Within the high yield closed-end fund space, there isn’t a whole lot of value to be found. Junk bonds have mostly been leaders within the bond market for the past three years (with the exception of the time around Liberation Day). Many CEF discounts have shrunk over that time, which is good for existing shareholders who’ve enjoyed the extra alpha, but it can be frustrating for new potential buyers who may be wondering if they’re buying at the right time.

The KKR Income Opportunities Fund (KIO) may be one of the funds that offers a bit of value. Over the past year, it’s gone from trading at a 10% premium to NAV to trading at a discount. In isolation, that means buyers could be finding better value here, but you always need to search for reasons why that might have occurred. If there’s a distribution cut, poor performance or something else, there might be a good reason it’s on sale.

Fund Background

KKR’s primary investment objective is to seek a high level of current income with a secondary objective of capital appreciation. It seeks to allocate across credit instruments to capitalize on changes in relative value among corporate credit investments and manage against macroeconomic risks. The fund also uses leverage in order to enhance yield and total return potential.

In the end, this becomes a fund that consists primarily of two asset classes - high yield bonds and leveraged loans. The modest addition of CLOs to round it out demonstrates that the fund’s management team is exploring several corners of the fixed income market for opportunities. The 30% use of leverage often pushes the yield into the 10%+ range, but these degrees of leverage frequently come at the expense of total return. KIO hasn’t had that issue as it carries a 5-star Morningstar rating.often pushes the yield into the 10%+ range, but it often comes at the expense of total return. KIO hasn’t had that issue as it carries a 5-star Morningstar rating.

KIO maintains a roughly 50/40/10 split between the asset classes shown above. The modestly different risk/return profiles do add some diversification benefits, but there are advantages in terms of just yield. Leveraged loans and CLOs have done relatively well recently and they offer a good yield/risk ratio. Junk bonds can be more volatile, but they’ve taken advantage of mostly narrow spreads for the past three years to fuel outperformance.

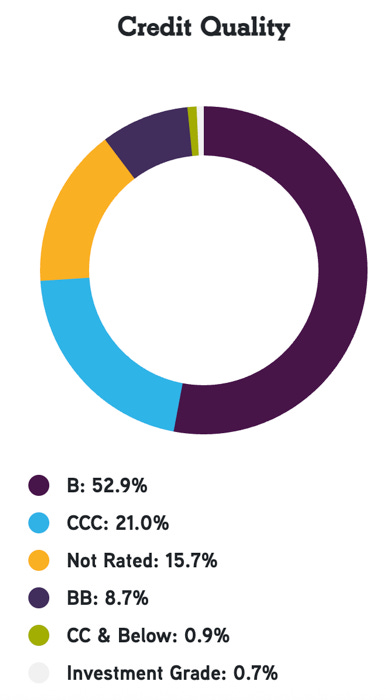

The credit profile for KIO could be considered below average. Many of these funds barbell their credit risk profiles around single-B securities. KIO, however, has a significantly larger allocation to CCC-rated notes than BB’s. The fund has been able to manage these risks effectively over the years, but it could present potential problems if spreads widen sustainably.