Every week, we’ll profile a high yield investment fund that typically offers an annualized distribution of 6-10% or more. With the S&P 500 yielding less than 2%, many investors find it difficult to achieve the portfolio income necessary to meet their needs and goals. This report is designed to help address those concerns.

Throughout the recent cycle, lower-grade debt has pretty consistently outperformed both investment-grade corporate bonds and sovereign debt, including Treasuries. For most, that has meant a focus on U.S. junk bonds, but that isn’t the only group that has done well. Emerging markets bonds, which have a good chunk rated as below investment-grade, have also outperformed recently. In some cases, they’ve done especially well given they’re getting the tailwind of a falling dollar as well.

The Morgan Stanley Emerging Markets Debt Fund (MSD) takes a relatively straightforward approach to investing in this space, but has the added benefit of targeting both government and corporate bonds. Given that these two groups often have dissimilar credit, risk and yield profiles, combining them into a single product helps diversify some of that risk away while providing the opportunity for extra yield. And MSD has really become an income generator over the past couple of years.

Fund Background

MSD’s primary investment objective is to produce high current income and as a secondary objective to seek capital appreciation. It does this by investing in a range of sovereign, quasi-sovereign and corporate debt securities in emerging markets, which may include U.S. dollar-denominated, local currency and corporate debt securities. To help achieve its objective, we combine top-down country allocation with bottom-up security selection.

MSD is pretty straightforward in that it combines macro and micro analysis to identify attractive investment opportunities. There’s essentially no leverage being used, so you’re getting more of a pure play on EM debt without the higher costs and higher risk. This sector is risky enough on its own that you probably don’t need leverage anyway. Overall, I see this as a smart strategy for approaching this sector and the fund’s 4-star Morningstar rating suggests it’s had some success in executing it.

Not surprisingly, government debt is the primary focus here. The roughly ⅔-⅓ split between sovereign debt and corporate bonds seems appropriate for overall market exposure and mimics pretty closely the allocation of the U.S. Barclays Agg index.

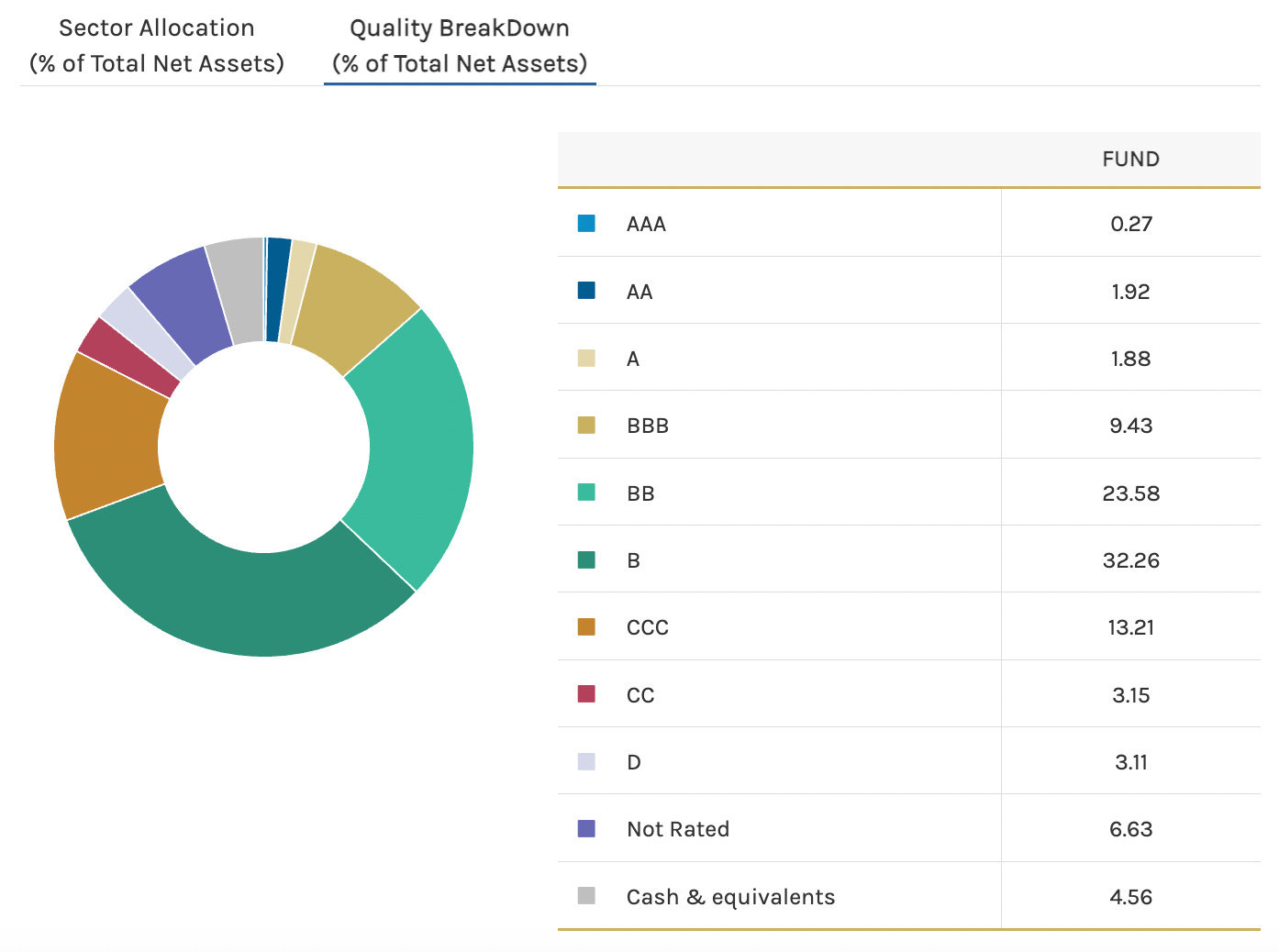

The credit allocation for this fund is mostly non-investment grade, which is to be expected, but the overall profile is riskier than you will find in standard EM debt portfolios. If we look at the EMB ETF as a benchmark, which also focuses on dollar-denominated emerging markets bonds, it’s got roughly a 50-50 split between investment-grade and junk. MSD has only about 14% in the higher quality bucket. Expect more credit sensitivity and volatility from this fund.

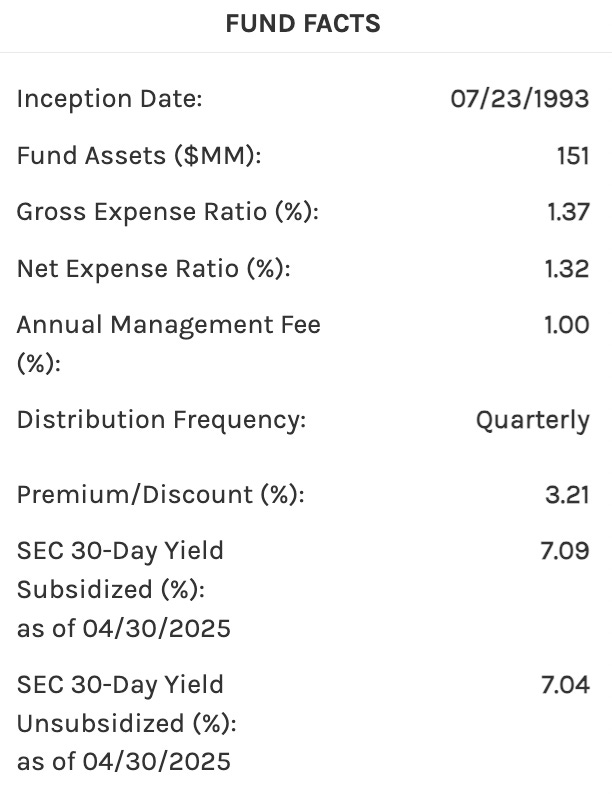

Since its inception in July 1993, MSD has generated a total return of 1,020%. That translates to an average annual return of around 8-9%.

This track record is quite solid given that it goes back more than 30 years. The NAV degradation of -60% isn’t necessarily attractive, but given that all of that occurred during the financial crisis and it’s been essentially flat ever since suggests that it’s done a good job of distribution sustainability over most of its lifetime. Drawdowns tend to be a little steeper for this fund, so investors concerned about principal preservation should be cautious.