Every week, we’ll profile a high yield investment fund that typically offers an annualized distribution of 6-10% or more. With the S&P 500 yielding less than 2%, many investors find it difficult to achieve the portfolio income necessary to meet their needs and goals. This report is designed to help address those concerns.

Whether it’s the CPI report showing a modest uptick, the UofM consumer sentiment showing a large increase to expectations or the NY Fed, which shows a steady 3% forward estimate, it’s safe to say that inflation is on the market’s mind. Steadily declining inflation post-2022 has given way to sticky and elevated inflation, but the possibility of a reignition also looms. This is especially the case given that the White House has frequently used tariffs as a tool both for political and economic purposes.

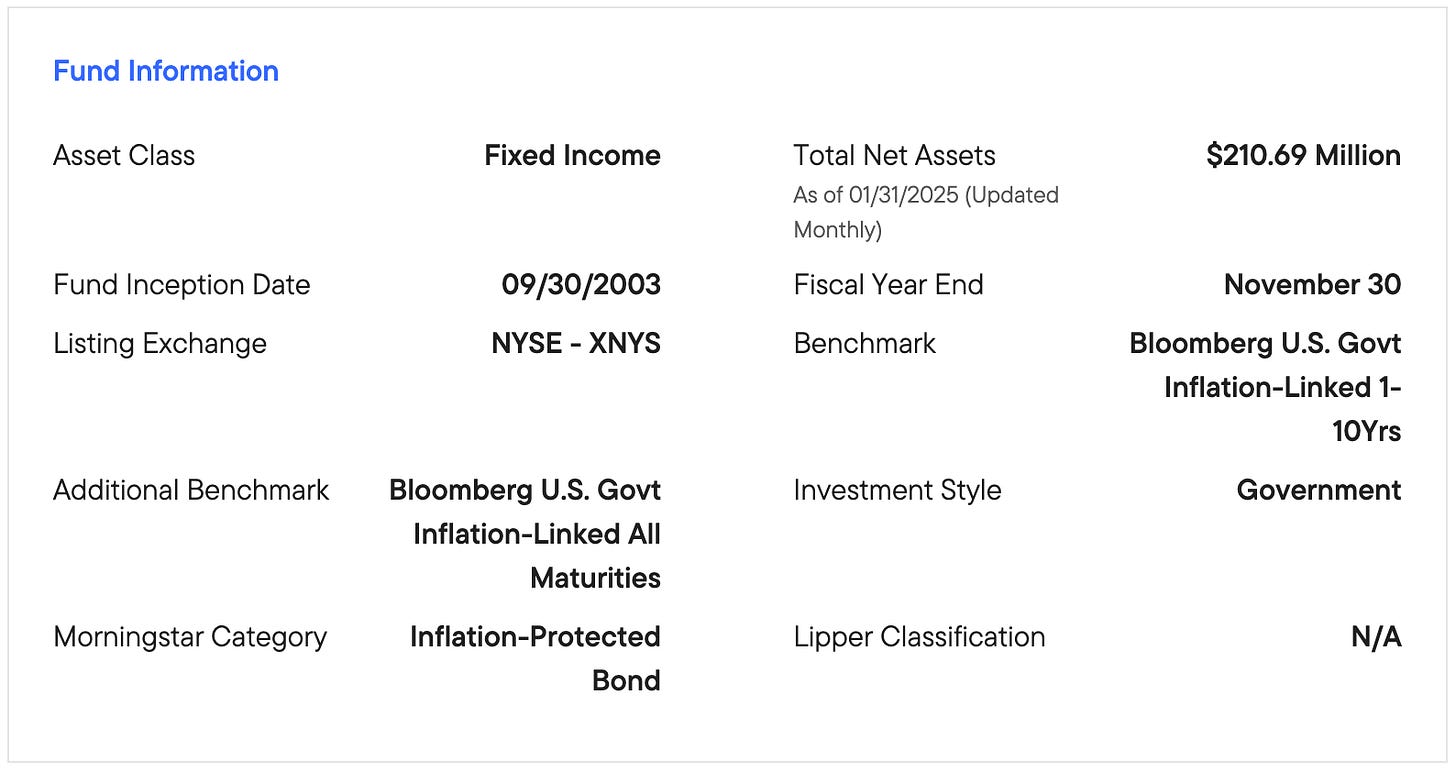

That means CEF investors should at least be aware of the Western Asset Inflation-Linked Income Fund (WIA). It’s easy to assume that this is a fund that invests in TIPS (and it mostly does), it could be considered a “plus” portfolio in that it has the freedom to diversify beyond just that core category. The use of leverage also gives it a unique flavor that makes it very different from other inflation-protected securities funds.

Fund Background

WIA provides a leveraged portfolio investing at least 80% in inflation-linked securities, consisting primarily of U.S. Treasury Inflation Protected Securities “TIPS”, with the ability to invest in other fixed-income assets including high-yield, emerging markets, structured products, commodities and currency. It seeks current income with a secondary investment objective of capital appreciation and emphasizes extensive credit research expertise to identify attractively priced securities.

TIPS became big performers in 2021-2022 due to rapidly rising inflation and high demand for portfolio protection. Even though there are signs that inflation may be re-accelerating, there hasn’t yet been a significant uptick in demand this time around. That’s probably fair given how the U.S. inflation rate is still around 3%, but the uncertain path of the trade war could change that quickly. People looking for more pure inflation protection might not like the leveraged nature of the fund and the 20% of the portfolio that isn’t TIPS may or may not perform as intended.