Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: AMID THE CHAOS, THE FLIGHT TO SAFETY TRADE FINALLY EMERGES

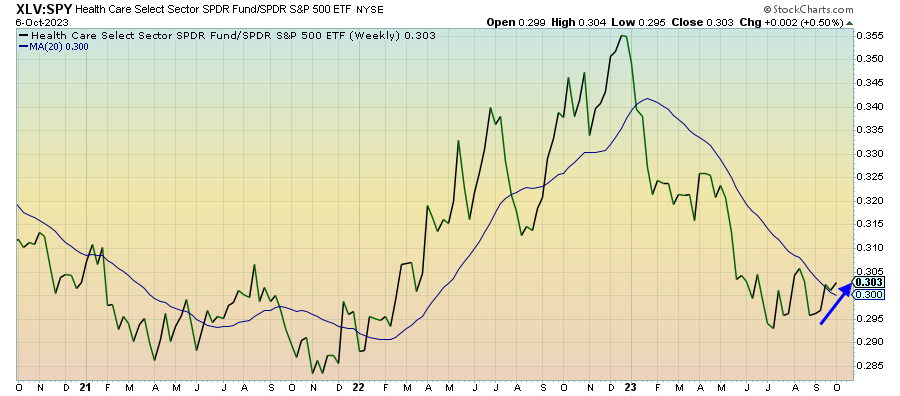

Health Care (XLV) – Better Times Ahead

This sector is a good example of just how mixed the U.S. equity market is right now. The current uptrend over the past month reflects the general cautious tone of the markets right now, but there’s been a lot of chop since the start of the summer. This tends to be a sector that responds better after risk-off conditions start setting in, so much of its potential outperformance could still be ahead.

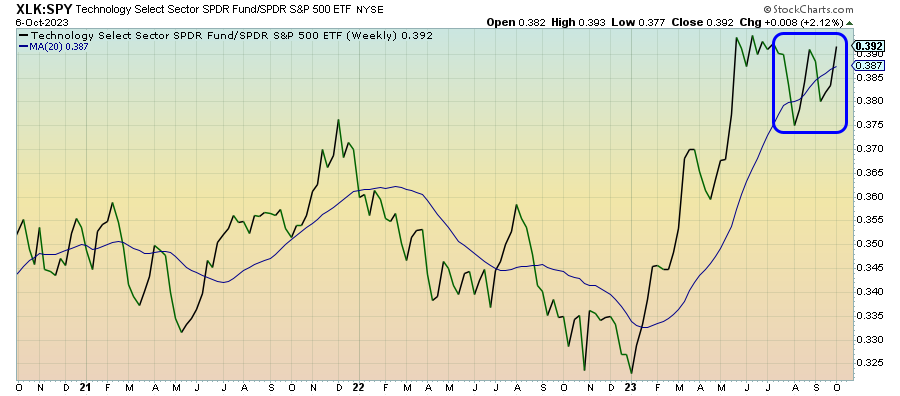

Technology (XLK) – Struggling To Figure It Out

Tech continues to experience some wild swings, which could be an indicator of how confused the market is right now. The first half of the year was dominated by the “stronger for longer” economy narrative that drove tech and growth stocks higher. Now, it looks like it’s trying to work recession risk & soaring rates into the equation and is struggling with how to figure it out.

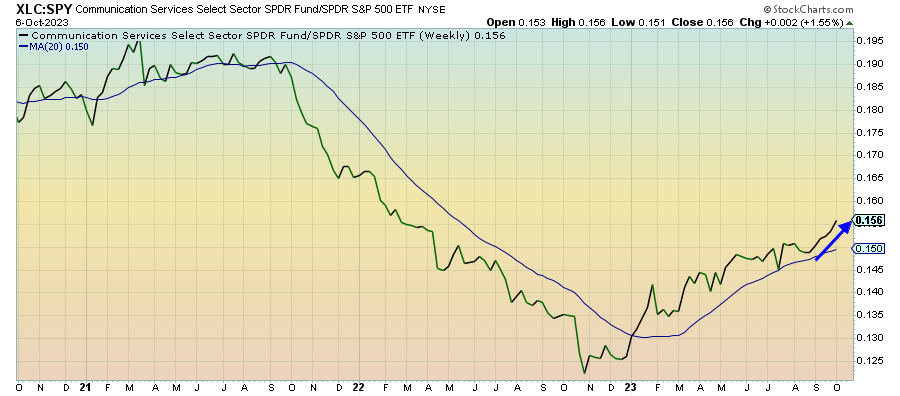

Communication Services (XLC) – Lower Volatility, But Highly Vulnerable

Relative to the S&P 500, this sector is at its highest level in more than a year and a half. Throughout 2023, it’s managed to avoid a lot of the volatility that its growth counterparts have and its combination of new and old business models have helped to balance out some risk. While the lack of relative volatility in this sector is encouraging, it’s still expensive and VERY top-heavy, which makes it especially vulnerable when investors eventually start de-risking.

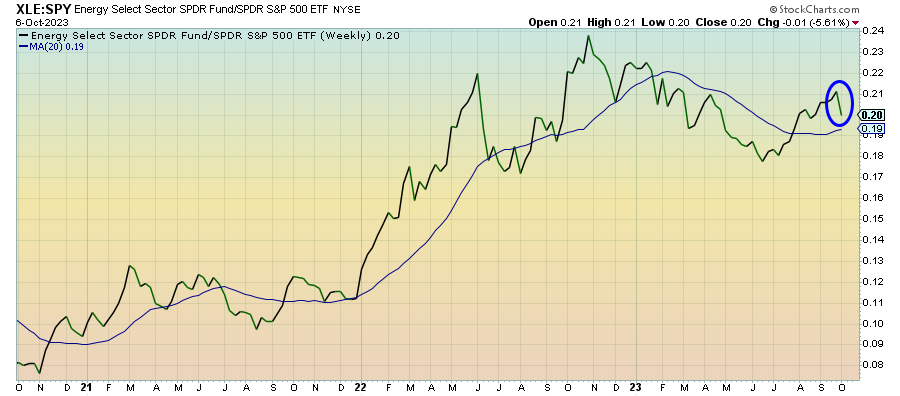

Energy (XLE) – Waiting For The Big Demand Destruction

Energy stocks finally took a step back last week as Saudi Arabia failed to step up its recent production cut plans, something which had been speculated, and gasoline inventories unexpectedly rose. Those, however, are short-term risk factors and the biggest catalyst to the sector is a broad global decline in energy demand. We’re starting to see that already, but conditions favorable for that to continue in the coming months & quarters.

Junk Debt (JNK) – Prone To A Pullback