A Lot Hinges On The Bank Of Japan

Plus - Discretionary Stocks Are The Undisputed Leader

Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: A LOT HINGES ON THE BANK OF JAPAN NEXT WEEK

Consumer Discretionary (XLY) – The Undisputed Leader

Discretionary stocks remain the undisputed U.S. equity market leader since the end of last summer. Even though the Fed is unlikely to cut as much as originally thought, long-term rates are easing, consumer spending has been resilient and post-election economic optimism has ruled the day. If the market continues its recent trend of finally rotating away from cyclicals and towards growth again, this rally could continue although it looks short-term overdone.

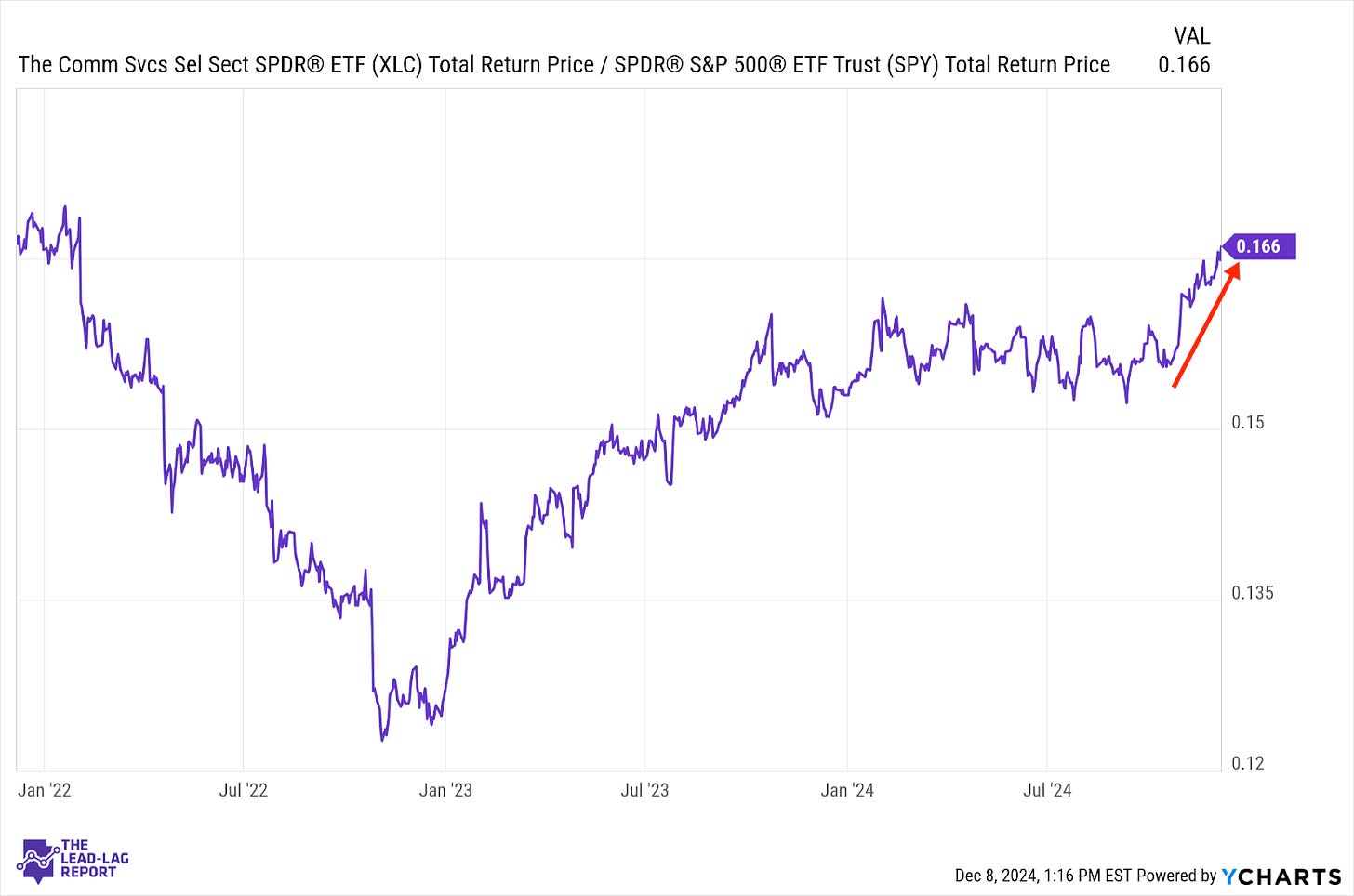

Communication Services (XLC) – The Breakout Continues

The post-election breakout continues for this sector. The market shifted in a big way towards growth stocks this past week, which could indicate interest consolidating around this theme. This has been a relatively broad rally, not just one driven by the mega-cap names, and that could be a good sign for sustainability.

Technology (XLK) – An Upside Sustainability Problem

Tech finally woke up last week and joined its growth sector counterparts in sharply outperforming the market. It’s a notable development because tech has consistently been underperforming the S&P 500 even before the election. Given some of the uncertainty surrounding this sector, such as a regulatory environment that’s very likely to tighten and a more challenging global trade environment, I’m not sure that even positive catalysts are sustainable right now.

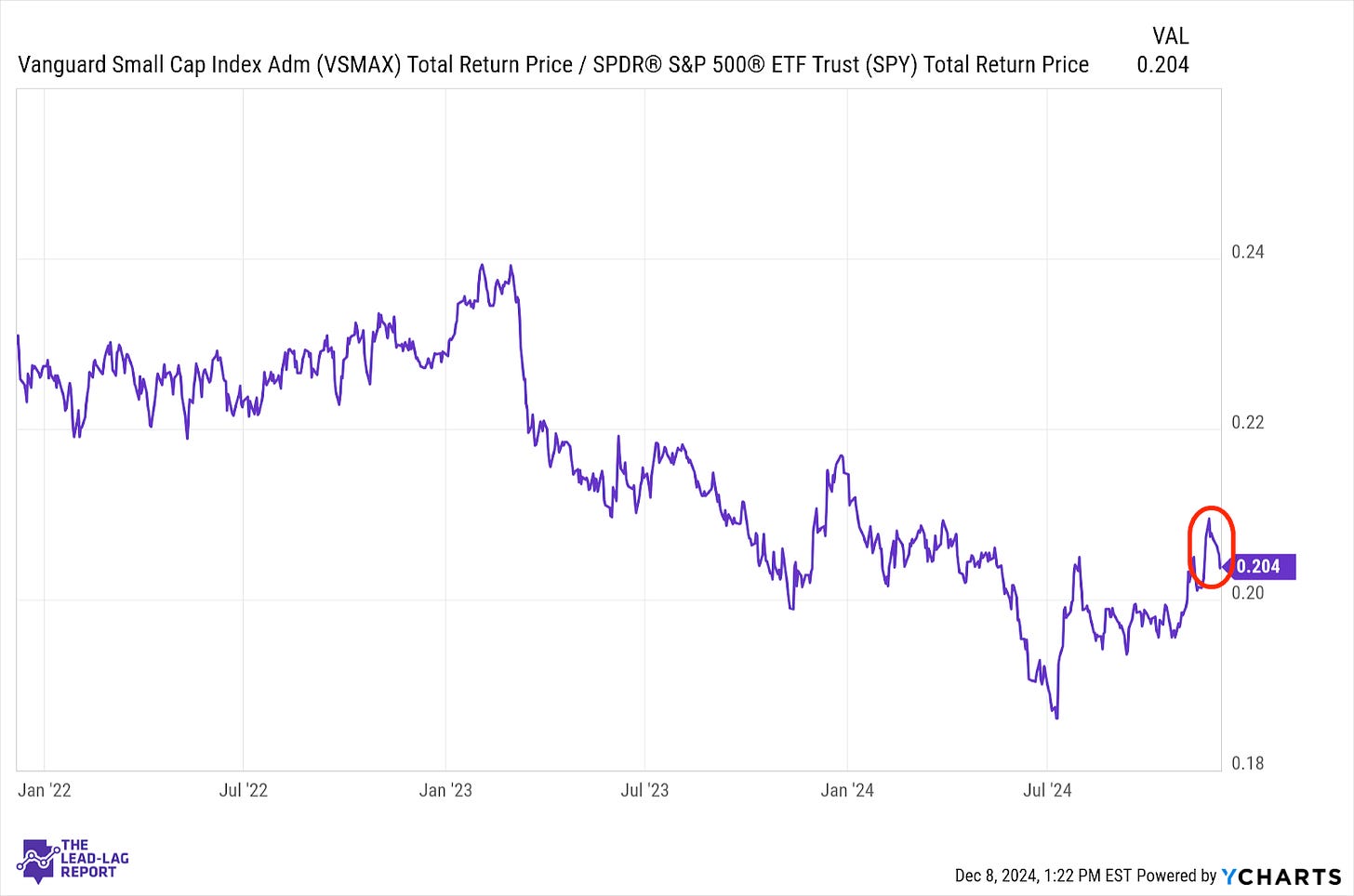

Small-Caps (VSMAX) – Trading Like Value Stocks

Small-caps continue trading on their value characteristics, not their growth ones. That means we’ve seen this sector lag whenever tech and the S&P 500 have been gaining. In that sense, they could actually hold up well in a downturn similar to how they did in 2022, but are likely to struggle as long as cyclicals are struggling.

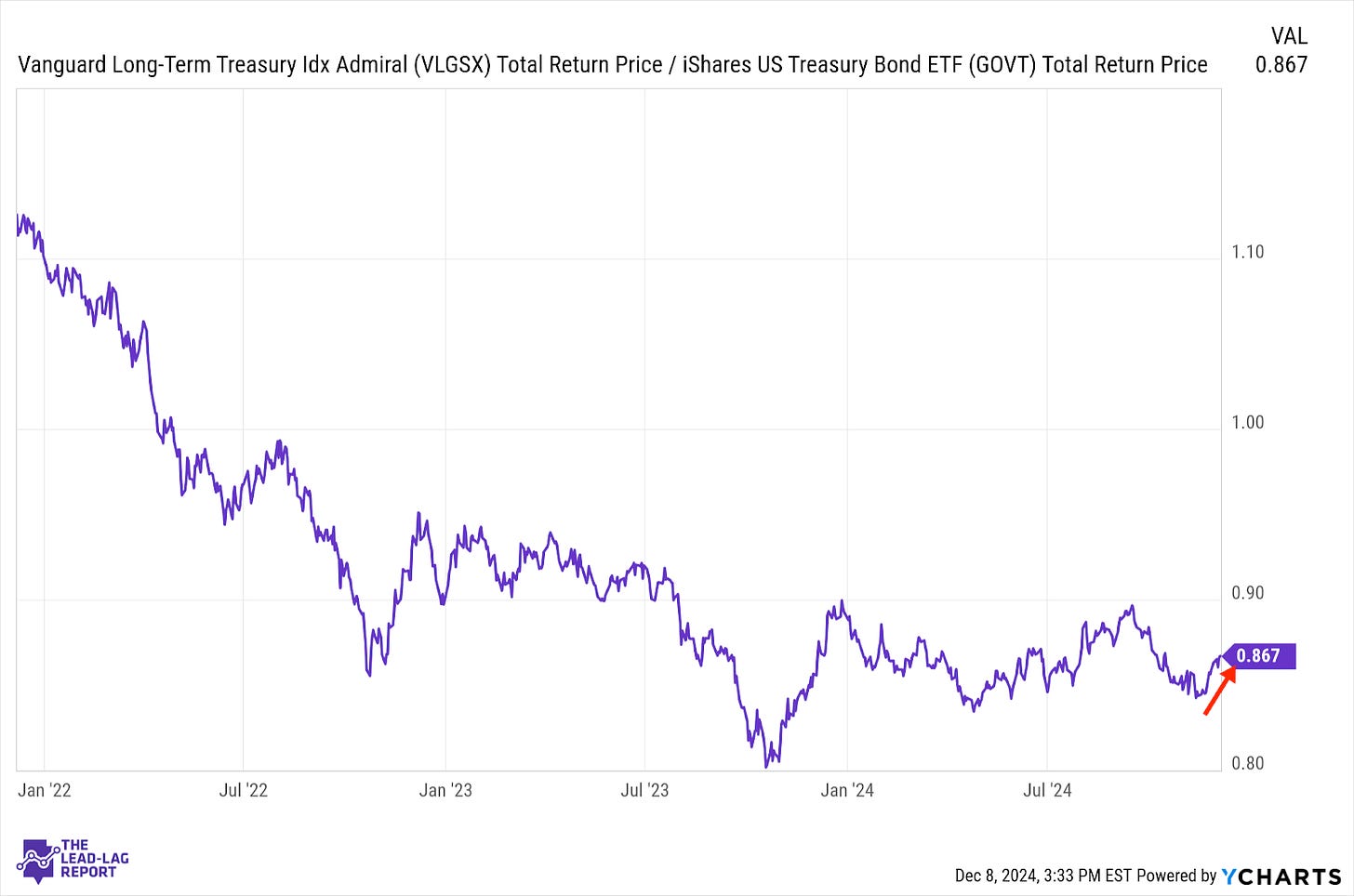

Long Bonds (VLGSX) – Will This Keep Diverging From Equities?

Treasuries are rallying here to the point where it can’t just be considered a quick pop. The 10-year yield has dropped 30 basis points in just over three weeks and that can’t be attributed just to normal buying and selling activity. Perhaps traders are un-pricing some of the odds of higher inflation next year and they’re worried about China or Japan or the labor market. Either way, I think we need to watch this closely if it keeps diverging from the message from equities.

Junk Debt (JNK) – Watch Next Week

Junk bonds are finally starting to back off a little here. Credit spreads haven’t really moved at all, so this is a direct result of the rebound in long-dated Treasuries. I wouldn’t write off this group yet given its history of resilience over the past two years, but it’s worth repeating that there isn’t much room for error here. Any negative change in conditions could be met with swift selling, which is why I’d be cautious holding this asset class heading into next week.

Join Kurv Investment Management’s Founder & CEO, Howard Chan today at 4 PM ET for a special anniversary webinar I’m hosting.

We'll dive into how Kurv has set itself apart by adopting an institutional approach to single-stock covered call strategies, effectively addressing challenges like NAV erosion that have impacted many ETFs in this space with the Yield Premium Strategy ETF Suite (AMZP, AAPY, GOOP, MSFY, NFLP, and TSLP)

Register now by clicking HERE.

DISCLAIMER – PLEASE READ: This is sponsored advertising content for which Lead-Lag Publishing, LLC has been paid a fee. The information provided in the link is solely the creation of Kurv Investment Management. Lead-Lag Publishing, LLC does not guarantee the accuracy or completeness of the information provided in the link or make any representation as to its quality. All statements and expressions provided in the link are the sole opinion of Kurv Investment Management and Lead-Lag Publishing, LLC expressly disclaims any responsibility for action taken in connection with the information provided in the link.

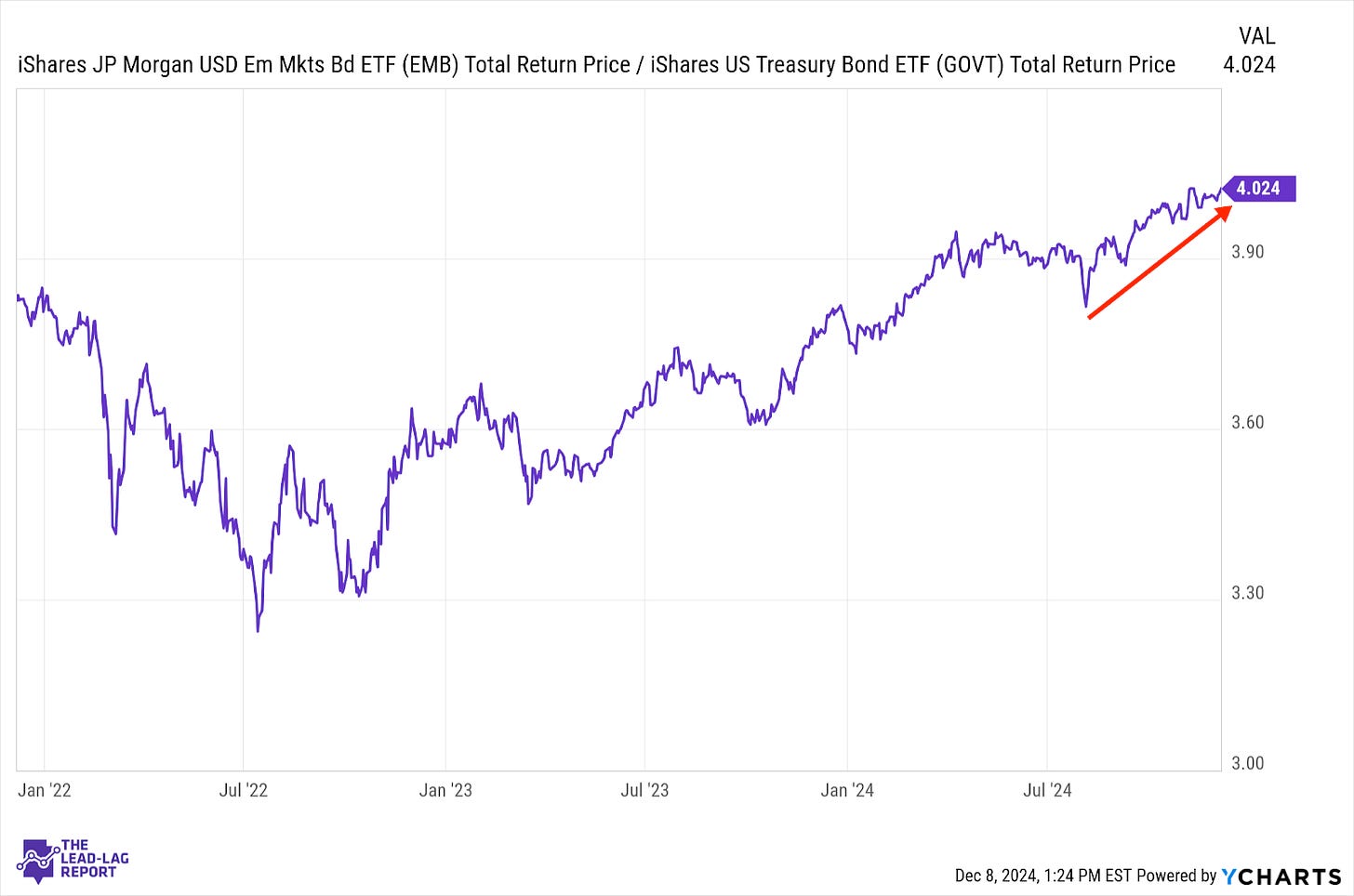

Emerging Markets Debt (EMB) – Favorable For A While Longer

Emerging markets debt has used the recent dip in the dollar to continue its steady outperformance trend even as U.S. junk bonds have turned the other way. This category is likely going to be considered more speculative as global conditions outside of the U.S. deteriorate, but many central banks are cutting rates and liquidity is likely to improve, thereby making conditions for EM debt favorable for a while longer.

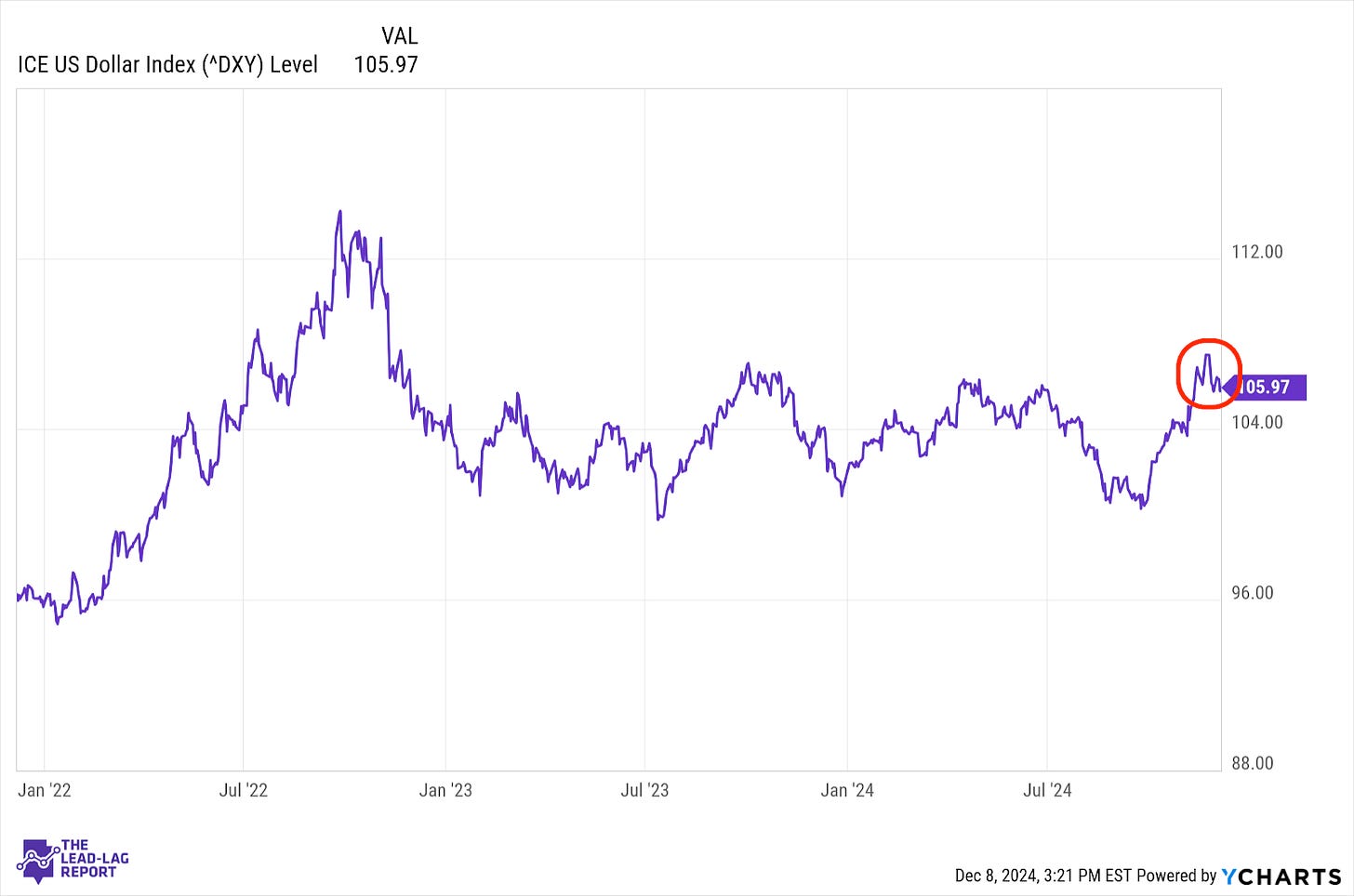

U.S Dollar ($USD) – Waiting On The BoJ

Many major Asian and European currencies, save for the yen, are actually depreciating relative to the dollar, so I’m not sure how much longer the greenback can trend lower without broader support. As mentioned many times in this space, the key here is the yen. If the BoJ decides to hike interest rates next week, I wouldn’t be surprised to see the dollar index make a sharp move lower.

LAGGARDS: THE RALLY IN LONG BONDS SHOULDN’T BE IGNORED

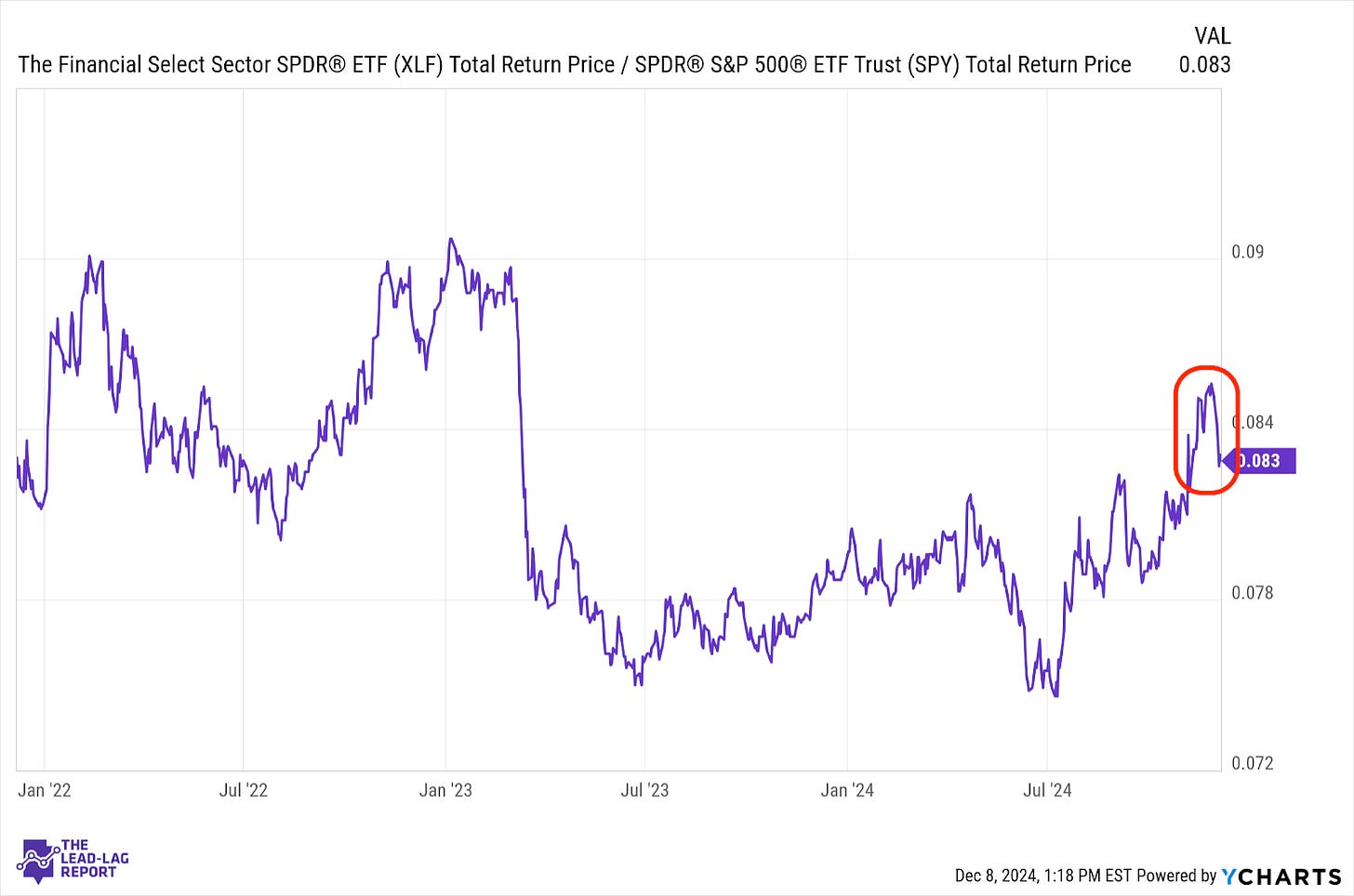

Financials (XLF) – Long-Term Case Remains Intact

The more direct Trump trade winners of recent weeks took a major step back last week. Given recent outperformance, they were probably due for a short-term pause, but I think the long-term case here remains intact. Plans to deregulate all across the U.S. economy should open up the operating environment for many sectors, but especially this one. With M&A and investment banking activity starting to rebound, this could be a strong year in 2025.

Energy (XLE) – Positive Short-Term Catalysts Emerging

The overall theme of slowing global energy demand has made this sector struggle for months, but a few positive short-term catalysts are emerging. OPEC announced an extension of its production cuts, adding some support to oil prices, while the Chinese government’s announcement that it plans to provide more fiscal and monetary support in the coming months enhanced the case for an energy rebound.

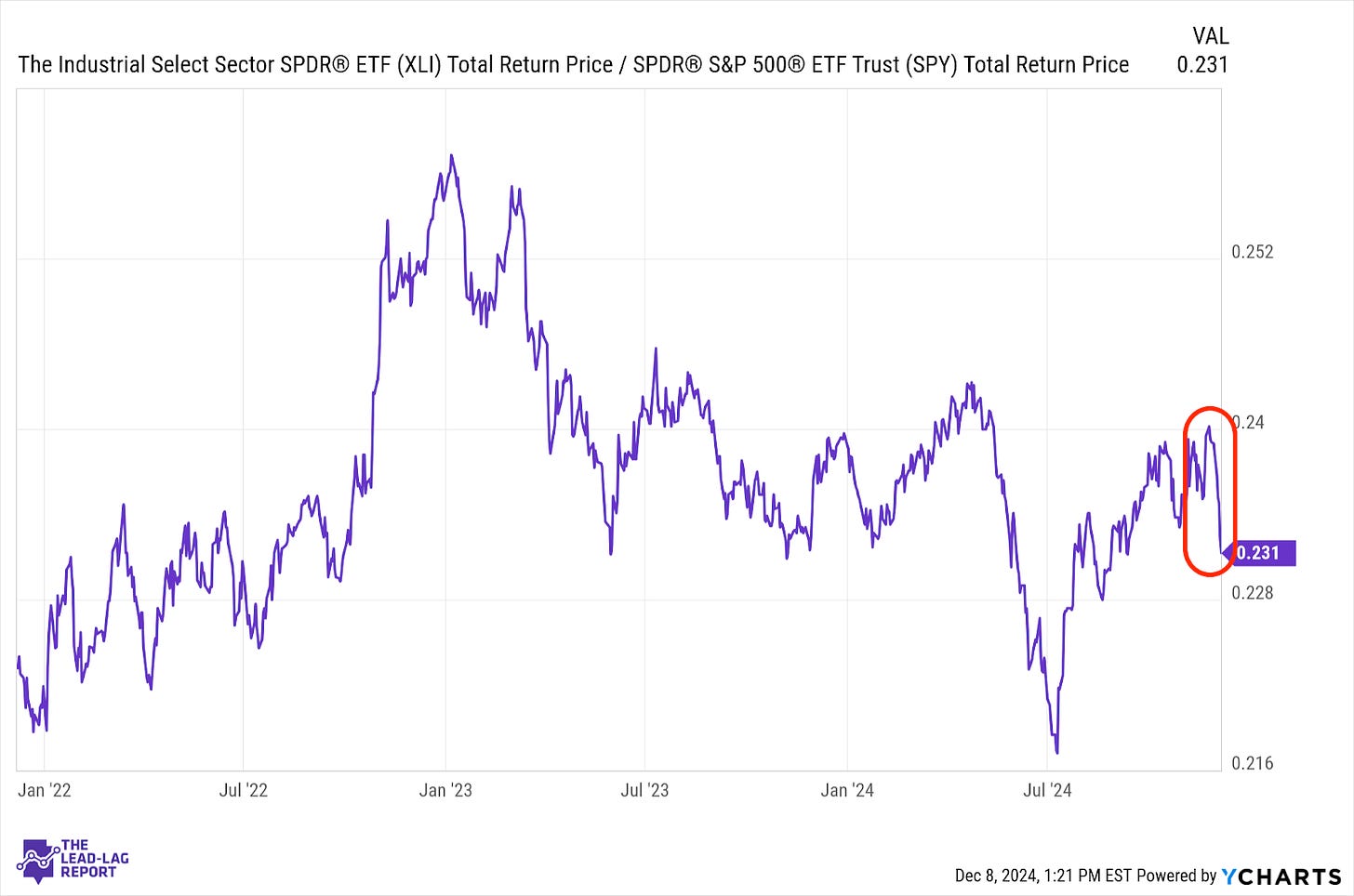

Industrials (XLI) – Big Step Backward

Last week, I expressed some concern about the choppiness of the recent uptrend and the market demonstrated why. Cyclicals sharply reversed and erased any outperformance going back to the end of last summer. I don’t think the investment case for cyclicals is over by any means yet, but the questions surrounding policy direction and whether inflation could stifle the expansion still loom.

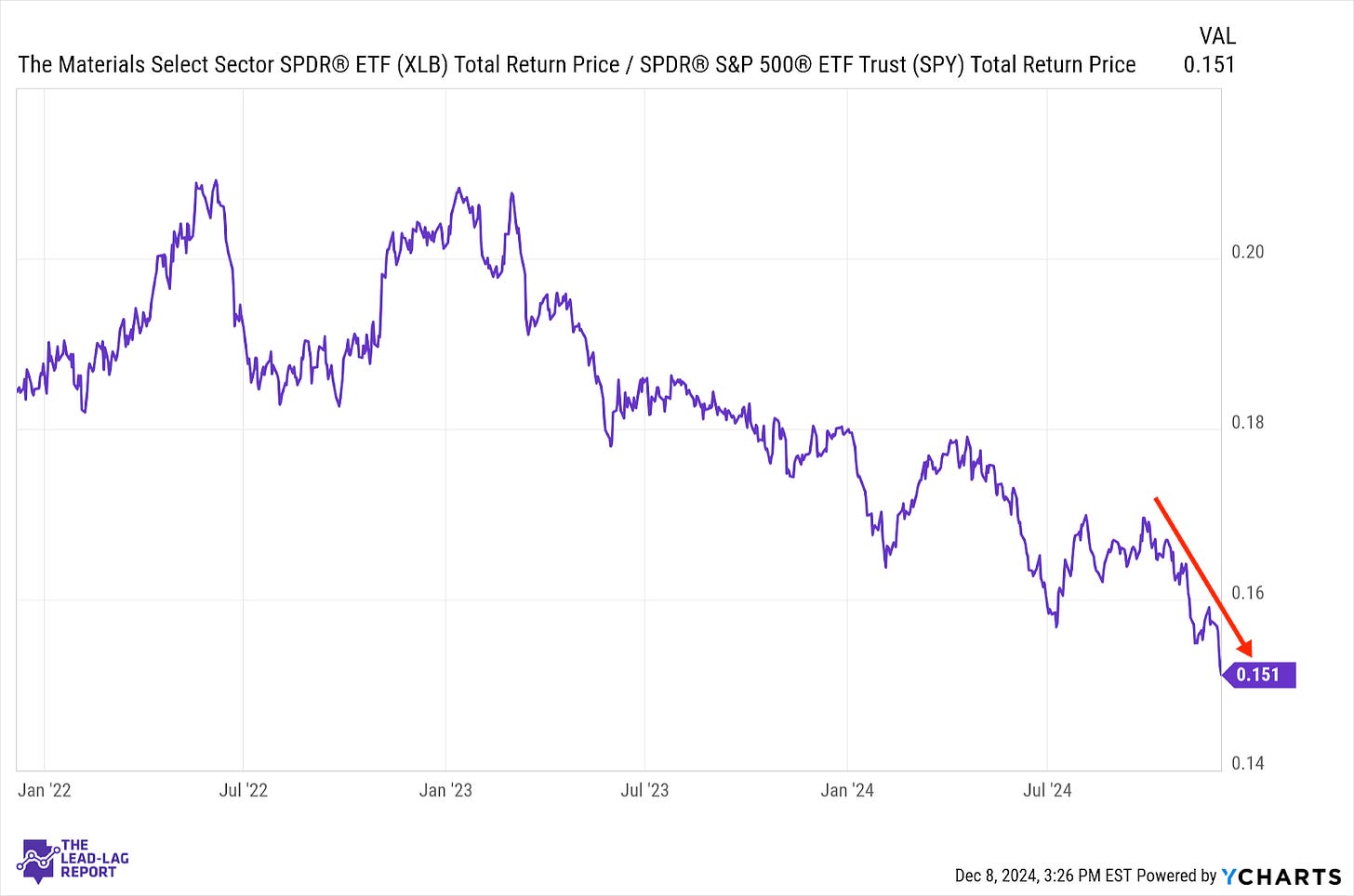

Materials (XLB) – Can China Rebound?

Materials stocks have spent the past two years setting a series of lower highs and lower lows relative to the S&P 500. This sector has consistently reflected the weakness in the global manufacturing sector and I don’t see that changing anytime soon. There are glimmers of hope in certain parts of the world, including China if their government stimulus package comes through, but it’s difficult to see a sharp reversal happening in the short-term here.

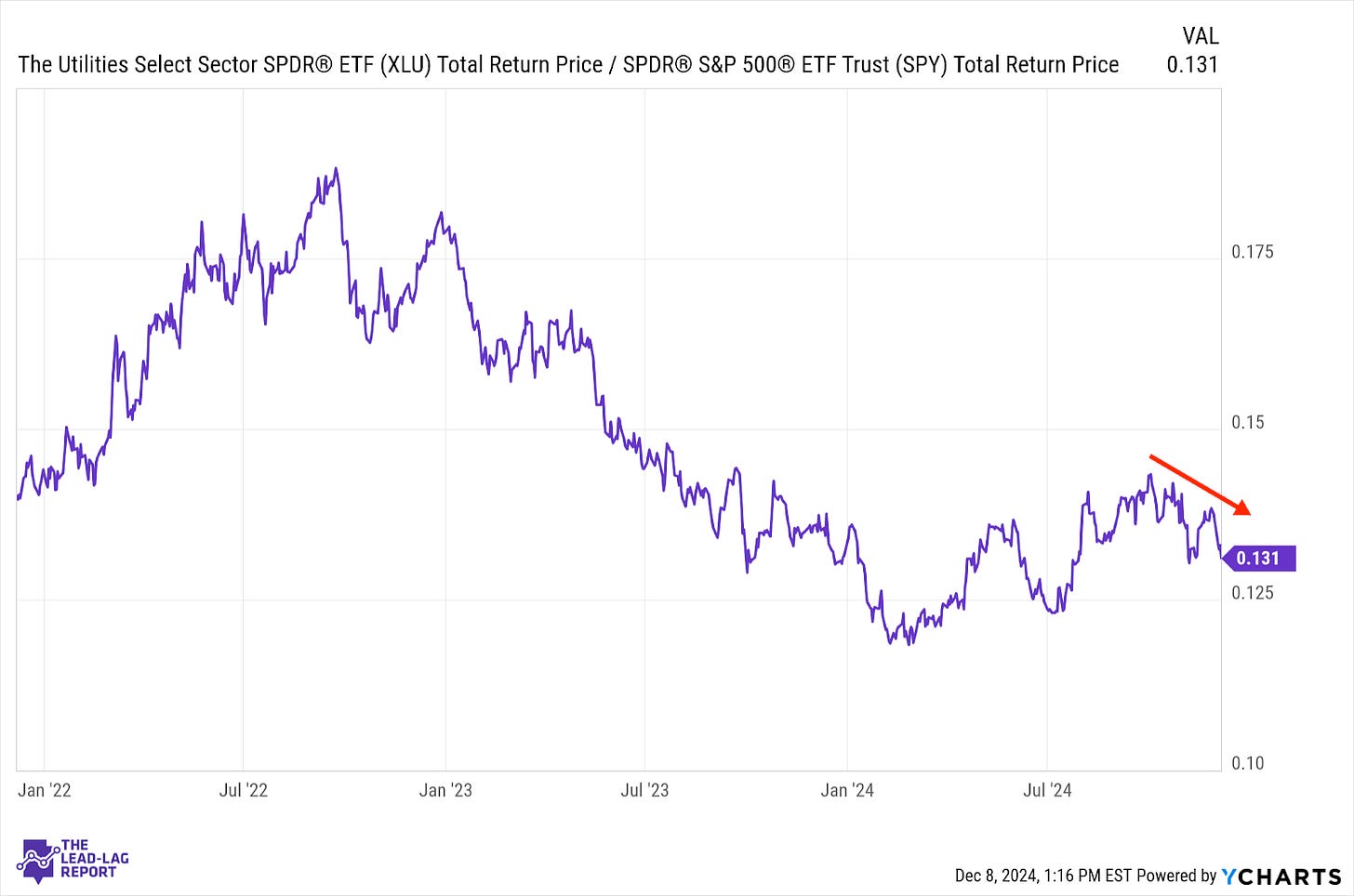

Utilities (XLU) – Could Rebound Later This Month

Utilities continue to fade here, easing up on one of the stronger signals that had been indicating caution. It had been outperforming the market for months even though other defensive counterparts had been consistently lagging. Now, the pro-business outlook during the second Trump presidency seems to be winning out. If the BoJ hikes next week and ushers in the December surprise, don’t be surprised to see this ratio shoot higher again.

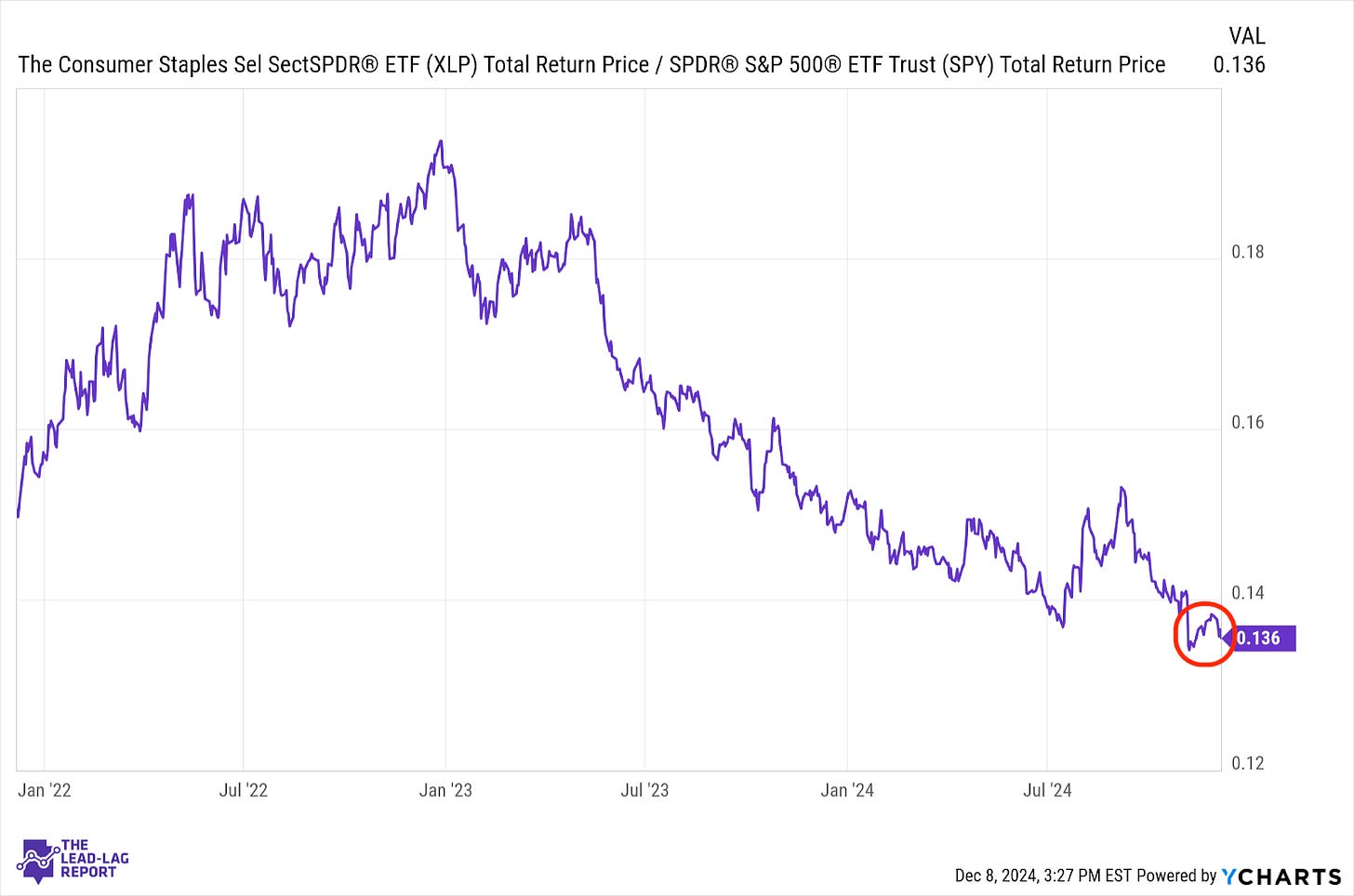

Consumer Staples (XLP) – Head Fake

It looked like the broad advance in defensive stocks over the past few weeks was signaling a sentiment shift in equities that would finally mirror the one taking place in Treasuries and gold. It’s starting to look like it might have been just another head fake. If the markets can make it through the next two weeks of all these global central bank meetings without any surprises, conditions are likely to remain risk-on into the new year.

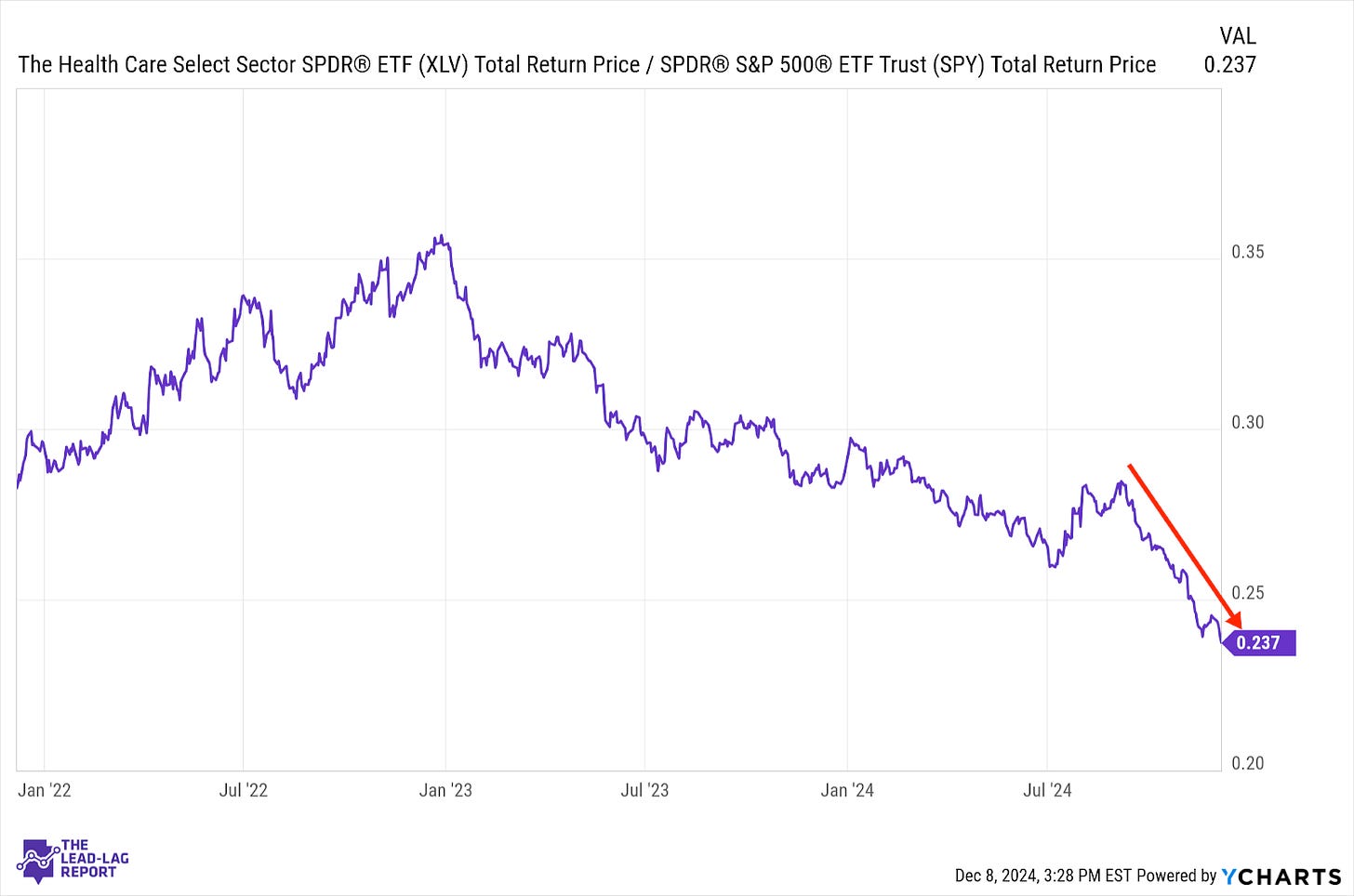

Health Care (XLV) – Murky Outlook

If staples and dividend stocks were signaling a potential shift towards caution, healthcare sure wasn’t. This continues to be one of the steadiest downtrends in the market right now. I still believe that if we get the December surprise from one of these central banks, this sector could turn into a leader given its lengthy history of being a bear market outperformer. Without that, however, it’s a murky outlook.

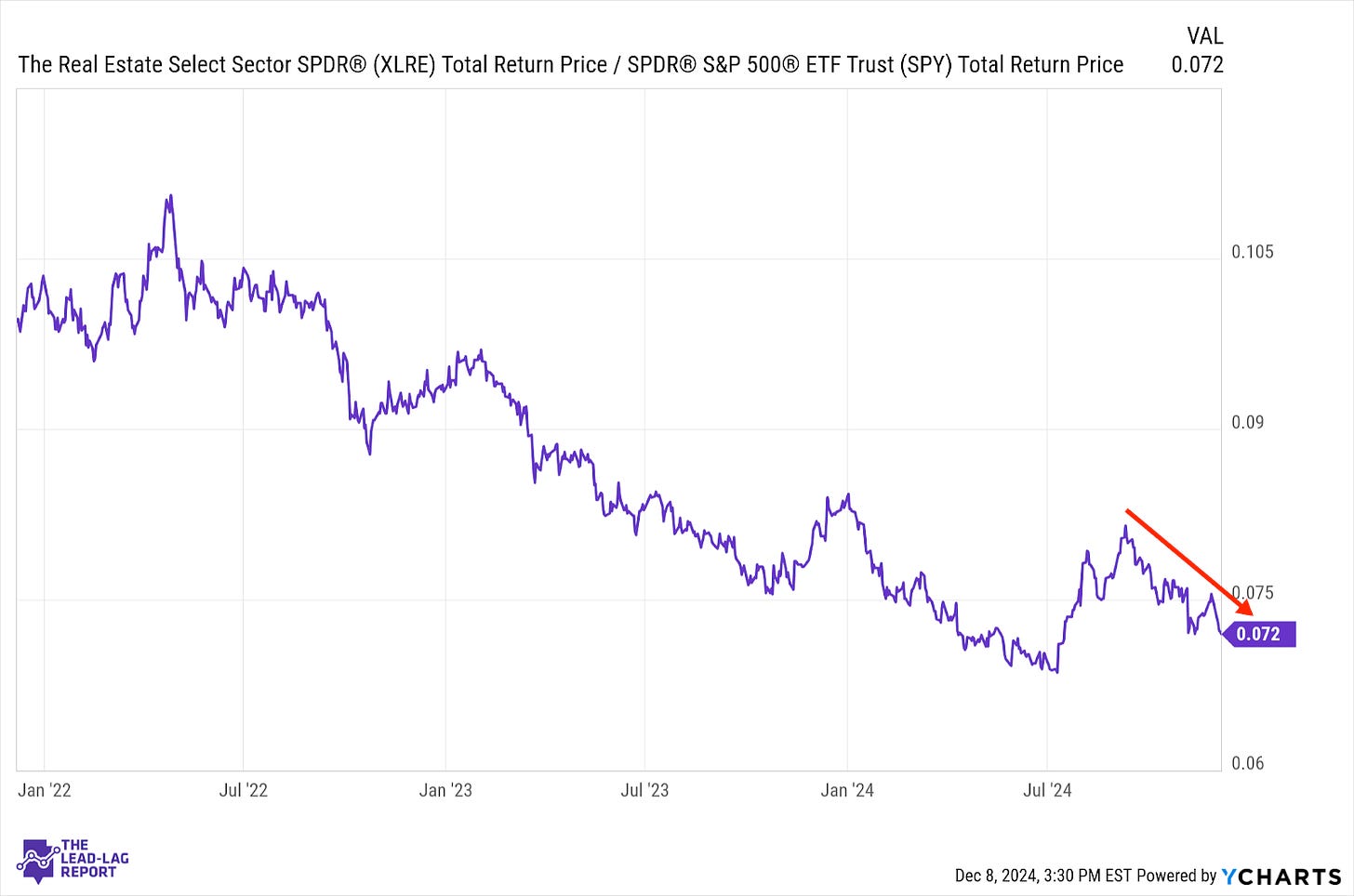

Real Estate (XLRE) – A Bad Sign For The Economy

Normally, REITs will react to changes in interest rates. Even though long-term Treasury yields have been moving lower for several weeks, real estate is still underperforming. This is generally a pretty negative sign for the markets because real estate, obviously, is a derivative of the housing market, which is a derivative of the lumber, which is one of the keys that drives the economy.

Dividend Stocks (SDY) – Just One Positive Short-Term Catalyst

With continued lagging behavior from defensive stocks and a sharp reversal in cyclicals, dividend stocks had almost no chance last week. The only real chance I see for an immediate upside catalyst is a surprise from the BoJ that turns sentiment negative. Absent that, seasonality and a general optimistic outlook for the U.S. economy could carry this downtrend into 2025.

Bonds (GOVT) – Shouldn’t Be Ignored

Treasuries have made notable progress over the past several weeks, but are still getting outpaced by equities. I think this could very well be a case of the bond market sniffing out some weaknesses in the economic narrative, while equities are driven pretty much by risk-on fervor. If yields keep moving lower, I think that’s a sign that some risk-off sentiment is setting in and is a signal that shouldn’t be ignored.

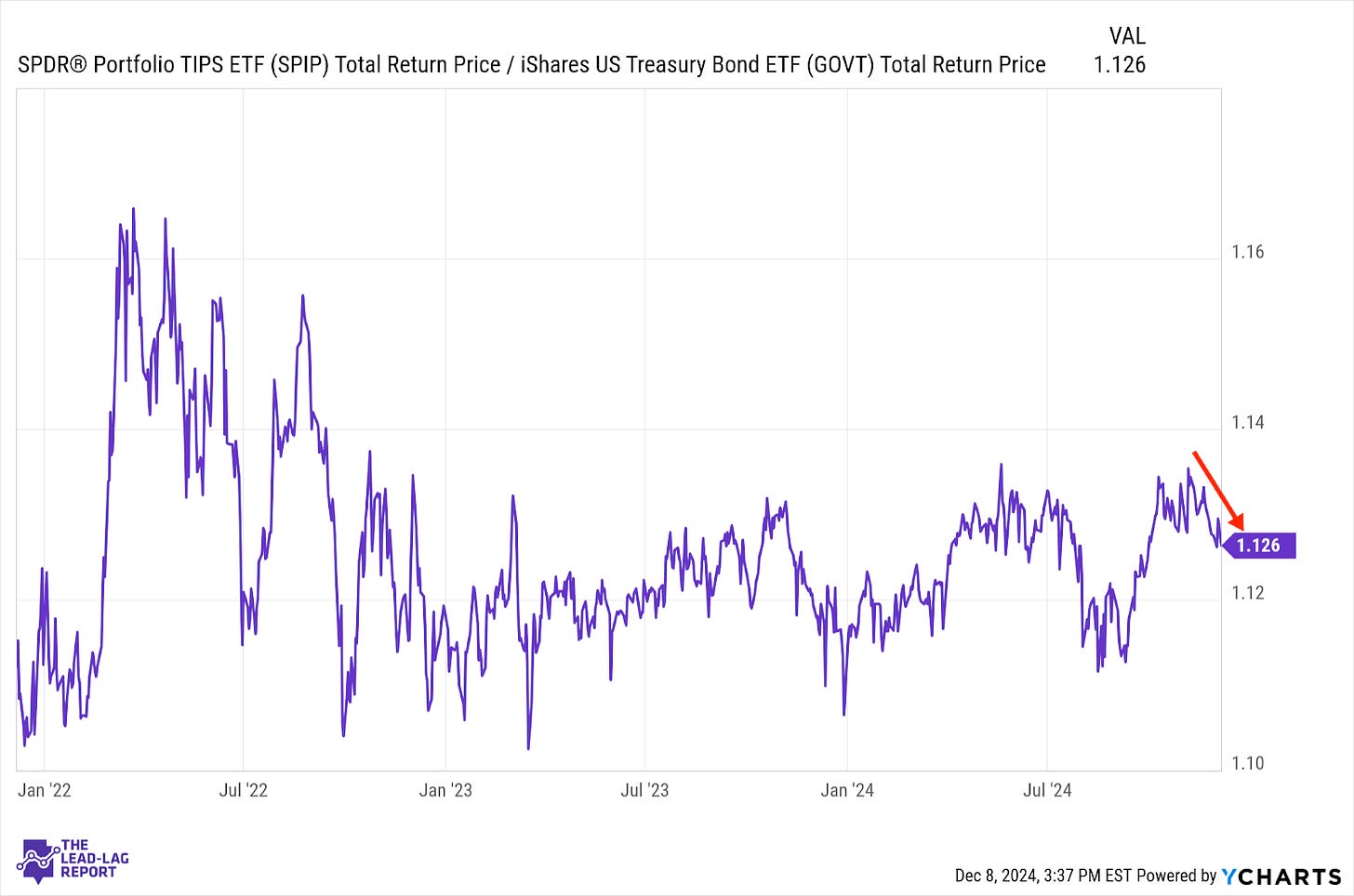

Treasury Inflation Protected Securities (SPIP) – Are Inflation Worries Actually Easing?

Treasury yields on the long end of the curve are dropping while TIPS is putting together a multi-week stretch of underperformance. Perhaps the market’s worries about inflation are actually easing and yields are heading back lower to reflect that. I don’t think that’s necessarily justified given that Trump has been pretty forcefully pushing the idea of tariffs on virtually every country worldwide.

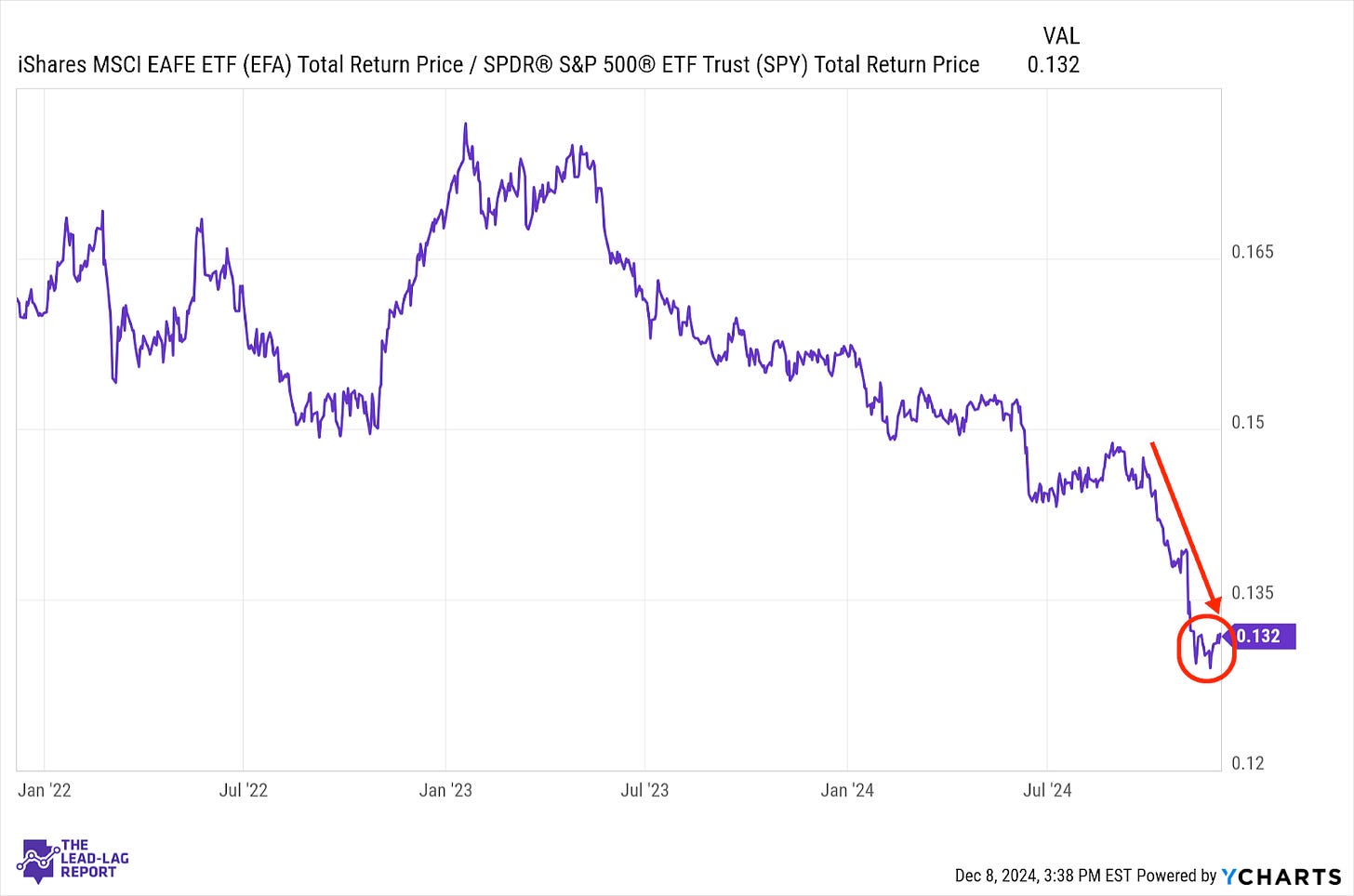

Europe, Australasia, and the Far East (EFA) – Starting To Bottom Out

Another sign that the post-election stock market rally could be fizzling is the fact that developed market equities could be bottoming out here relative to the S&P 500. There hasn’t been a lot of great news coming out of Asia or Europe, although central bank rate cuts over the next two weeks could help. Based on economic activity alone, it seems unlikely that international stocks are ready to stage a big comeback right now.

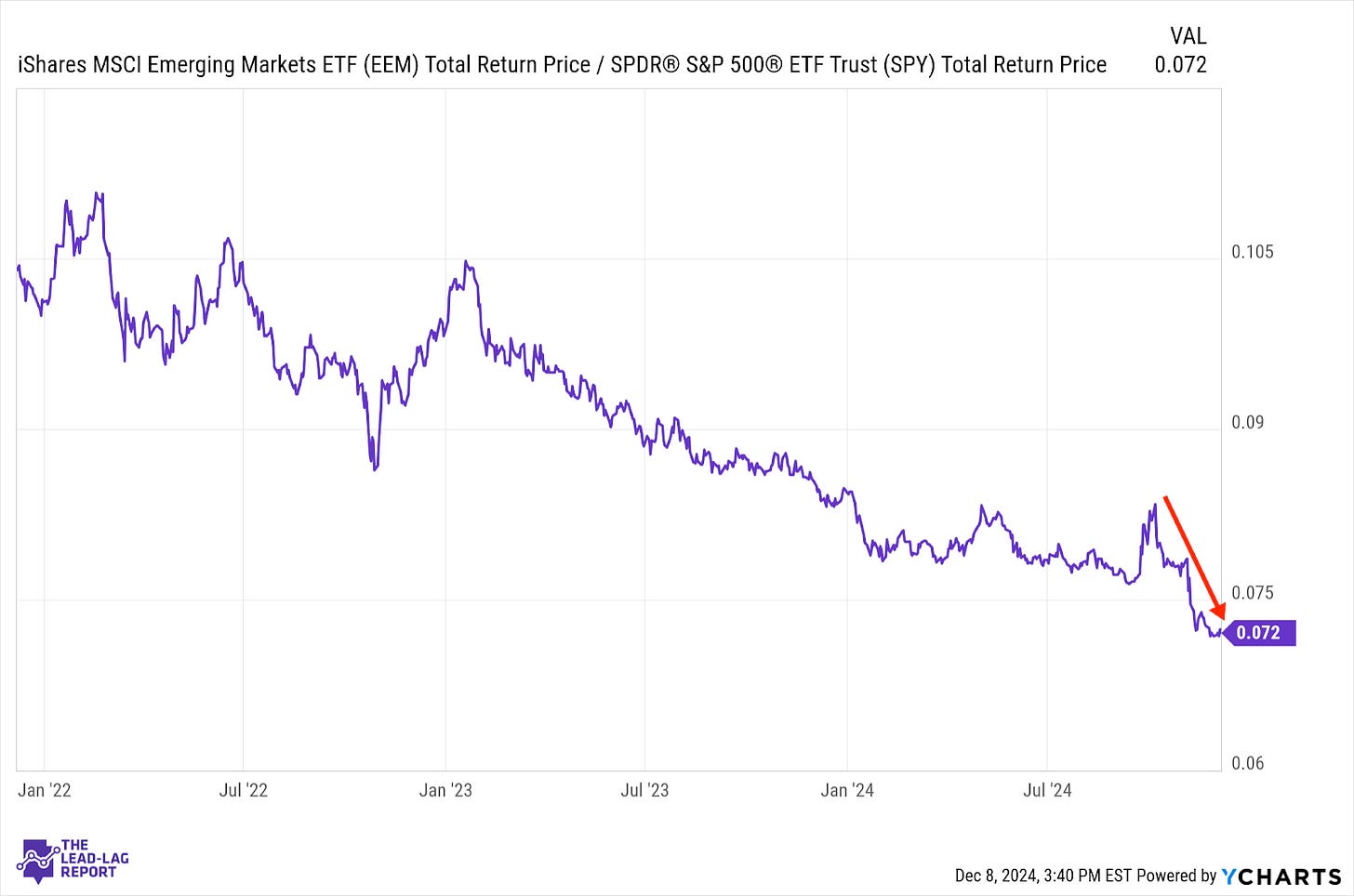

Emerging Markets (EEM) – Being Skeptical Of Stimulus Plans

This chart reflects the steady underperformance of emerging markets dating back to….well, a long time ago! But it doesn’t reflect the announcement over the weekend that the Chinese government intends to step up stimulus efforts. Now, we’ve heard this before. Stocks rocketed ahead by 30% before giving most of it back. It’s a positive if the government follows through, but don’t be surprised if the market turns skeptical.

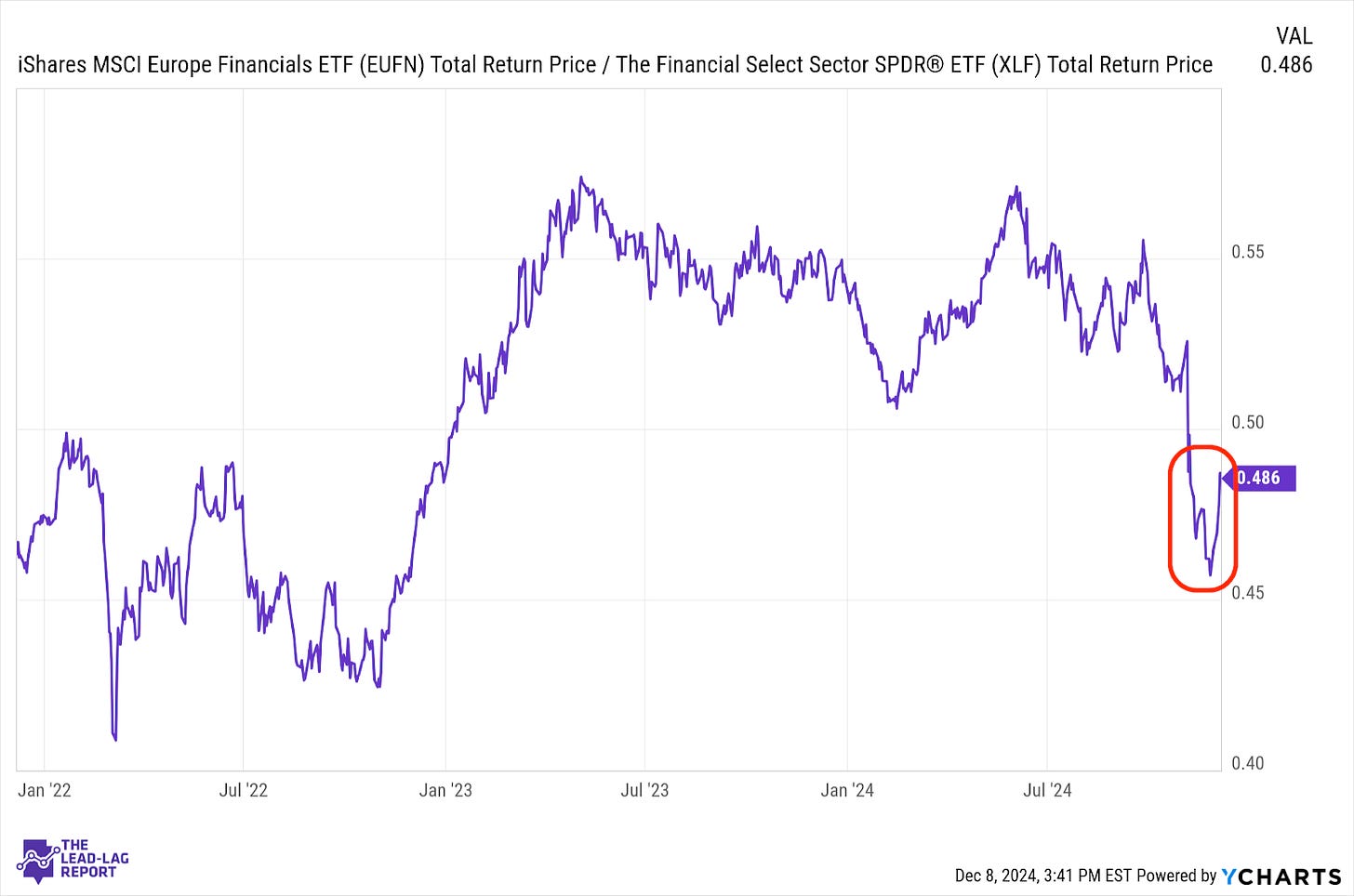

European Banks (EUFN) – The Long-Term Trend Is Down

This ratio reflects the sharp underperformance of U.S. financials last week more than a rally in Euro banks. Given the potential for a deregulatory tailwind, I feel comfortable saying that the longer-term trend in this ratio is probably down. The European economy is in a really rough spot right now trying to avoid recession and it’s cyclical sectors like this one that usually get hit hardest in that kind of environment.

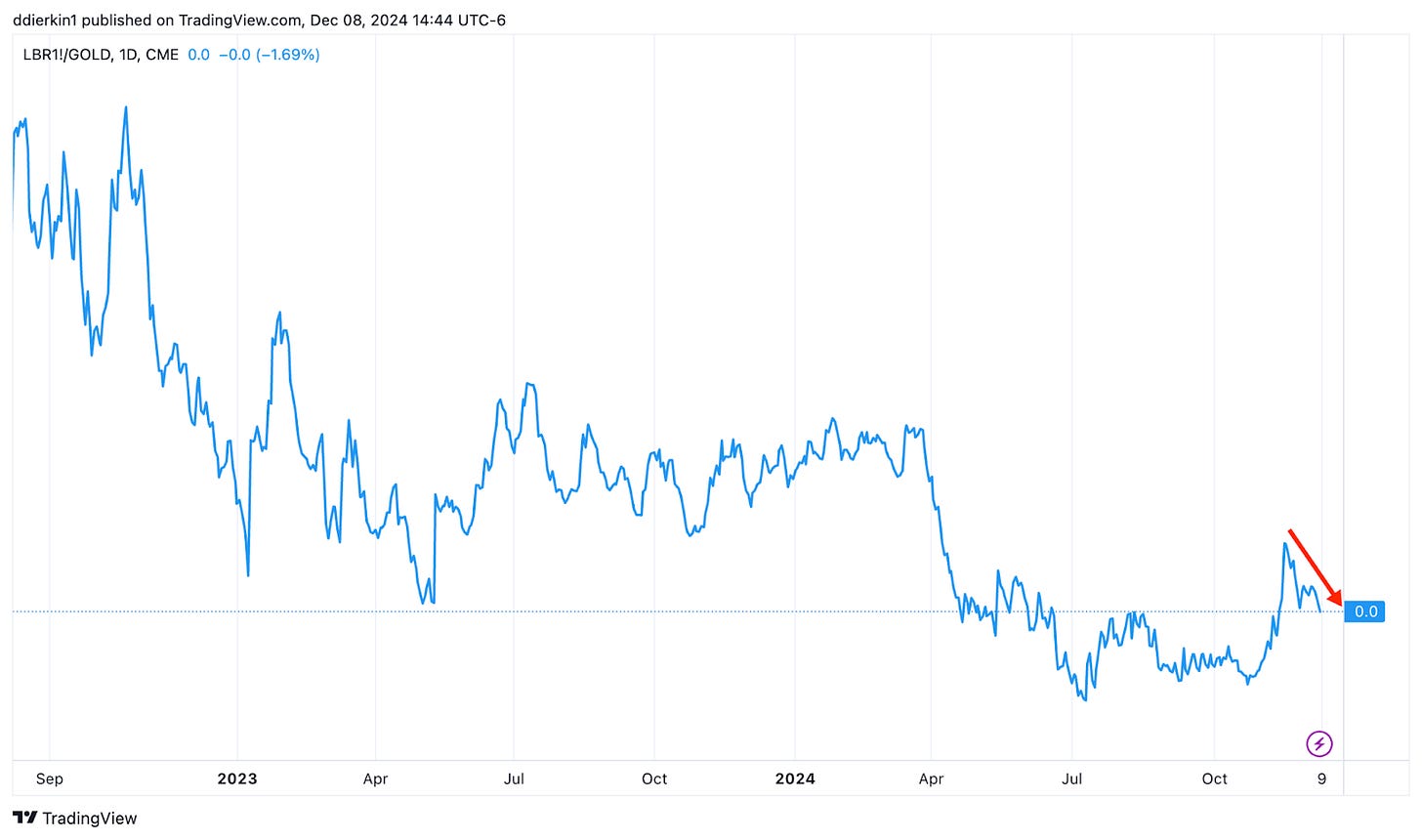

Lumber (LUMBER) – Not Being Driven By The Risk-Off Side

Lumber/gold continues to reverse hard from its peak several weeks ago. The relative weakness we’re seeing in REITs right now coupled with waning demand in manufacturing and housing is clearly having a negative impact. Gold has been relatively steady in the past few weeks, so this isn’t necessarily being driven from the risk-off side of this equation. It’s an issue of concern about the economic growth path.

The Lead-Lag Report is provided by Lead-Lag Publishing, LLC. All opinions and views mentioned in this report constitute our judgments as of the date of writing and are subject to change at any time. Information within this material is not intended to be used as a primary basis for investment decisions and should also not be construed as advice meeting the particular investment needs of any individual investor. Trading signals produced by the Lead-Lag Report are independent of other services provided by Lead-Lag Publishing, LLC or its affiliates, and positioning of accounts under their management may differ. Please remember that investing involves risk, including loss of principal, and past performance may not be indicative of future results. Lead-Lag Publishing, LLC, its members, officers, directors and employees expressly disclaim all liability in respect to actions taken based on any or all of the information on this writing.