$ATACX: Rotation Strategies and Rising Geopolitical Risk in 2026

Key Highlights

Geopolitical instability in 2026 has increased the frequency and severity of market risk-off episodes.

Traditional static portfolios have shown vulnerability during periods when stocks and bonds fall together.

Tactical rotation strategies seek to dynamically adjust between risk-on and risk-off assets based on market signals.

The ATAC Rotation Fund (ATACX) is designed to rotate between equities and U.S. Treasuries in response to changing volatility conditions.

A World on Edge in 2026

Geopolitical risk has become a defining feature of the investment landscape in 2026.¹ Ongoing conflict in Eastern Europe, persistent strategic rivalry between the United States and China, and renewed trade and industrial policy uncertainty have combined to create an environment where market sentiment can shift abruptly. These dynamics have contributed to elevated volatility and an increased sensitivity to political headlines, even when underlying economic data remains mixed rather than outright recessionary.

Market behavior has reflected this tension.² Equity investors have oscillated between optimism tied to technological innovation and concern over geopolitical escalation. Periodic selloffs have often been driven less by corporate fundamentals and more by sudden changes in perceived global risk. While markets have adapted to certain long-running conflicts, each new development has carried the potential to disrupt risk appetite.

For investors, this environment has complicated traditional portfolio construction. Staying fully invested in equities can expose portfolios to sharp drawdowns during geopolitical shocks. Moving entirely to cash, however, risks missing periods of recovery and upside participation. This challenge has renewed interest in strategies that aim to adapt dynamically as conditions change, rather than relying on static allocations.

From Safe Havens to Structural Uncertainty

Historically, rising geopolitical or economic uncertainty has triggered a familiar market response: a rotation away from equities and toward perceived safe havens, particularly U.S. Treasury securities.⁴ During many major equity drawdowns over the past several decades, Treasuries provided diversification benefits by holding their value or appreciating as stocks declined.

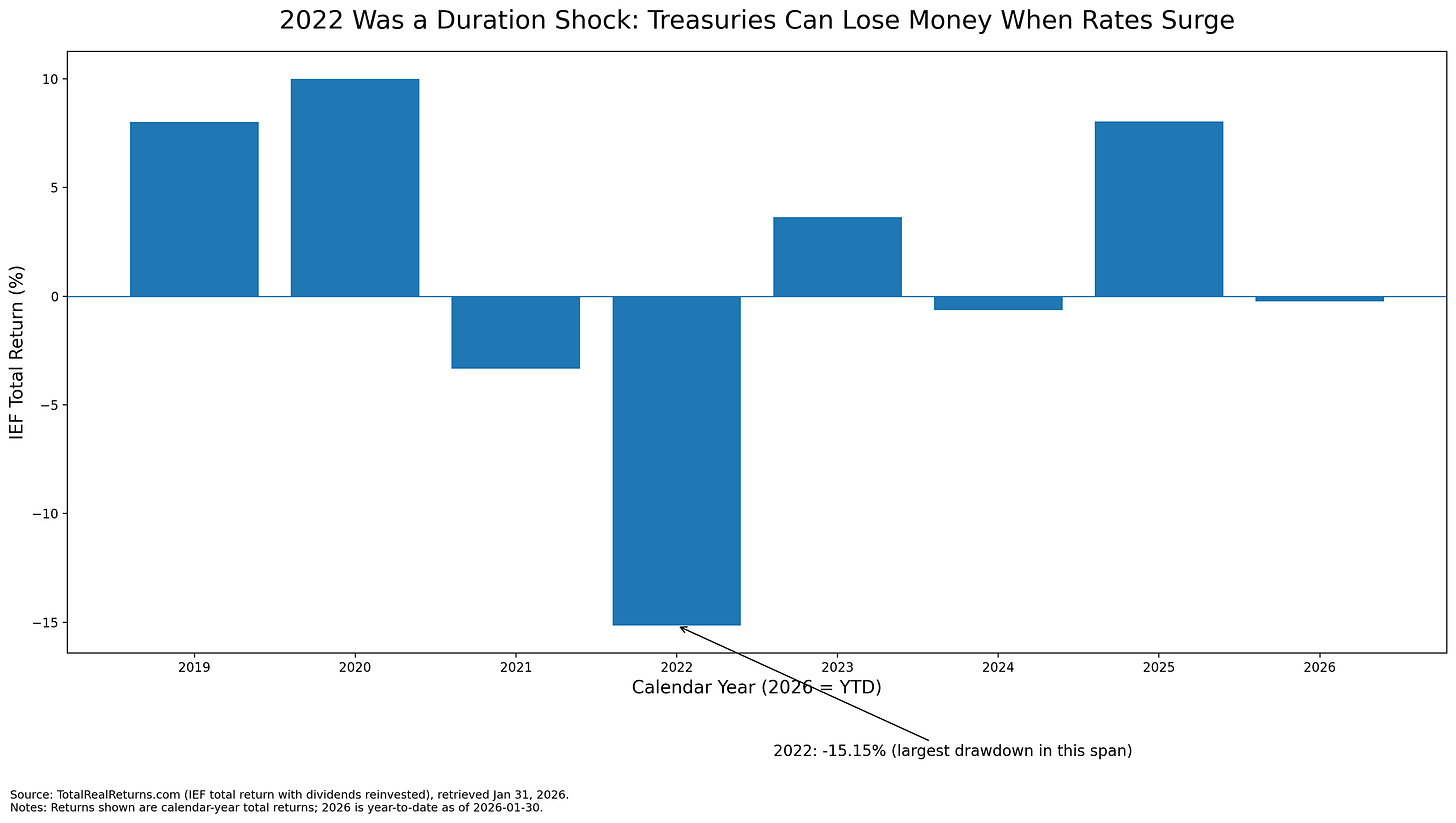

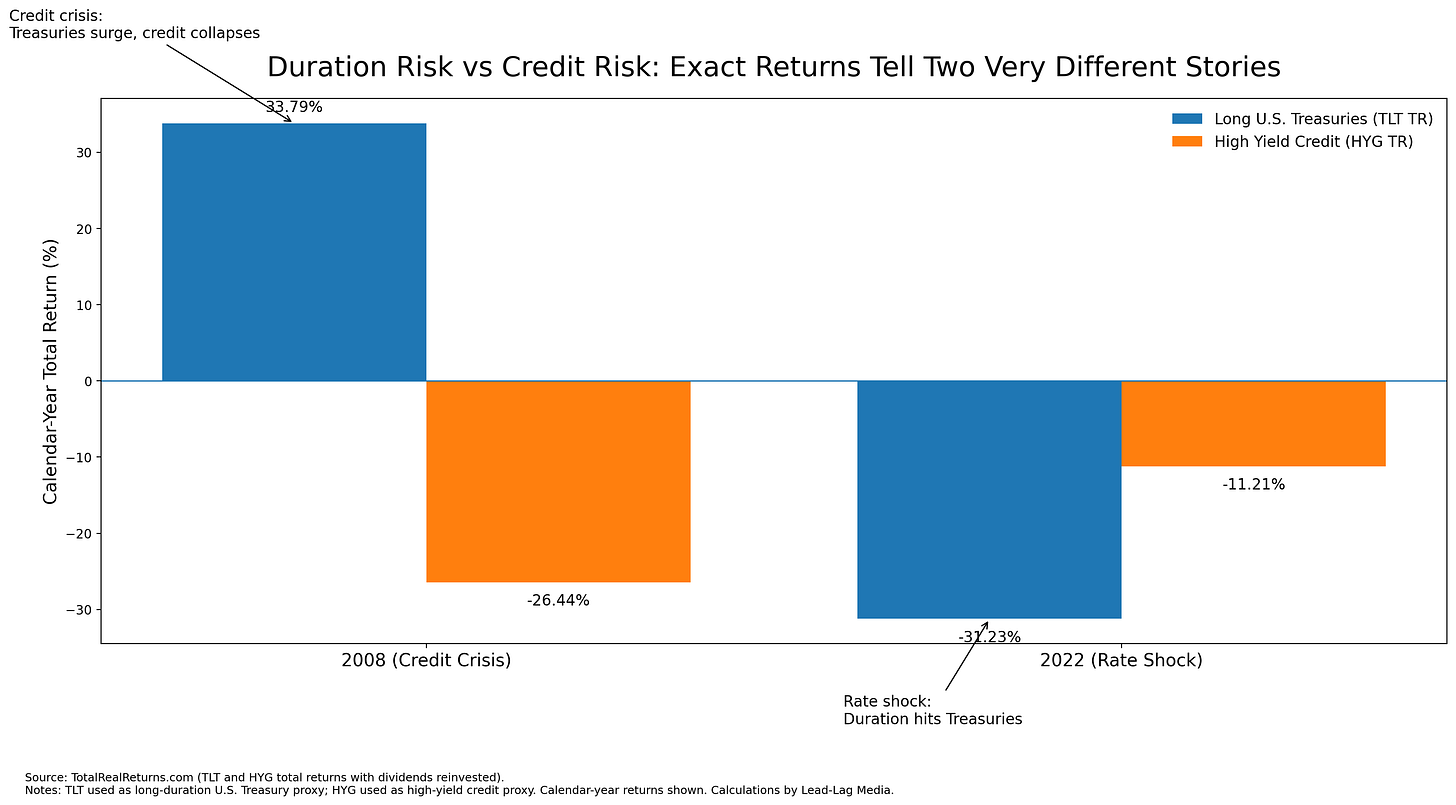

The experience of 2022 challenged this assumption.⁵ That year stands out as a historical outlier rather than a new structural regime. Rapid monetary tightening and inflation shocks created a rare environment in which both stocks and bonds declined together, undermining diversification. Outside of that episode, U.S. Treasuries have continued to behave as defensive assets during equity drawdowns. The key distinction is the source of bond losses. In 2022, bonds declined primarily due to duration risk, as rapidly rising interest rates drove prices lower across the Treasury curve. That dynamic differs materially from credit-driven sell-offs, where widening credit spreads reflect deteriorating growth expectations and rising default risk. Relying solely on fixed allocations assumes that historical relationships will always hold. When those relationships break down, portfolios can become more exposed than anticipated. This realization has prompted investors and advisors to consider approaches that can adjust exposure in response to evolving market signals rather than remaining anchored to predetermined weights.

Tactical Rotation as a Risk-Management Tool

Tactical rotation strategies attempt to address these challenges by shifting between offensive and defensive assets based on objective indicators. Instead of maintaining constant exposure to both stocks and bonds, these strategies aim to increase equity exposure during favorable conditions and rotate defensively into Treasuries when signs of rising volatility emerge.

The ATAC Rotation Fund (ATACX) provides an example of this approach in practice.⁶ The fund is designed to rotate between equity ETFs and U.S. Treasury ETFs depending on market conditions. During periods when risk appetite is strong and volatility indicators are subdued, the strategy may allocate fully to equities, including large-cap, small-cap, or emerging market exposures. When defensive signals strengthen, the fund can shift entirely into Treasury securities, adjusting duration based on prevailing conditions.

The rotation process is evaluated systematically, with portfolio shifts guided by observable market behavior rather than discretionary judgment.⁷ Indicators such as the relative performance of traditionally defensive assets, including utilities and Treasuries, play a role in signaling changes in market risk dynamics. When these assets begin to outperform broader equity markets, it may indicate rising investor caution and the potential for increased volatility. The strategy responds by reducing equity exposure and increasing defensive positioning. Conversely, when risk appetite improves, the allocation can rotate back toward equities.

This disciplined framework is intended to remove emotional decision-making from the investment process. Rather than reacting to headlines after markets have already moved, the strategy seeks to respond to changes in market behavior that historically have preceded shifts in volatility. The objective is not to predict specific geopolitical events, but to adapt to how markets price risk as uncertainty evolves.

Trade-Offs and Portfolio Implications

Tactical rotation strategies are not without drawbacks.⁸ Current market conditions further highlight the distinction between Treasuries and credit-sensitive assets. Corporate bonds, especially lower-quality credit, often behave more like equities during stress periods because their prices are sensitive to credit risk rather than pure interest-rate movements. With credit spreads historically tight and default risk potentially underpriced, a widening in corporate spreads would increase the likelihood that stocks and corporate bonds decline together. In that environment, U.S. Treasuries could reassert their traditional role as a safe haven, benefiting from flight-to-quality flows even as risk assets sell off. During extended periods of low volatility and steady equity advances, a strategy that periodically shifts defensively may lag fully invested equity portfolios. Defensive rotations that prove premature can result in missed upside, particularly in momentum-driven markets. Additionally, tactical funds often carry higher expenses than passive index funds and may generate additional tax considerations in taxable accounts.

These trade-offs underscore the importance of positioning such strategies appropriately within a broader portfolio. Rather than serving as a core replacement for long-term equity exposure, a fund like ATACX may function as a tactical or alternative allocation designed to help manage drawdown risk. Its value proposition is rooted in risk management and adaptability rather than constant outperformance.

In the context of 2026, these characteristics may be particularly relevant. The combination of geopolitical uncertainty, shifting monetary policy expectations, and late-cycle economic dynamics increases the likelihood of abrupt market regime changes. A strategy that can rotate decisively between risk-on and risk-off positions offers a structured way to navigate this uncertainty.

Conclusion

Rising geopolitical risk has reinforced the importance of flexibility in portfolio construction. Static allocations, while effective over long periods, can struggle during environments when traditional asset relationships break down. Tactical rotation strategies seek to address this challenge by adjusting exposure in response to market signals rather than remaining fixed.

The ATAC Rotation Fund represents one implementation of this philosophy, aiming to balance participation in equity market advances with defensive positioning during periods of heightened risk. While no strategy can eliminate volatility or guarantee positive outcomes, a disciplined rotation approach may help investors manage uncertainty more effectively.

As 2026 continues to unfold, adaptability remains a critical attribute. For investors seeking a systematic way to respond to shifting risk conditions without abandoning market participation altogether, tactical rotation strategies warrant consideration as part of a diversified portfolio framework.

Footnotes

George Devo, “Biggest Geopolitical Risks for Investors in 2026,” Portfolio Adviser, January 29, 2026.

Lisa Shalett, “Will 2026 Be a High-Wire Act for Markets?,” Morgan Stanley, January 21, 2026.

Hightower Advisors, “Navigating Markets Among Geopolitical Uncertainty,” January 21, 2026.

State Street Global Advisors, The Great Repricing: Are U.S. Treasuries Still a Safe Haven?, 2025.

Laila Maidan, “The Volatile Bond Market Could Cause a System Reset,” Business Insider, October 21, 2022.

Michael A. Gayed, CFA, “Why Tactical Allocation Funds Like ATACX Matter in a Late-Cycle Environment,” The Lead-Lag Report, October 2025.

ATAC Funds, “ATAC Rotation Fund Overview,” accessed 2026.

Michael A. Gayed, CFA, “How ATACX Approaches Late-Cycle Risk,” The Lead-Lag Report, October 2025.

ATAC Rotation Fund Prospectus, accessed 2026.

The Russell 2000 Index is a stock market index that tracks the performance of 2,000 small-cap US companies, serving as a key benchmark for small-cap stocks and a barometer for the US economy

The Nasdaq 100 is a stock market index comprising the 100 largest non-financial companies listed on the Nasdaq stock exchange, weighted by modified market capitalization

The Standard and Poor’s 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States.

Past performance is no guarantee of future results.

The Fund’s investment objectives, risks, charges, expenses and other information are described in the statutory or summary prospectus, which must be read and considered carefully before investing. You may download the statutory or summary prospectus or obtain a hard copy by calling 855-ATACFUND or visiting www.atacfunds.com. Please read the Prospectuses carefully before you invest.

Fund Risks: An investment in the Fund is subject to numerous risks including the possible loss of principal. There can be no assurance that the Fund will achieve its investment objective. Equity securities, such as common stocks, are subject to market, economic and business risks that may cause their prices to fluctuate. As with all ETFs, Fund shares may be bought and sold in the secondary market at market prices. The market price normally should approximate the Fund’s net asset value per share (NAV), but the market price sometimes may be higher or lower than the NAV. There are a limited number of financial institutions authorized to buy and sell shares directly with the Fund, and there may be a limited number of other liquidity providers in the marketplace. There is no assurance that Fund shares will trade at any volume, or at all, on any stock exchange. Low trading activity may result in shares trading at a material discount to NAV. Please see the prospectus and summary prospectus for a complete description of principal risks.

The Fund’s investments will be concentrated in an industry or group of industries to the extent the portfolio manager deems it appropriate to be so concentrated. In such event, the value of Shares may rise and fall more than the value of shares that invest in securities of companies in a broader range of industries.

Investing involves risk including the possible loss of principal.

JOJO is distributed by Foreside Fund Services, LLC.

ATACX is distributed by Quasar Distributors, LLC.