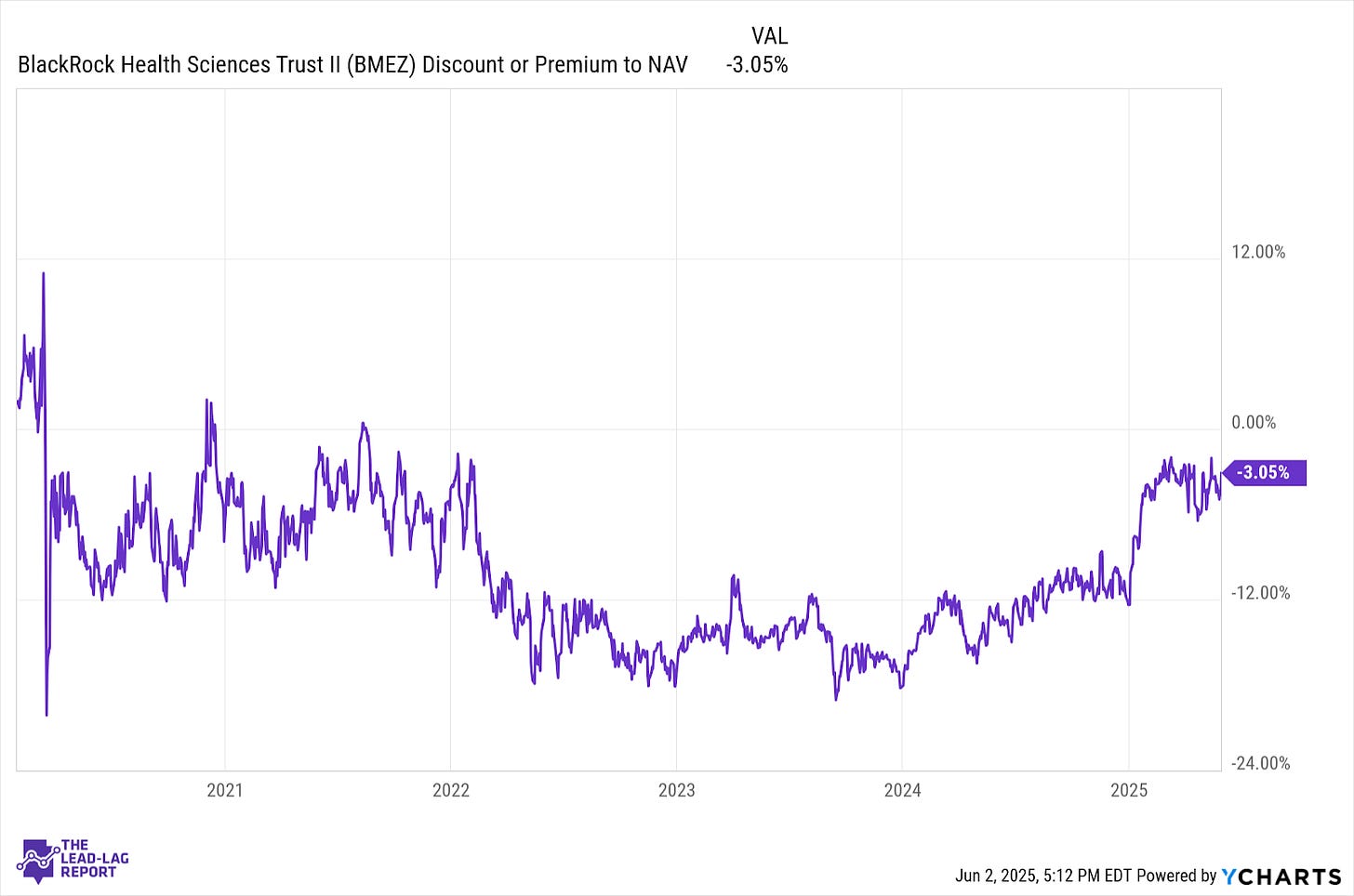

BMEZ’s discount to NAV began closing around the time the fund switched to a 12% managed distribution policy. High yields usually attract more income seekers, which often leads to narrower discounts. These kinds of double digit managed yields usually lead to NAV decay, so I’m not sure this is a better outcome overall.

Macro Environment

Healthcare hasn’t really had any sustainable momentum for years. Its best year in recent memory came in 2022 when healthcare stocks largely remained flat, while tech stocks and tech-heavy indices came crashing back to earth. Prior to that, you’d have to look at the COVID pandemic and the 2018 mini-bear market to find outperformance. Before that, it was the first half of the 2010s.

In other words, healthcare really tends to outperform in the majority of cases when the market is under some stress. That’s not unusual for defensive sectors and strategies, but healthcare’s history with this stereotype seems especially strong.

The market still seems to want to favor growth and large-caps over everything right now. If the economy is slowing, which seems likely to some degree, healthcare has a chance to outperform. If we see a snapback to positive GDP in Q2 and/or trade war risk can remain subdued, it doesn’t seem like the set of conditions that would favor this sector. BMEZ does, however, have a healthy dose of smaller companies and more speculative biotech names, so it could get swept up in a risk-on environment, but I wouldn’t necessarily bet on it.

The big bet, as I’ve said repeatedly, is on deregulation. If Trump decides to push in on that in the 2nd half of 2025 (or even later than that), healthcare and biotech should be prime beneficiaries. This would help companies cut compliance & oversight costs and help a lot on the drug approval side, including better approval rates and faster times to market.

With the focus on trade and tariffs, that may still be a little ways off, but it looms as perhaps the biggest catalyst in the near-term.

Distribution Policy

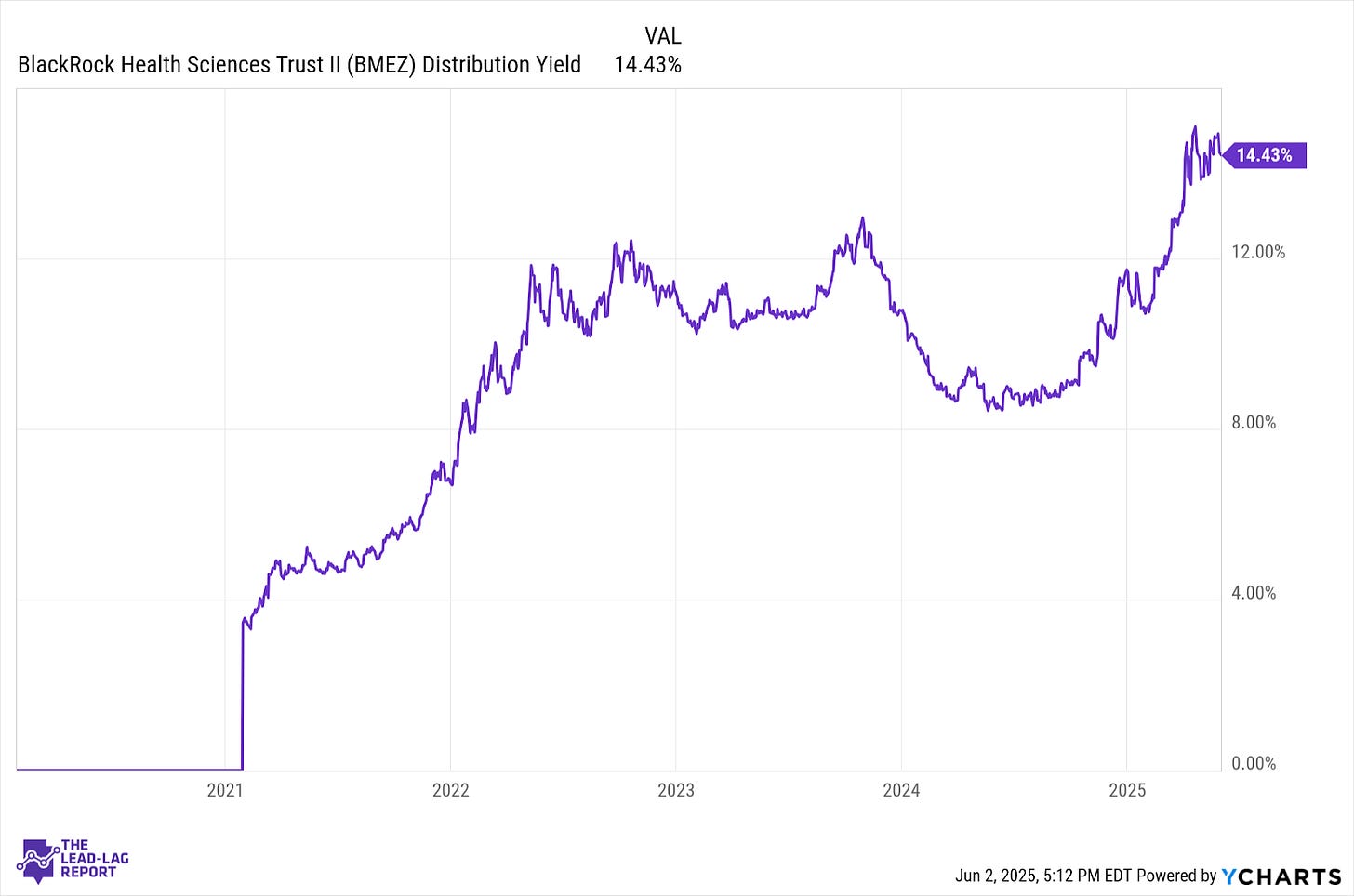

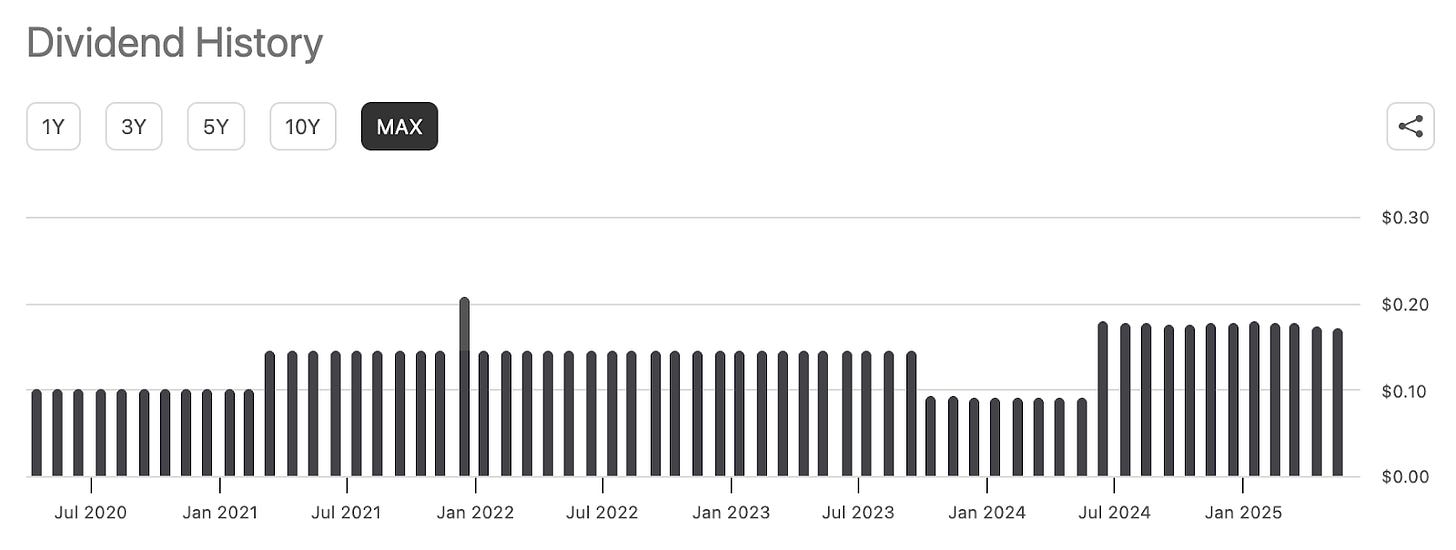

BMEZ maintains a monthly managed distribution policy that currently pays 12% of net assets annually. The trailing 12-month yield is above this level due to share price changes, but investors should expect a rate of 12% going forward.

Managed distribution programs are great for predictability, but it usually comes down to the distribution rate. For healthcare stocks, 12% seems awfully if it needs to be backed by income and capital gains. BMEZ was being targeted by noted activist firm Saba Capital and I suspect the new policy was established to help shrink the discount and make it less attractive. Either way, I see the high potential for NAV degradation over time due to the unsustainability.

The monthly distributions looking forward should be pretty steady and consistent with the managed distribution plan.

Advantages

The fund’s composition provides a nice mix of high growth smaller companies with more durable large-cap names.

The fund’s new distribution plan should be attractive to those seeking income predictability and a double digit yield.

There’s a potentially big tailwind here if the White House makes deregulation a focus.

Disadvantages

The distribution policy’s high yield target looks unsustainable long-term without significant NAV degradation.

The narrowing discount means there’s little value to be had in the near-term.

Final Thoughts

BMEZ provides some nice diversification within the healthcare space if you’re looking for an all-in-one product. The investment in private companies is unusual within the fund space and could be a differentiator.

Overall, I think it comes down to what you believe will happen with deregulation. The U.S. economy appears poised to rebound and with the Fed probably considering rate cuts in the 2nd half, the bigger potential might be with growth over defensive. If dereg happens though, healthcare could become one of the market’s bigger winners.

The Lead-Lag Report is provided by Lead-Lag Publishing, LLC. All opinions and views mentioned in this report constitute our judgments as of the date of writing and are subject to change at any time. Information within this material is not intended to be used as a primary basis for investment decisions and should also not be construed as advice meeting the particular investment needs of any individual investor. Trading signals produced by the Lead-Lag Report are independent of other services provided by Lead-Lag Publishing, LLC or its affiliates, and positioning of accounts under their management may differ. Please remember that investing involves risk, including loss of principal, and past performance may not be indicative of future results. Lead-Lag Publishing, LLC, its members, officers, directors and employees expressly disclaim all liability in respect to actions taken based on any or all of the information on this writing.