Every week, we’ll profile a high yield investment fund that typically offers an annualized distribution of 6-10% or more. With the S&P 500 yielding less than 2%, many investors find it difficult to achieve the portfolio income necessary to meet their needs and goals. This report is designed to help address those concerns.

Even though spreads are already near all-time lows, high yield bonds remain the group of choice within the fixed income market. In the lead-up to the election and especially after it, junk bonds have continued to outperform Treasuries almost non-stop. If the triple tailwind of tax cuts, Fed rate cuts and deregulation can keep risk assets in favor without spiking inflation again, junk bonds and riskier debt instruments could have another leg higher.

The Credit Suisse Asset Management Income Fund (CIK) focuses mostly on the junk bond market, but surrounds it with enough exposure to alternative assets, such as senior loans and asset-backed securities, to give it a slightly different feel. I’ve warned repeatedly over the past several quarters about how junk bonds are overvalued and the risks in the credit market are still especially high. Given the state of federal deficits and debt levels along with the risk of higher inflation, I think those risks are still present. However, a flood of liquidity could make the short-term still a positive one.

Fund Background

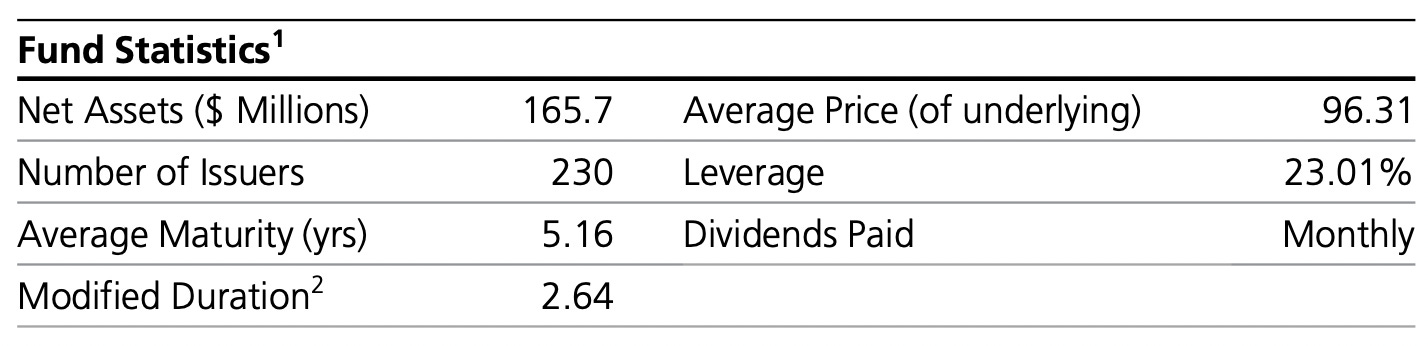

CIK’s investment objective is current income consistent with the preservation of capital. The fund primarily invests in high yield fixed income securities that are in the lower ratings categories of the nationally recognized ratings services. It may invest in debt securities, such as mortgage-backed securities, loans and loan participations, senior loans and other types of loans with fixed and variable interest rates. The fund also utilizes leverage to enhance yield and total return potential.

The inclusion of senior loans to this portfolio, while only in minor quantities, is a nice augment to the mostly high yield bond portfolio. It presents a slightly different risk/reward profile with a higher yield and could actually improve the risk & yield tradeoff. The use of leverage is modest enough that it doesn’t necessarily make it hard to justify cost-wise, but I think it is right on the edge. There’s nothing terribly unusual about the portfolio’s composition and I don’t see any unusual risks being taken here, so its success is largely going to come down to management effectiveness.