Every week, we’ll profile a high yield investment fund that typically offers an annualized distribution of 6-10% or more. With the S&P 500 yielding less than 2%, many investors find it difficult to achieve the portfolio income necessary to meet their needs and goals. This report is designed to help address those concerns.

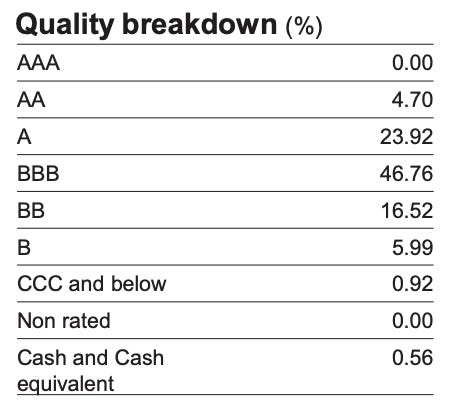

I continue to feel that junk bonds don’t present an attractive risk/reward tradeoff. Spreads are still historically low and investors aren’t pricing in the level of risk that exists within this group. That presents a problem for income investors who want to capture a high yield through a CEF, but don’t want the risk. Many fixed income CEFs are low quality portfolios, some of which are VERY low. It’s tough to find a good mix of credits and higher quality within the CEF universe, but there are a few options.

The Invesco Bond Fund (VBF) isn’t a pure investment-grade bond fund, but it’s close. Its exposure to junk bonds is fairly minimal and its diversification is a real asset. On top of that, it has a very reasonable expense ratio and doesn’t use leverage at all. It’s definitely one of the more conservative income options in the CEF market and, while its monthly distribution isn’t fixed, it could provide a nice option for income investors in this market.

Fund Background

VBF is an active, total return strategy with an objective to provide current income with preservation of capital by investing primarily in corporate bonds. It is the fund’s policy to have at least 80% of its total assets invested in debt securities, securities of or guaranteed by the U.S. Government, commercial paper and cash and cash equivalents.

Junk bonds continue to outperform Treasuries in this market, but I don’t think that trend can sustain for a lot longer. Credit conditions are tenuous. Inflation risk may be returning. Who knows what’ll happen with tariffs at this point, but that’ll probably create volatility if nothing else. The fund’s focus on higher-rated securities is a definite plus, but I like how there’s a focus on risk management, diversification, quality and value also being considered. Whether that style is currently in favor or not, it’s the kind of strategy that can work well as a long-term holding regardless.

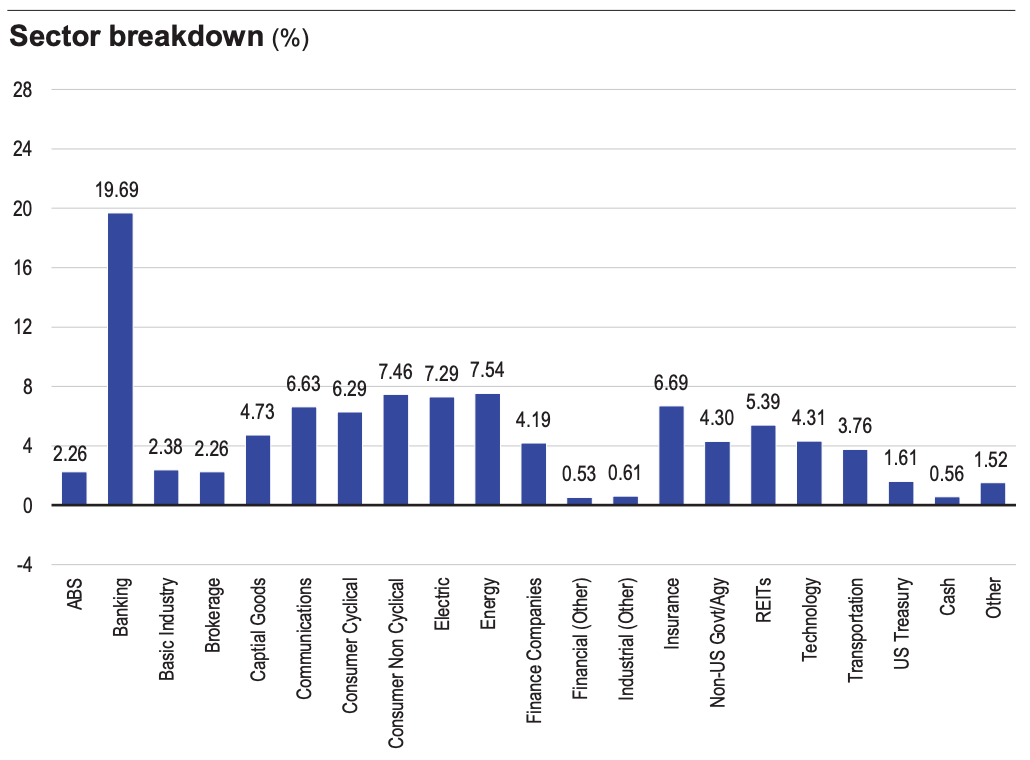

VBF does a pretty good job of maintaining diversity, although this graphic might be a little misleading. It slices and dices the portfolio enough that it gives the impression that risks are spread out. You could, however, argue that insurance, finance companies, brokerage and banking, for example, all belong under the same “financials” umbrella. In that case, the 33% collective allocation to those four categories might suggest not as much diversification as originally thought. Still, I think there’s enough of a mix that concentration risk is minimized.

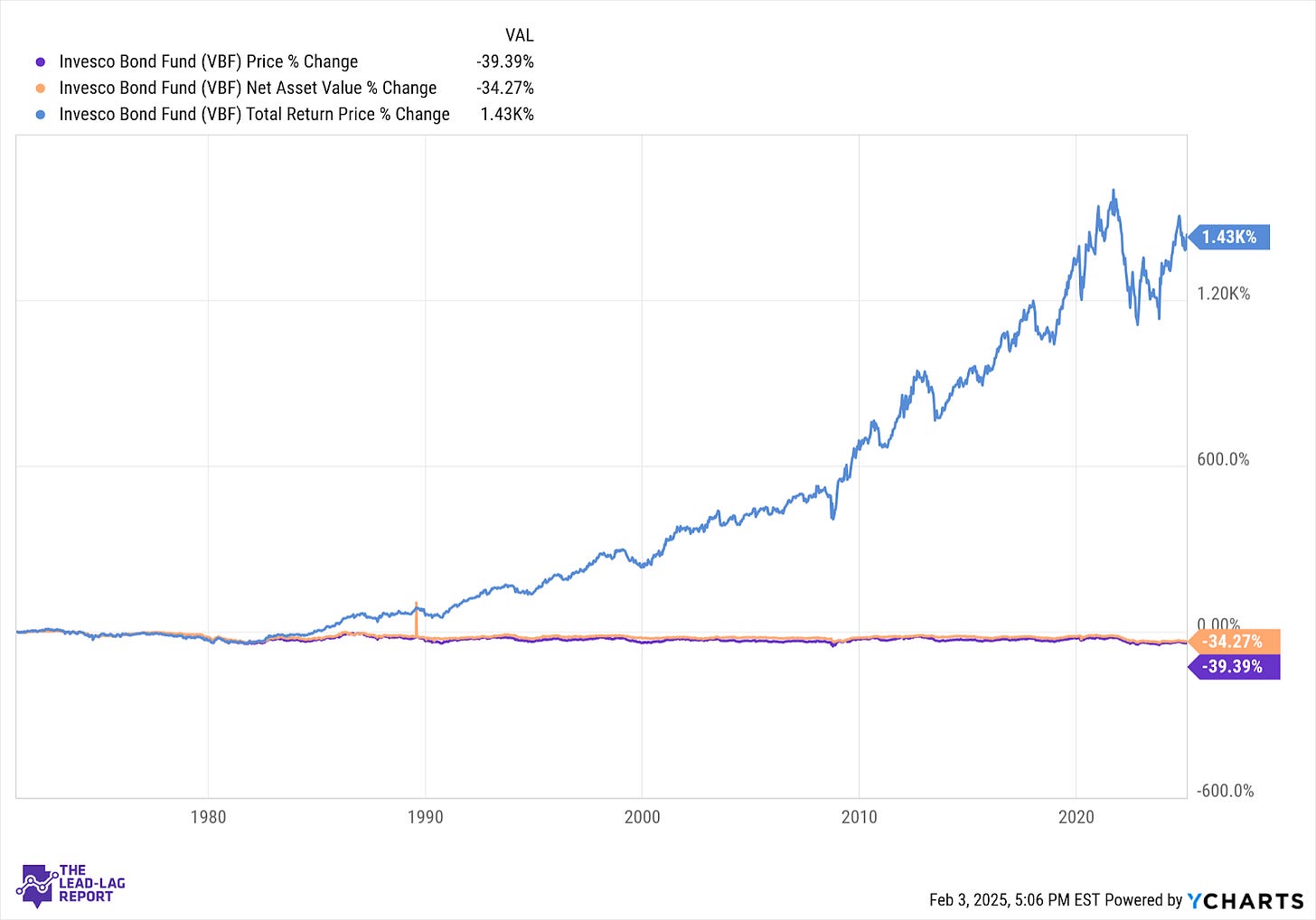

Roughly 20% of the portfolio rates as below investment-grade, which feels like a reasonable enough number to act as a yield enhancer without overexposing investors to risk, especially since most of it resides in the highest BB category. The effective duration on the portfolio currently is around 7 years, so there is some interest rate volatility exposure. The latest portfolio turnover rate is listed as 175%, although that number is over 6 months old. Regardless, that’s a lot of trading being done in this fund, which can create some adverse consequences, as we’ll see in a moment.

VBF was launched in October 1970. Since its inception, the fund has returned a total of 1,430%, which translates to just around 7% annually.