Every week, we’ll profile a high yield investment fund that typically offers an annualized distribution of 6-10% or more. With the S&P 500 yielding less than 2%, many investors find it difficult to achieve the portfolio income necessary to meet their needs and goals. This report is designed to help address those concerns.

2025 has marked the return of dividend stocks, but more in the sense of conservative stocks falling less than the broader market during a downturn. Still, they’ve provided a bit of a security blanket as mega-caps, which once pulled the major averages higher, are now pulling them back down.

That doesn’t mean, however, that dividend stocks are a bad opportunity right now. In fact, with the April data coming soon on many fronts, we may soon get confirmation that recession risk is rising and risk-off conditions may be ready to extend for a while. The abrdn Total Dynamic Dividend Fund (AOD) invests in this area of the market with a strategy that’s fairly benign, but that’s not its biggest feature at the moment. The fund recently changed its distribution policy to pay 12% annually. That’s a sizable jump and one that is likely to attract new investors. But is it sustainable?

Fund Background

AOD's primary investment objective is to seek high current dividend income while focusing on long-term growth of capital as a secondary investment objective. It will invest primarily in the equity securities issued by domestic and foreign companies that pay dividends.

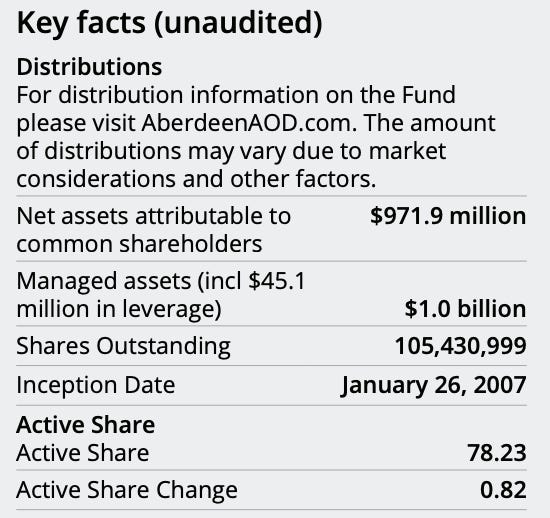

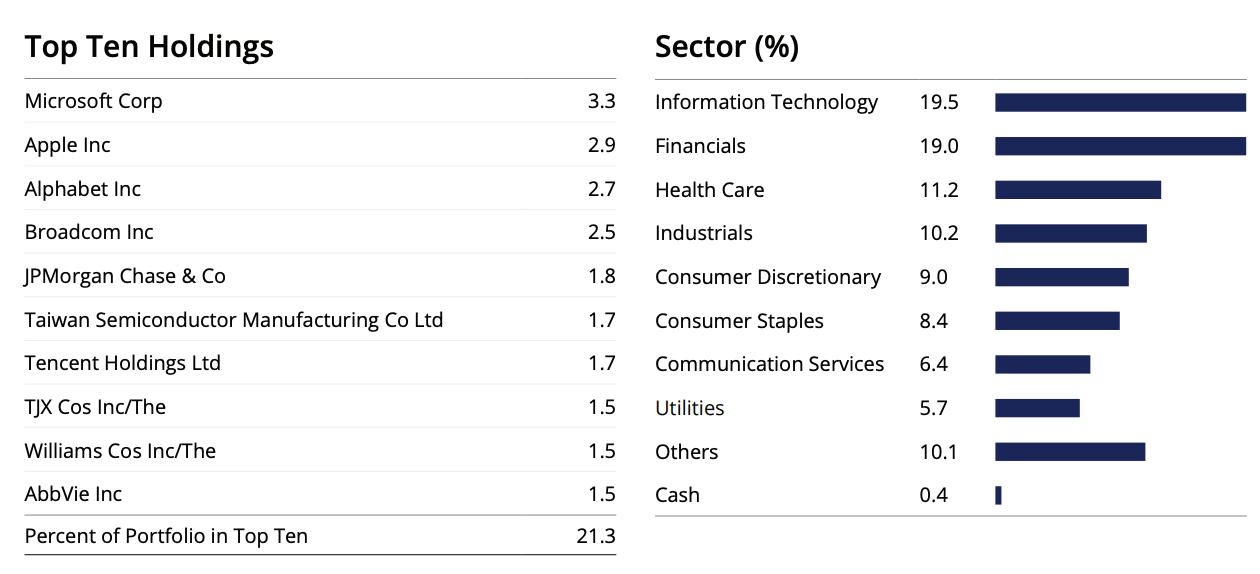

AOD’s investment process isn’t terribly unique in that it simply tries to identify and invest in the best equities out there. The use of leverage is so low that it's probably of relatively little consideration here. The high active share is always an encouraging sign. Too often we see funds with high expense ratios and active managers build portfolios that look substantially the same as the S&P 500. While there are familiar names in the top 10, the active share indicates that there’s plenty of differentiation from broad equity indices.

Again, there’s a fairly heavy large-cap tilt here, as is to be expected, including the magnificent 7 names in the top 3 positions. From a sector perspective, there’s a significant underweight to tech in AOD’s portfolio and a sizable overweight to financials (with only modest deviations elsewhere). Overall, AOD has more of a cyclical lean and that probably helped it out quite a bit in 2025. The avoidance of tech exposure potentially positions it well moving forward.

AOD has a roughly 60/40 global asset allocation, which is pretty typical for these types of funds. The relatively modest 10% allocation to Asia and virtually no allocation to Latin America means that the fund isn’t quite as diversified as it could be, but this may be a deliberate move to avoid some of the geopolitical risk from tariffs. The portfolio’s P/E ratio of 18 is modestly above that of the benchmark, but not enough to signify a major tilt towards growth or high beta.

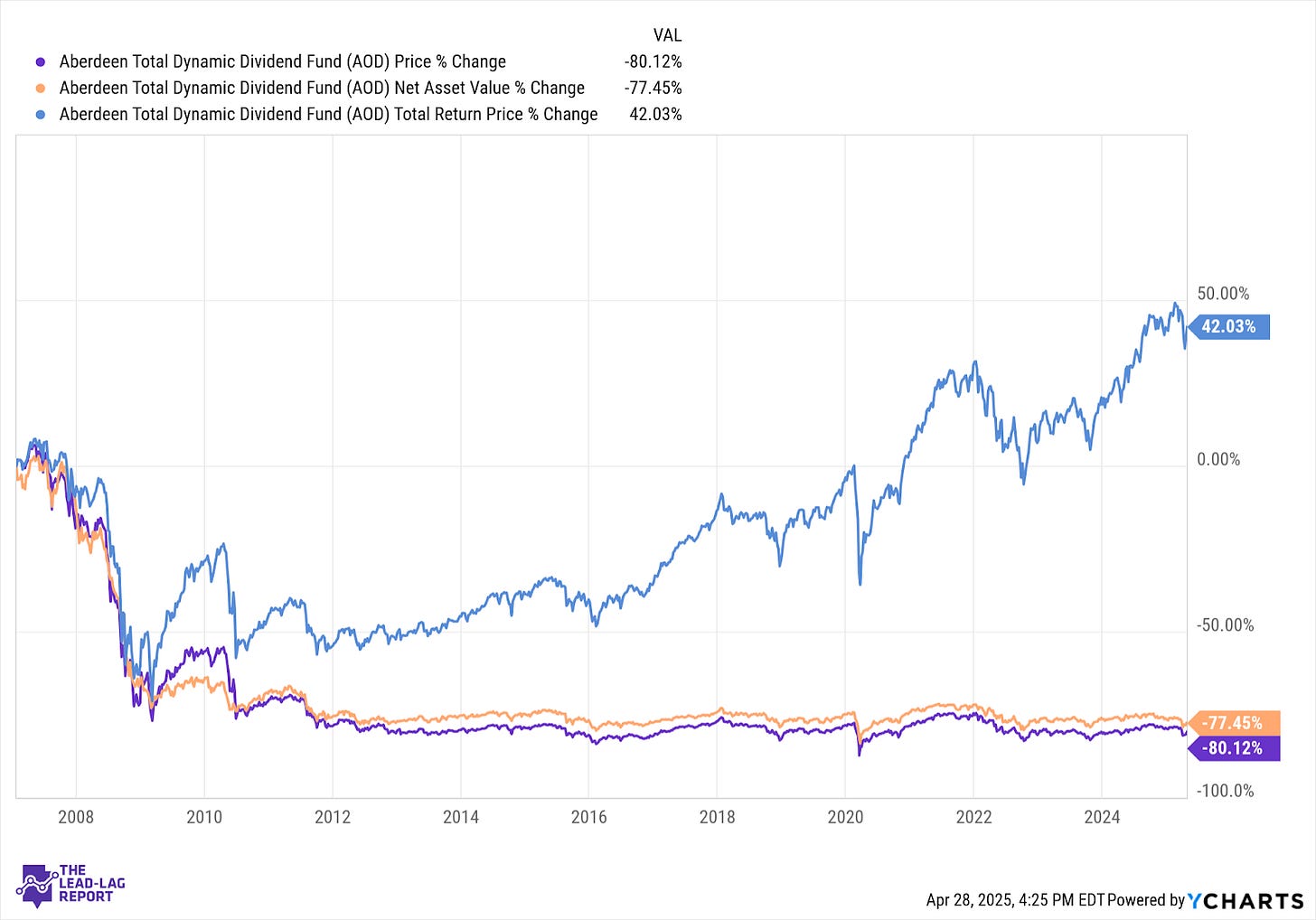

Since its inception in January 2007, AOD has generated a total return of 42%. That translates to an average annual return of around 2%.

Obviously, timing is a big factor in the fund’s historical returns. If you want to consider just the past 15 years, AOD has averaged a 4.4% return and an 8% average annual return over the past decade. Those are clearly better, but they still trail the S&P 500 by a wide margin. On the surface, the 80% degradation of NAV would be a red flag, but it’s actually been relatively steady since the end of the financial crisis. Over the past decade, the NAV has only declined by about 13%, not much of a red flag.