Are Publicly Listed Private-Equity Firms Positioned to Benefit from the Rebound in Exit Activity?

For most of 2022 and 2023, private-equity firms found themselves in an uncomfortable position: plenty of companies to sell, but almost no market willing to buy. Rising interest rates, shaky economic conditions, and a frozen IPO window left sponsors holding aging assets far longer than intended. By late 2025, though, that pressure valve has finally begun to release. Exit markets are reopening, deal flow is improving, and the backlog of stale portfolio companies is thinning. The practical question for investors is whether this renewed activity will translate into stronger results for publicly traded private-equity firms—and whether this recovery is durable enough to back with capital.

A Slow-Moving Market Finally Turns

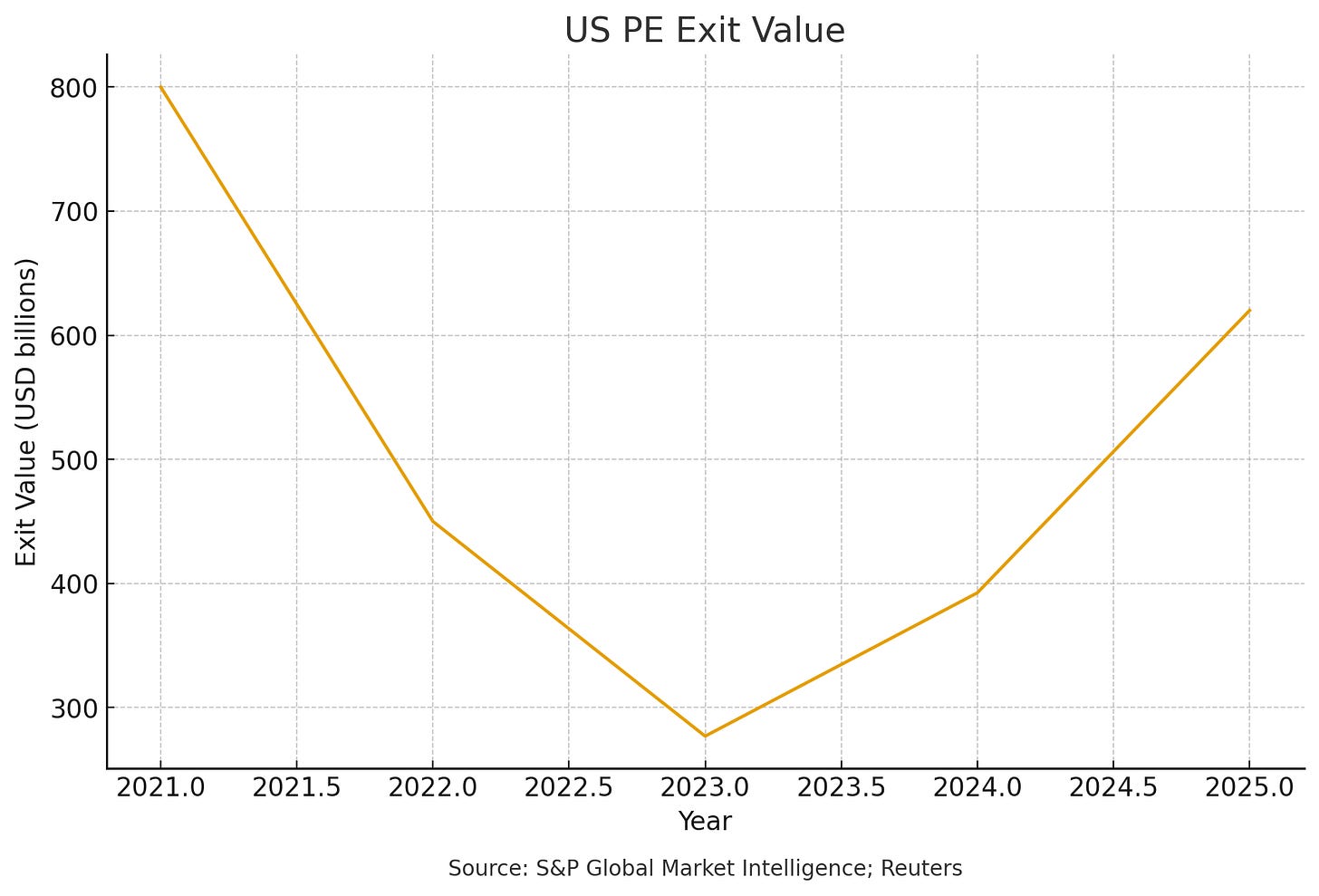

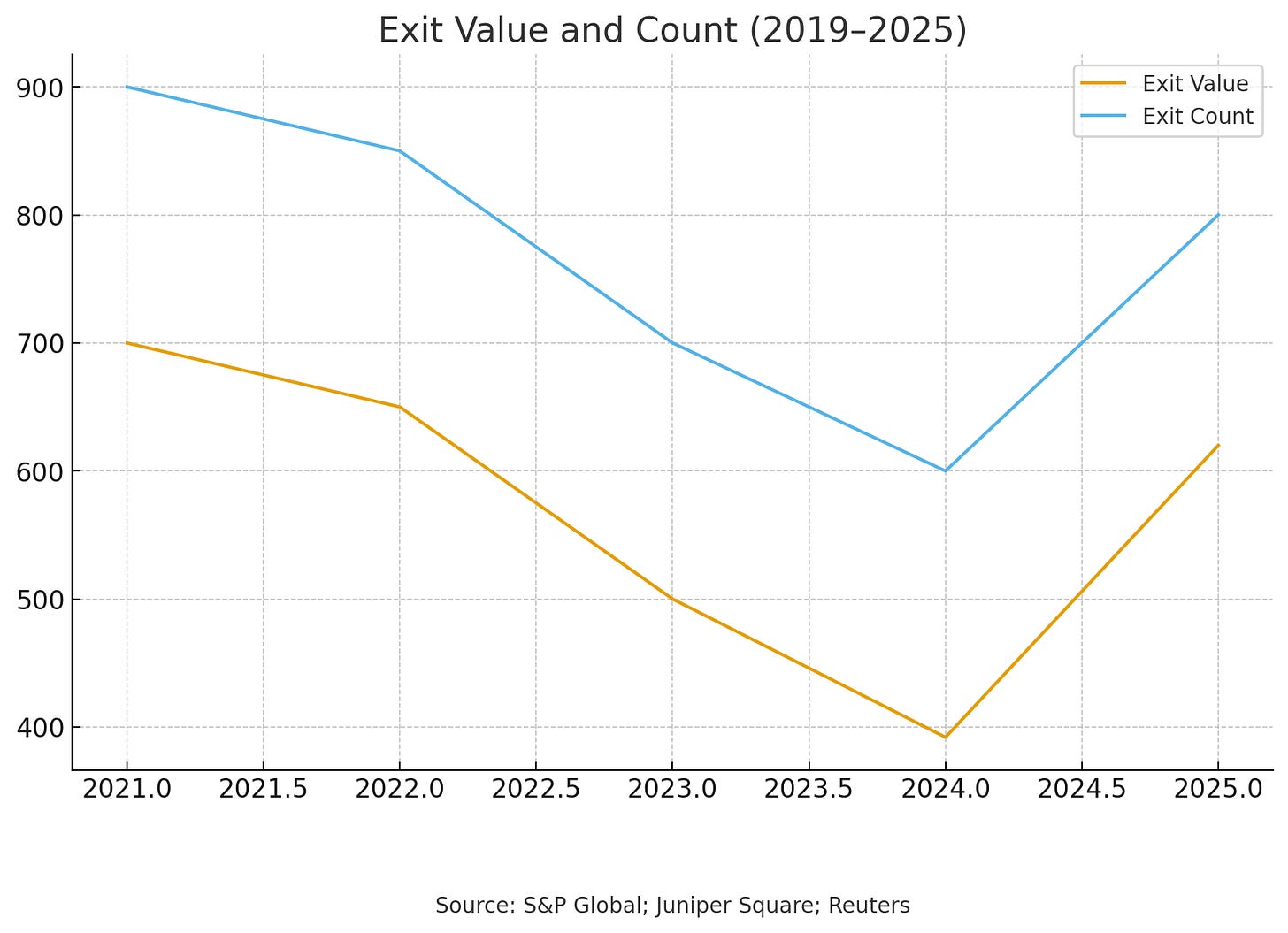

The exit environment hit bottom in 2023, when U.S. private-equity exits fell to roughly $277 billion— an abrupt reversal from the frenzy of 2021.¹

Figure 1. U.S. private-equity exit values dropped sharply after 2021 before beginning to recover in 2024–2025.

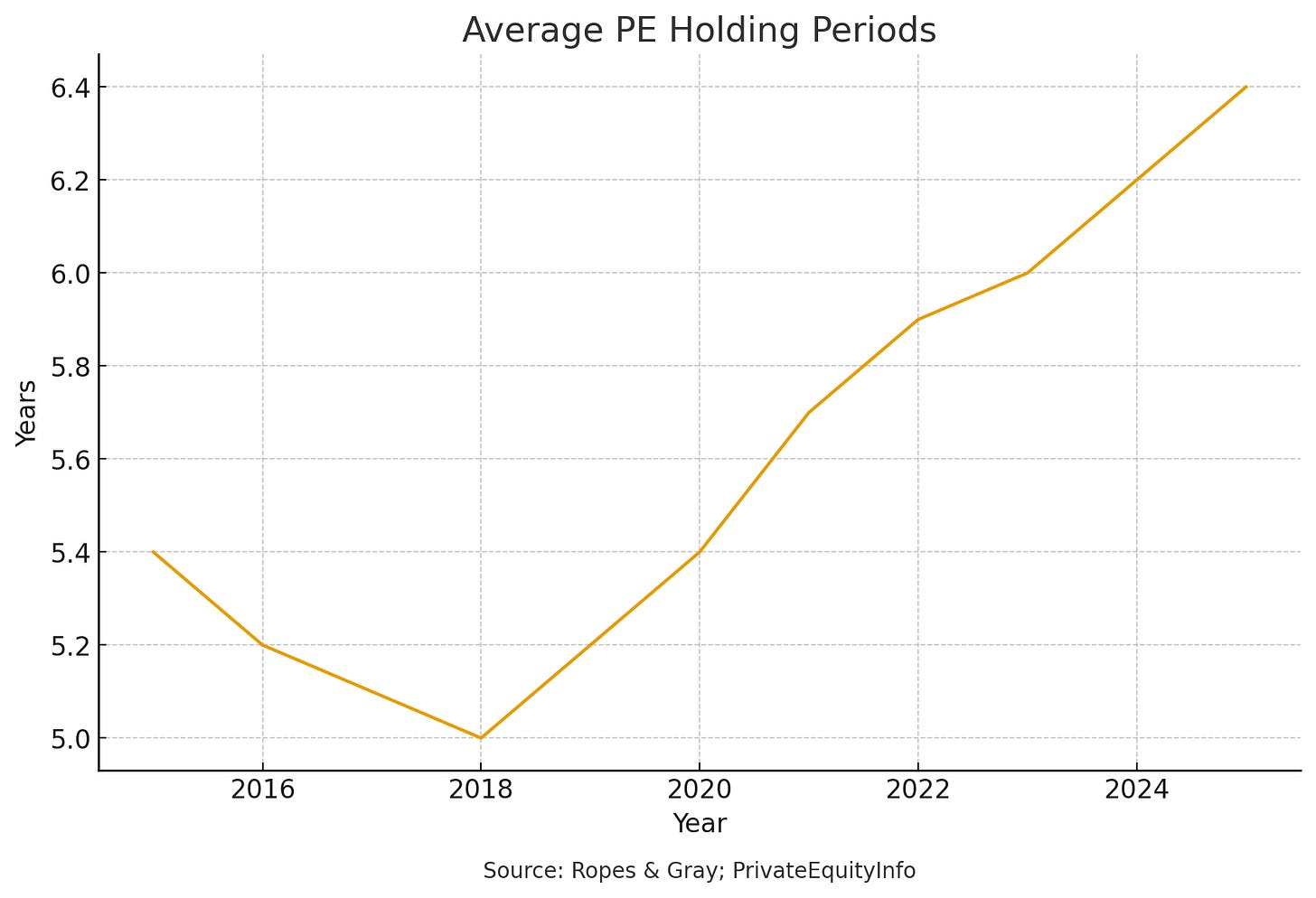

A growing share of portfolio companies sat seven years or longer, well beyond typical holding periods, as firms delayed selling in the hope of a more hospitable market.² Limited partners grew restless; many managers said their priority had shifted almost entirely to monetizing older positions rather than hunting for new deals.²

Conditions began to thaw in 2024 as rate hikes paused, credit markets steadied, and bid-ask spreads narrowed.³ By early 2025, dealmakers were openly acknowledging the shift. U.S. exits jumped to $413 billion in 2024,¹ and momentum accelerated into 2025. Through October, firms had already completed 1,300 U.S. exits worth about $621.7 billion—well ahead of the prior year.¹ PitchBook reported that third-quarter exit volumes were the strongest since late 2021.¹

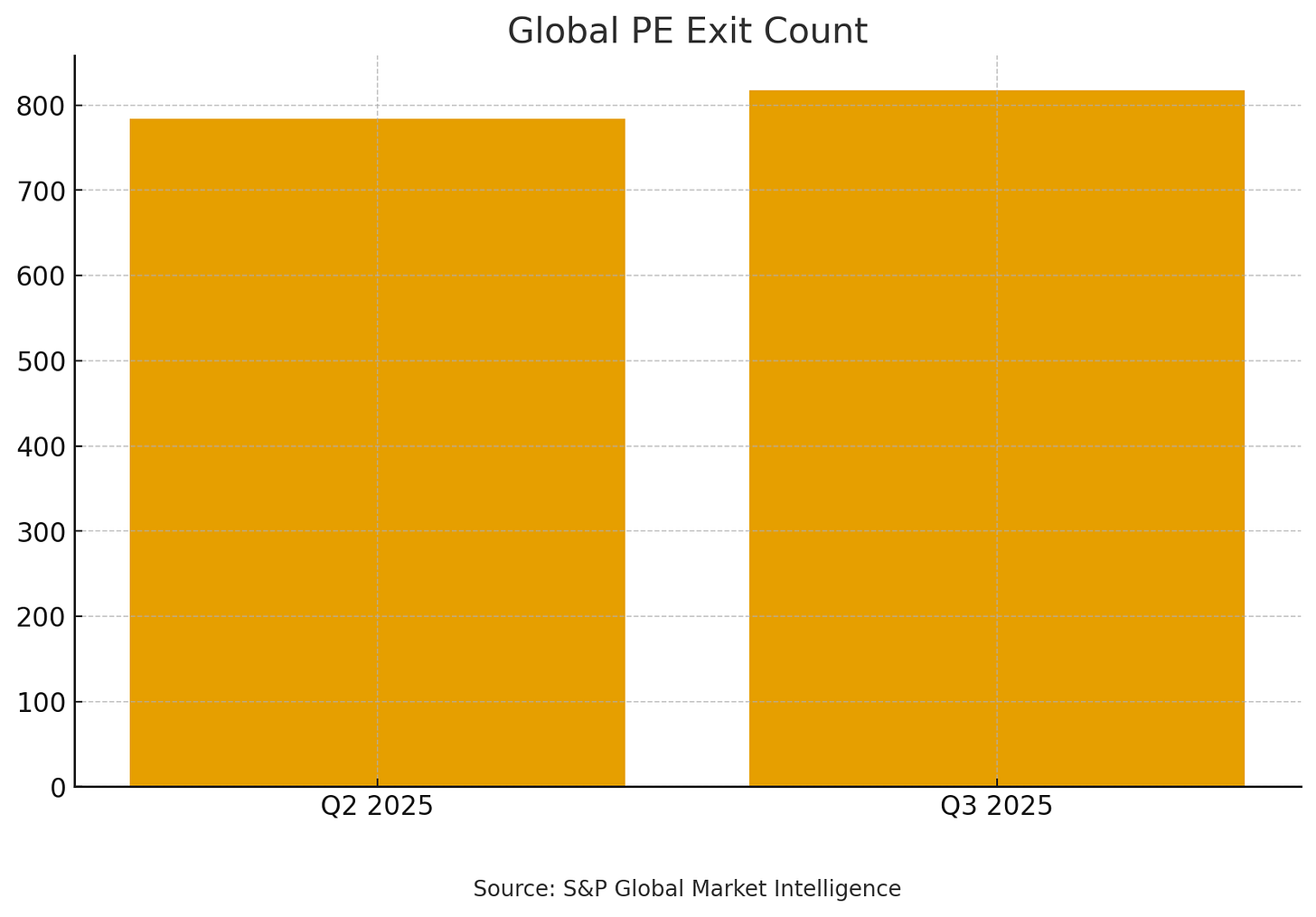

Figure 2. Global private-equity exit counts rose between Q2 and Q3 2025, marking one of the busiest quarters since 2021.

The recovery is not flawless. Many deals clearing the market are smaller and priced below sponsors’ expectations.⁴ Holding periods continue to rise—now about 3.9 years, up from 3.0 in 2022.²

Even with a pickup in IPOs this year, listings remain well below pre-pandemic norms.⁵ In short, the flywheel is turning again, but not yet spinning at full speed.

Figure 4. Exit activity over the last several years shows the 2021 peak, the 2022–2023 downturn, and the 2025 recovery phase.

Still, liquidity is flowing, cash is returning to LPs, and firms are finally reducing their inventory of older assets. That shift alone marks a meaningful change from the paralysis of the previous two years.

Why Public PE Firms Stand to Benefit

For publicly listed private-equity firms, exits are the engine that converts years of work into tangible financial results. Selling portfolio companies unlocks carried interest, crystallizes performance fees, and often generates balance-sheet gains. During the 2021 boom, firms such as Blackstone and Carlyle posted record results largely because they were able to sell assets into a hot market.⁶ When exits slowed in 2022–2023, distributable earnings fell accordingly. KKR noted that the slowdown also reduced capital recycled back to LPs—making it harder for the firm to raise new funds.⁷

The tone today is different. With activity rebounding, firms are positioned to recognize more performance fees and potentially boost shareholder distributions. Blackstone’s Stephen Schwarzman has said the “dealmaking pause is behind us,” pointing to lower rates and renewed M&A appetite as supportive of stronger exit volumes in late 2025 and 2026.⁵ A healthier exit market improves not just profits but also investor sentiment; when PE firms can return capital to LPs, fundraising tends to follow. That dynamic favors the large, publicly traded managers who already dominate the asset-gathering landscape.

Consolidation is another factor working in their favor. The drought in exits hit smaller managers hardest, while the largest firms gained fundraising share. The top ten U.S. PE firms captured roughly 46% of all capital raised in 2025, up from 35% in 2024.² For listed giants—Blackstone, KKR, Apollo, Carlyle—this means they emerge from the downturn both financially intact and competitively stronger.

Risks remain. Apollo has cautioned that the rebound won’t immediately produce a “massive monetization cycle,” noting that plenty of mediocre companies still lack obvious buyers.⁸ An economic downturn or tightening in credit could shut the window again. Even so, diversification across credit, real estate, and infrastructure helped the large PE platforms weather the last cycle, and stronger exit markets now give them the chance to operate at full strength.

A Public-Market Way to Play the Trend: The WHITEWOLF LBO ETF

Investors who want exposure to this rebound without selecting individual stocks have an alternative: the WHITEWOLF Publicly Listed Private Equity ETF (LBO). Launched in late 2023, it offers active exposure to publicly traded private-equity and credit managers.⁹ Its portfolio includes major diversified asset managers—Blackstone, KKR, Apollo, Carlyle—as well as business development companies such as Ares Capital and Hercules Capital.¹⁰

The fund aims for both income and long-term appreciation,⁹ and many of its holdings pay sizable variable dividends tied to deal activity. Because BDCs must distribute most of their income, the ETF can o er a yield component alongside potential capital gains. Structurally, LBO acts as a liquid, public-market wrapper for a traditionally illiquid asset class, giving investors diversified exposure to firms whose earnings rise and fall with private-equity exits.¹¹

Figure 5. Year-to-date exit value in 2025 already exceeds full-year 2024 levels, underscoring the strength of the current rebound.

The risks are equally clear. These companies can be volatile, amplifying shifts in credit conditions and market sentiment. A pause in dealmaking, a spike in defaults, or a broader equity correction would likely affect the ETF. Expenses are higher than passive index alternatives, and diversification does not eliminate exposure to cyclical downturns. Even so, for investors with a thesis on the continued normalization of exits and fundraising, LBO provides a straightforward way to express it.

The Bottom Line

Private-equity exits are finally recovering after two years of stagnation, and the effects are rippling through the system: LPs are getting liquidity, managers are harvesting long-delayed gains, and public firms are seeing renewed momentum in earnings. Early indications—from rising exit volumes to more confident commentary on earnings calls—suggest that the next phase of this cycle could be meaningfully better for listed PE stocks.⁵ ⁷

The opportunity is real, but so are the caveats. The rebound could stall if economic conditions deteriorate, and the industry’s backlog will take time to unwind fully. For investors, the prudent stance is measured optimism: recognize that publicly listed PE firms are positioned to benefit from the reopening of the exit market, but size exposure appropriately and be aware that progress may be uneven.

An ETF like LBO provides a broad, liquid way to participate in this trend, wrapping the theme into a single vehicle. Whether accessed through a fund or individual stocks, the thesis rests on the same idea: the private-equity machine is running again, and the firms that survived the drought in strong condition may be the ones best able to capitalize on the recovery.

Footnotes

1. Isla Binnie, “US private equity exit deals set for second year of recovery, PitchBook finds,” Reuters, December 4, 2025.

2. PitchBook via Private Equity Insights, “US private equity exits gain momentum for a second year as firms race to o load ageing assets,” PE Insights, 2025.

3. Commonfund, “Private Equity Trends in 2024: Year in Review and Looking Forward,” January 24, 2025.

4. S&P Global Market Intelligence, “Private equity exit count grew in Q3 2025 as transaction sizes shrank,” October 17, 2025.

5. Ropes & Gray LLP, “U.S. Private Equity Market Recap – September 2025,” September 2025.

6. Private Equity Insights, “KKR’s earnings more than double on higher management fees, asset sales,” summarizing Reuters Q3 2021 results.

7. Isla Binnie and Arasu Kannagi Basil, “KKR’s profit beats forecast on credit-led inflows, oneo charge weighs,” Reuters, November 7, 2025.

8. S&P Global Market Intelligence, remarks by Apollo’s James Zelter, October 17, 2025.

9. White Wolf Capital, “Launch of WHITEWOLF Publicly Listed Private Equity ETF (LBO),” November 29, 2023.

10. LBO ETF Holdings, StockAnalysis.com, accessed November 25, 2025.

11. White Wolf Capital Advisors, “WHITEWOLF Publicly Listed Private Equity ETF (LBO) – Fund Overview,” 2025.

Important Information:

Investors should consider the investment objectives, risks, charges and expenses carefully before investing. For a Prospectus or Summary Prospectus with this and other information about the Fund, please call +1-305-605-8888 or visit our website at https://lbo.fund/. Read the prospectus or summary prospectus carefully before investing.

Investment Risk. When you sell your Shares of the Fund, they could be worth less than what you paid for them. The Fund could lose money due to short-term market movements and over longer periods during market downturns. Listed Private Equity Companies Risk. There are certain risks inherent in investing in listed private equity companies, which encompass financial institutions or vehicles whose principal business is to invest in and lend capital to or provide services to privately held companies. Generally, little public information exists for private and thinly traded companies, and there is a risk that investors may not be able to make a fully informed investment decision. Business Development Company (BDC) Risk. BDCs generally invest in less mature U.S. private companies or thinly traded U.S. public companies which involve greater risk than well-established publicly traded companies. While the BDCs in which the Fund invests are expected to generate income in the form of dividends, certain BDCs during certain periods of time may not generate such income. Master Limited Partnership Risk. An MLP is an entity that is classified as a partnership under the Internal Revenue Code of 1986, as amended, and whose partnership interests or “units” are traded on securities exchanges like shares of corporate stock. Investments in MLP units are subject to certain risks inherent in a partnership structure, including (i) tax risks, (ii) the limited ability to elect or remove management or the general partner or managing member, (iii) limited voting rights and (iv) conflicts of interest between the general partner or managing member and its affiliates and the limited partners or members.

An investment in the Fund involves risk, including possible loss of principal. Exchange-traded funds (ETFs) trade like stocks, are subject to investment risk, fluctuate in market value and may trade at prices above or below the ETF’s net asset value (NAV), and are not individually redeemable directly with the ETF. Brokerage commissions and ETF expenses will reduce returns. ETFs are subject to specific risks, depending on the nature of the underlying strategy of the Fund, which should be considered carefully when making investment decisions. For a complete description of the Fund’s principal investment risks, please refer to the prospectus.

Shares of the Funds Are Not FDIC Insured, May Lose Value, and Have No Bank Guarantee.

The Fund is distributed by PINE Distributors LLC. The Funds’ investment adviser is Empowered Funds, LLC, which is doing business as ETF Architect. White Wolf Capital Advisors, LLC serve as the Sub-advisers to the Fund. PINE Distributors LLC is not a iliated with ETF Architect or White Wolf Capital Advisors, LLC.

DISCLAIMER – PLEASE READ: This is a sponsored article for which Lead-Lag Publishing, LLC has been paid a fee. Lead-Lag Publishing, LLC does not guarantee the accuracy or completeness of the information provided in the article or make any representation as to its quality. All statements and expressions provided in this article are the sole opinion of White Wolf and Lead-Lag Publishing, LLC expressly disclaims any responsibility for action taken in connection with the information provided in the discussion. The content in this writing is for informational purposes only. You should not construe any information or other material as investment, financial, tax, or other advice. A participant may have taken or recommended any investment position discussed, but may close such position or alter its recommendation at any time without notice. Nothing contained in this article constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in any jurisdiction. Please consult your own investment or financial advisor for advice related to all investment decisions.