It’s AI mania running wild! 2023 has already been dominated by the performance of the S&P 7 and last week’s action continued to exacerbate the trend. While the signals all flip to risk-on this week, this is mostly a function of the mega-cap growth rally and not a true reflection of the market as a whole.

*MEMORIAL DAY SALE! Get 50% off The Lead-Lag Report TODAY. Award winning stock & bond market research to anticipate corrections, crashes, & volatility.*

How To Interpret the Signals: Within each strategy, there is a risk-on and risk-off investment recommendation, with the risk-off option being the more conservative of the two. When a particular signal indicates that investors should be risk-off, for example, subscribers should consider investing in the risk-off option and avoiding the risk-on option. The opposite, therefore, would be true when the signal flips to risk-on. In each strategy, you’d always be invested in one option or the other.

Here’s how to read the scorecard for each strategy:

Some of the strategies will be more aggressive than others. The “Leverage For The Long Run” strategy, for example, uses the S&P 500 and 2x-leveraged S&P 500. The more conservative “Lumber/Gold Bond” strategy, however, uses intermediate-term Treasuries and the S&P 500. In every case, a risk-off signal indicates that you should be invested in the more conservative of the two options, while a risk-on signal indicates you should be invested in the more aggressive one.

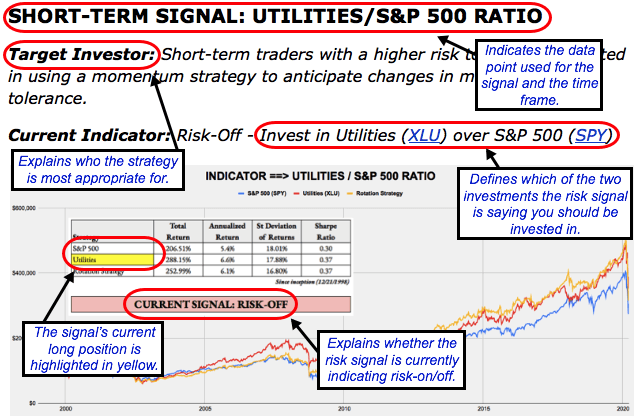

SHORT-TERM SIGNAL: UTILITIES/S&P 500 RATIO

Target Investor: Short-term traders with a higher risk tolerance interested in using an equity momentum strategy to anticipate changes in market risk tolerance.

Current Indicator: Risk-On

Strategy: Beta Rotation - Example: Invest in S&P 500 (SPY) over Utilities (XLU)

SHORT-TERM SIGNAL: LONG DURATION/INTERMEDIATE DURATION TREASURIES RATIO

Target Investor: Short-term traders with a higher risk tolerance who want to use the activity in the U.S. Treasury market to judge overall risk levels.

Current Indicator: Risk-On

Strategy: Tactical Risk Rotation - Example: Invest in S&P 500 (SPY) over Long-Duration Treasuries (VLGSX)

INTERMEDIATE-TERM SIGNAL: LUMBER/GOLD RATIO

Target Investor: Short- and long-term investors willing to trade more frequently using the classic cyclical vs. defensive asset comparison.