Every week, we’ll profile a high yield investment fund that typically offers an annualized distribution of 6-10% or more. With the S&P 500 yielding less than 2%, many investors find it difficult to achieve the portfolio income necessary to meet their needs and goals. This report is designed to help address those concerns.

Even though the Fed is likely to begin cutting interest rates soon in order to address some signs of economic weakness, stocks continue to push higher. The idea of lower rates and potentially more liquidity has investors in a good mood, so long as there are no obvious signs of a breakdown. The good times haven’t just existed on the equity side though. Convertibles are one of the best-performing fixed income groups this year. Obviously, their stock/bond hybrid nature has helped in that regard, but they could be a nice mix for anyone looking to blend growth with income.

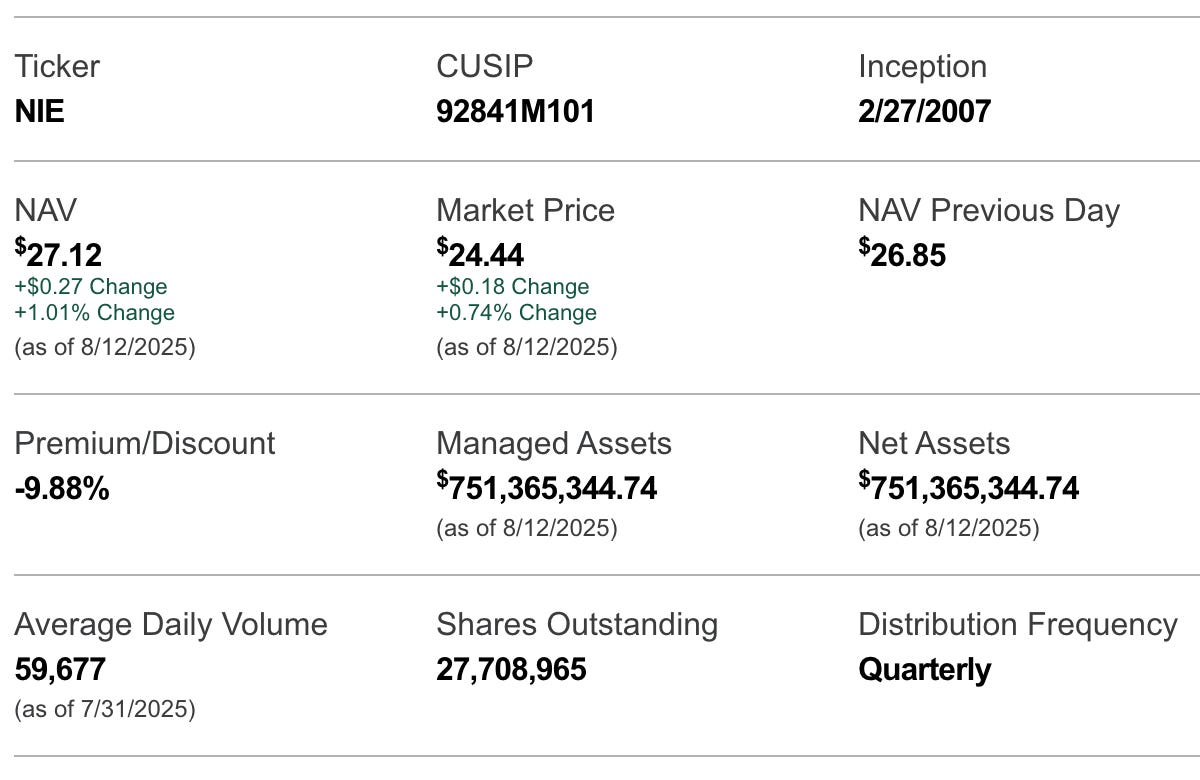

The Virtus Equity & Convertible Income Fund (NIE) combines these two asset classes within a single portfolio. What’s intriguing about the fund is that it uses a dynamic approach to asset allocation. That gives it the flexibility to pivot as the management team sees fit, which could be an important advantage over more static strategies.

Fund Background

NIE seeks total return comprising capital appreciation and current income. Under normal circumstances, the fund will invest in a combination of equity securities and income producing convertible securities. The equity component of the fund may vary from 40-80% and the convertible component may vary from 20-60% of assets. NIE also typically employs a strategy of writing call options on the stocks held in the equity component, generally with respect to approximately 70% of the value of each stock position.

I think active management makes a lot of sense within this portfolio. Static allocations to an equity/fixed income portfolio might not work in many cases, as we’ve seen over the past few years. The ability to shift from one sleeve to another may help mitigate some of that downside risk. The covered call strategy helps to generate the income and getting all of this for an expense ratio of 1.07% seems quite reasonable for this space.

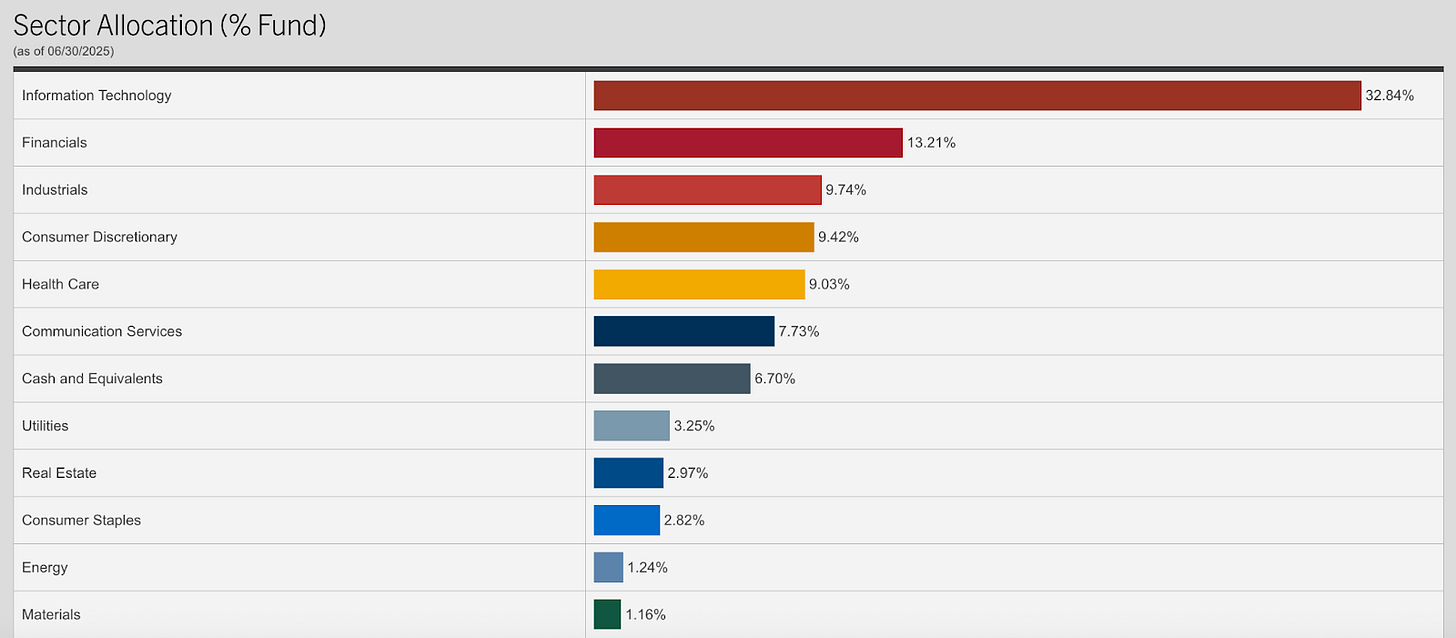

While the expense ratio for the overall strategy may seem reasonable, it might seem less so if you look at the equity allocation. Those sector weighting are awfully similar to that of the S&P 500, usually within a couple percent in either direction. Plus, the top 5 equity holdings of the fund are NVIDIA, Microsoft, Apple, Amazon and Meta Platforms. There’s really not much unique here on the equity side.

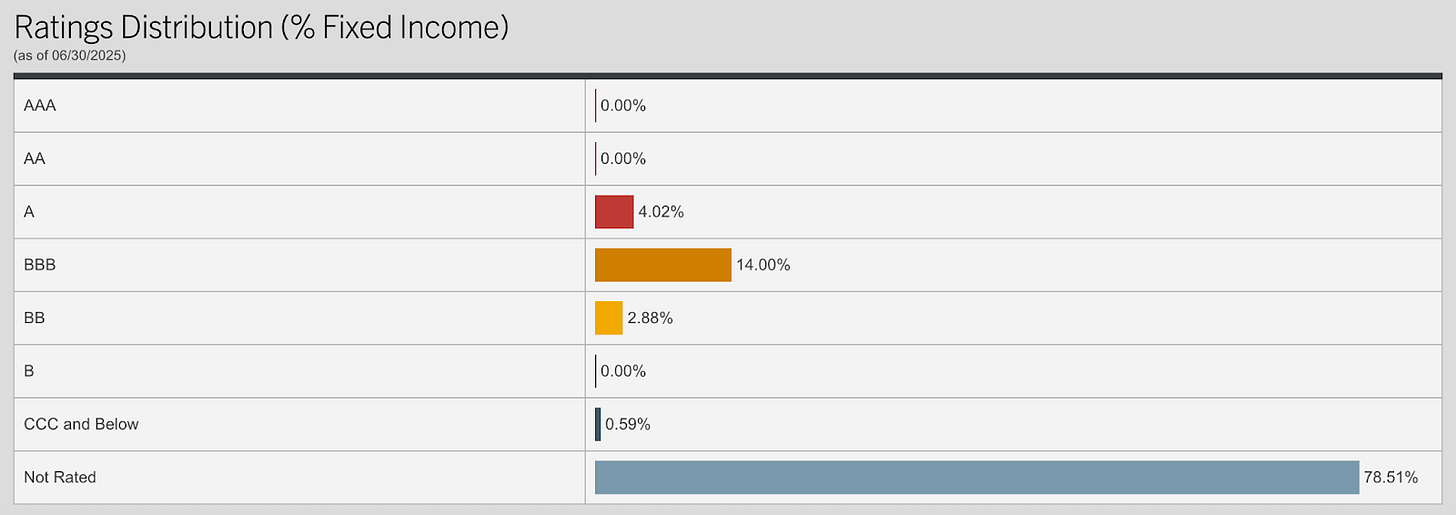

The convertible sleeve is mostly investment-grade. This is also consistent with what we typically see in the credit quality profiles of broad convertible bond portfolios. If buying NIE, this is pretty much combining a pretty vanilla equity portfolio with a pretty vanilla convertible portfolio. The only real unique thing is the dynamic allocation changes to each.