Every week, we’ll profile a high yield investment fund that typically offers an annualized distribution of 6-10% or more. With the S&P 500 yielding less than 2%, many investors find it difficult to achieve the portfolio income necessary to meet their needs and goals. This report is designed to help address those concerns.

When it comes to asset allocation, investors are in a bit of a tricky spot. On one hand, earnings have been relatively good, the Trump tax cut bill should add more liquidity to the economy and the Fed is likely to begin cutting rates soon. All of that should be supportive of higher equity prices. On the other hand, the housing market is starting to weaken, the labor market is beginning to cool and non-U.S. economies, such as Europe and Japan, are struggling with growth. Those kinds of factors might be supportive to bonds.

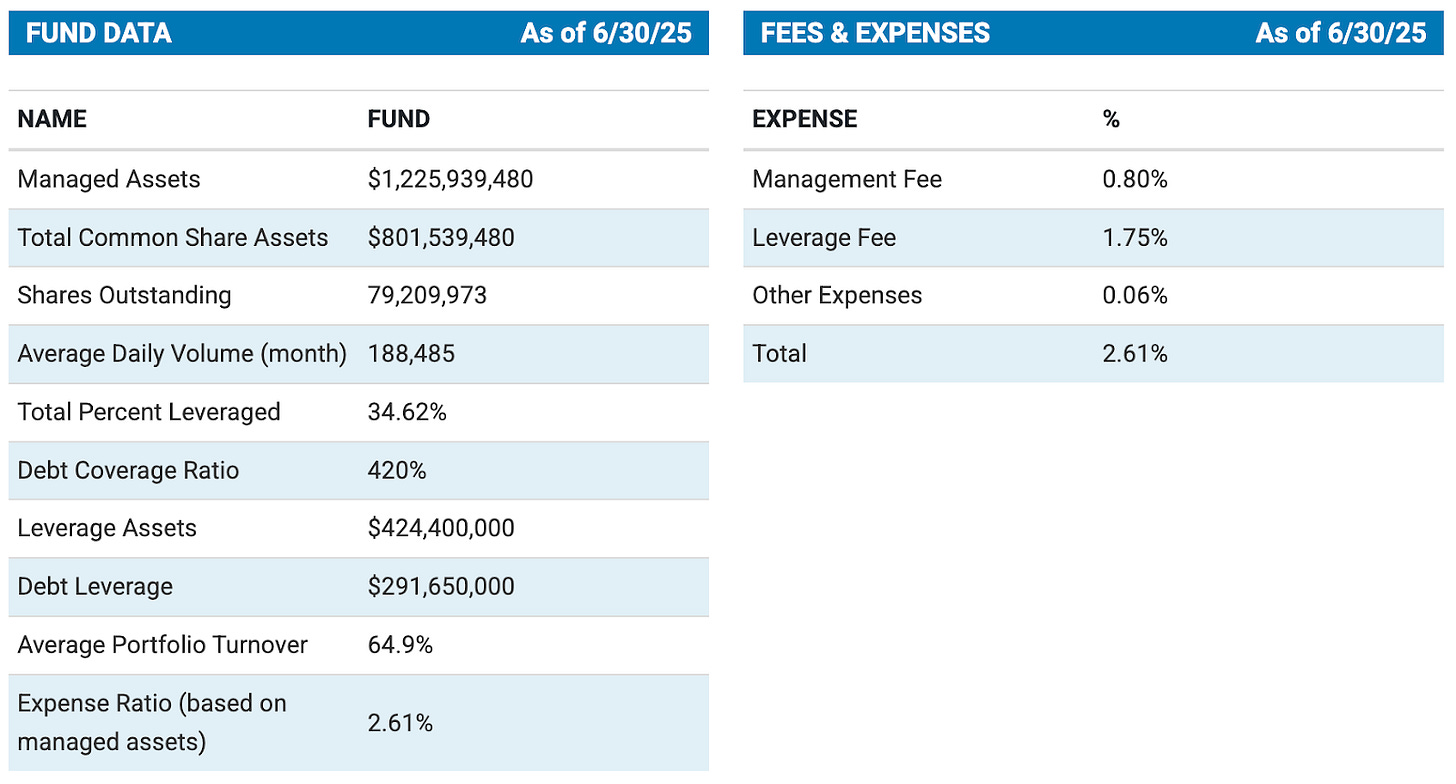

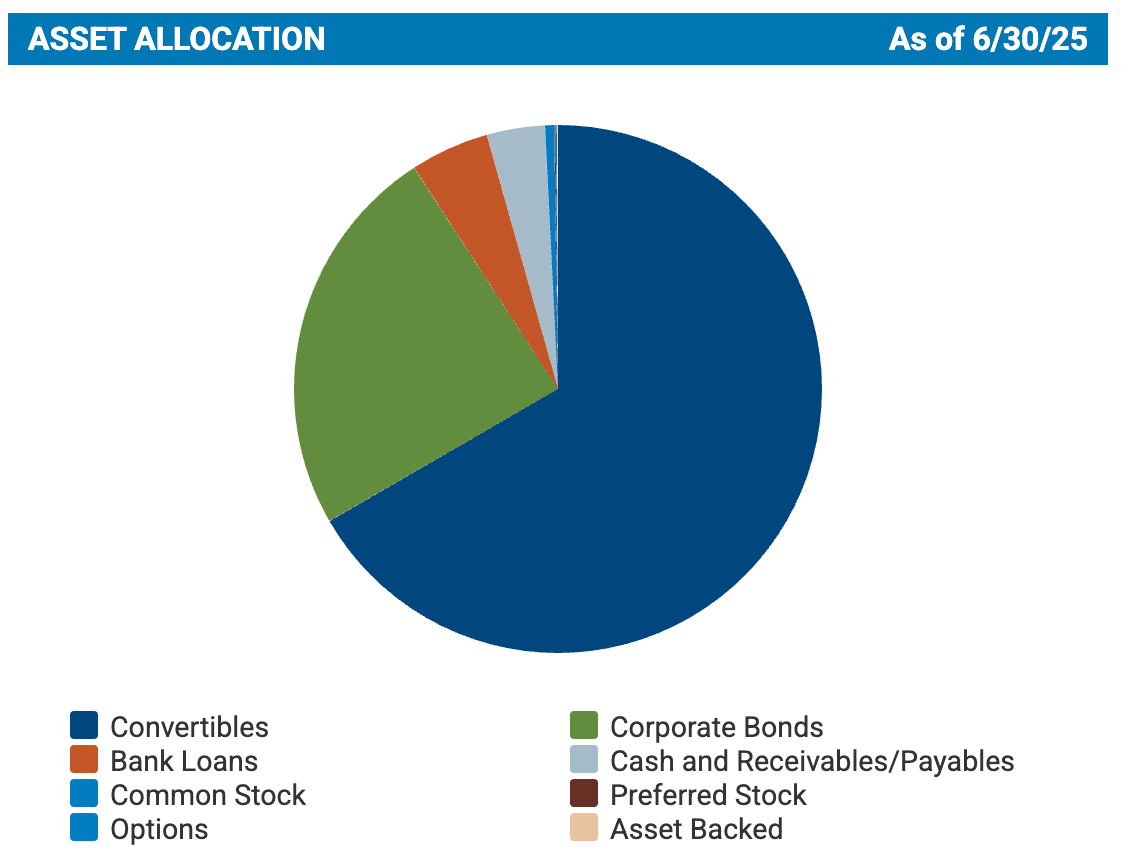

How does one walk the tightrope? Convertibles could be the answer. Those are the stock/bond hybrids that maintain fixed income properties but have the ability to convert into stocks under certain conditions. The Calamos Convertible Opportunities & Income Fund (CHI) might seem like a pure play on these securities, but it’s actually not. It’s MOSTLY convertibles, but its ability to add in exposures to other income-producing securities, including corporate bonds and bank loans, gives it a potentially more comprehensive play on the fixed income space.

Fund Background

CHI seeks total return through capital appreciation and current income by investing in a diversified portfolio of convertible securities and high-yield corporate bonds. It aims to provide consistent income through monthly distributions set at levels the investment team believes are sustainable. It also seeks to be less susceptible to rising interest rates than traditional fixed-income funds and invests in a broad range of security types to actively manage risk/reward characteristics over full market cycles. The fund uses leverage to enhance yield and total return potential.

Convertibles are clearly the play if you’re investing in this fund, but the ability to balance it out with other asset classes is advantageous. That’s especially true nowadays as junk bonds have been steadily outperforming. Convertibles have been riding equity market momentum, but bank loans and high yielders have also been doing well. That modest difference in risk/return profiles should help to diversify away a bit of risk, but that 35% leverage rate brings it all back and then some.

As mentioned, CHI is very roughly ⅔ convertibles and ⅓ junk bonds with other asset types providing minor exposures at the margins. What’s a bit interesting is that about ⅓ of that non-convertible sleeve in the fund is actually rated investment-grade. This fund probably isn’t as risky, at least from a credit standpoint, as it might appear on the surface.

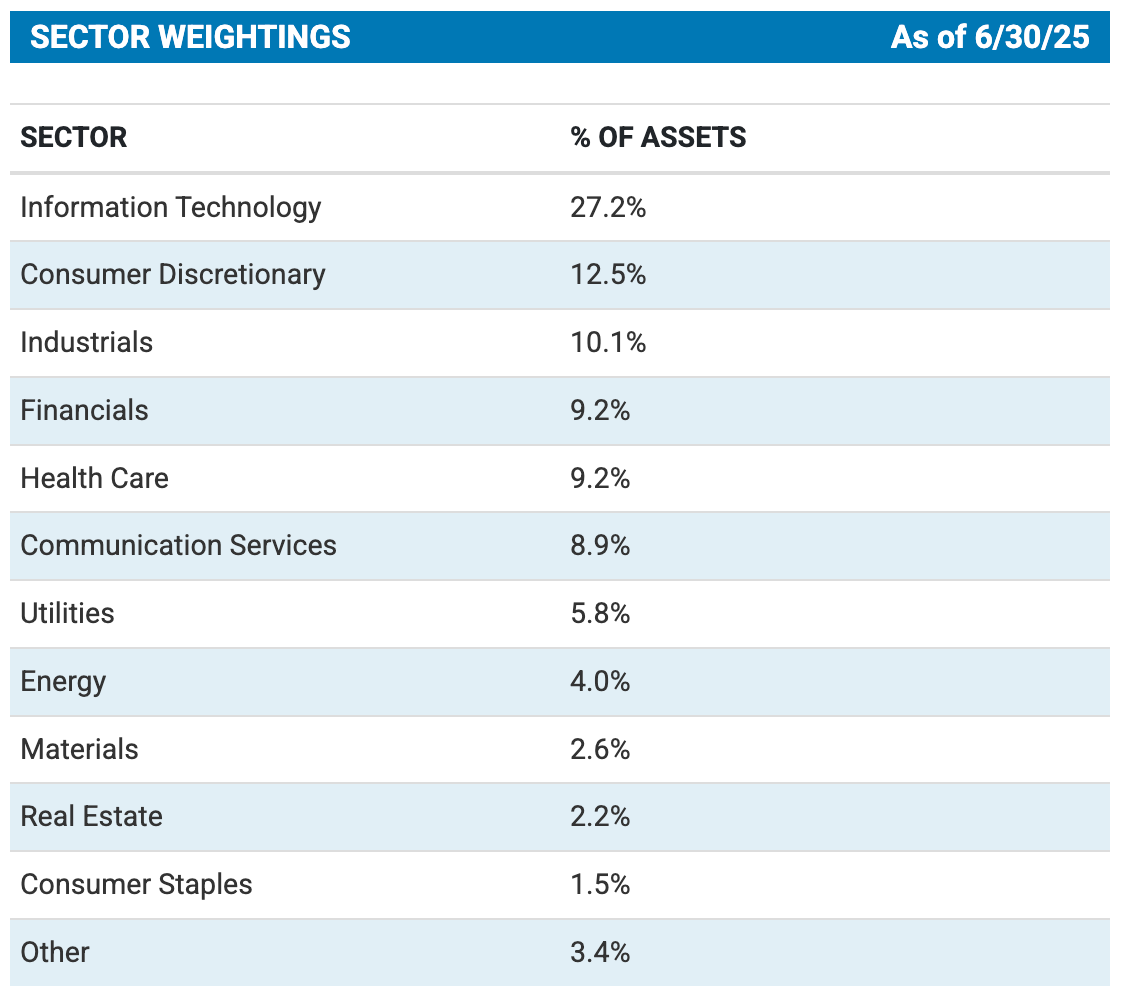

It’s no surprise that CHI is as top-heavy in tech as it is given that’s where the alpha has been. These are just the magnificent 7 tech names either. Three of the fund’s top 4 positions are Snowflake, Uber and Microstrategy convertibles. There’s definitely a willingness to push into some of the industry’s more volatile names.

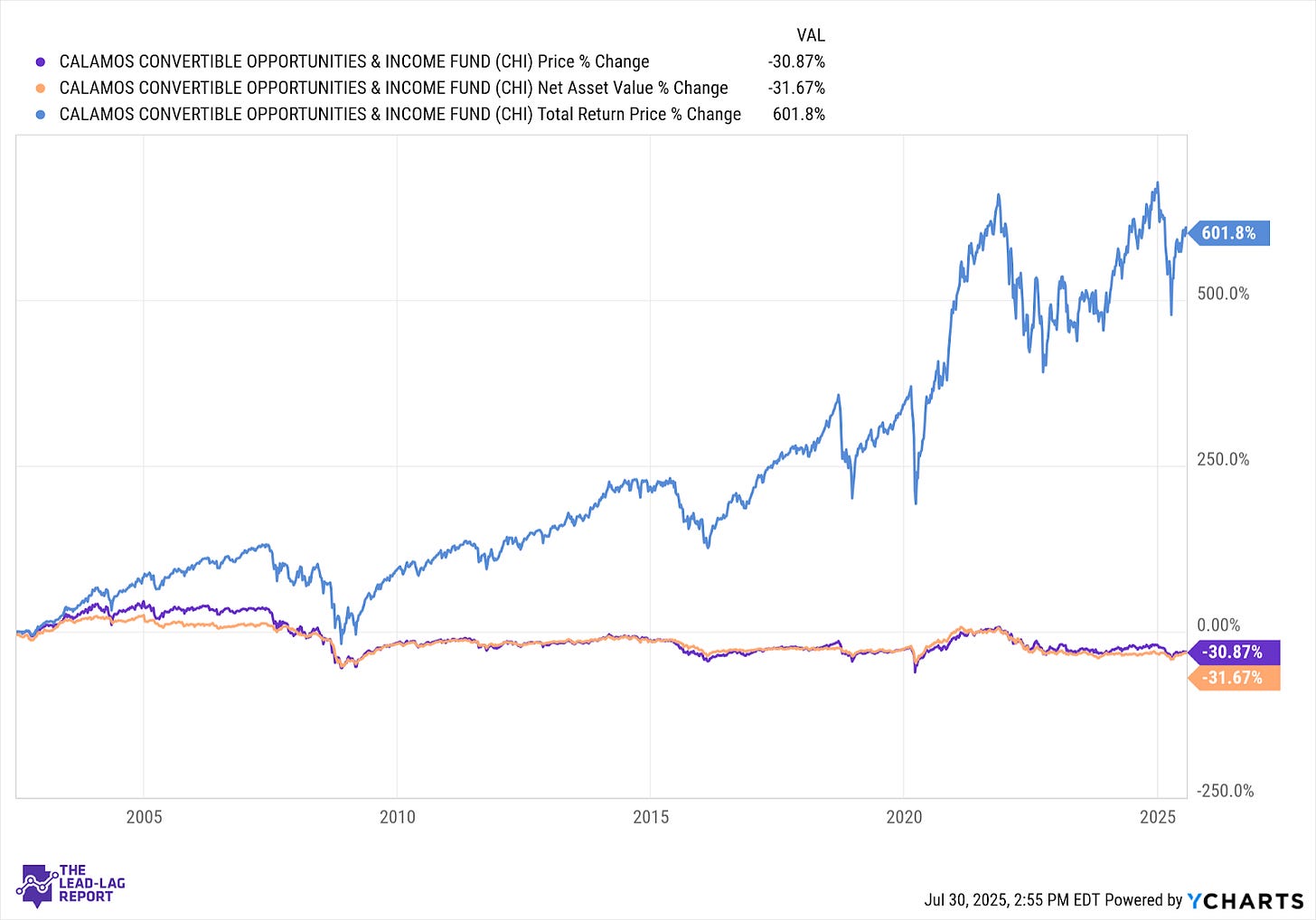

Since its inception in June 2002, JCE has generated a total return of 602%. That translates to an average annual return of around 9%.