Another day, another change in tariff policy. After claiming that China violated any agreements made earlier this year with regards to trade, the White House announced it was extending the tariff pause on certain imports, including semiconductors and GPUs, to August 31st. Given the VIX’s lack of response to most of the recent trade developments, it sure seems like the market has had enough of reacting to these starts and stops (the VIX even broke below 18 this week). This is probably the right take given how no one, including the White House, has any real clue about how this is all going to play out. Based on recent macro data, it looks like the market may have begun pivoting back to trading on fundamentals.

One of the more interesting numbers is the Atlanta Fed’s Q2 GDP estimate, which currently sits at a huge +4.6%. We expected some type of snapback from the pre-Liberation Day push to import as much as possible before tariffs were implemented. That’s been a big contributor to the Q2 estimate, but the biggest driver is expected to be consumer spending. If we continue to get a relative easing on the trade front (meaning we don’t go back to 100%+ tariffs and nothing really sticks for long) and Q2 can deliver a positive growth story, I think there’s a case to be made that stocks have some upside potential in the near-term. If we get the eventual push towards deregulation that Trump has talked about, it could be another big tailwind.

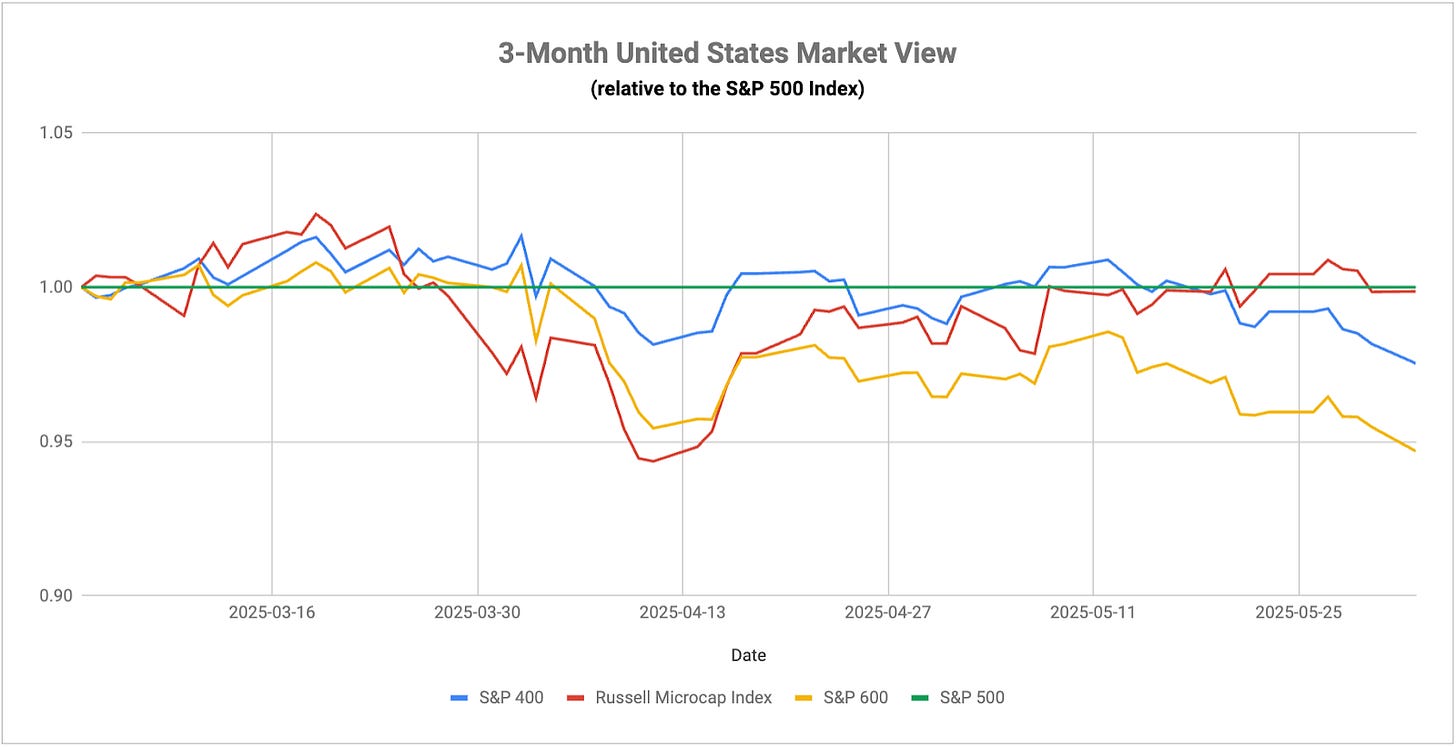

If the market believes this though, why are small-caps still lagging so badly? This group should be one of the biggest beneficiaries of a tariff pause and a deregulatory push. If the lows are already in, shouldn’t small-caps be rebounding harder based on these catalysts? This is one of the things that concerns me about this market - small-caps have shown little to no life and Treasury yields still haven’t returned lower to their pre-Liberation Day levels. Regarding the latter, inflation expectations are still really high and maybe that’s playing into investor psyche a bit, but I’m inclined to believe that there’s something else going on that’s delaying or preventing the market reaction I’d expect to see.

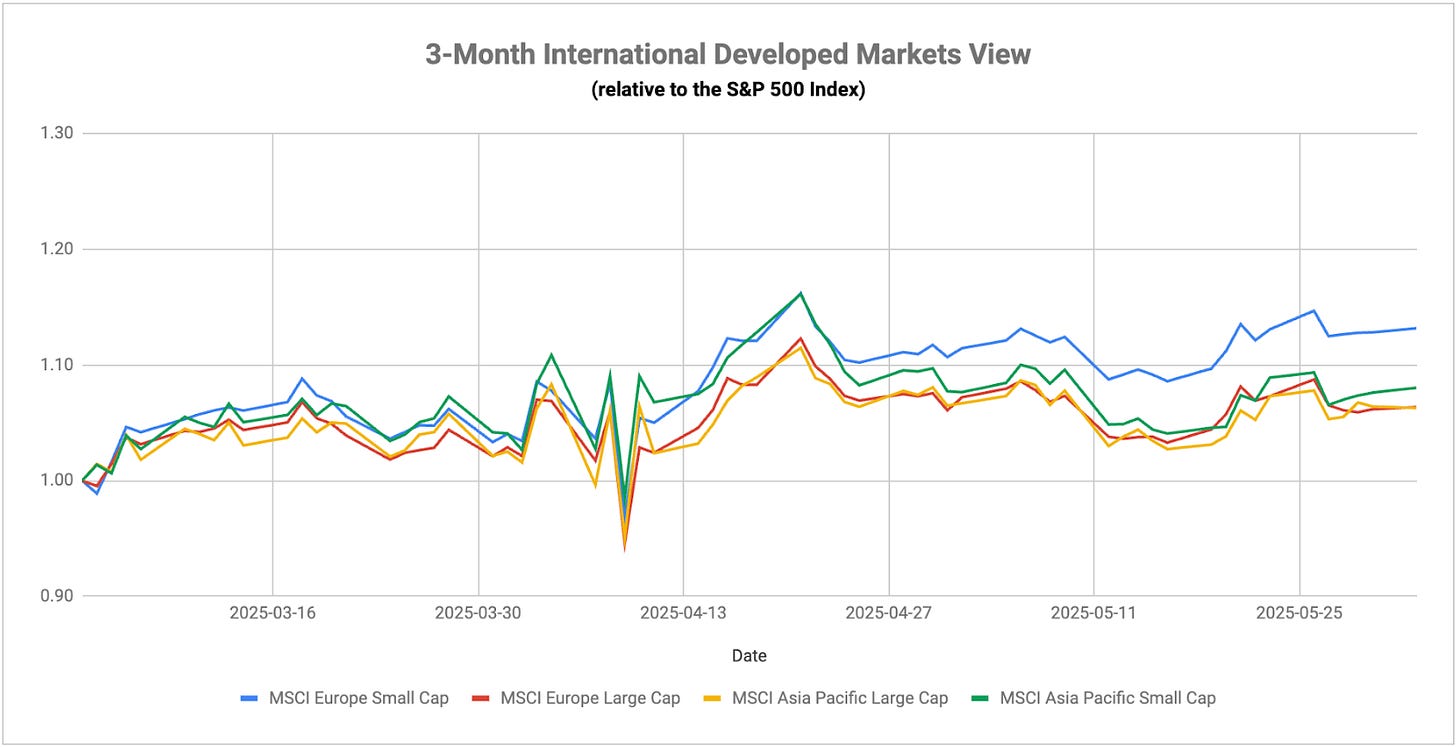

The May inflation report provided a few important milestones for the Eurozone. The annualized print came in at 1.9%, which would be only the 2nd time in the past four years that the inflation rate came in below 2%. Falling energy prices were a contributor, but more importantly, the stickier services inflation rate came in at just 3.2%, its lowest reading in more than three years. These numbers should help give the ECB the all-clear to continue lowering interest rates in 2025. While the Eurozone economy has delivered five consecutive quarters of positive growth, those gains have only averaged 0.2-0.3% per quarter, not enough to where one distinct catalyst couldn’t flip the economy back into contraction. The ECB has lowered its benchmark rate by nearly 200 basis points over the past year and is expected to cut again later this week.

Special Announcement

LeadLag is a proud media partner of Wealth Management EDGE, taking place on June 10-12 at The Boca Raton Resort!

Wealth Management EDGE, the industry's largest gathering of senior financial advisors, is the only wealth management conference encompassing investment, productivity and growth strategies. Learn more about the event here: https://informaconnect.com/edge/

Join us this June at EDGE and save 20% by using code “LeadLag2025”

If you are a financial advisor, register for the event for free with code “LL2025Adv”

The -0.2% GDP growth rate for Japan in Q1 further complicates the job of the Bank of Japan. In the three previous quarters, growth had been solid enough that there was a case to be made that the BoJ could potentially hike rates to fight its growing inflation problem. With the economy contracting due to a combination of trade war fallout and a lack of consumer demand, the central bank is likely to find itself in a tough spot again. The country’s inflation rate is stuck at 3.6% and month-over-month readings show little progress being made to get back to the 2% target. When I say that Japan is perhaps the biggest risk to the global economy, this is what I’m talking about. Japan could be the biggest stagflationary risk out there and if growth starts coming in around 0% and inflation remains stuck in the 3-4% range for the foreseeable future, it could be an ugly outcome not only for stocks but for anything that relies on the Japanese economy or the yen to function.

The latest manufacturing PMI data out of China suggests that the economy may be back in trouble again. For most of the past three years, the manufacturing sector has been pretty stagnant, flipping between periods of expansion and contraction. The May reading of 48.3 marks the lowest print in nearly three years and the first contraction of 2025. The PBoC has continued to take modest steps to ease monetary conditions and refocus on growing the private sector instead of just throwing money at the problem. Manufacturing and domestic demand are the two core components of the Chinese economy. The former may be slipping again and the latter has struggled going all the way back to the COVID pandemic. With steeper tariffs potentially still on the horizon, the outlook for China is starting to get weaker.

In the way that small-caps are lagging large-caps, emerging markets are still struggling to gain ground against the S&P 500. I think there’s a case that there’s some real potential here if conditions fall into place. The weaker dollar already works into emerging markets’ favor. If we get a little stability from Treasury yields here so that higher U.S. interest rates don’t start drawing capital away from emerging markets, the relative growth profile and discounted valuations could finally see some results. Some leadership from Chinese stocks would certainly help, although that’s in some question too. The recent decline in manufacturing underscores the idea that the recovery there is weak and consumption levels still aren’t where they need to be. If the PBoC’s stimulative efforts work, this could be an interesting longer-term play.

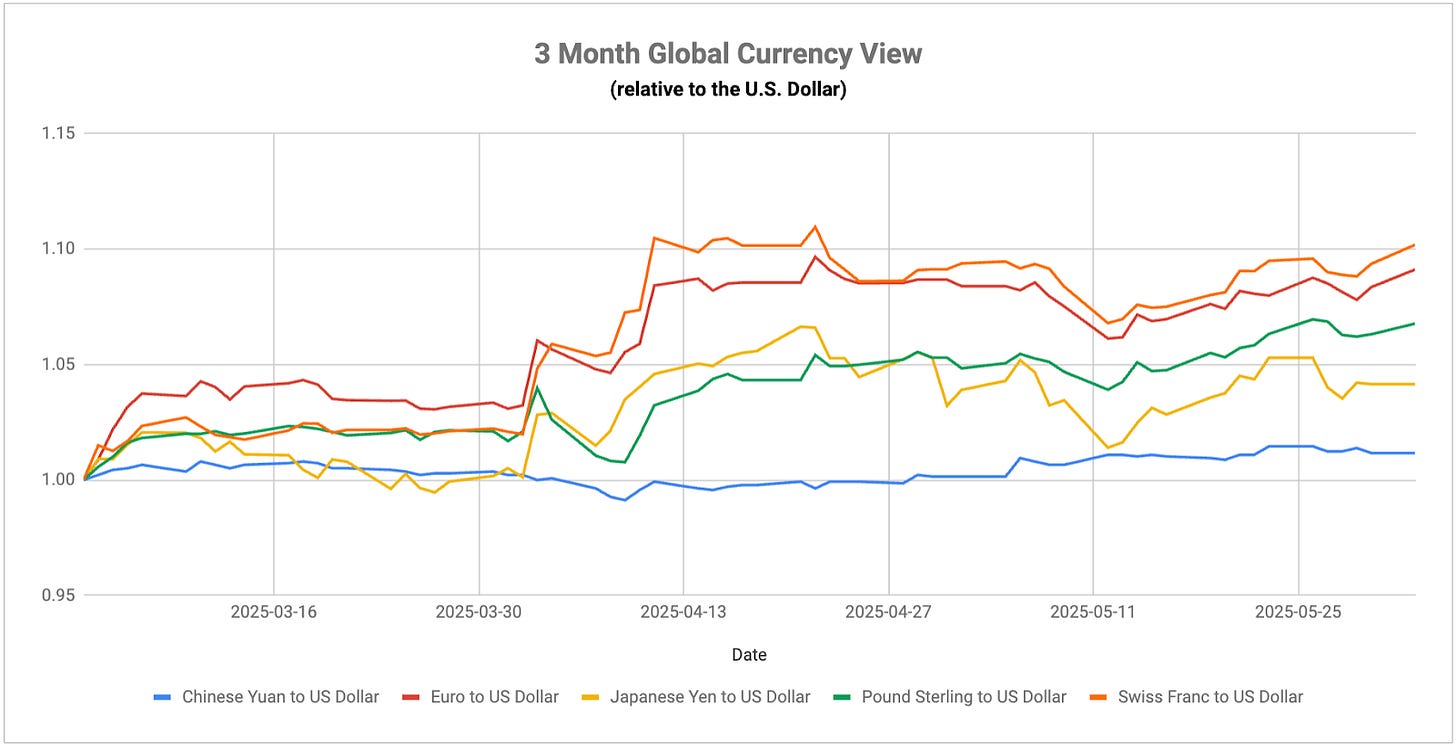

The story here is the disconnected relationship between the dollar and long-term Treasury yields. Traditionally, the two are positively correlated. In recent weeks, however, we’ve seen the dollar plunge but yields keep drifting higher. This is a reflection of the market’s concern over soaring debt levels triggered by the potential passage of the Trump tax cut bill. There’s also the geopolitical backdrop in play. The anti-American sentiment seems to be a real thing and that could push central banks away from their reliance on the dollar as the global reserve currency.

European currencies are strengthening, normally a counterintuitive move given that the ECB is cutting rates while the Fed holds and U.S. Treasury yields move higher. I talk a lot about the carry trade, but I wonder how many traders might be using the dollar as the short in these situations and that’s contributing to some of the downside pressure. Given the expected rebound in U.S. growth in Q2, I’m not sure I’d want to place too large a bet on that trade, but I don’t think it’s unreasonable to think it might be happening.

The Lead-Lag Report is provided by Lead-Lag Publishing, LLC. All opinions and views mentioned in this report constitute our judgments as of the date of writing and are subject to change at any time. Information within this material is not intended to be used as a primary basis for investment decisions and should also not be construed as advice meeting the particular investment needs of any individual investor. Trading signals produced by the Lead-Lag Report are independent of other services provided by Lead-Lag Publishing, LLC or its affiliates, and positioning of accounts under their management may differ. Please remember that investing involves risk, including loss of principal, and past performance may not be indicative of future results. Lead-Lag Publishing, LLC, its members, officers, directors and employees expressly disclaim all liability in respect to actions taken based on any or all of the information on this writing.