A Junk Bond Fund Built For This Environment, But There Are A Lot Of Risks Within

Every week, we’ll profile a high yield investment fund that typically offers an annualized distribution of 6-10% or more. With the S&P 500 yielding less than 2%, many investors find it difficult to achieve the portfolio income necessary to meet their needs and goals. This report is designed to help address those concerns.

The passage of Trump’s tax bill presents an interesting environment for junk bonds. On one hand, more favorable conditions for corporations should help support balance sheet health and could provide a boost for lower-rated credit. On the other hand, a massive tax cut & spending bill could raise fiscal risks and bring inflation risk back into the picture over the intermediate- to longer-term. However, with more liquidity likely flowing into the system, there’s an easy case to be made that recent events have improved the outlook for junk bonds.

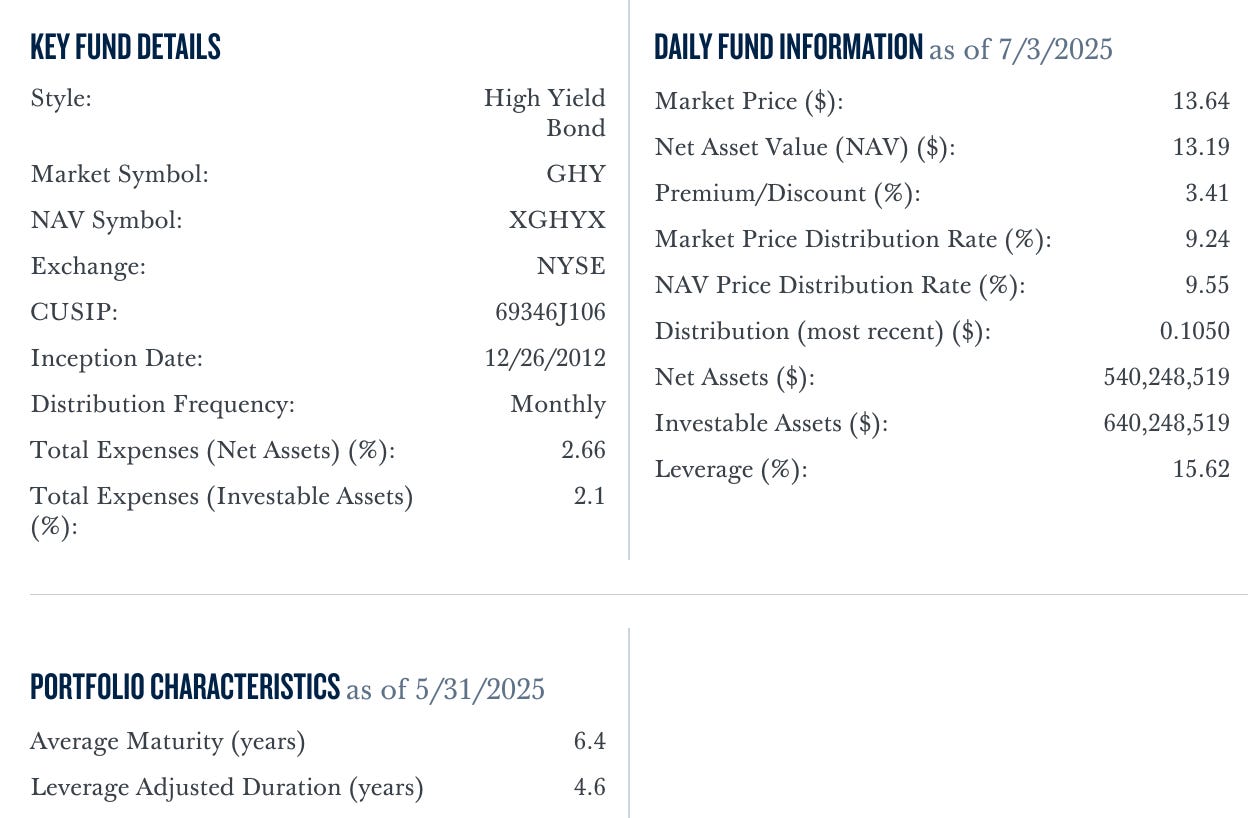

The PGIM Global High Yield Fund (GHY) invests throughout the world as the name suggests, which alters the outlook somewhat. The U.S. high yield bond market may look more attractive, but certain markets may not appear the same. Emerging markets debt has done well recently, but developed market bonds have been more mixed. There’s a yield opportunity here, but the broad diversification could actually hinder some of that opportunity.

Fund Background

GHY seeks to provide a high level of current income by investing primarily in below investment-grade fixed income instruments of issuers located around the world, including emerging markets. The fund also uses leverage to enhance yield and total return potential.

A couple of things stand out to me right away. First is the 15% leverage overlay. You probably know that this is around the range where I think leverage has the best chance of success. Once you get up in the 20-30% range, leverage becomes too costly in this environment to have a high degree of success. The 10-15% area improves the odds, although the 2.66% expense ratio shows that it’s still costly. Second, I like that the fund includes emerging markets. This group is probably one of the better opportunities in fixed income right now, especially with the falling dollar, and I think it’s a positive that the GHY has exposure.