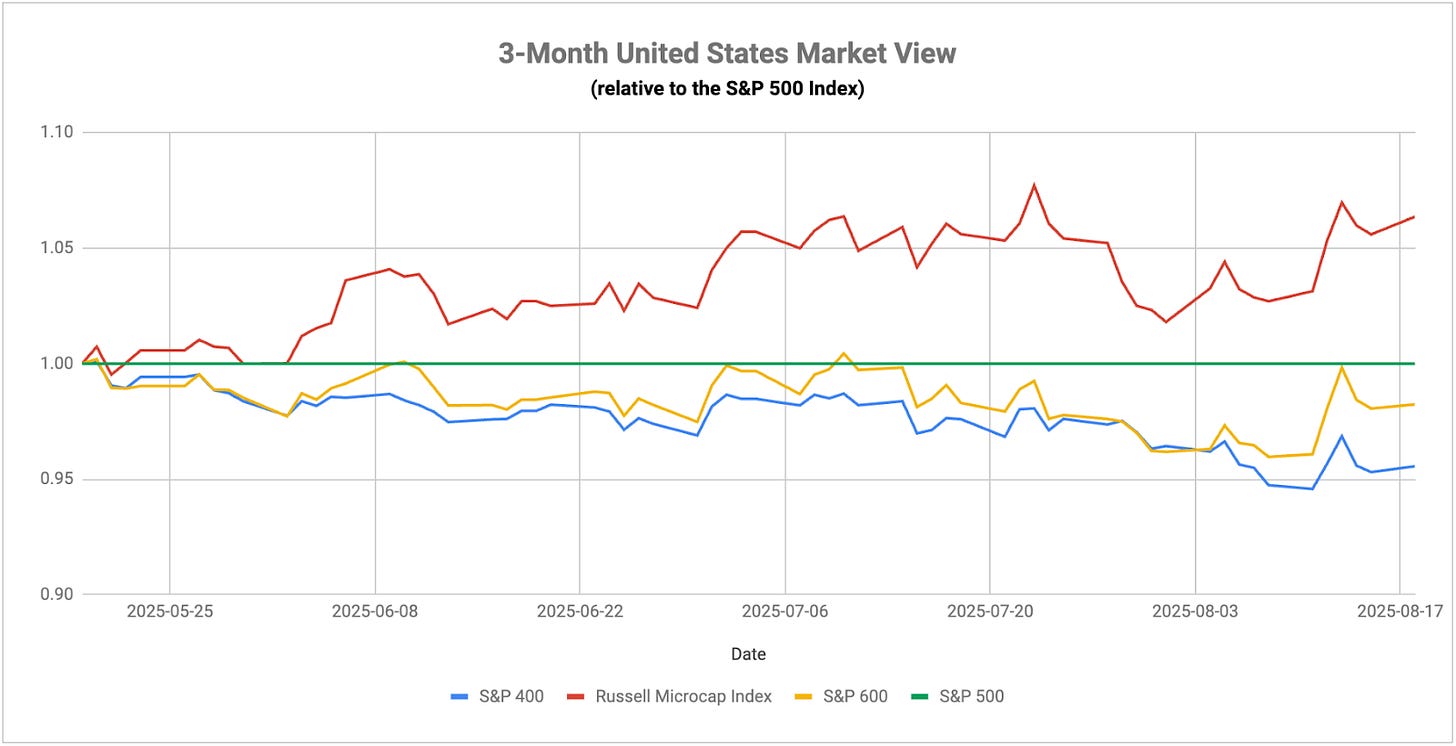

August has carried a different tone for U.S. stocks. Inflation is easing slowly rather than falling away, with core services still tight in shelter and medical care. That mix didn’t break the soft-landing story, but it did nudge investors to rethink how much future growth is already embedded in the highest multiples. The result has been a quiet rotation. Quality cyclicals and dependable dividend payers took in steady flows as investors favored companies that can fund themselves, price rationally, and live with rates that plateau rather than drop fast. Energy has also earned a look on the back of firmer crude and disciplined capital plans. It’s not a wholesale style change. It’s the market asking for balance after a long stretch where a narrow group did most of the lifting.

Rates told a parallel story. Supply, not inflation fear, is doing the heavy lifting at the long end. A busy schedule of coupon auctions reminded everyone that deficits matter, and the term premium crept back into the 7 to 30 year zone. Inflation expectations barely moved, which is another way of saying this backup in yields looks more like a duration and liquidity problem than a macro scare. That setup favored short-duration corporate credit over long Treasuries and put fresh pressure on bond proxies like utilities and REITs. If budget headlines intensify into September, duration may stay a source of volatility rather than ballast, which argues for keeping interest rate sensitivity on a short leash.

Breadth improved at the margin, and that matters. Manufacturing surveys hovered near contraction while services cooled, yet neither truly rolled over. Earnings season reinforced the point that cash generation and balance sheet clarity are back in fashion. Small caps drew a few believers as regional banks delivered cleaner credit updates, and as hiring plans in small business surveys edged up after months of drift. That doesn’t guarantee leadership changes hands, but it does reduce the odds that a handful of names has to keep doing all the work. If inflation grinds in the 2½ to 3 percent range and the Fed follows a careful easing path, leadership likely remains rotational, which keeps stock selection and timing squarely in focus.

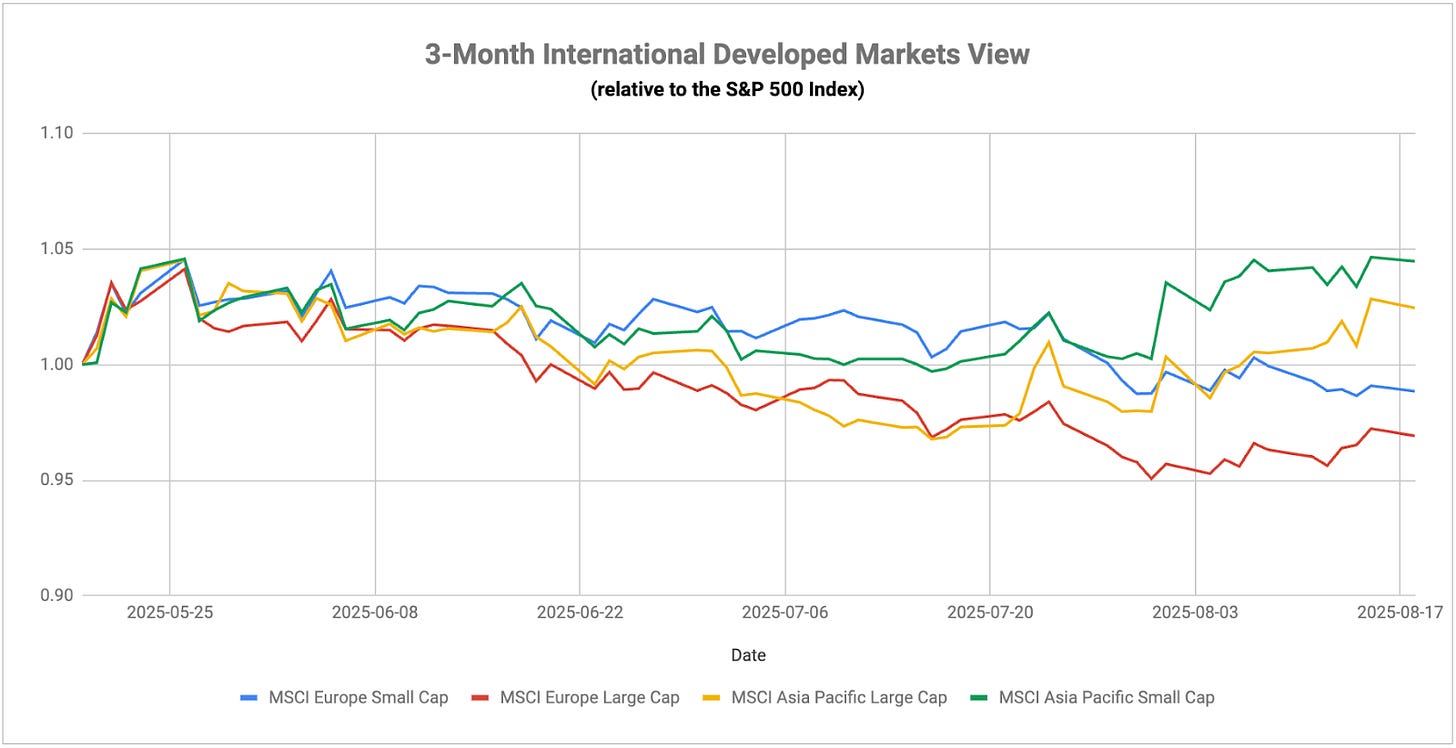

Europe is practicing patience while growth tries to find its footing. Headline inflation is near target, yet services prices are still sticky and recent PMIs point to softer activity. The European Central Bank has room to wait after its early-summer trim, so the policy message stayed cautious. That combination has capped bond rallies and pushed equity investors to trade the growth pulse rather than bank on a quick rate tailwind. Autos and luxury remain sensitive to every China read-through, while defensives grind higher. A weaker euro would normally cushion exporters, but with global demand uneven the market wants clearer evidence that orders are stabilizing before it pays up for cyclicals again.

The UK tells a similar story through a different lens. Monthly GDP bounced, labor data softened a touch, and inflation progress remained uneven. The Bank of England cut rates, but emphasized that services inflation needs to cool more decisively. The path to further rate cuts exists, just not in a straight line, which favors firms with pricing power and tidy balance sheets that can carry higher real rates a little longer. Domestically focused small and mid caps have room if real incomes hold, but the margin for policy error is small and guidance sensitivity is high.