Trump's unprecedented removal of Fed Governor Lisa Cook marks a potential turning point for central bank independence and monetary policy. The president cited alleged mortgage fraud as justification, but the timing suggests political motivations as Trump has repeatedly demanded rate cuts that the Fed has so far resisted. This battle over Fed independence has immediate market implications. Treasury yields shifted dramatically with the 2-year dropping while 30-year rates climbed, creating the steepest yield curve steepening since early 2022. If Trump ultimately prevails, we might be entering a fundamentally different era of monetary policy where political influence plays a much larger role in rate decisions.

August's economic data presented a complex picture that makes gauging the true direction challenging. Second-quarter GDP was revised upward to 3.3% from the initial 3% estimate, with business investment showing particular strength, reflecting the ongoing AI-driven capital expenditure boom. Yet consumer sentiment paints a different picture. The Conference Board consumer confidence index dropped to 97.4 in August, but the expectations index fell further to 74.8. Historically, readings in the 70s and below signal higher risk of recession. This disconnect between solid economic data and deteriorating consumer sentiment creates an interesting dynamic heading into the traditionally challenging September trading period.

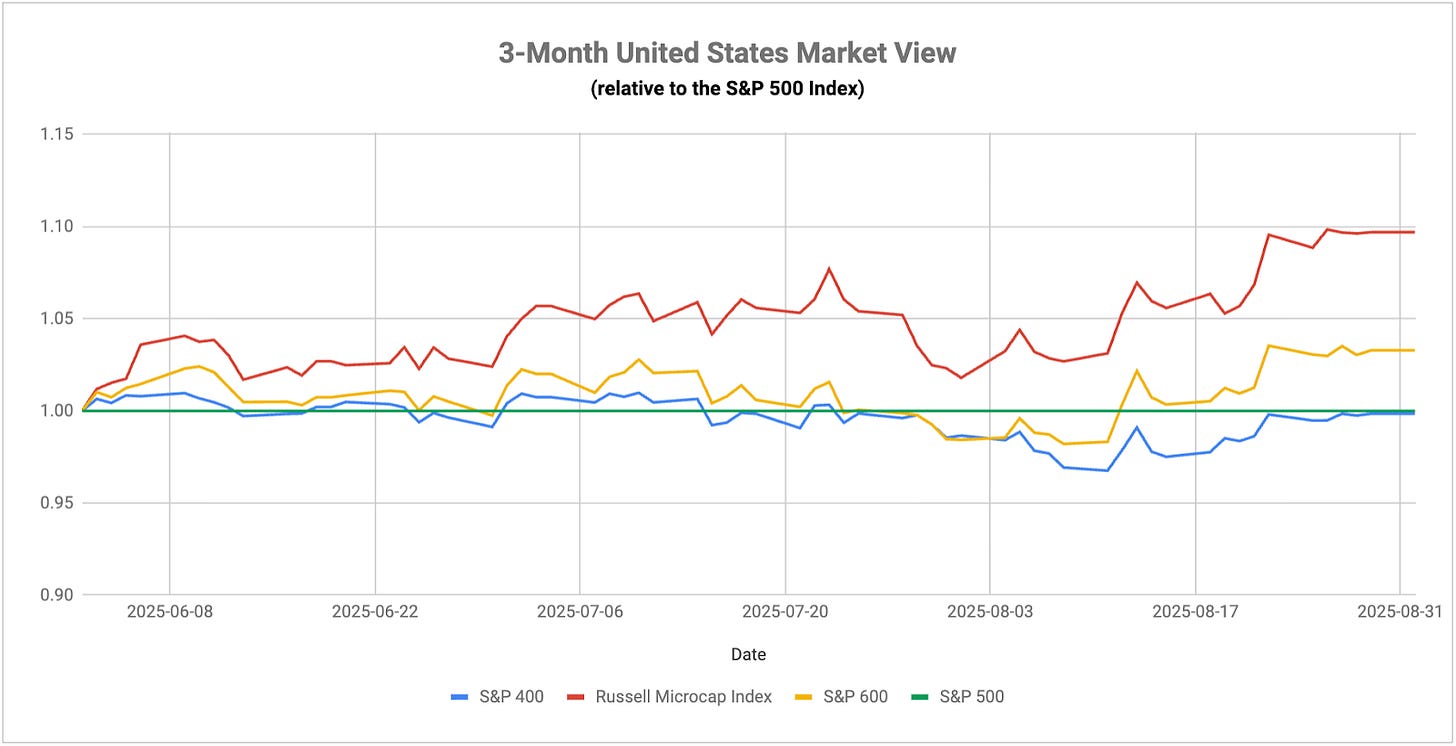

Small-cap stocks finally showed signs of life with their strongest relative performance in nine months, surging 7% in August. The valuation story here is particularly compelling. The Russell 2000 trades for less than half the S&P 500 on a price-to-book basis. If conditions move in favor of cyclicals longer-term, where small-caps are more heavily represented, this group could finally have an extended run. We're roughly 14 years into a cycle of mostly large-cap leadership. Whether that just means that the cycle is long in the tooth or it means that it could be in the late stages remains to be seen. This rotation, however, could have staying power if economic conditions remain supportive, potentially offering smaller companies their moment after years of persistent underperformance relative to the tech-dominated S&P 500.