A $1.6 Billion Check Without Wall Street

How Ares’ latest financing deal underscores the rising dominance of private credit in leveraged finance

Key Highlights

Ares’ $1.6 billion financing for the Evermark transaction highlights how private credit has become a primary source of capital for leveraged buyouts.¹

Private lenders now fund the majority of global LBO activity, reflecting a structural shift away from traditional banks.²

The expansion of private credit strengthens the earnings and strategic positioning of publicly listed private-equity and leveraged-finance firms.

The WHITEWOLF Publicly Listed Private Equity ETF (LBO) is designed to capture this ecosystem through diversified exposure to listed beneficiaries of private capital growth.³

A Billion-Dollar Loan Without a Bank

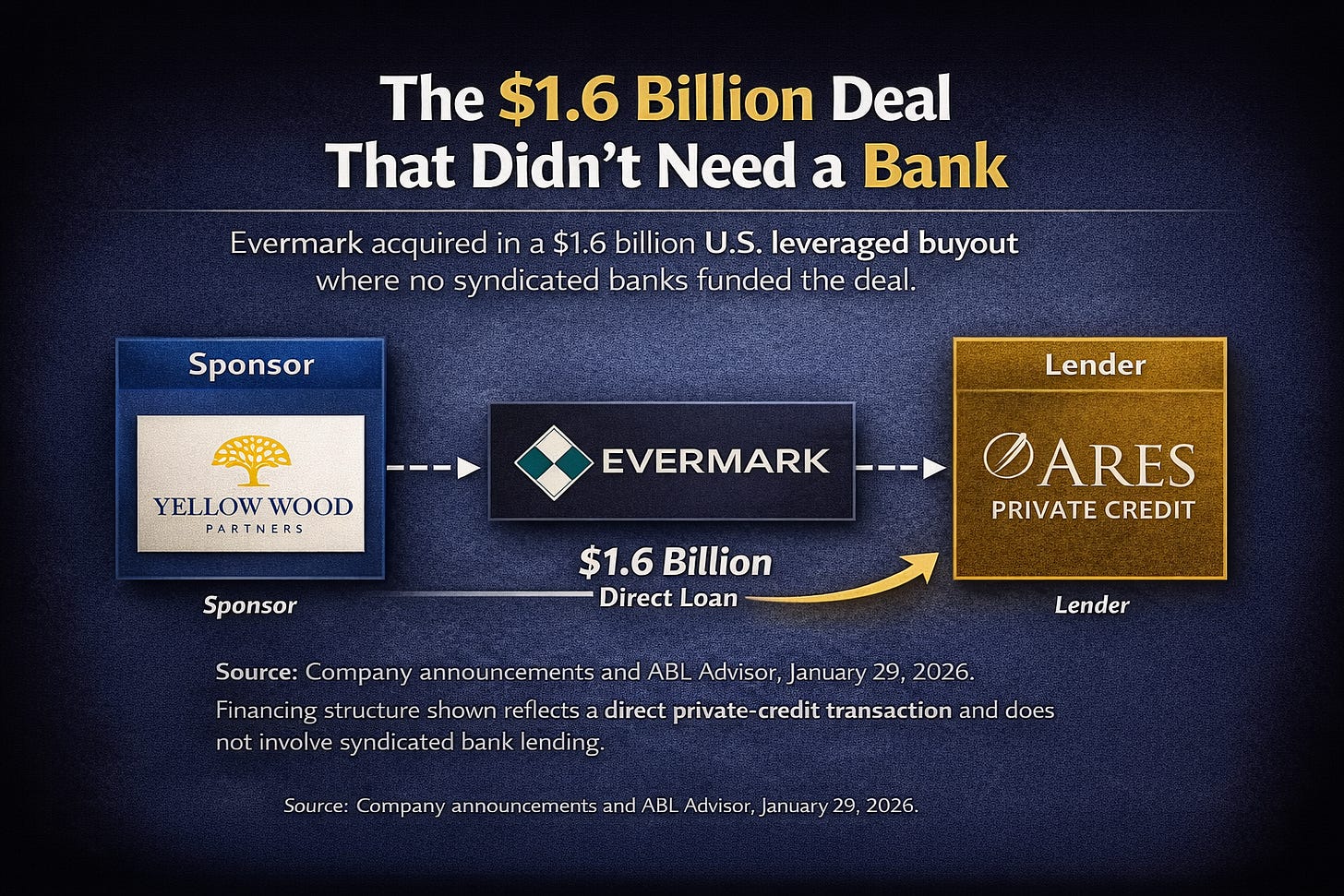

A decade ago, a $1.6 billion acquisition loan would almost certainly have been led by a syndicate of global investment banks. Today, that assumption no longer holds. Ares Management’s role in leading the $1.6 billion debt financing behind the merger of Suave and Elida Beauty into Evermark illustrates just how far private credit has moved into territory once dominated by banks.¹

What made the transaction notable was not simply its size, but its execution. The financing was delivered by Ares’ private credit platform rather than through syndicated loans or public debt markets. The speed and certainty of that capital allowed Yellow Wood Partners, the transaction’s private-equity sponsor, to close the deal without relying on market conditions or investor appetite for broadly distributed debt.

This was not an isolated instance. Around the same period, Ares also arranged an upsized $1.6 billion loan for Veritas Capital’s acquisition of Global Healthcare Exchange, using portability provisions that allowed the debt to transfer seamlessly to the new owner.⁴ Such borrower-friendly structures underscore why private lenders have become increasingly attractive partners for buyout sponsors.

The broader implication is clear. Private credit platforms now possess the scale, balance-sheet capacity, and underwriting expertise to execute financings that rival traditional bank syndicates. That capability fundamentally alters the competitive landscape for leveraged finance. For private-equity firms, it reduces execution risk. For lenders, it reinforces their role as essential infrastructure within the buyout ecosystem.

This shift matters because leveraged finance sits at the core of private-equity economics. The ability to secure reliable, flexible financing directly influences deal volume, transaction structures, and returns. As private lenders step into that role, they strengthen the economic moat around firms that operate at the intersection of private equity and credit.

Private Credit Takes the Lead in Buyout Financing

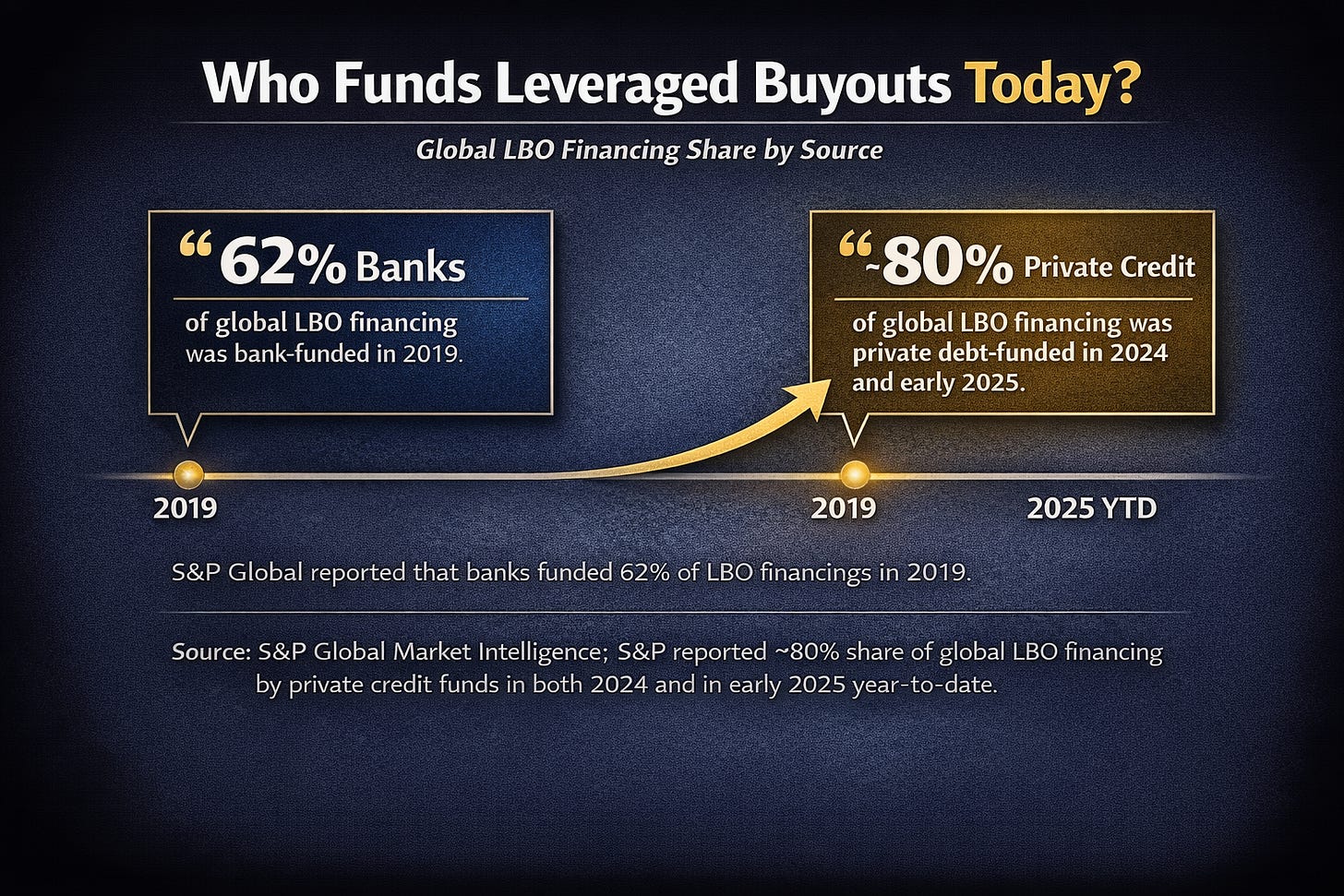

Data now confirms what transactions like Evermark signal. Private credit has become the dominant source of leveraged-buyout financing globally. In 2024, private lenders supplied roughly three-quarters of LBO debt, marking the highest share in at least a decade.² Early 2025 figures indicate that share has climbed further, exceeding four-fifths of new buyout financing.²

Banks, constrained by post-financial-crisis regulations and balance-sheet limitations, have steadily retreated from riskier leveraged lending. Capital requirements and regulatory scrutiny have made large, highly levered transactions less attractive for traditional lenders. Private credit funds, less encumbered by these constraints, filled the void.

Speed has been a critical differentiator. Direct lenders can underwrite and hold entire loans, avoiding the syndication risk inherent in bank-led financings. In volatile markets, that certainty is often worth paying for. Buyout sponsors value the ability to lock in capital quickly, especially when competing for assets or navigating uncertain market conditions.

Customization has also played a role. Private loans frequently include tailored covenant packages, delayed-draw features, and transferability provisions that are difficult to achieve in public markets. These features reduce friction for sponsors and enhance flexibility across ownership changes.

While banks have regained some footing during periods of market stability, the longer-term trajectory remains intact. Private credit’s rise reflects a structural realignment rather than a temporary dislocation. The leveraged-finance market is no longer defined solely by syndicated loans and high-yield bonds. It now includes a deep and growing pool of private capital capable of supporting complex transactions across market cycles.

For investors, this matters because it reshapes where economic value accrues. Fee income, interest income, and asset growth increasingly flow through private-market platforms rather than traditional banking channels. Firms positioned within this ecosystem benefit not only from transaction activity, but from the durability of demand for non-bank capital.

Why the Private Credit Boom Supports Listed Private-Equity Firms

Private credit assets under management now exceed $1.7 trillion globally, reflecting years of steady inflows from institutional investors seeking differentiated income streams.⁵ The appeal lies in contractual cash flows, seniority in the capital structure, and limited correlation to public equity markets.

Borrowers, meanwhile, have embraced private credit for its discretion and reliability. Private loans avoid the disclosure requirements and market exposure associated with public debt issuance. In uncertain environments, that discretion becomes particularly valuable.

These dynamics reinforce the business models of publicly listed private-equity and alternative-asset managers. Firms that operate both credit and equity platforms benefit from internal synergies. Private-equity sponsors generate demand for financing, while affiliated credit platforms supply it. This alignment supports asset growth, recurring fee revenue, and long-term earnings visibility.

Publicly traded vehicles provide a way for investors to participate in this trend without committing capital to illiquid private funds. Business Development Companies, alternative-asset managers, and listed private-equity firms all stand to benefit from sustained private-market activity. Their earnings are tied not only to asset appreciation, but to the ongoing provision of capital across thousands of private companies.

The WHITEWOLF Publicly Listed Private Equity ETF (LBO) was constructed with this ecosystem in mind. Launched in late 2023, the actively managed ETF invests in publicly traded firms that play central roles in leveraged buyouts, private credit, and private-equity ownership.³ Its holdings span asset managers, direct lenders, and specialty finance companies that collectively underpin modern private-market finance.

By design, the fund seeks to capture the structural growth of private capital rather than the performance of individual transactions. This approach reflects a broader thesis: private markets are absorbing a larger share of corporate financing and ownership, and listed firms that facilitate this process are positioned to benefit over time.

Risks remain. Credit cycles turn, defaults rise, and deal activity can slow during economic downturns. However, private credit’s ability to negotiate restructurings privately and its senior position in capital structures can mitigate downside risk relative to equity-only strategies.

From a portfolio-construction standpoint, exposure to listed private-equity and leveraged-finance firms introduces a hybrid profile. These businesses combine elements of equity growth and income generation, offering diversification relative to traditional stocks and bonds.

The Ares financing serves as a case study rather than an anomaly. It illustrates how private credit has matured into a cornerstone of corporate finance. As long as banks remain constrained and companies continue to seek flexible capital solutions, private lenders are likely to remain indispensable.

For investors, the implication is straightforward. The growth of private credit strengthens the economic foundation of firms operating within the leveraged-finance ecosystem. Vehicles like LBO provide a transparent, liquid way to access that theme, aligning portfolios with the evolving structure of global capital markets.

Footnotes

ABL Advisor. “Ares Leads $1.6B Debt Financing to Support Suave Brands and Elida Beauty Merger to Create Evermark.” January 29, 2026.

S&P Global Market Intelligence. “Private Debt’s Share of Buyout Financing Hits Decade High.” February 6, 2025.

White Wolf Capital Advisors, LLC. “White Wolf Announces the Launch of Its First Exchange-Traded Fund.” November 29, 2023.

Private Equity Insights. “Ares Upsizes $1.6bn Loan as Private Credit Leans on Deal Portability.” January 2026.

NEPC. “The NEPC Guide to Private Debt.” December 22, 2025.

Important Information:

Investors should consider the investment objectives, risks, charges and expenses carefully before investing. For a Prospectus or Summary Prospectus with this and other information about the Fund, please call +1-305-605-8888 or visit our website at https://lbo.fund/. Read the prospectus or summary prospectus carefully before investing.

Investment Risk. When you sell your Shares of the Fund, they could be worth less than what you paid for them. The Fund could lose money due to short-term market movements and over longer periods during market downturns. Listed Private Equity Companies Risk. There are certain risks inherent in investing in listed private equity companies, which encompass financial institutions or vehicles whose principal business is to invest in and lend capital to or provide services to privately held companies. Generally, little public information exists for private and thinly traded companies, and there is a risk that investors may not be able to make a fully informed investment decision. Business Development Company (BDC) Risk. BDCs generally invest in less mature U.S. private companies or thinly traded U.S. public companies which involve greater risk than well-established publicly traded companies. While the BDCs in which the Fund invests are expected to generate income in the form of dividends, certain BDCs during certain periods of time may not generate such income. Master Limited Partnership Risk. An MLP is an entity that is classified as a partnership under the Internal Revenue Code of 1986, as amended, and whose partnership interests or “units” are traded on securities exchanges like shares of corporate stock. Investments in MLP units are subject to certain risks inherent in a partnership structure, including (i) tax risks, (ii) the limited ability to elect or remove management or the general partner or managing member, (iii) limited voting rights and (iv) conflicts of interest between the general partner or managing member and its affiliates and the limited partners or members.

An investment in the Fund involves risk, including possible loss of principal. Exchange-traded funds (ETFs) trade like stocks, are subject to investment risk, fluctuate in market value and may trade at prices above or below the ETF’s net asset value (NAV), and are not individually redeemable directly with the ETF. Brokerage commissions and ETF expenses will reduce returns. ETFs are subject to specific risks, depending on the nature of the underlying strategy of the Fund, which should be considered carefully when making investment decisions. For a complete description of the Fund’s principal investment risks, please refer to the prospectus.

Shares of the Funds Are Not FDIC Insured, May Lose Value, and Have No Bank Guarantee.

The Fund is distributed by PINE Distributors LLC. The Funds’ investment adviser is Empowered Funds, LLC, which is doing business as ETF Architect. White Wolf Capital Advisors, LLC serve as the Sub-advisers to the Fund. PINE Distributors LLC is not a iliated with ETF Architect or White Wolf Capital Advisors, LLC.

DISCLAIMER – PLEASE READ: This is a sponsored article for which Lead-Lag Publishing, LLC has been paid a fee. Lead-Lag Publishing, LLC does not guarantee the accuracy or completeness of the information provided in the article or make any representation as to its quality. All statements and expressions provided in this article are the sole opinion of White Wolf and Lead-Lag Publishing, LLC expressly disclaims any responsibility for action taken in connection with the information provided in the discussion. The content in this writing is for informational purposes only. You should not construe any information or other material as investment, financial, tax, or other advice. A participant may have taken or recommended any investment position discussed, but may close such position or alter its recommendation at any time without notice. Nothing contained in this article constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in any jurisdiction. Please consult your own investment or financial advisor for advice related to all investment decisions.