Every week, we’ll profile a high yield investment fund that typically offers an annualized distribution of 6-10% or more. With the S&P 500 yielding less than 2%, many investors find it difficult to achieve the portfolio income necessary to meet their needs and goals. This report is designed to help address those concerns.

A relative de-escalation in global trade tensions (at least from the days of 100%+ tariffs on Chinese imports) and a belief that rate cuts from the Fed are on the way have combined to send U.S. equity indices back to all-time highs. Investors seem to feel that inflation is under control, people are still working and GDP will continue to grow positively. That’s added a backbone of support even though there are some underlying signals that there are cracks under the surface.

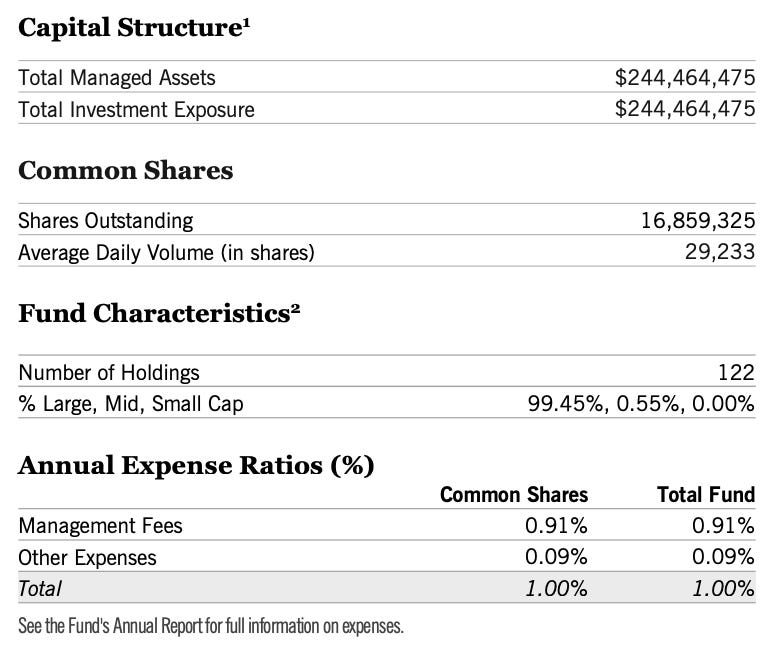

That combination of conditions could motivate some investors to seek a way to mitigate some volatility within the equity sleeve of their portfolios. The Nuveen Core Equity Alpha Fund (JCE) combines large-cap equity exposure with a partial covered call overlay to offer equity market upside with a high yield. It’s not a complicated strategy by any means, but JCE does have some unique features, which means investors need to consider the tradeoffs.

Fund Background

JCE’s investment objective is to provide an attractive level of total return, primarily through long-term capital appreciation and secondarily through income and gains. The Fund invests in large capitalization U.S. common stocks, using a proprietary quantitative process designed to provide the potential for long-term outperformance. The Fund also sells call options with a notional value of up to 50% of the Fund's equity portfolio in seeking to enhance risk-adjusted performance relative to an all equity portfolio.

The 50% overlay is nice because it allows for the high yield capture without giving up virtually all equity upside, as you would with a 100% overlay. In that way, it provides a modest hedge against some downside risk, but upside participation should U.S. stocks keep testing new all-time highs. The fund’s use of quantitative analysis to select stocks helps take some of the emotional decision making out of the equation, but (as we’ll see in a moment) it falls victim to recency bias.

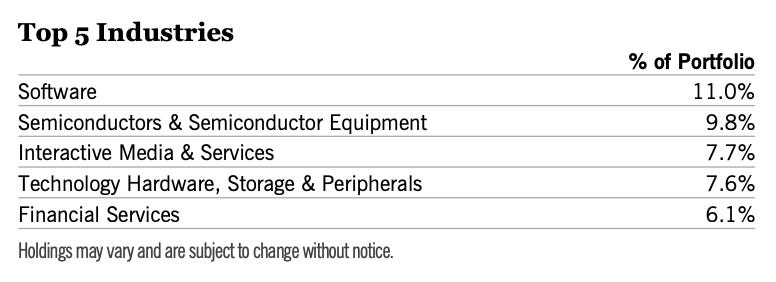

In total, JCE is about ⅔ tech stocks with the remaining allocation split relatively evenly between media and financial services names, which include digital payment processors and the like. In other words, this is a very growth-oriented fund. The fund’s management process is clearly leaning towards previous winners from the past 2-3 years or it sees the biggest future growth potential from some of the market’s expensive names.