A Rally at Stall Speed – Can Bad News Keep Being Good News?

Are markets rising for the right reasons?

Key Highlights

Markets rallied in early 2026 not on accelerating growth, but on signs that economic momentum is cooling enough to keep central banks cautious.

U.S. labor data point to a stall-speed economy, with hiring slowing sharply while layoffs remain limited.

Federal Reserve officials appear content to pause, prioritizing risk management over aggressive easing or renewed tightening.

Global inflation pressures are easing, particularly in Europe, but geopolitical shocks and policy uncertainty remain meaningful risks.

Elevated equity valuations leave little room for disappointment as earnings season and political transitions approach.

The first full week of 2026 delivered a jolt of optimism in U.S. equity markets, even as incoming economic data pointed to a slowing expansion. Investors welcomed a weaker-than-expected jobs report and other signs of cooling activity, interpreting them as reducing the risk of further monetary tightening. Equities rallied broadly as a result, with the S&P 500 reaching a record high on Friday and finishing the week up roughly 1.6%.¹ Cyclical and value stocks, which lagged for much of last year, led the advance.¹ The underlying message was familiar but still striking: bad economic news was treated as good news for markets.

That reaction raises a deeper question as the year begins. Is the rally being driven by improving fundamentals, or by confidence that central banks will step in if growth falters further? The distinction matters, particularly with valuations elevated and macro uncertainty still unresolved.

A Stall-Speed Economy and a Cautious Fed

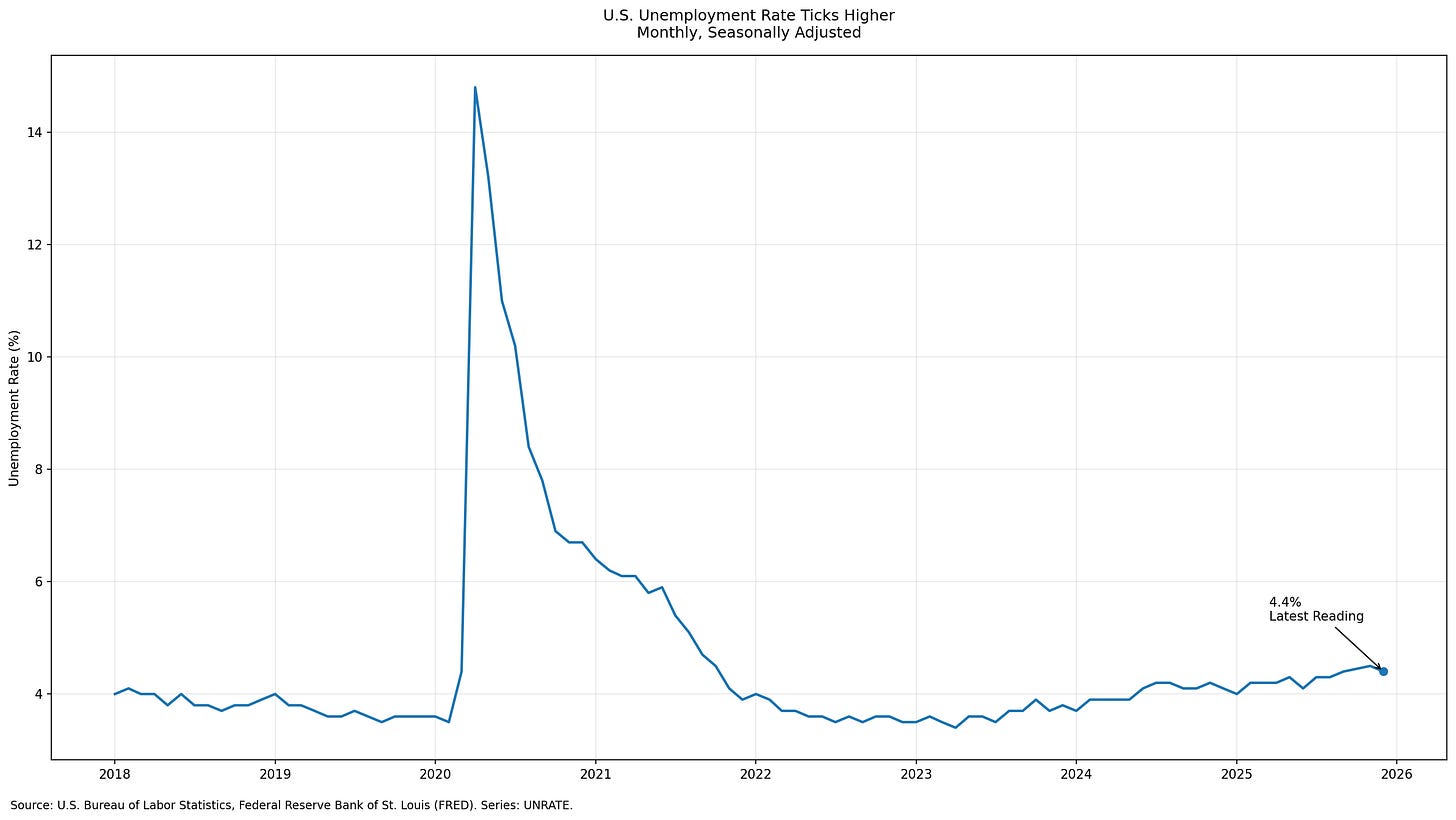

Friday’s labor market report crystallized the emerging slowdown. Nonfarm payrolls increased by just 50,000 in December, well below expectations and one of the weakest readings in several years.² Job losses were concentrated in cyclical sectors such as construction, retail, and manufacturing, reinforcing concerns that higher interest rates and policy uncertainty are weighing on activity. At the same time, the unemployment rate edged down to 4.4% from 4.5%, suggesting the labor market is cooling but not unraveling.²

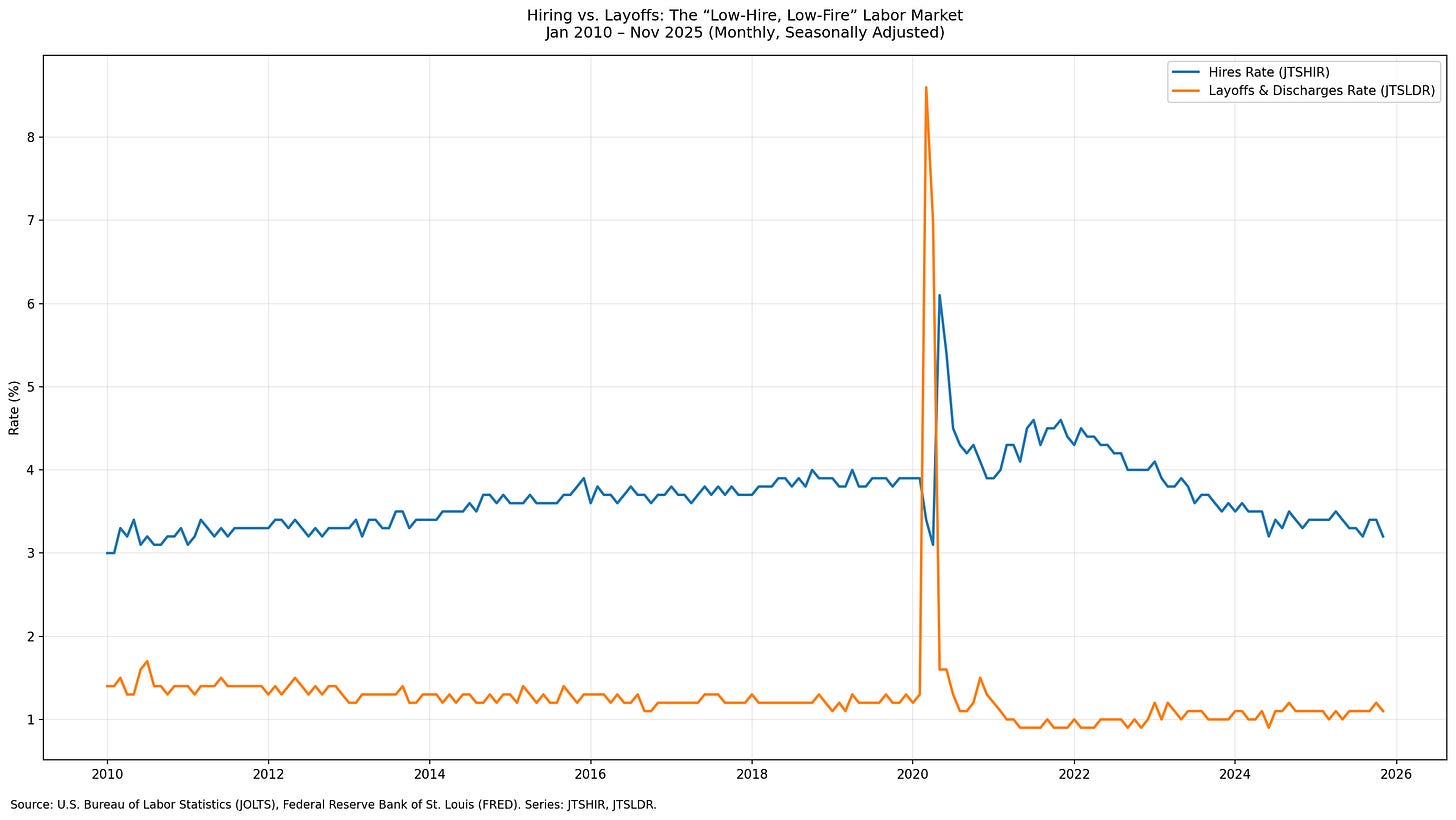

This dynamic has become a defining feature of the current cycle. Hiring has slowed markedly, but layoffs remain historically low.³ Firms appear reluctant to expand payrolls, yet equally unwilling to cut staff aggressively after the labor shortages of recent years. Job openings fell to roughly 7.1 million in November, the lowest level in more than a year, underscoring the cautious stance of employers.³ Voluntary quits also remain subdued, signaling worker unease about changing jobs in a less certain environment.³ The result is a labor market stuck in limbo: resilient enough to avoid panic, but weak enough to keep recession fears alive.

Other data reinforced this picture of cooling momentum. The Institute for Supply Management’s manufacturing index fell to 47.9 in December, marking a 14-month low and the tenth consecutive month of contraction.⁴ Manufacturers cited tariffs and elevated input costs as persistent headwinds, while demand outside a few AI-linked segments remained soft.⁴

Federal Reserve officials, for their part, have responded with caution rather than urgency. Minutes from the Fed’s December meeting revealed a deeply divided committee, with a 25-basis-point rate cut approved only after a finely balanced debate.⁵ Three policymakers dissented, reflecting uncertainty on both sides of the policy spectrum.⁵ Most officials signaled a preference to pause, projecting just one additional quarter-point cut in 2026.⁶

Public remarks this week echoed that tone. Richmond Fed President Tom Barkin said rates are now near neutral and emphasized that future moves should be carefully calibrated to incoming data.⁷ With inflation still slightly above target and unemployment low by historical standards, the Fed appears reluctant to move aggressively in either direction.⁷ One exception was newly appointed Governor Stephen Miran, who argued for more than 100 basis points of rate cuts this year.⁷ His comments drew attention precisely because they remain far outside the consensus.

Another looming variable is leadership. Jerome Powell’s term as Fed Chair ends in May, and President Trump is expected to announce a successor soon. Markets widely anticipate a more dovish tilt under new leadership, a factor that may already be influencing risk appetite.⁷ For now, however, policy remains on hold, and investors seem comfortable with that equilibrium.

Global Crosscurrents and Political Risk

Beyond the United States, the global backdrop offered a mix of reassurance and fresh uncertainty. In Europe, inflation eased to 2.0% in December, effectively reaching the European Central Bank’s target.⁸ After years of elevated price pressures, the euro zone appears to have achieved a soft landing on inflation, giving the ECB flexibility to keep rates steady in 2026.⁸ Growth, however, remains modest, with manufacturing activity still under strain from trade frictions and weak external demand.⁸ Even so, the normalization of European inflation removes one major source of global policy risk.