Every week, we’ll profile a high yield investment fund that typically offers an annualized distribution of 6-10% or more. With the S&P 500 yielding less than 2%, many investors find it difficult to achieve the portfolio income necessary to meet their needs and goals. This report is designed to help address those concerns.

Interest rates have been falling all along the yield curve now that the Fed has begun its latest cutting cycle. That means yields on a lot of fixed income products are falling as well, but not so for the Invesco Municipal Opportunity Trust (VMO). This past summer, it made a 60% distribution increase, bringing the fund’s yield to its highest level in more than 7 years. That makes the fund an interesting option for high yield seekers in upper income brackets, but it also raises the concern about relative value. Investors often bid up shares of high yield funds, negating some of the total return potential in the process.

That may not be the case with VMO though. It might still be on sale despite the new higher yield, which makes it a great time to review this fund and how it looks moving forward.

Fund Background

VMO’s investment objective is to provide current income which is exempt from federal income tax. The fund also utilizes a high degree of leverage in order to enhance yield and total return potential.

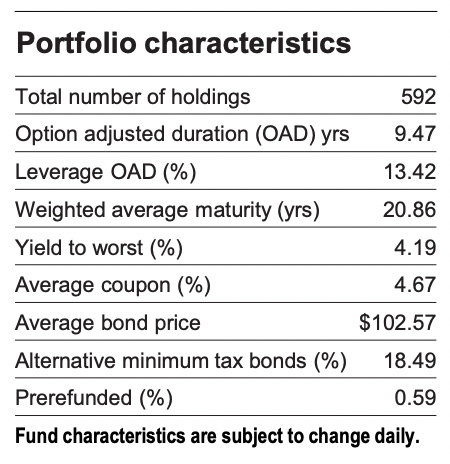

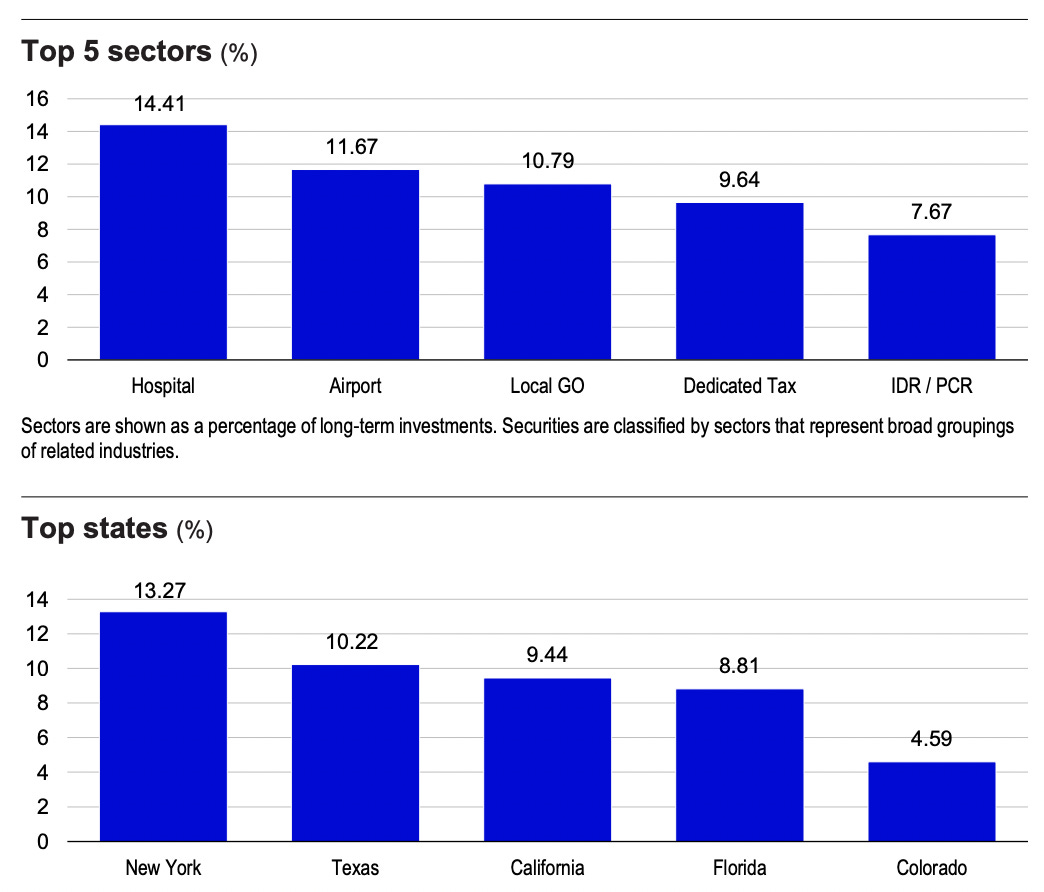

With the portfolio being well-diversified, consisting mostly of investment-grade bonds and targeting an intermediate-term maturity, VMO provides a fairly straightforward portfolio without any surprises or unusual selection strategies. In that way, it can make for a fairly good core fixed income holding. The leverage is the unique part of the fund. This addition pushes the portfolio’s duration up to more than 13 years, making interest rate risk a big consideration. A 35% leverage level also makes volatility a concern. This is a classic example of weighing whether or not the extra yield being captured is worth the extra risk being taken to get it.

VMO is almost entirely an investment-grade portfolio, but more than that, it’s mostly in the AAA-A rated buckets. That makes it of higher quality than many other bond funds that lean heavily into the BBB category for higher yield. With spreads on the junk side still extremely narrow and not presenting a very attractive risk/reward opportunity, tilting heavily towards higher quality, especially in an environment where delinquency rates are rising, is probably a good thing.

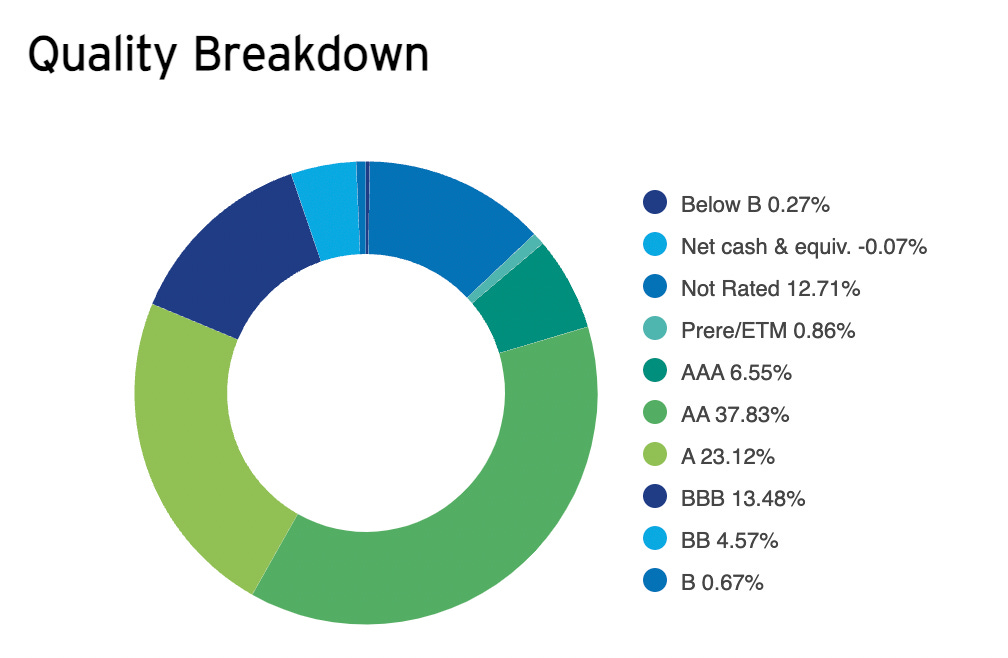

Nothing hugely surprising when you dig into the composition of the fund. The states of New York, California, Texas and Florida receiving the largest allocations is pretty typical of what you see in the muni market. Credit type diversification is pretty solid with no one group overweighting the portfolio.

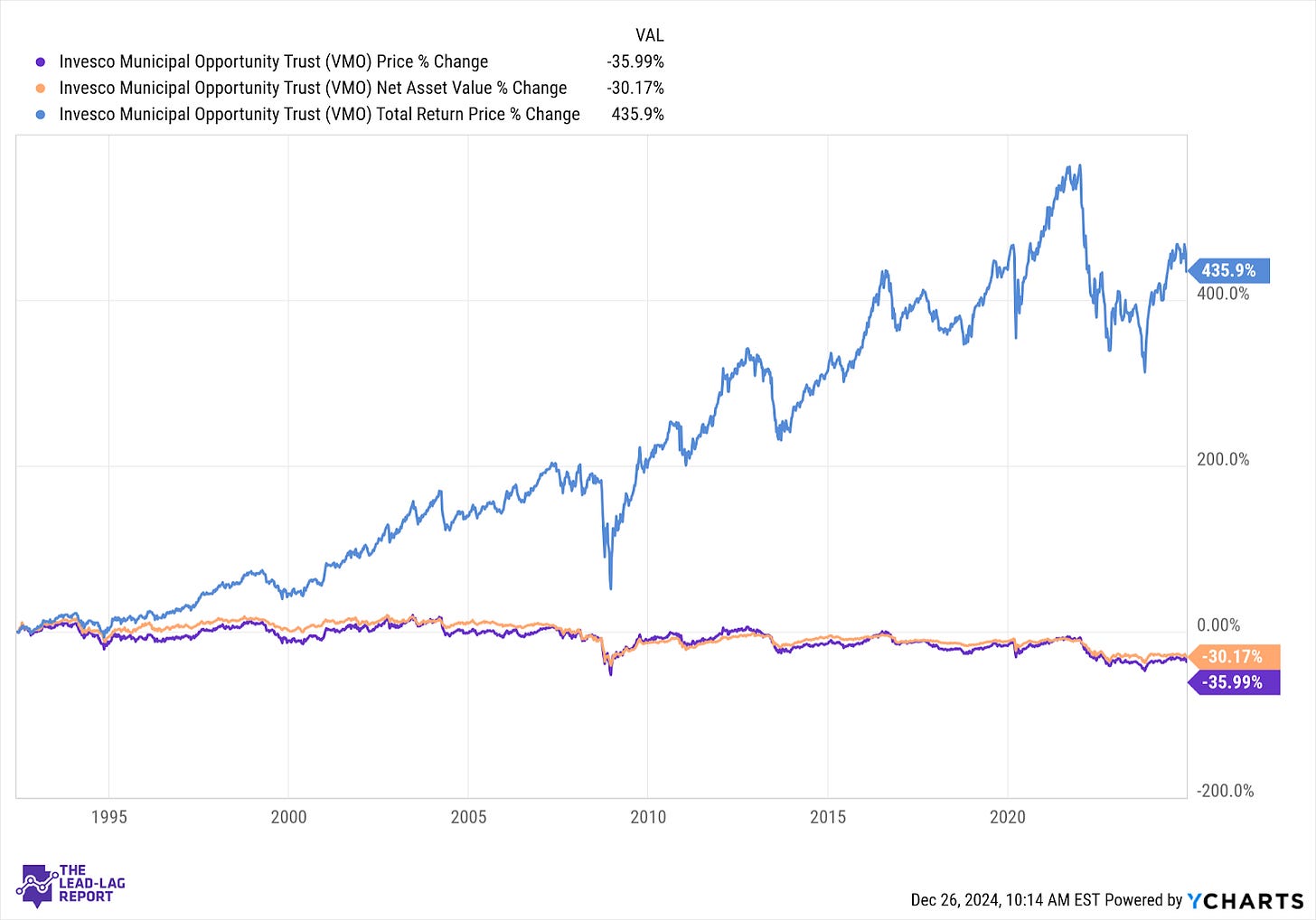

VMO was launched in April 1992. Since its inception, the fund has returned a total of 436%, which translates to about 5.4% annually.

An NAV degradation of only 30% over the course of more than three decades indicates solid management of the portfolio. The annualized return of more than 5% has earned VMO a strong 4-star rating from Morningstar, but the relative steadiness of the NAV may be more important. That suggests the fund’s distribution policy is being managed appropriately and is balanced with the income that the fund is earning.