Every week, we’ll profile a high yield investment fund that typically offers an annualized distribution of 6-10% or more. With the S&P 500 yielding less than 2%, many investors find it difficult to achieve the portfolio income necessary to meet their needs and goals. This report is designed to help address those concerns.

We may finally be seeing a bit of a shift in the fixed income market. Treasury yields became more volatile around the time that the Trump tax bill passed due to debt and deficit concerns. They turned volatile again along all points of the curve when the July jobs report came in weak and accelerated the expectation for Fed rate cuts. Junk bonds began underperforming. Spreads widened, but not a whole lot. There was finally a sense of risk-off getting priced into bonds.

One area that might also be affected is the mortgage-backed security market. If mortgage rates begin to fall, it could accelerate the pace of refinances again, but a weakening labor market could mean that default and delinquency risk could be on the rise. There’s some data suggesting that the housing market is topping out and the commercial market still remains under pressure. Housing has been a bright spot in the U.S. economy for a while now, but is the tide getting ready to turn?

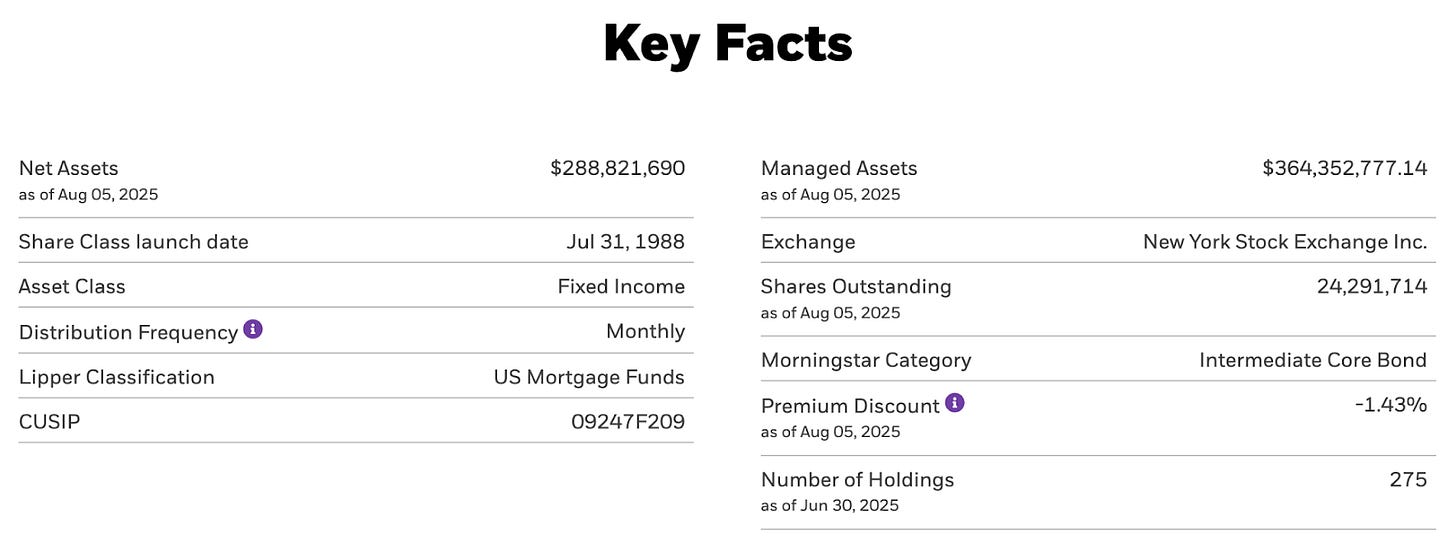

Fund Background

BKT’s investment objective is to manage a portfolio of high-quality securities to achieve both preservation of capital and high monthly income. It seeks to achieve its investment objective by investing at least 65% of its assets in mortgage-backed securities. It also invests at least 80% of its assets in securities that are (i) issued or guaranteed by the US government or one of its agencies or instrumentalities or (ii) rated at the time of investment either AAA by S&P or Aaa by Moody’s. The fund also utilizes leverage to enhance yield and total return potential.

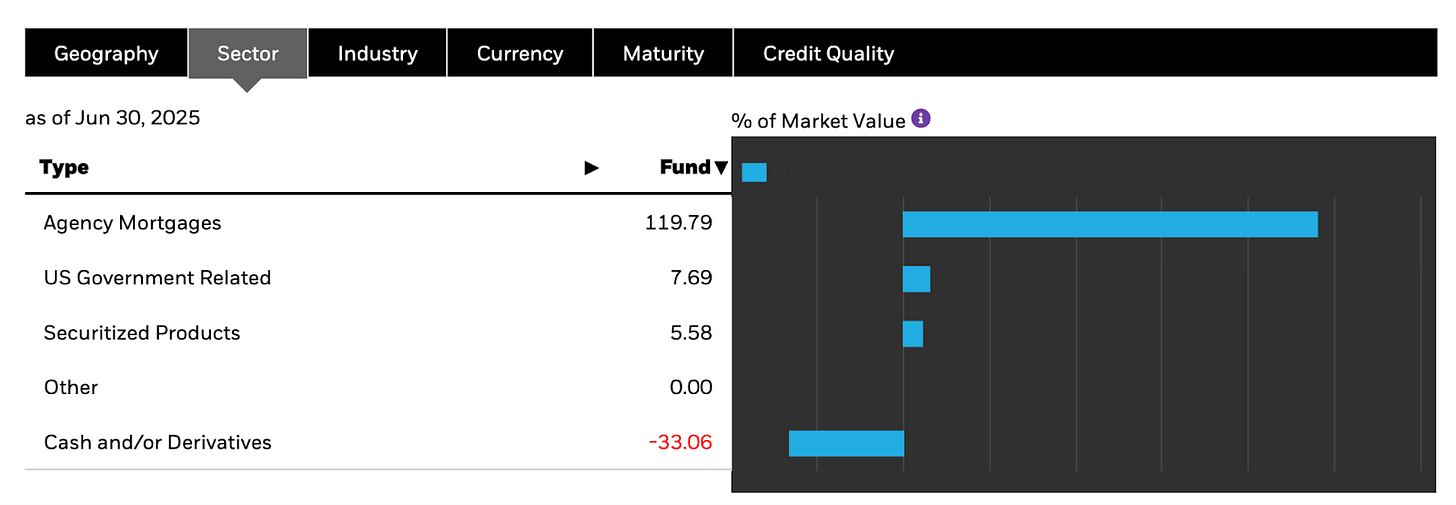

There’s nothing terribly fancy or unusual about this portfolio since it pretty much just targets high opportunity MBS. Most of the fund is invested in intermediate-term bonds with maturities of between 3-10 years. The 20% use of leverage, however, pushes portfolio duration up to 6.6 years. That means investors are going to be exposed to a fair amount of rate volatility. That could be a good thing if the Fed cuts rates and mortgage rates are able to follow. We’ve seen several times recently that expectations don’t necessarily turn into reality and that could be risky.

The degree of leverage used by BKT pushes the agency bond exposure well above 120%. Again, nothing terribly unusual. The majority of the fund’s holdings are FNMA bonds, but there’s notable exposures to the traditional FHLMC and GNMA securities as well.