Every week, we’ll profile a high yield investment fund that typically offers an annualized distribution of 6-10% or more. With the S&P 500 yielding less than 2%, many investors find it difficult to achieve the portfolio income necessary to meet their needs and goals. This report is designed to help address those concerns.

While it hasn’t necessarily been a strategy that’s been in favor for some time, dividend investing still presents one of the best ways to create long-term wealth. This is especially the case for retirees, who are probably looking for some combination of capital preservation and steady, predictable income. The latter can often be found via closed-end funds that offer fixed distribution schedules, but the former is a little more hard to come by. Many take on higher risks, including the use of leverage, in order to amplify potential returns, but those also come at the expense of greater drawdown risk. There are some exceptions though.

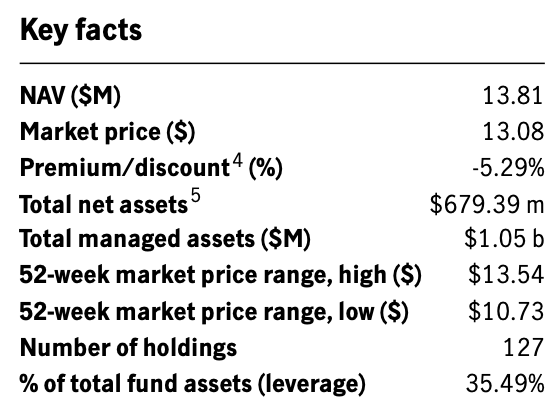

The John Hancock Premium Dividend Fund (PDT) targets income-producing securities, but manages to keep risk levels fairly contained despite the 36% leverage overlay. On the surface, the yield-to-risk tradeoff looks fairly attractive, but there are a few issues under the surface, namely idiosyncratic risk, that investors need to be aware of before jumping in.

Fund Background

PDT’s primary objective is high current income that’s also consistent with modest growth of capital. It typically invests in dividend-paying securities, seeking income from dividend-paying preferred stocks, common equities and bonds. The fund will also emphasize securities in the high-dividend-paying utilities sector. It also utilizes leverage in order to enhance yield and total return potential.

The fund says that it emphasizes dividend-paying stocks, this is really a fund with three distinct silos - common stocks, preferreds and fixed income - each getting a very roughly equal weighting. This makes it a nice asset allocation product that goes after multiple income sources and security structures. Anytime the degree of leverage goes above 30%, I get nervous because that’s the range where that leverage is going to get less likely to pay off (the fund’s 5.25% net expense ratio due to the cost of implementing that leverage makes it very tough to outperform over time). No matter how well the portfolio is constructed, that might be an incredibly tough hurdle to clear.

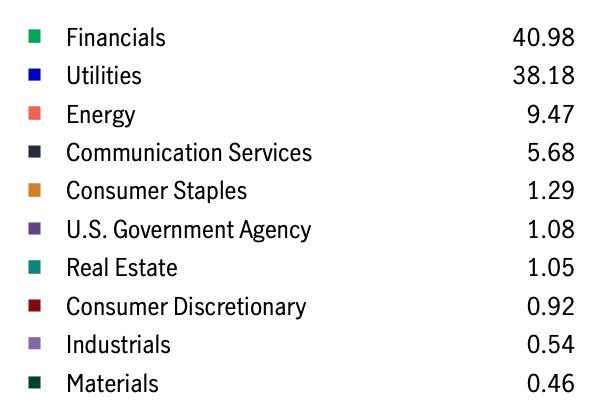

The fund’s focus on dividend-paying utility stocks is pretty clear. Whenever you’re looking at a large percentage of the fund’s assets getting invested in preferreds, you know that financials are going to have a big allocation too. As a result, 80% of the fund is focused on just two sectors. They’re rate and cyclically sensitive sectors too even though the nature of the securities might favor a slightly lower risk profile. Side note: if you’re looking for a deregulation play, this might not be a bad fund to keep in mind.

There’s a pretty heavy large-cap lean to the portfolio, which is helpful from a risk management standpoint, but doesn’t necessarily make the portfolio all that unique. For those looking strictly for a more pure conservative income play, the composition makes sense, but investors should consider whether or not they can find something much, much cheaper elsewhere and just create the income stream themselves.