Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: TREASURIES, GOLD & UTILITIES ARE MORE IMPORTANT THAN NEW S&P 500 HIGHS

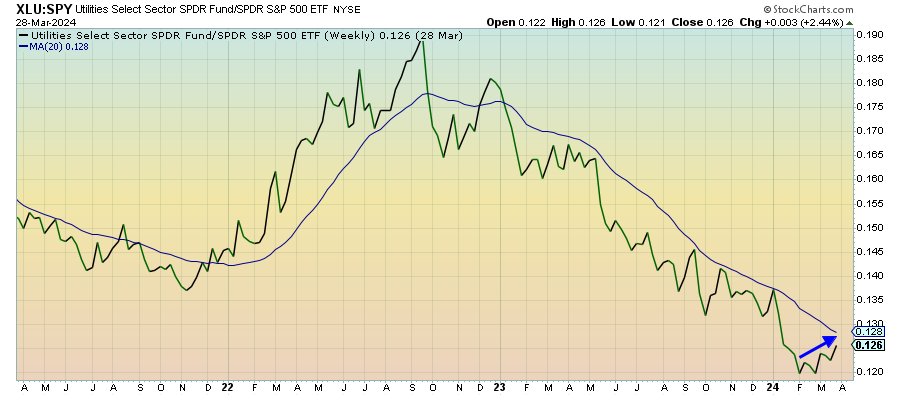

Utilities (XLU) – More Risk-Off Than Risk-On

Utilities are joining Treasuries and gold in confirming that short-term conditions actually look more risk-off than risk-on. This sector is undoubtedly getting a boost from the idea of falling interest rates later this year, but I really think the situation in Japan is spilling over into defensive assets here. The decline in the yen and the instability created by it threatens to spike volatility, something that the signals are picking up on.

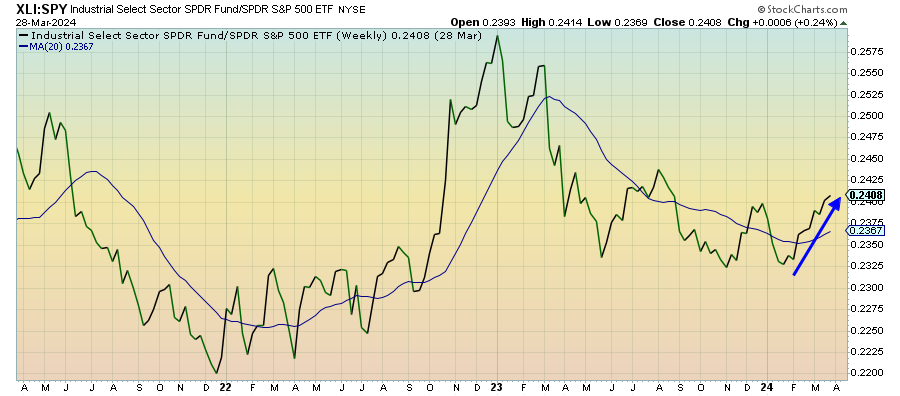

Industrials (XLI) – A Dangerous Game

The steady outperformance of industrials is stretching into its third month and it’s being confirmed by its cyclical counterparts - financials, energy and materials. The Fed seems not at all interested in slowing down the economy as long as the disinflationary trend remains in place. For now, that’s fueling the reflation trade, but Powell is playing a dangerous game.

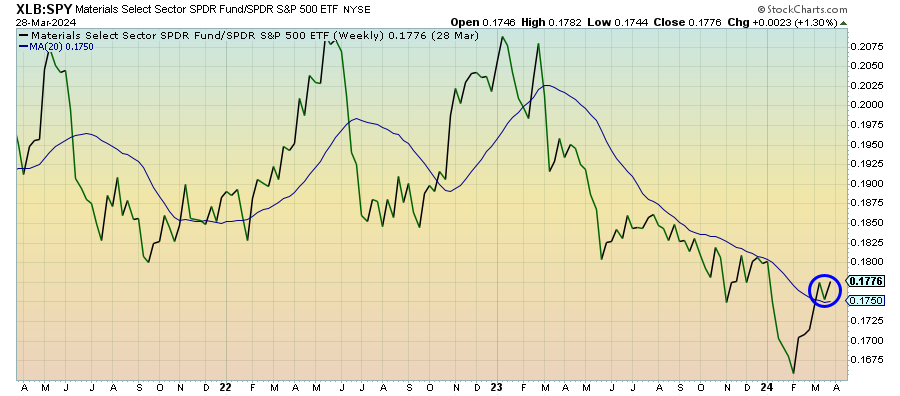

Materials (XLB) – The Rising Tide

The commodities bull roars on, although the biggest gains by far are coming from agriculture and crude oil. The cyclical rally is currently the rising tide that’s lifting all boats and materials stocks are no exception, but there has been a little chop in recent weeks. China’s manufacturing sector is showing signs of picking up and this could be a catalyst that keeps the demand for materials and metals at a robust level.

Financials (XLF) – Downplaying CRE Risk

Investors continue to downplay commercial real estate risk. The cyclical upturn and improving activity in the manufacturing sector are creating a potentially improved outlook for lending. Banks generally prefer higher rates since it improves margins, so we’ll need to see if the reiteration of the Fed’s multiple rate forecast this year has the potential to damage banks’ bottom lines.

Energy (XLE) – Supply & Demand Coming Together