Every week, we’ll profile a high yield investment fund that typically offers an annualized distribution of 6-10% or more. With the S&P 500 yielding less than 2%, many investors find it difficult to achieve the portfolio income necessary to meet their needs and goals. This report is designed to help address those concerns.

Now that the United States and China have agreed to a temporary trade truce, it might unleash another rally for junk bonds. That group has been outperforming Treasuries for several weeks now in anticipation of easing geopolitical tensions, but the U.S.-China standoff was the big one that needed to be resolved. Lower-grade debt started to turn higher ahead of that finally finding some resolution and it could be that the outperformance is poised to continue.

The Allspring Income Opportunities Fund (EAD) targets not just the junk bond market, but also the senior loan and preferred markets for a little extra juice. The focus on the former group could help it target an area of the fixed income market that’s set up nicely to outperform, while the latter group provides some extra flexibility if it can identify particularly attractive opportunities. It could be a combination that serves investors well here.

Fund Background

EAD seeks a high level of current income and may also seek capital appreciation consistent with its investment goal. Under normal market conditions, the fund invests at least 80% of its total assets in below-investment-grade (high yield) debt securities, loans and preferred stocks. The fund also utilizes leverage in order to enhance yield and total return potential.

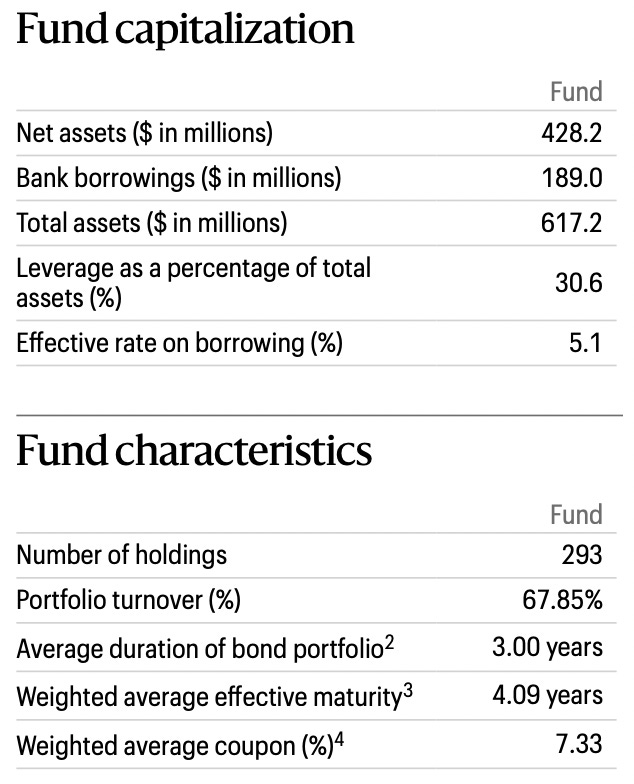

A few things I notice looking over the data points above. First, the fund’s strategy is fairly straightforward and there really any extenuating circumstances to consider. The 3-year duration of the portfolio means that interest rate risk is modest, something which could be beneficial given how we may see the yield curve shift a bit higher here on the long end. The 67% turnover rate suggests that there’s enough change happening in the portfolio to help ensure that its active share is high, but not so much that it becomes tax-inefficient. The 30% use of leverage is on the higher end and the high cost of financing is reflected in the 3.8% gross expense ratio.

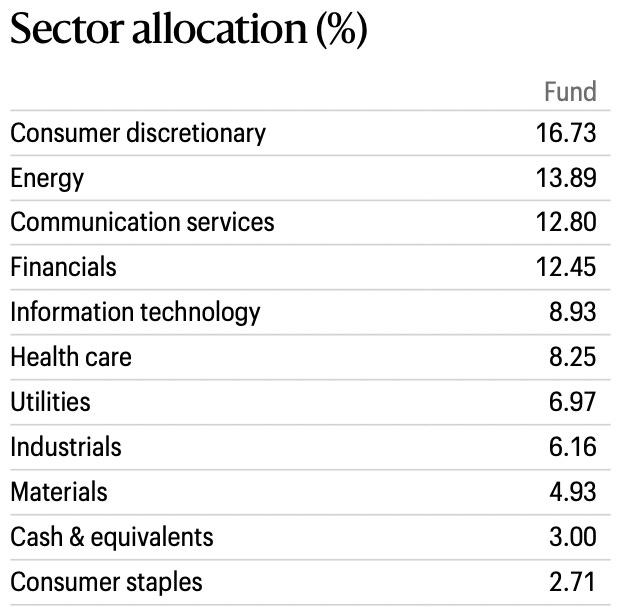

Not that a bond fund should necessarily have a sector allocation similar to that of the S&P 500, but this portfolio looks substantially different. The higher allocation to financials isn’t surprising, but the mix of growth and cyclical allocations could mean there’s the potential for a little higher volatility here. Overall, diversification is good and I see little idiosyncratic risk.

For a junk bond focused closed-end fund, EAD’s credit allocation qualifies as modestly above average. The 80%+ allocation to BB-rated and B-rated bonds (with the tilt towards the former category) suggests that credit risk isn’t over the top, at least in comparison to its CEF peers. It’s actually a pretty comparable allocation to many standard junk bond indices, so default risk is pretty down the middle with this portfolio.