Every week, we’ll profile a high yield investment fund that typically offers an annualized distribution of 6-10% or more. With the S&P 500 yielding less than 2%, many investors find it difficult to achieve the portfolio income necessary to meet their needs and goals. This report is designed to help address those concerns.

While the trend of junk bonds outperforming broad Treasuries hasn’t ended yet, it’s definitely shallowing up. The anticipated Fed rate cutting cycle has brought long-end yields lower and that’s helped long bonds become more competitive. With signs that the housing market may be topping out and this week’s ADP employment report showing a decline in jobs in June, conditions may soon turn against riskier asset classes.

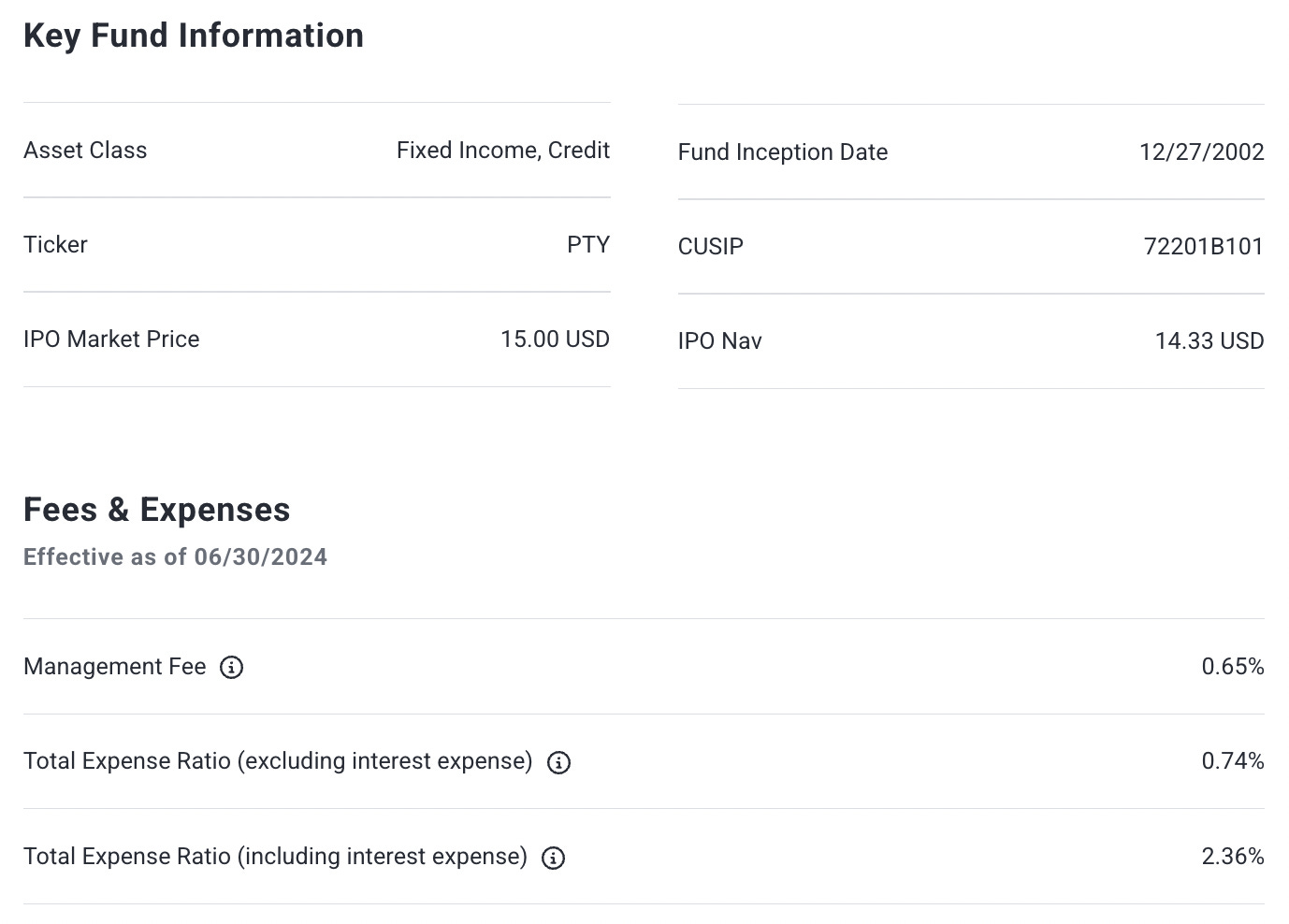

One of the largest closed-end credit funds out there is the PIMCO Corporate & Income Opportunity Fund (PTY). It’s more of an all-credit portfolio in that it owns corporates, both investment-grade and junk, senior loans, agency bonds and asset-backed securities. It’s been popular among investors for its mix, but also its yield, which has routinely hovered north of 10%. But it also trades at a significant premium above its NAV. Many investors don’t like paying above market prices for their investments and PTY is a good test case for whether the value is worth the cost.

Fund Background

PTY uses a dynamic asset allocation strategy that focuses on duration management, credit quality analysis, risk management techniques and broad diversification among issuers, industries and sectors. The fund seeks maximum total return through a combination of current income and capital appreciation.

Under normal conditions, it invests in corporate, government, municipal, mortgage-backed and asset-backed securities of varying maturities. It also utilizes leverage to enhance yield and total return potential.

PTY’s strategy that focuses on utilizing fundamental, macro, industry and company-specific research is an attractive one. It’s this combination top-down/bottom-up analysis that helps the strategy act as a cross-check against itself. The 15% use of leverage, which can vary over time, is kind of in the sweet spot of being useful enough to generate alpha potential but not enough to overdo it. That 2.3% expense ratio, however, could be difficult to overcome in achieving above average returns. Given its diversity, PTY has the potential to be an all-in-one fixed income holding for yield seekers.

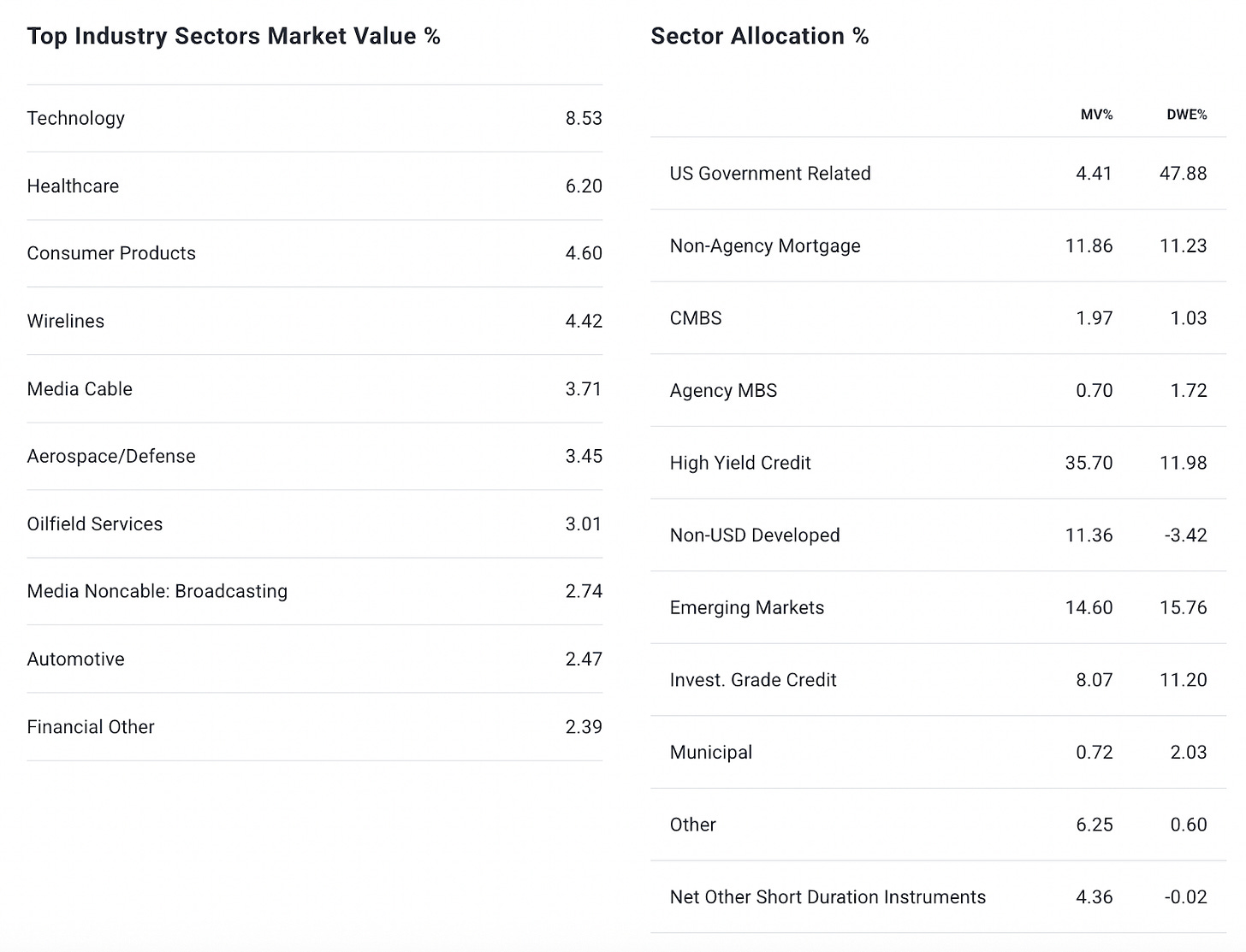

A plurality of the fund’s assets are in high yield credit, but the portfolio is fairly diversified beyond that. The double digit allocation to developed & emerging market credit and non-agency mortgage bonds reflects a definite tilt towards corporate bonds but a relatively solid mix beyond that. There’s an overall 60/40 split between junk and investment-grade securities, which gives it a nice diversification across credits, regions and sectors while delivering a higher yield.

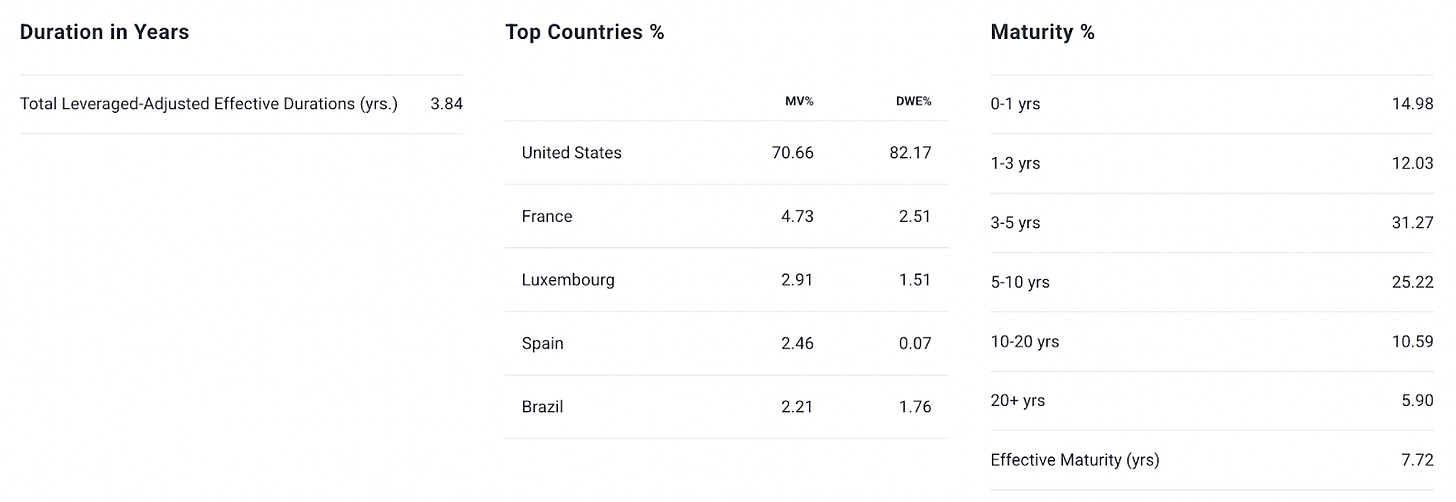

PTY maintains a minor global diversification, which is pretty consistent with a lot of other fixed income CEFs. The 4-year duration of the portfolio reduces a modest amount of duration risk, especially given that it’s leverage-adjusted, which may be a good thing given that yields have turned more volatile in light of competing macro forces. If yields follow the Fed lower, there’s obviously some appreciation potential that could be missed out on.

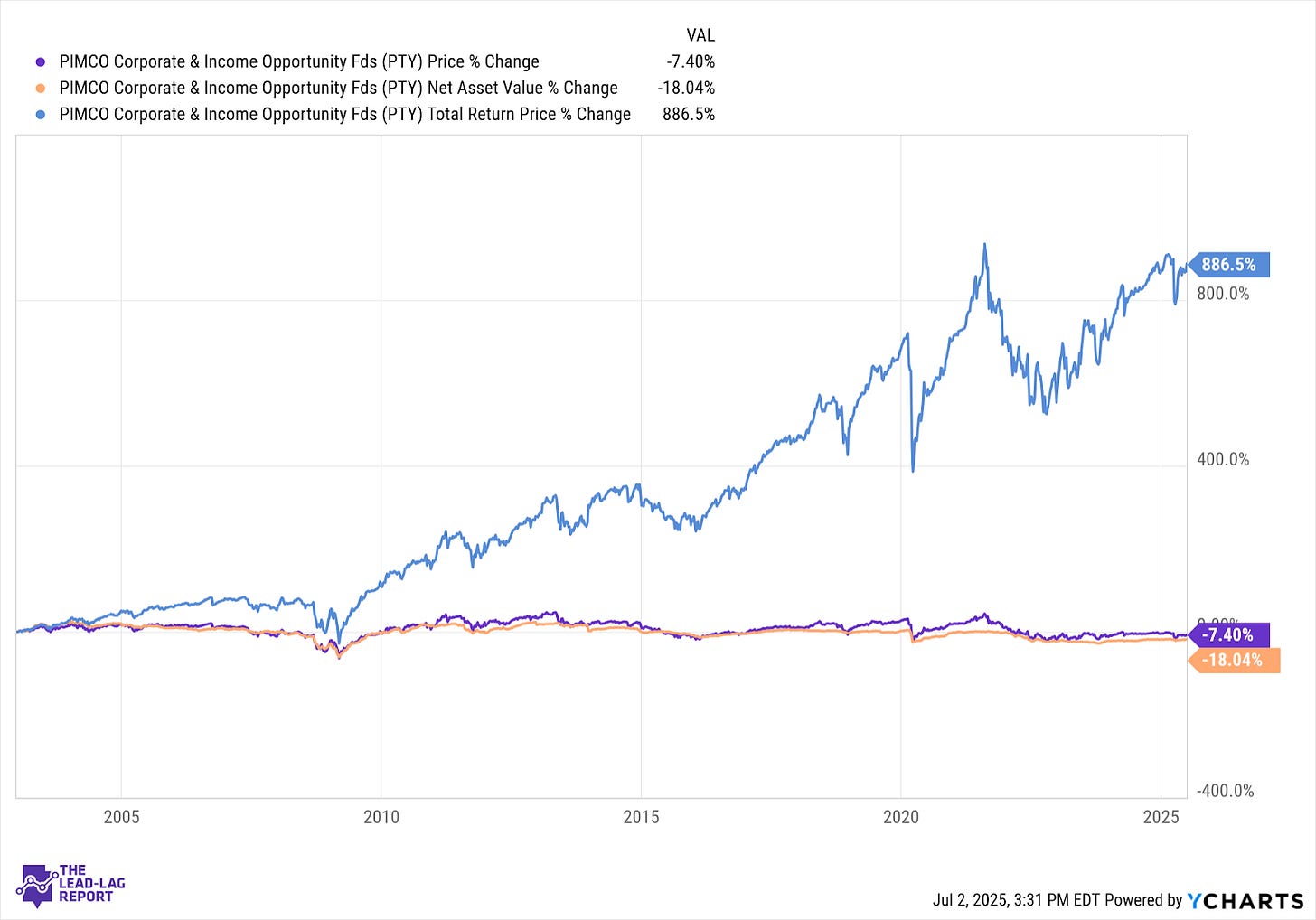

Since its inception in December 2002, PTY has generated a total return of 886%. That translates to an average annual return of around 12-13%.

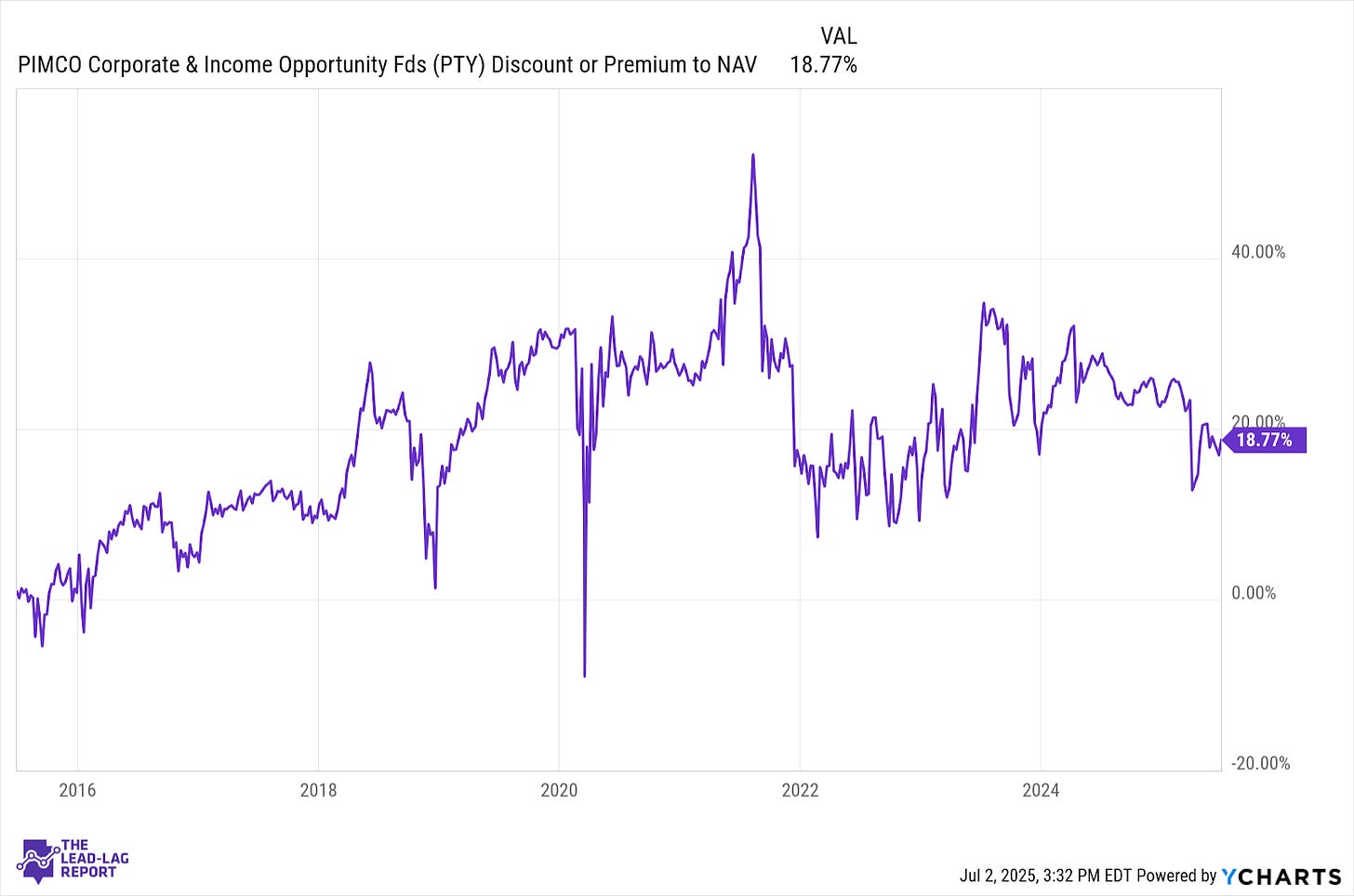

These returns have put PTY in the tippy top of its Morningstar category over the past 1-, 3-, 5- 10- and 15-year time periods, obviously earning a 5-star rating in the process. Based on this, it’s no surprise that this fund has become one of the largest in the CEF space. Demand for shares is high, but since CEFs only have a fixed number of shares available, it creates competition for those shares. The level of that competition shows up in the fund’s premium to NAV.

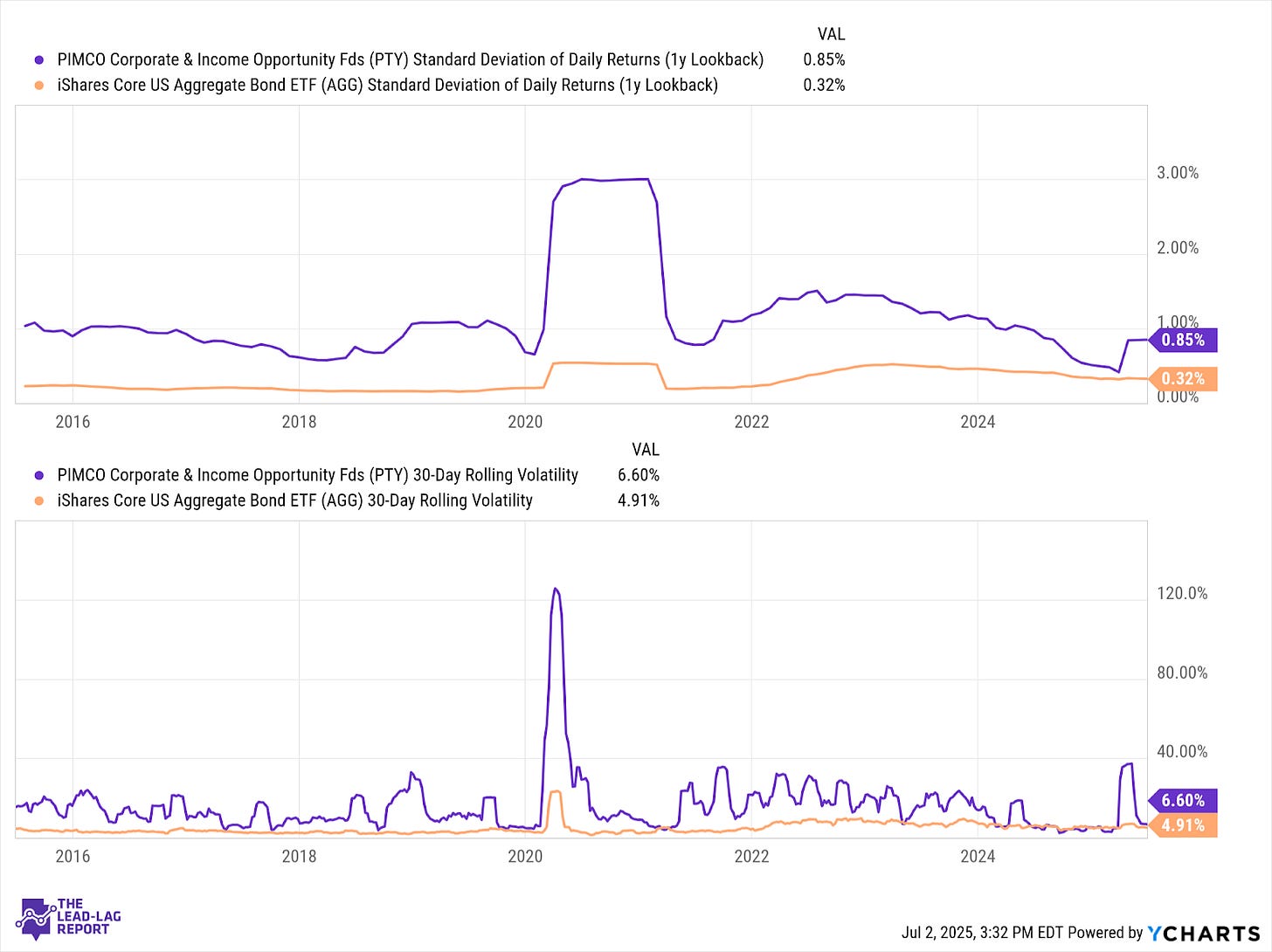

The fund’s volatility level is much higher than that of the Barclays Agg index. Granted, this probably isn’t a good comparison given the differences in composition, but it’s a good illustration of how risk levels are likely to differ when compared to a familiar index. The composition adds a degree of risk as does the use of leverage. Even though risk-adjusted returns for PTY have still been superior, it does reduce the attractiveness of the fund a bit given how much risk investors have needed to take to achieve those returns.

As mentioned earlier, an 18% premium to NAV is one of the highest you’ll find in the CEF space (and that’s actually down significantly from its recent peak). Should investors be OK with paying nearly 20% above sticker price just to own shares? In my opinion, probably not. Although it doesn’t matter as much if the premium remains elevated, it’s important to point out that a lot of those historical returns were achieved in a period with conditions that were very favorable to junk bonds. As the economy slows here, a shrinking premium could actually enhance downside risk.

Macro Environment

The macro risks that are present in the junk bond universe are still very much there even though current optimism and low credit spreads are kind of drowning them out. Credit conditions have been getting worse for some time, including default and delinquency rates. That part isn’t new, but bond investors have largely ignored it with hopes for Fed rate cuts ahead and a generally healthy U.S. economy.

Now, the calculus may be changing. We’re seeing supply/demand imbalances in the housing market and the national average home price has declined for the second straight month. Home affordability has been a concern for several quarters and we might be starting to see the fallout from it.

The ADP labor market report is particularly concerning. Since the post-pandemic period, the jobs market has been the cornerstone of the recovery and a primary reason why most believe that the soft landing narrative is intact. The job loss in June was the first monthly decline since early 2023. We’ve seen soft data that suggests sentiment around the labor market has been weakening, but this is the first real hard data showing a contraction. This may not necessarily translate to a similar result for the NFP report, but it’s certainly not a positive sign.

Overall, the conditions that have supported junk bonds throughout the past few years look like they’re deteriorating. Only 40% of the portfolio is non-investment grade, but a macro trend like that will probably impact all riskier credit.

Distribution Policy

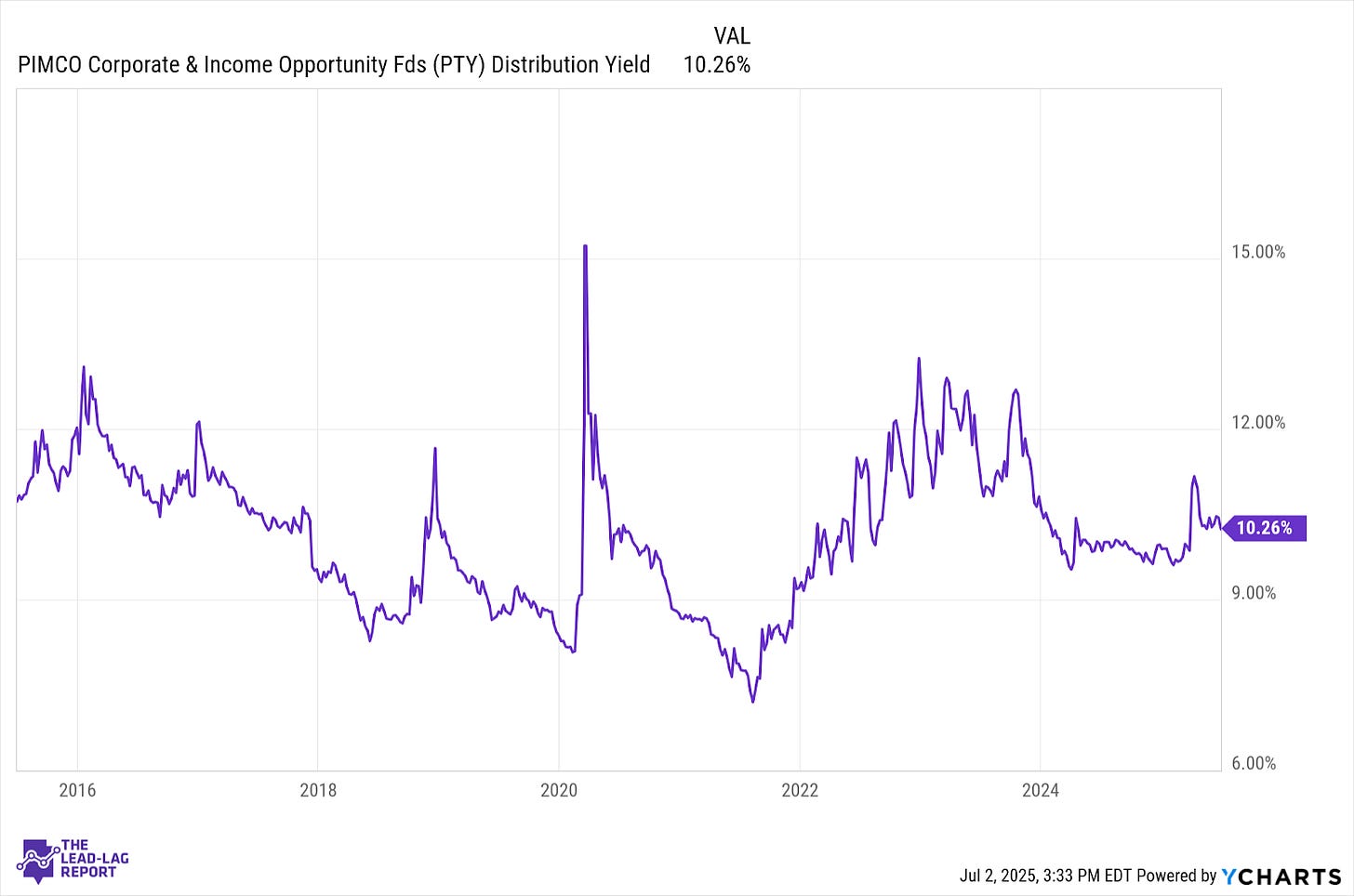

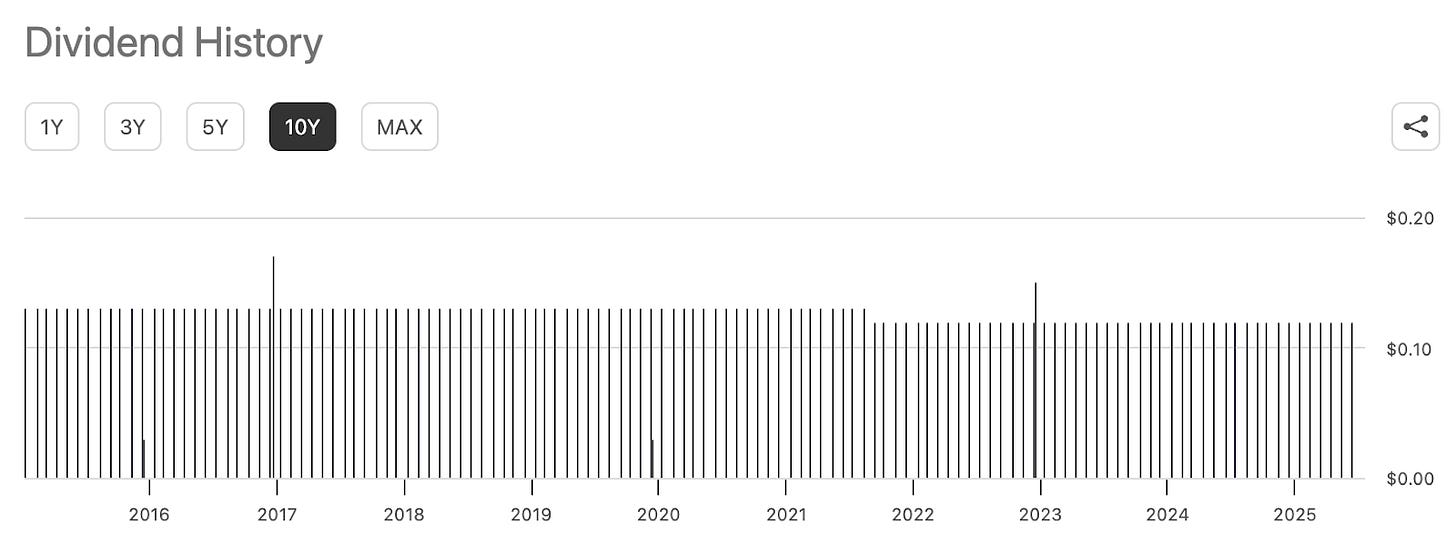

PTY maintains a fixed monthly distribution policy that currently pays $0.1188 per share or $1.4256 per share annually. At current share prices, that translates to a forward-looking annualized yield of 10.3%.

The historical total returns of PTY are likely what’s driving investor interest, but a distribution yield that’s steadily in the 9-10% range is a big bonus. Investors are getting a steady income stream as well as some extra capital appreciation that’s supported distribution durability over the past decade-plus.

In its recent history, the distribution has only been cut once - back in 2021 in the aftermath of the COVID pandemic. In fairness, a lot of fixed income funds cut their distributions around that time, so PTY doing the same is understandable. Again, the ability of the fund to historically generate the total return necessary to fund the distribution adds a layer of sustainability.

Advantages

The fund’s historical performance record is the clear draw here. It’s been an elite performer within its group over the past 15 years, but we’ll see if that trend continues into the future.

Distribution sustainability is high. Given recent history, the distribution is likely still in solid shape moving forward, but that’ll depend on economic health.

The diversification within the fund allows it to act as a potential one-stop for fixed income exposure within a portfolio.

Disadvantages

While the fund has a terrific track record, the fact that the fund trades at an 18% premium to NAV takes away some of the attractiveness. Investors always need to make sure they’re getting relative value from their investments and I’m not sure paying 118 cents on the dollar qualifies.

The high cost of leverage, even in PTY’s relatively modest overlay, becomes expensive quickly, as evidenced by the 2.4% expense ratio.

Final Thoughts

There’s little question that PTY is one of the best fixed income CEFs out there. Its performance has delivered and the portfolio hits most corners of the market.

The issue comes with the price investors need to pay to own it. The current premium isn’t quite a dealbreaker, but it does tilt the risk/reward profile in a negative way.

If the high yield market is deteriorating as many suspect, the fund might not only experience negative performance, but also a shrinking of that premium, which adds to the downside. The premium has held in its current range for a while, so maybe the risk of a decrease in the premium isn’t as big as I fear, but it’s certainly a risk.

I think PTY is still worth consideration here, but investors probably need to keep an especially close eye on it given all that’s happening in the macro background.

The Lead-Lag Report is provided by Lead-Lag Publishing, LLC. All opinions and views mentioned in this report constitute our judgments as of the date of writing and are subject to change at any time. Information within this material is not intended to be used as a primary basis for investment decisions and should also not be construed as advice meeting the particular investment needs of any individual investor. Trading signals produced by the Lead-Lag Report are independent of other services provided by Lead-Lag Publishing, LLC or its affiliates, and positioning of accounts under their management may differ. Please remember that investing involves risk, including loss of principal, and past performance may not be indicative of future results. Lead-Lag Publishing, LLC, its members, officers, directors and employees expressly disclaim all liability in respect to actions taken based on any or all of the information on this writing.