Are Investors Concerned About Inflation Risk Or Not?

Comparing the UofM and NY Fed Reports

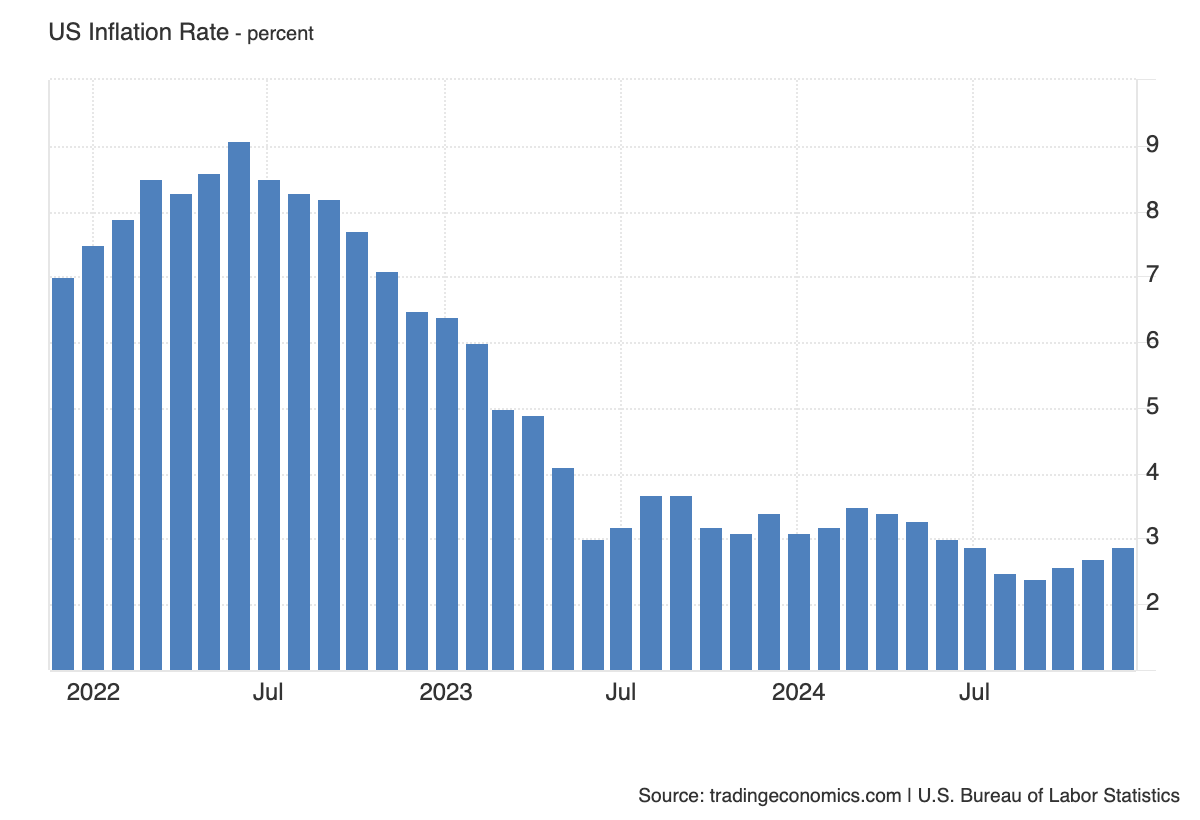

Even before tariffs started to become a hot topic several months ago, the U.S. inflation rate has been having trouble getting back to the Fed’s 2% target. After finally getting back to 3% in the summer of 2023, progress has stalled out. Since then, the headline rate has mostly been hanging out in the 3% to 3.5% range. After again showing some improvement in the 2nd half of 2024, inflation looks like it’s back on the way up again.

Core inflation, rent inflation and services inflation have consistently run hotter than this and that’s helped prevent the Fed from being able to significantly lower the Fed Funds rate throughout this cycle.

For the most part, investors have gotten relatively comfortable with (or at least used to) the inflation rate hovering around 3%. With GDP growth still looking healthy and the labor market still tight, the markets have been willing to accept a modestly higher inflation rate as long as nothing is breaking in the bigger picture.

That started to change somewhat as it became more likely that Donald Trump was going to win a second term in the White House. He has long favored tariffs as both a political and economic tool and he often talked about targeting other nations, both allies and otherwise, as soon as he was inaugurated. Since then, the rhetoric has regularly shifted from hot to cold and tariffs have been used more as a bargaining chip up to this point, but it seems clear that investors and consumers are realizing the risks of tariffs over the long-term.

That risk is that they usually get passed on to consumers and that runs the risk of reigniting inflation. It’s still too early to see a measurable impact of the tariffs levied so far, but it’s clearly on investors' minds.

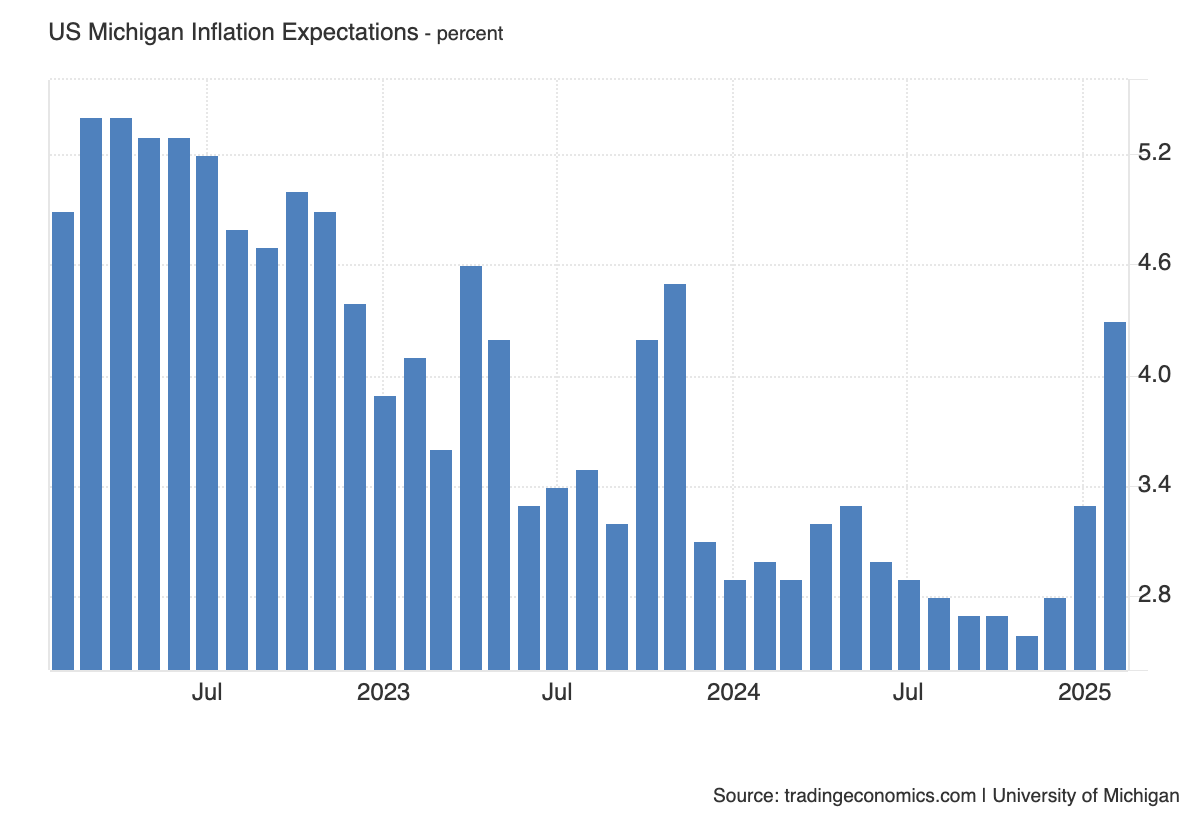

Even knowing this, the University of Michigan consumer sentiment, which includes a read on forward-looking inflation expectations, was a bit jolting.

The January number jumped from 3.3% to 4.3% in a single month, which is also a huge jump from the 2.6% reading in November. While there are obviously a lot of factors at play in this report, it’s fair to point out that this coincides with the time frame since Trump’s election win became likely. In other words, inflation expectations rose as tariff threats and tariff implementations grew.