Key Highlights

The JOJO.INDEX has shifted into “junk-off,” signaling increased probability of near-term volatility.

Utility stock leadership triggered the rotation, a historically reliable early warning signal.

Credit spreads remain near historic lows, leaving little margin for error.

Investor sentiment shows extreme optimism despite signs of economic cooling.

The signal does not predict a crash, but it does suggest risk is being underpriced.

Why the JOJO.INDEX Matters Right Now

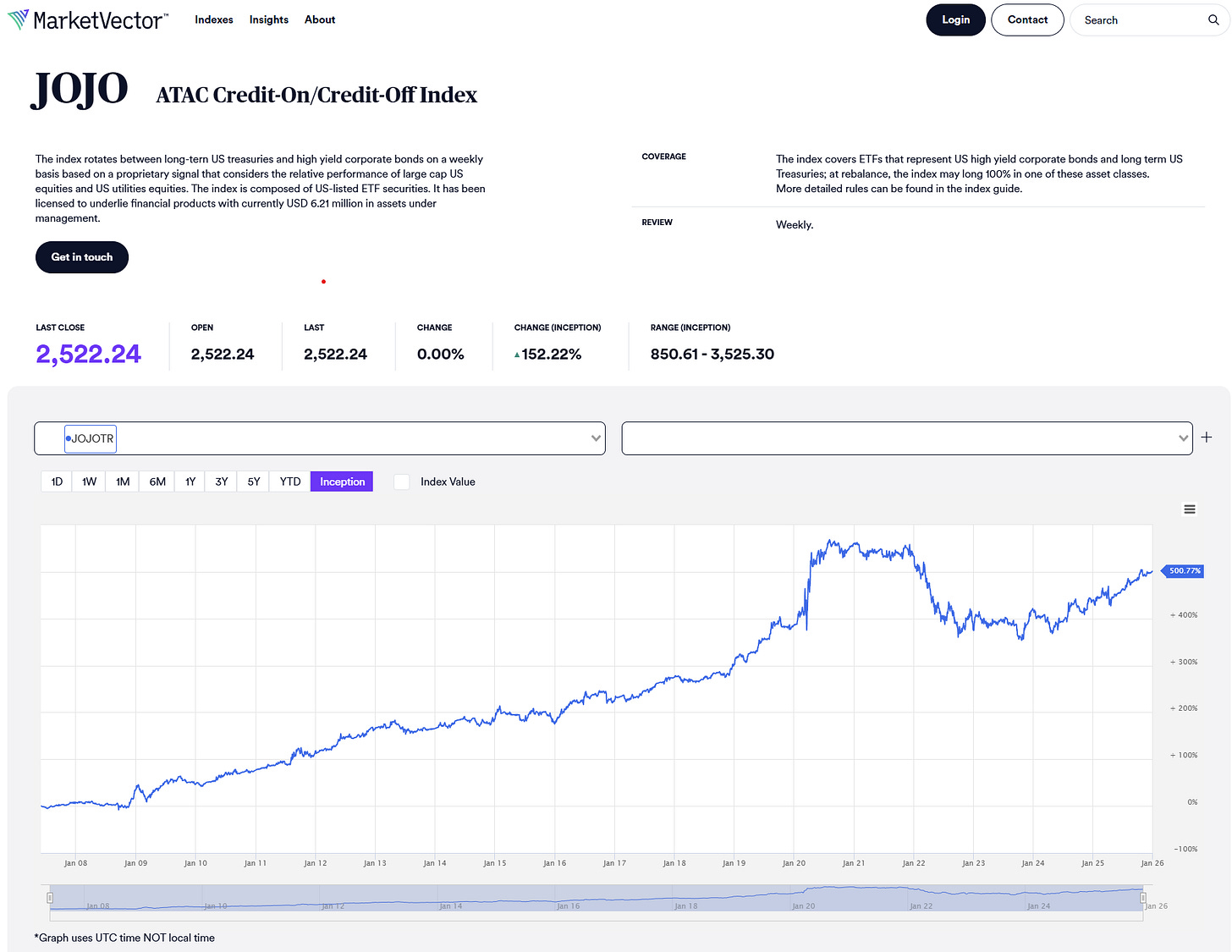

Markets have been remarkably calm, even as macro crosscurrents continue to build beneath the surface. Equity volatility has stayed compressed, credit spreads remain tight, and investor sentiment is broadly confident that any economic slowdown will be shallow and manageable. Against that backdrop, the JOJO.INDEX quietly flipped into “junk-off” mode late last week, rotating fully out of high-yield bonds and into long-duration Treasuries.

The JOJO.INDEX, formally known as the ATAC Credit-On/Credit-Off Index, is a rules-based allocation model designed to respond to changes in market risk appetite. It toggles between high-yield corporate bonds and long-duration Treasuries based on a single signal: the short-term relative performance of utility stocks versus the broader equity market. When utilities outperform, the index adopts a defensive posture. When they lag, it takes on credit risk.

This recent switch matters because defensive rotations have been rare over the past year. When they do occur, they have often preceded periods of rising volatility rather than followed them. The index is not reacting to headlines or forecasts. It is responding to market behavior that has historically led stress rather than confirmed it.¹

The Mechanics Behind the Junk-Off Signal

The logic of the JOJO.INDEX is intentionally simple. Utilities are among the most defensive equity sectors, with stable cash flows and bond-like characteristics. When investors begin rotating into utilities relative to the S&P 500, it often reflects a subtle shift toward safety before risk assets broadly reprice.

Academic and industry research has shown that short-term utility outperformance tends to precede higher volatility and weaker equity returns.² This relationship forms the backbone of the JOJO.INDEX methodology. Each week, the index evaluates the recent performance spread between utility stocks and the broader market. If utilities lead, the model moves entirely into Treasuries. If not, it allocates to high-yield bonds.

Late last week, that threshold was crossed. Utilities had quietly begun outperforming despite ongoing strength in major equity indices. The result was a full rotation into Treasuries. While the move may appear abrupt, the underlying behavior had been developing for weeks. Historically, such divergences have tended to resolve through volatility rather than continued calm.

Utilities as an Early Warning Signal

Utilities are often dismissed as dull or backward-looking. In reality, they have functioned as a reliable early warning signal across multiple market cycles. Because they sit at the intersection of interest rates, economic expectations, and risk tolerance, changes in their relative performance can reveal investor intent before it becomes obvious elsewhere.