Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: SMALL-CAPS START SPRINGING BACK TO LIFE

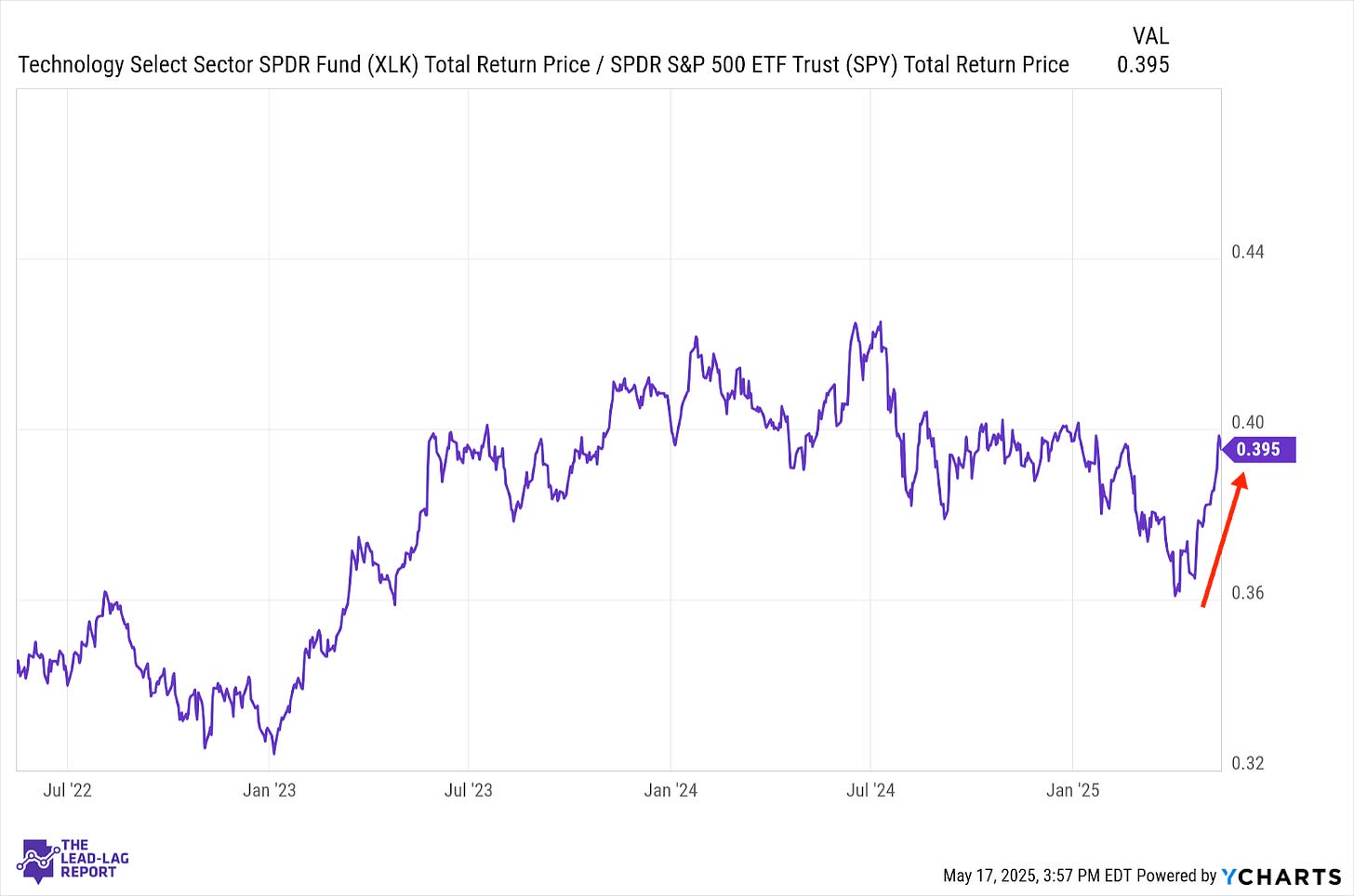

Technology (XLK) – Return In Progress

Tech is continuing to enjoy a renaissance thanks to the Trump reversal on reciprocal tariffs. It’s unclear as of yet whether or not inflation will still be an issue in this environment given April’s below expectation reading. If tariffs remain on pause indefinitely and the U.S. economy can return to expansion in Q2, there’s a clear case to be made that tech can rediscover its footing as a market leader.

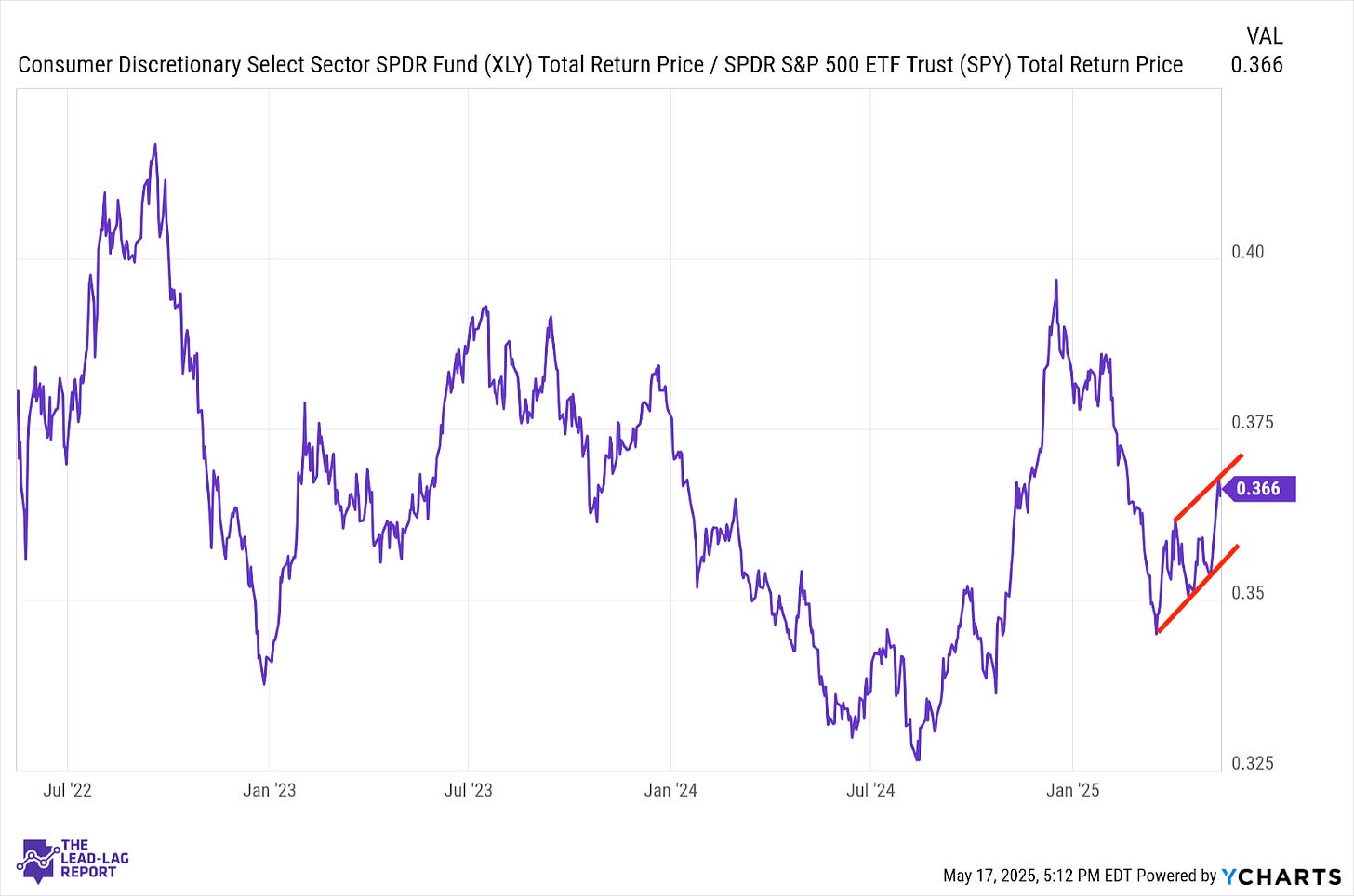

Consumer Discretionary (XLY) – Spending vs. Credit

After a miserable start to 2025, discretionary stocks look like they’re re-establishing a new uptrend. Whether it’s sustainable remains to be seen. The worst of the tariff fears appear to be off the table for the time being, but there are still questions remaining about how strong the consumer really is. The spending numbers have been resilient throughout this cycle, but the credit usage numbers still show many getting pushed to the brink.

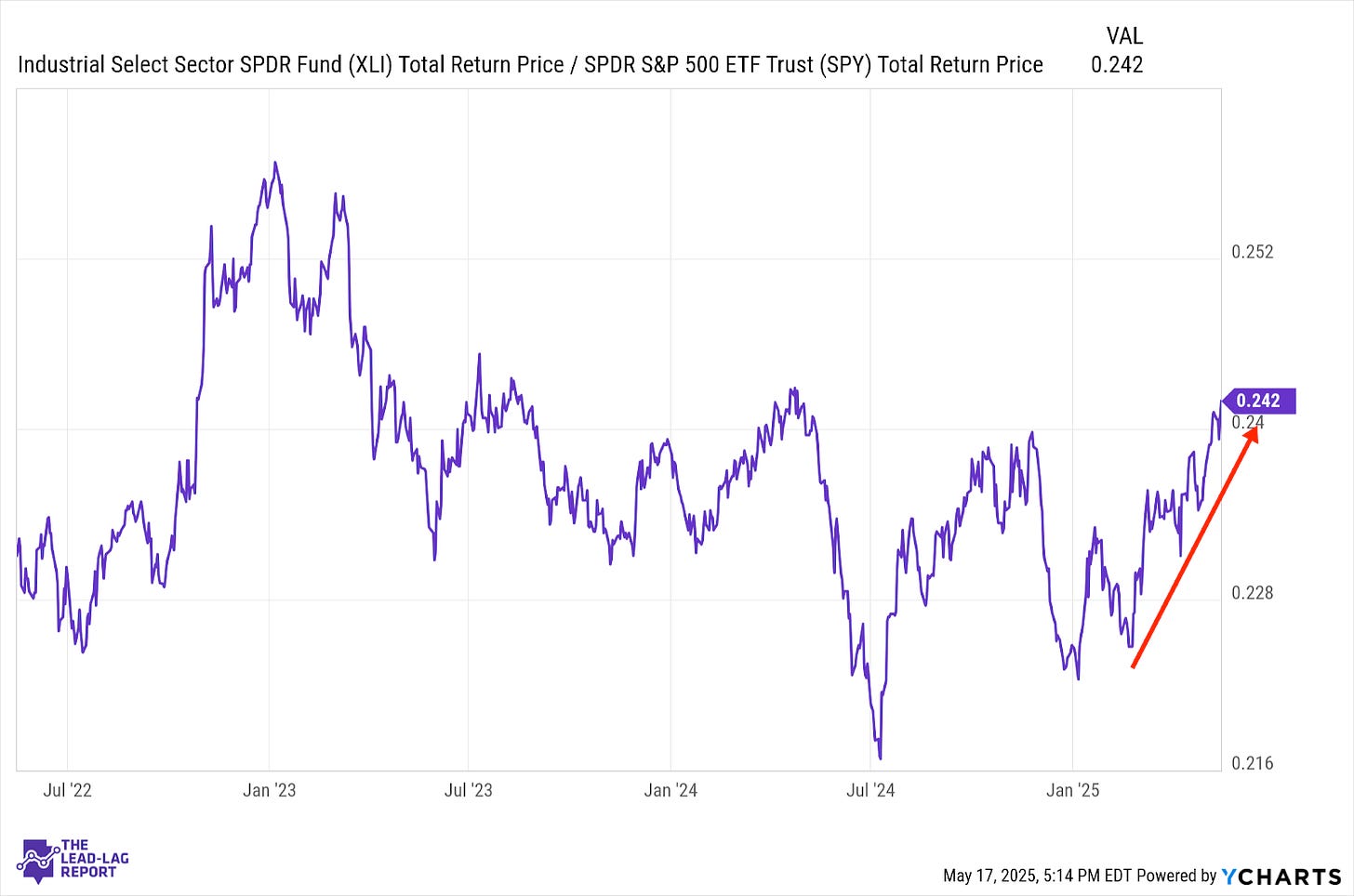

Industrials (XLI) – A Bit Of A Curiosity

This ratio is back to roughly a one-year high, building on momentum that’s been in place since the beginning of the year. Its fairly steady outperformance is a bit of a curiosity given how the trade war was expected to stifle manufacturing (something we’ve seen hints of, but not to a major degree). The recent improvement in sentiment has certainly played a role in this sector’s outperformance.

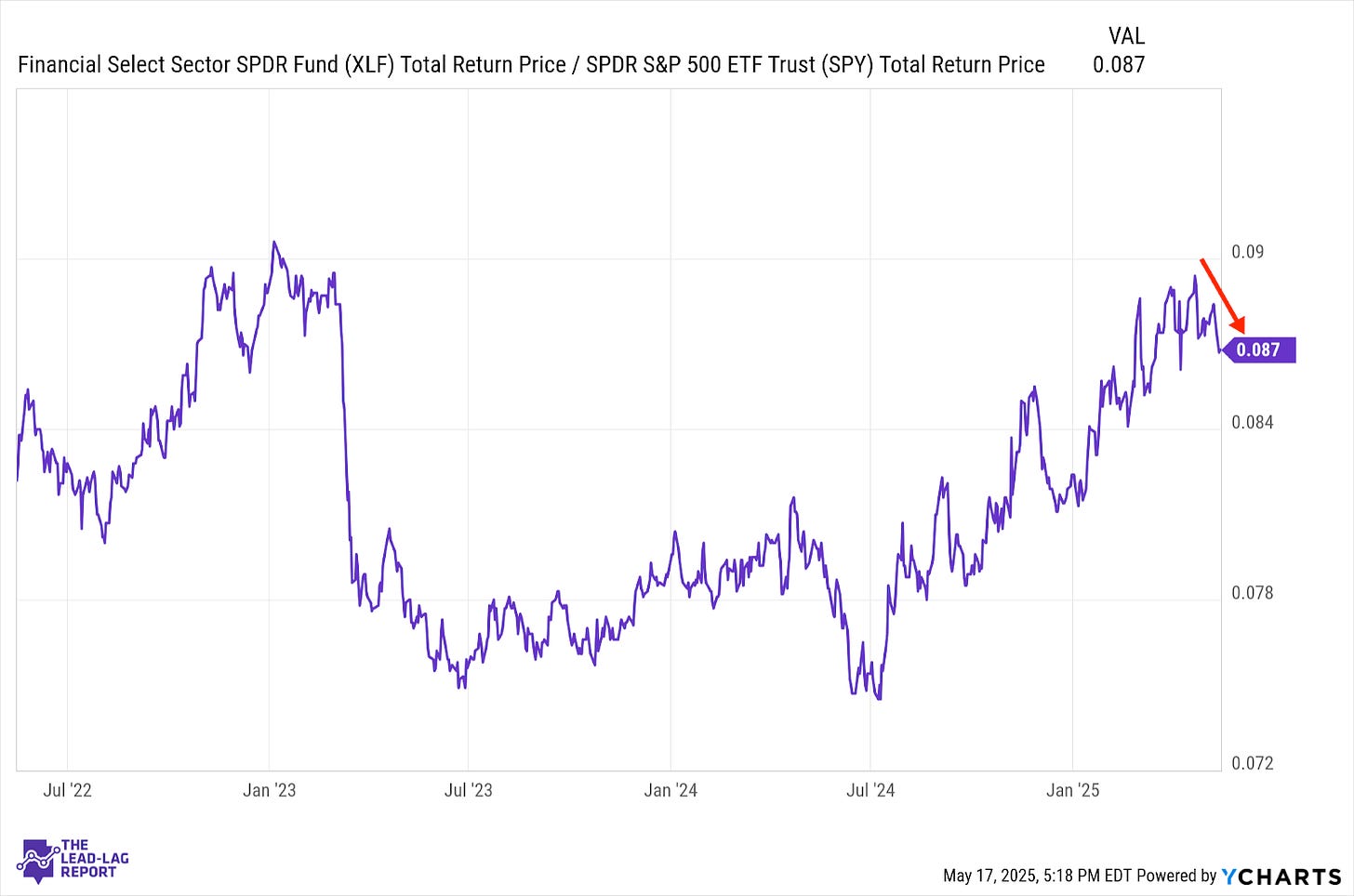

Financials (XLF) – Running Out Of Steam

The uptrend in financials looks like it might finally be running out of gas. With interest rates trending higher and continued degradation in small business optimism, we may have finally reached a point of capitulation. That’s not to mention, of course, that this sector tends not to do quite as well comparatively speaking in strong risk-on environments.

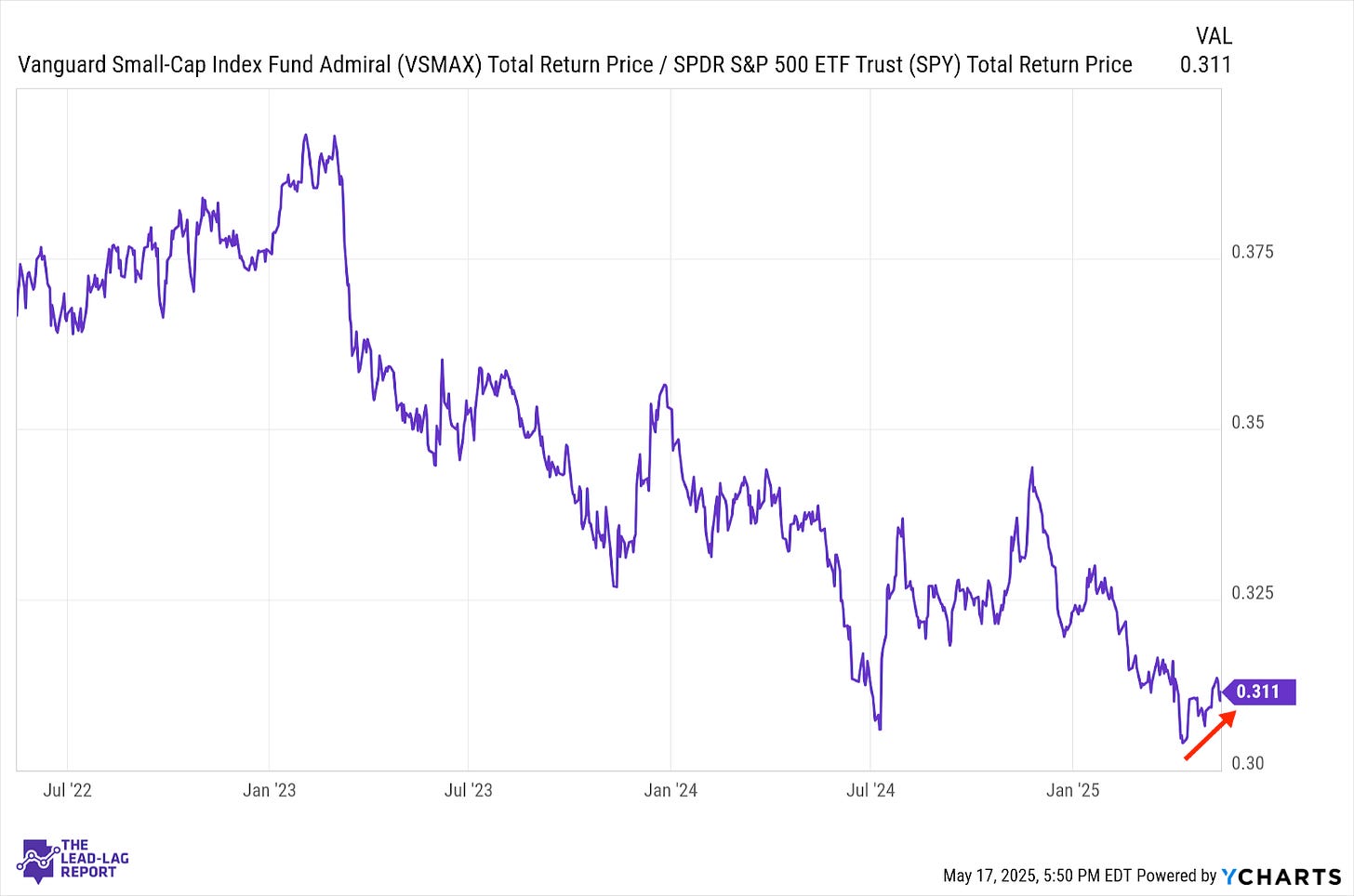

Small-Caps (VSMAX) – Showing Signs Of Life Again

I’ve said recently that now might be the time for small-caps to outperform given how easing trade tensions should improve the investment case for them. We have been stealthily seeing that narrative play out over the past few weeks, but the uptrend has been a little weak. Small-caps could benefit from a move lower in interest rates, although that likely appears a bit elusive for now.

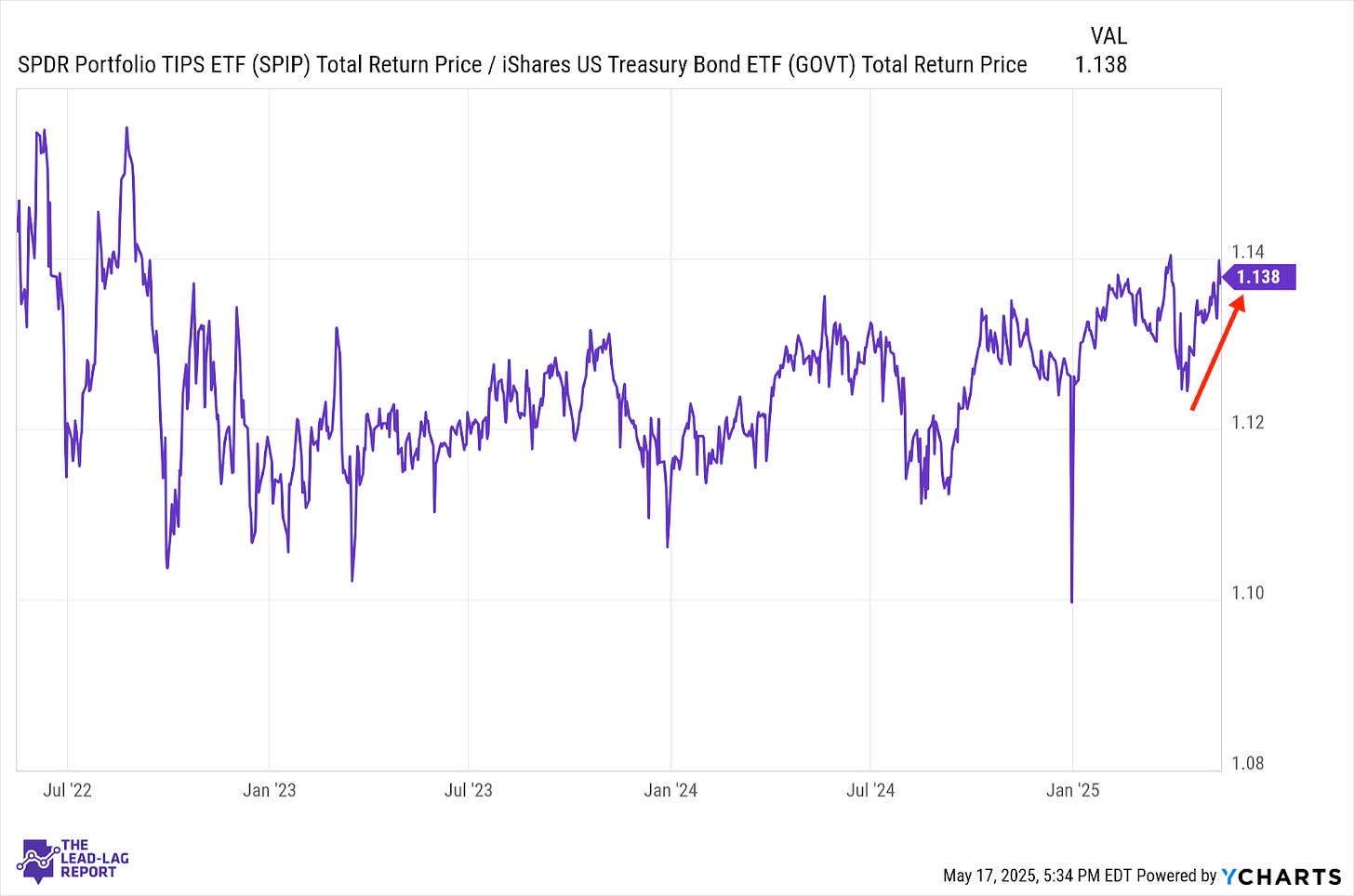

Treasury Inflation Protected Securities (SPIP) – A Curious Bounce

It’s a bit curious to see TIPS outperforming the Treasury market given how easing trade tensions should also be easing inflationary worries. This may be more of a commentary on the weakness in Treasuries, in general, as opposed to strength in TIPS. Either way, this ratio has largely been in a sideways pattern for the past few years, so not much of a signal is being given.

Junk Debt (JNK) – Risk-On Is Back On