Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: TIPS INDICATING THAT INVESTORS ARE REALLY STARTING TO GET NERVOUS ABOUT INFLATION

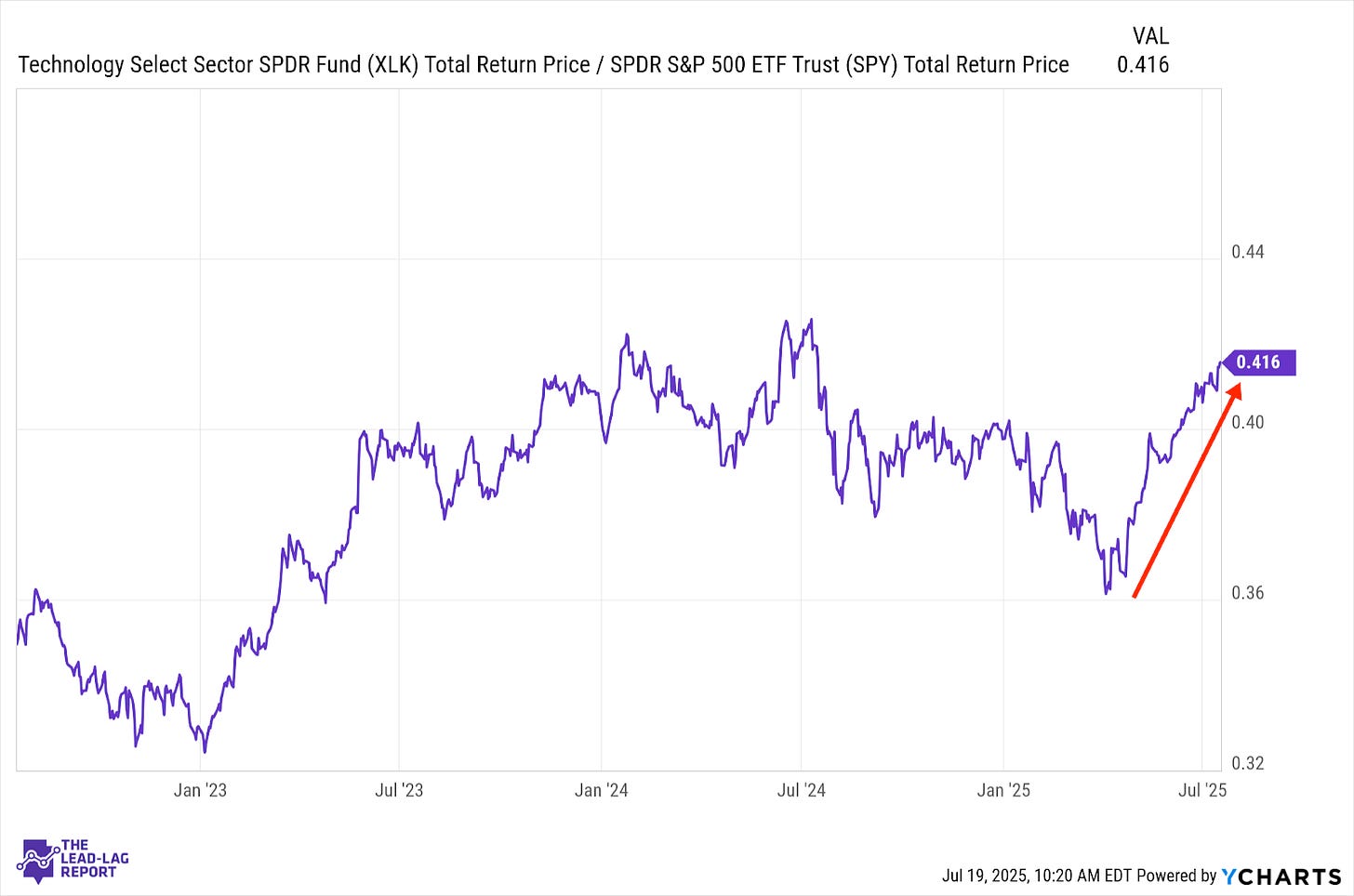

Technology (XLK) – Solid Macro Backdrop With Little Volatility

Really no changes again for this sector. Most of the recent data has come in at or near expectations without any surprises. The market has largely shrugged off tariff tension risk. Labor market and economic growth data have remained resilient and steady. There’s typically less volatility during the summer months to begin with. A relatively solid backdrop of macro data has allowed growth sectors to remain in the lead.

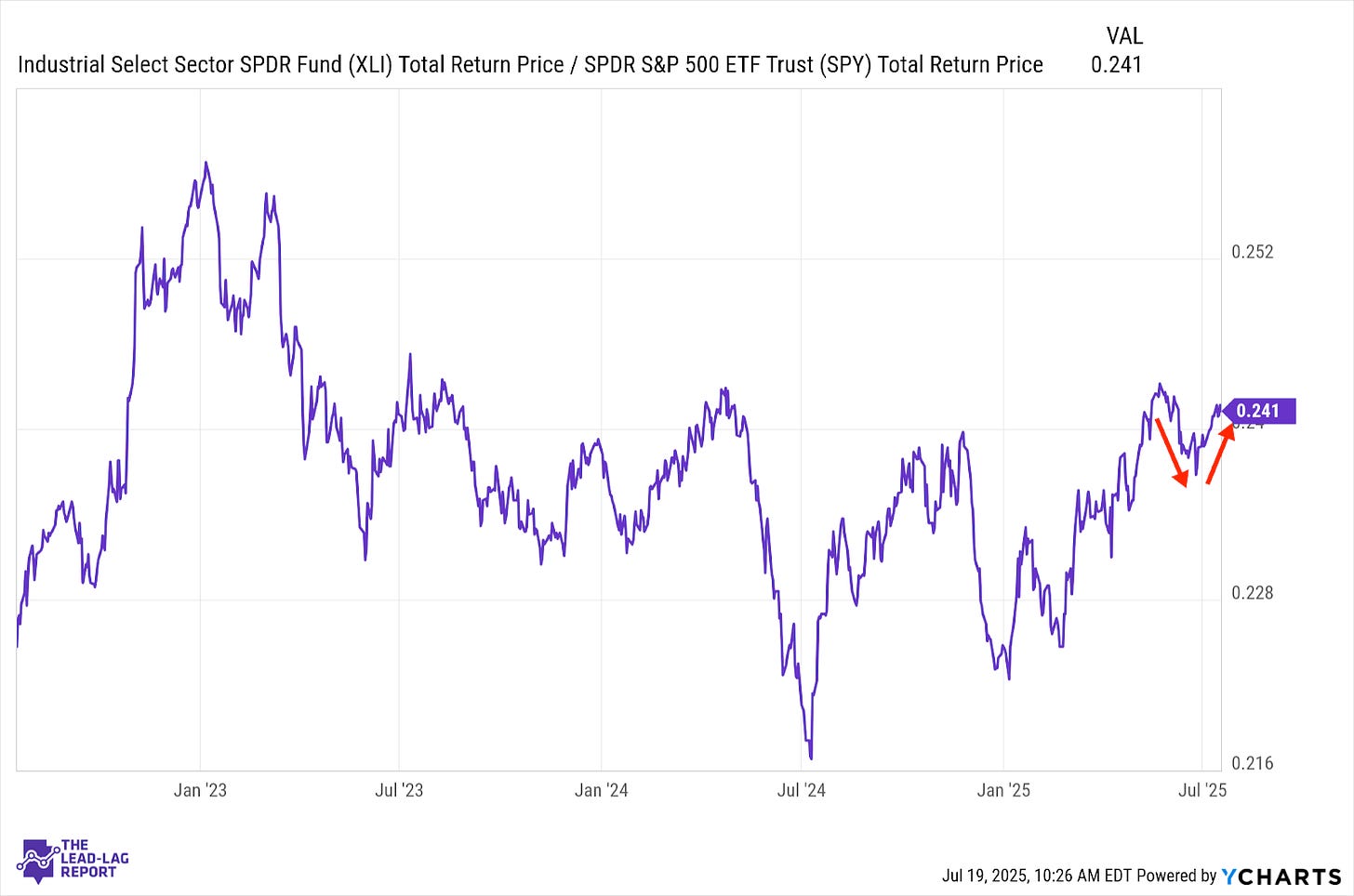

Industrials (XLI) – Inflation Creeping In

Manufacturing sector dynamics have improved somewhat in recent months, but that could just be a short-term effect of businesses trying to get ahead of tariffs. The latest CPI report suggests that some tariff-related inflation may be starting to creep in, although import prices and PPI appear to still be under control.

Long Bonds (VLGSX) – Flight To Safety Developing

While this ratio has begun trending lower, long-term yields moved steadily lower as last week went on and continued into the early part of this week. The contentious Trump-Powell relationship has started to dominate the news cycle and the president’s efforts to oust the Fed Chair as soon as possible might finally be weighing on sentiment. While rate cut optimism is always lingering, this could be a bit of a flight to safety move.

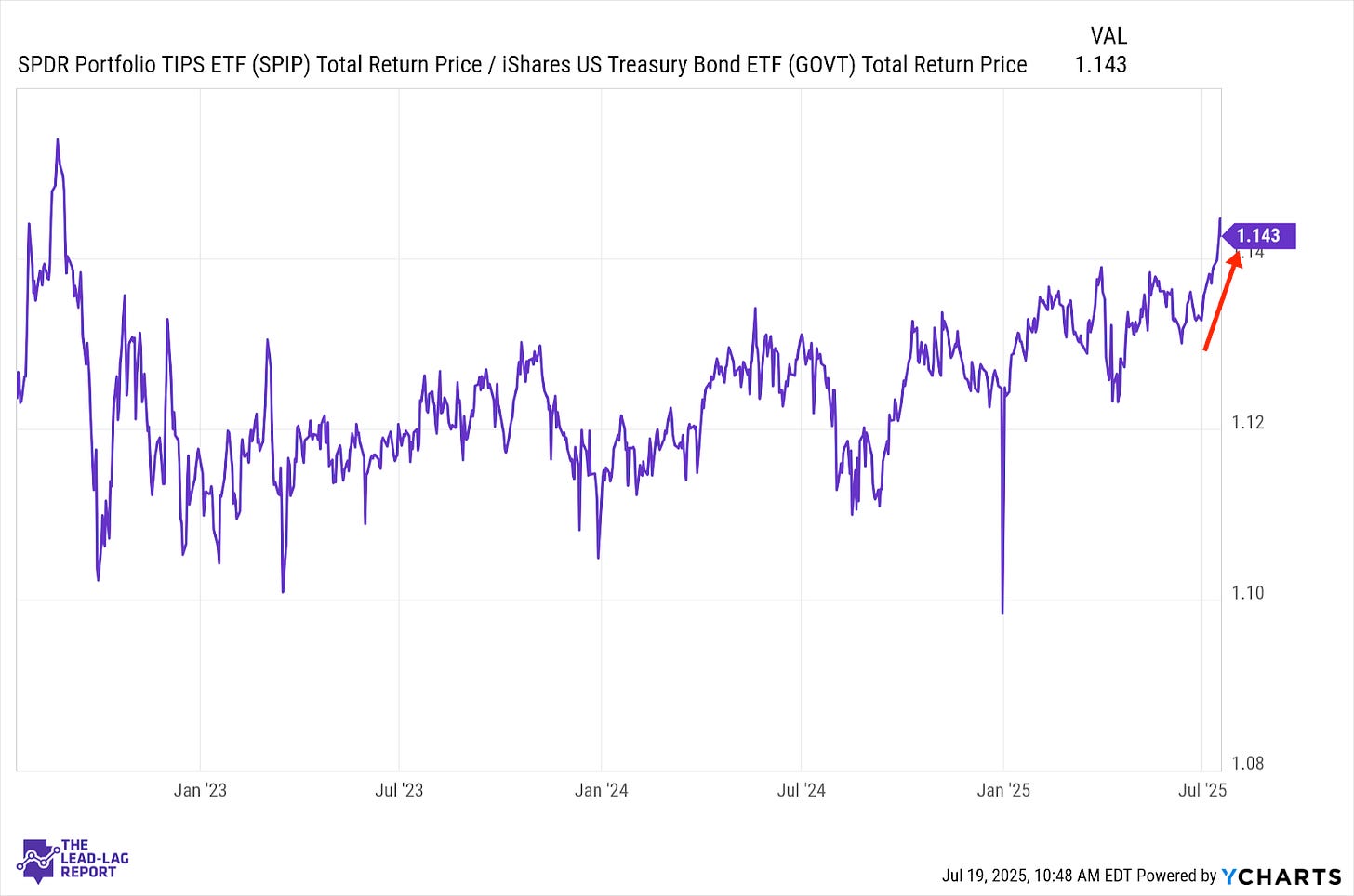

Treasury Inflation Protected Securities (SPIP) – Slight Uptrend Developing

We may be seeing the first notable outperformance from TIPS in roughly a year. Trump’s rhetoric around Powell and the Fed seems to be raising some concerns about the direction of inflation should Trump get his wish to force a massive rate cut. The backdrop of tariffs and the liquidity injection from the tax cut bill will probably help the pulse for TIPS.

Junk Debt (JNK) – Durable Despite Rate Pressures