Every week, we’ll profile a high yield investment fund that typically offers an annualized distribution of 6-10% or more. With the S&P 500 yielding less than 2%, many investors find it difficult to achieve the portfolio income necessary to meet their needs and goals. This report is designed to help address those concerns.

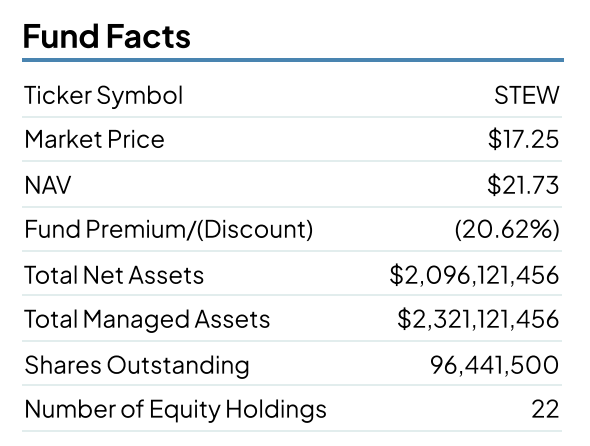

Despite their reputation, not every closed-end fund pays a high yield. Yes, this is a space where we discuss high yield options, but it’s also important to recognize the other choices that are out there. Some, such as the SRH Total Return Fund (STEW), maintain a fairly straightforward objective and look a lot like traditional equity funds. In STEW’s case, it targets quality companies trading at below their intrinsic value.

But sometimes those strategies have drawbacks. In particular, does a CEF using a fairly standard investment strategy justify an expense ratio that is often 1% or more above that of an index ETF? STEW has generated some relatively good returns in recent years, but it all comes down to the structure, the composition and whether or not the strategy makes sense given the cost.

Fund Background

STEW is a non-diversified closed-end fund with a total return investment objective. To achieve its objective, the fund utilizes a bottom-up, value-driven investment process to identify securities of good quality businesses trading below estimated intrinsic value. The intent of this process is to identify investment opportunities that will provide attractive returns over a long holding period. The fund also utilizes leverage in order to enhance yield and total return potential.

The term “non-diversified” is the key phrase here. It becomes clear seeing that STEW holds fewer than two dozen individual positions, but it’ll become more obvious when we dive into the fund’s top holdings later. The fund’s “growth at a reasonable price” strategy is admirable enough and the fact that it only has about a 10% leverage overlay gives the fund the opportunity for outperformance without getting too cost-prohibitive. STEW is less about the strategy itself and more about what the output of that strategy is.

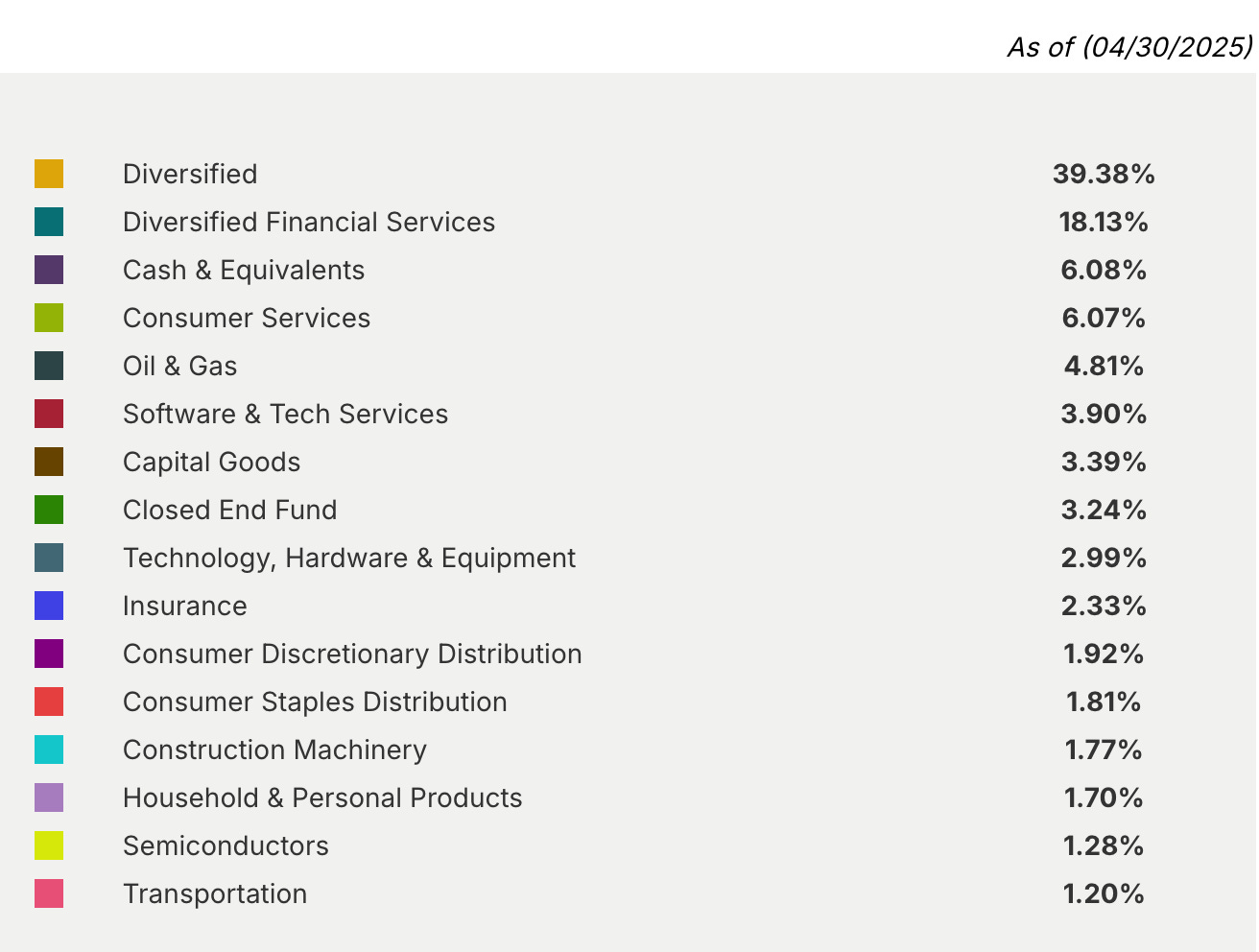

Nearly 60% of the portfolio is invested in securities categorized as “diversified”, a bit ironic given how the fund is considered non-diversified according to its objective. Some of the top sector holdings, including financial services, consumer services and energy, make sense given that’s often where you find value according to the traditional valuation metrics. The top-heaviness of the portfolio does introduce idiosyncratic risk, which can be problematic.

Here’s where “non-diversified” becomes obvious. More than 40% of the fund is in Berkshire Hathaway, while the other 60% is relatively reasonably distributed to the other 20 names.