Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: ANOTHER NARROW TECH-ONLY RALLY

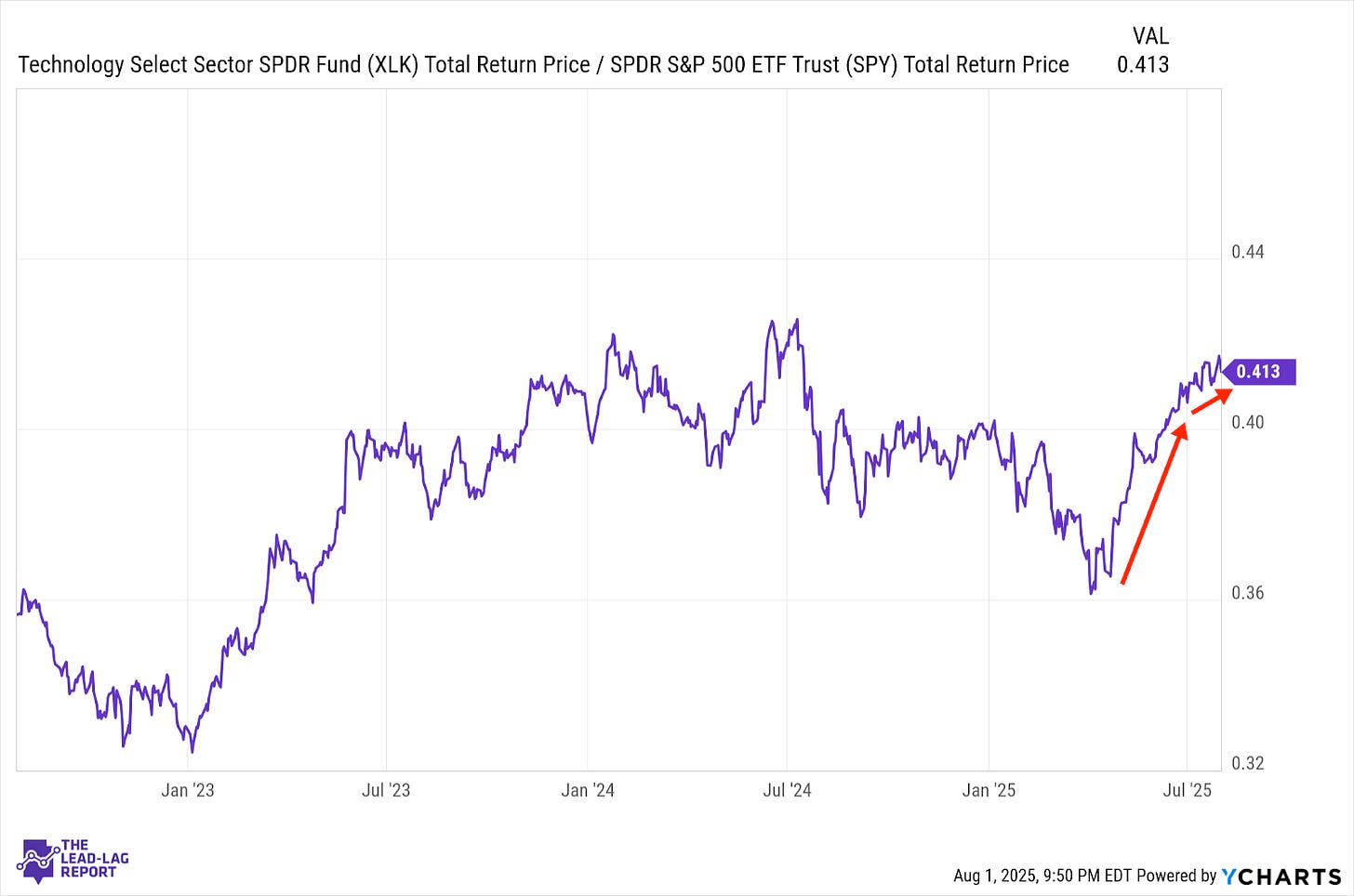

Technology (XLK) – Tech Earnings Keep The Uptrend Intact

Tech stocks have started to lose a little steam after a strong run with the ratio weakening a bit lately, but the uptrend relative to the S&P 500 is still intact. Even after Friday’s jobs report gave the markets a jolt, the strong earnings reports from the mag 7 names fueled by AI growth was enough to keep optimism high and buyers involved.

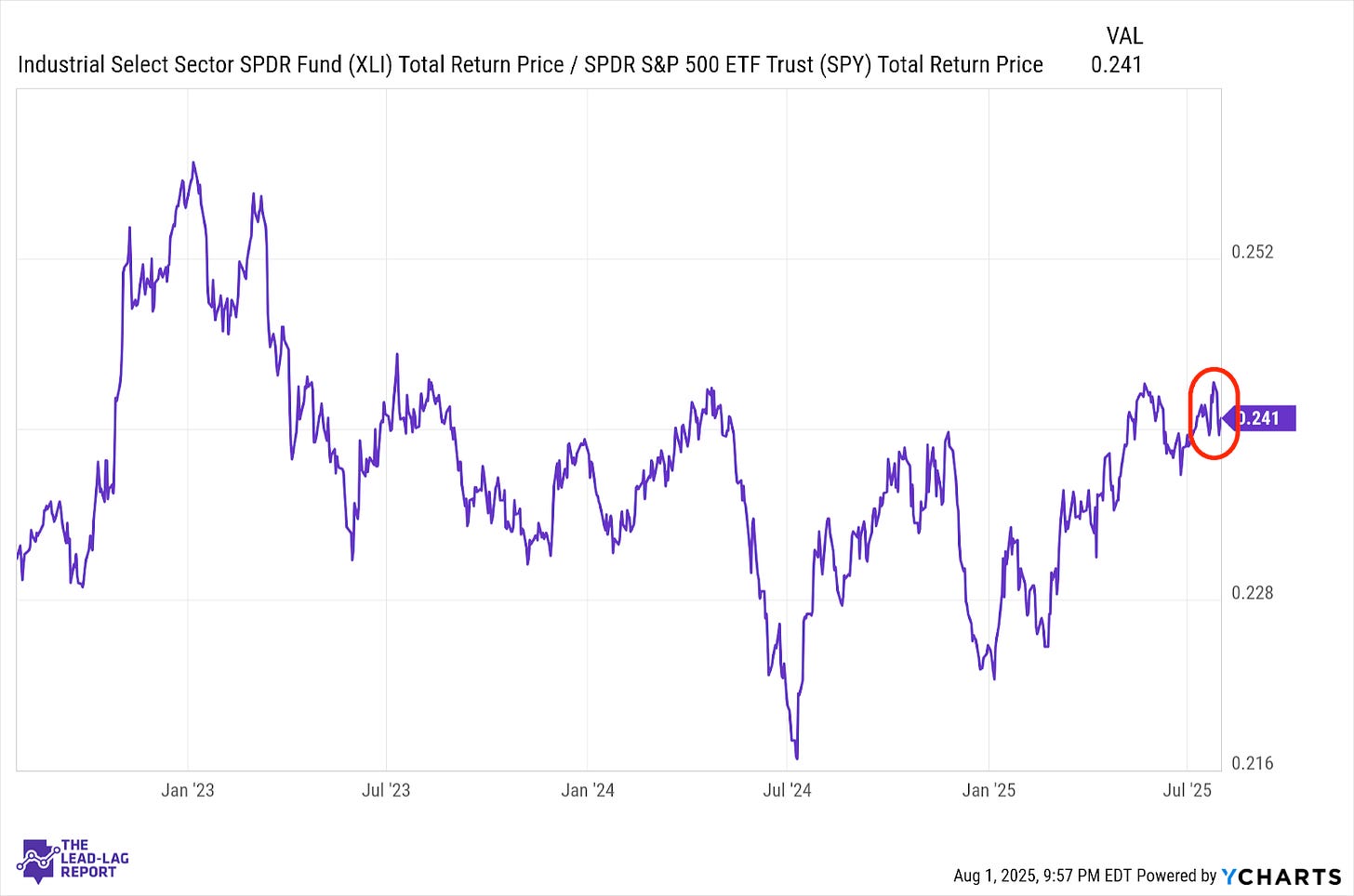

Industrials (XLI) – Cyclical Tailwind Is Fading

While industrials have maintained their status as year-to-date market leader, stocks have turned more volatile relative to the market and the outlook may be deteriorating. July’s manufacturing PMI came in weaker than expected and, if the non-farm payroll report is any indication, we may finally be slipping into a period of economic contraction, something which will likely damage cyclical stocks.

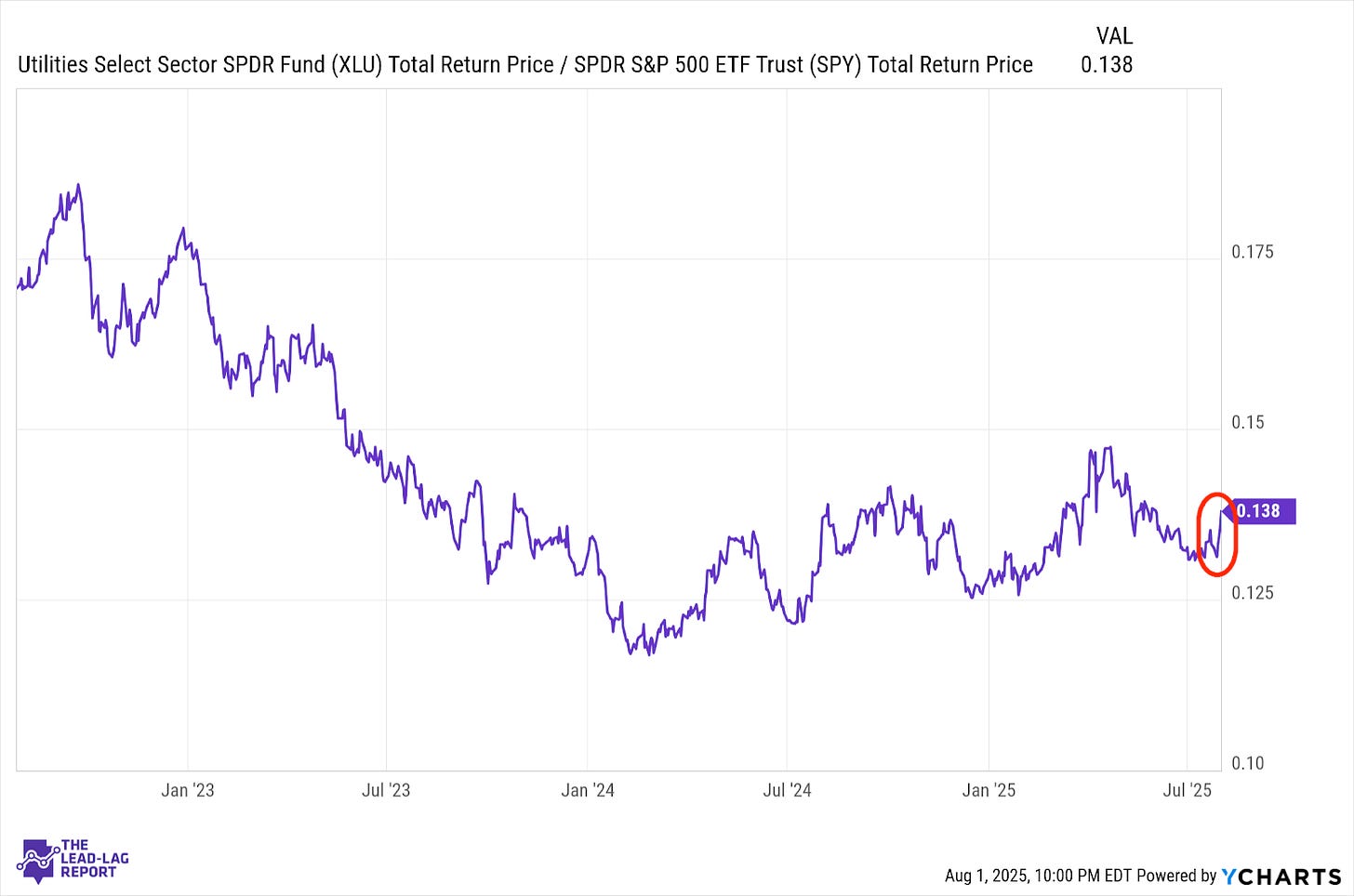

Utilities (XLU) – Temporary Risk-Off Emerging

Utilities perked up quite a bit last week following evidence of a potentially rapidly weakening labor market. The uptick in this ratio coincided with a big move higher in gold prices and a sharp drop in Treasury yields. The softer economic data is nudging investors back towards defensive issuers, at least temporarily, but broader shifts towards risk-off have been elusive since April despite the data raising concerns.

Long Bonds (VLGSX) – Temporary Blip?

While long bonds have made progress over the past few weeks, we've seen this before. Treasuries have had a history over the past two years of spikes during economic data or geopolitical jolts only to see sentiment return to positive shortly thereafter. Monday’s strong rebound for equities that lacked an obvious catalyst for the move could indicate that risk-on sentiment is still in place.

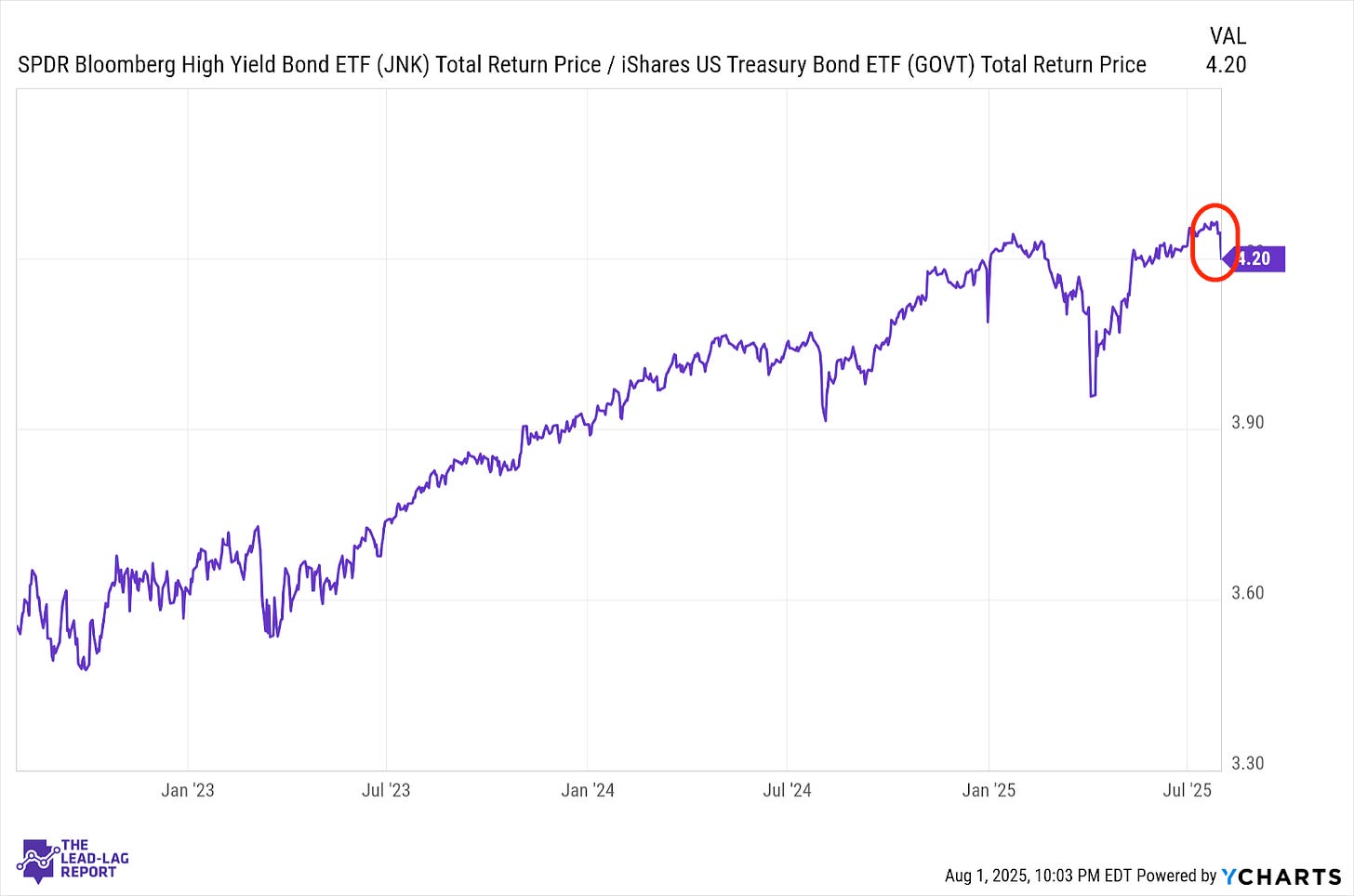

Junk Debt (JNK) – Knocked Back On Its Heels

Junk bonds got knocked back on their heels following last week’s jobs report and this ratio saw its biggest downturn since Q1. Treasury yields dropped and spreads widened with investors weighing generally solid corporate earnings against the backdrop of a weaker economy. This sector has been very durable throughout the post-2022 cycle, but the resilience might be running into trouble.

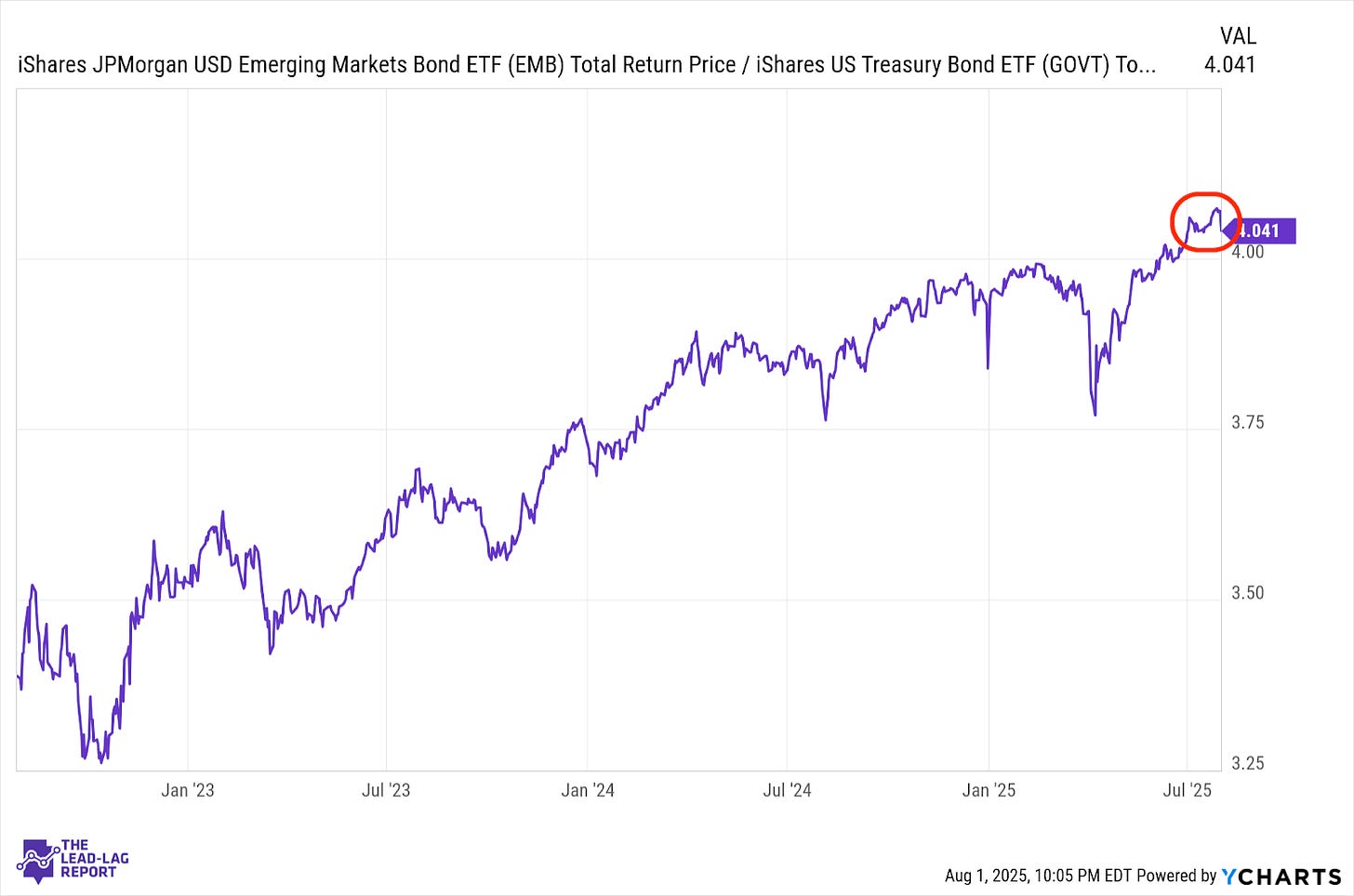

Emerging Markets Debt (EMB) – An Opportunity For A Big Step Forward

Emerging market bonds got shaken last week along with most other forms of lower quality debt, but the falling dollar managed to add some support. EM debt has benefited from the relative calm in global risk sentiment over the past four months, but if the U.S. economy starts to show signs of breaking down and foreign markets can hold up due to value, economic cycle or another reason, there may be an opportunity for this group to take a big step forward in the global fixed income market.

European Banks (EUFN) – Attention Shifts Back To The United States