Even as U.S. stocks have spent the past three months producing generally steady gains, the behavior of the 10-year Treasury yield has been unusual to say the least. Historically, we usually see Treasury yields all along the curve falling when the Fed begins a rate cutting cycle. Since the middle of September, however, the 10-year has risen by 50 basis points. It looks like the duration-related move in the yield curve actually took place this past summer as Fed rate cut expectations went from “likely” to “imminent”. Now we’re lining up for a period that could be favorable for equities, but not so much bonds.

Under normal circumstances, the Fed cuts rates into a weakening economic cycle in order to support labor market growth and employment. Today, however, you’ve got the Fed cutting into a generally healthy economy where the labor market is at a level that the central bank has traditionally called “full employment”. That’s good for growth and I think that’s generally being reflected in forward-looking GDP forecasts, but it also creates another set of problems. We may be seeing yields rise as investors remain risk-on and the negative correlation between stocks & bonds returns, but I also think it has a lot to do with inflation risk.

Solid growth, a tight labor market and greater liquidity are inherently inflationary and likely helping to push rates higher. I also think the markets are pricing in a greater likelihood of a second Trump presidency and the fiscal byproducts that could result from it. I don’t think there’s much question that trillion-plus dollar annual deficits are becoming the norm more than the exception, but Trump policies, if enacted, would probably have the potential for even larger deficits. Plus, if he implements the huge tariffs that he’s been campaigning on, inflation rates (and Treasury yields) could soar again. This could be a bit of a hedge against some of these outcomes that we’re seeing in the bond market right now.

Gold would also be confirming this sentiment with its relentless rally. Utilities is still the best-performing S&P 500 sector year-to-date. Lumber prices are still stagnant. It’s impossible to ignore these signals. While the Fed is likely to do its best to keep flooding the system with liquidity and low rates, existing debt levels and consumer credit conditions may negate a lot of it. Delinquencies are already at multi-year highs and unlikely to head lower again anytime soon. Lower rates may not matter if there’s no demand in the first place. Fiscal and monetary conditions could ignite a further boom in risk asset prices, but subsequent inflation and negative credit conditions could still usher in the big credit event after that.

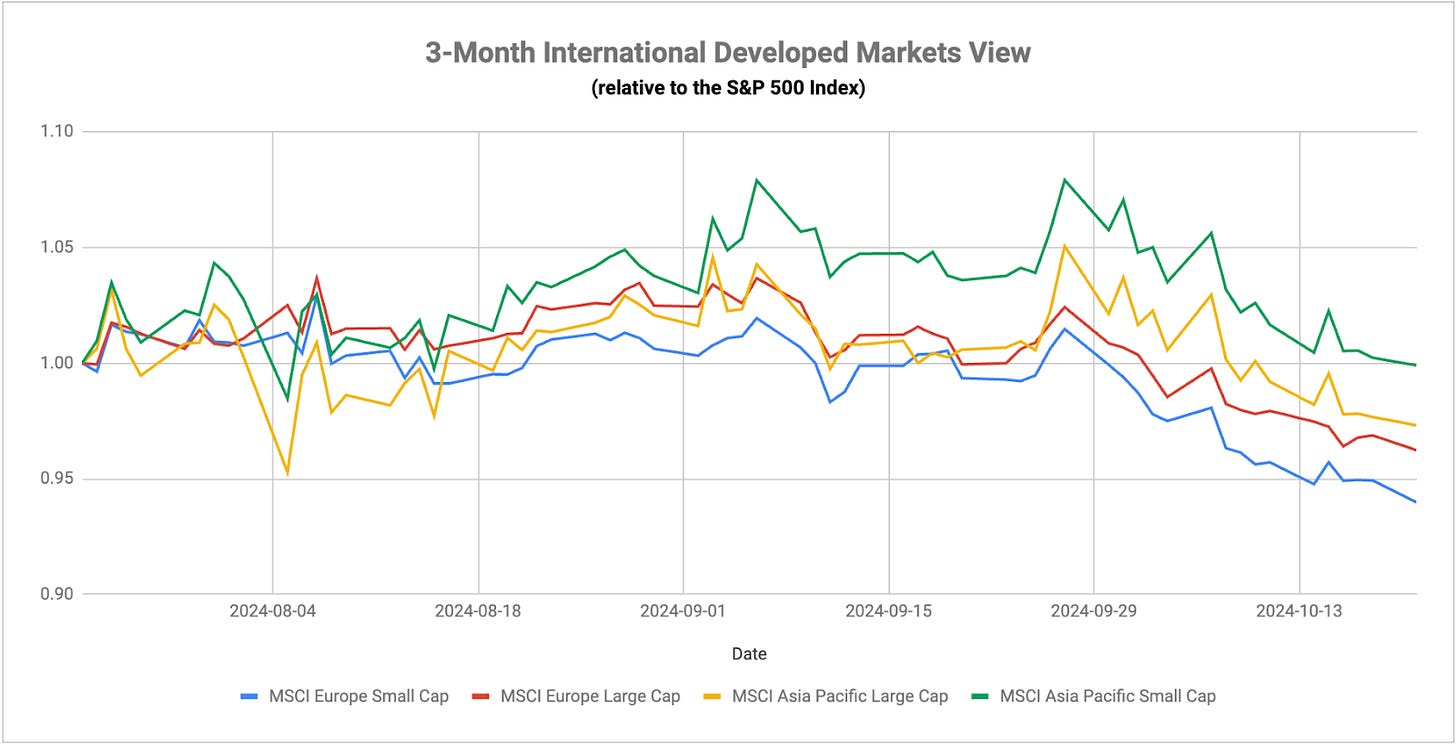

Last week, the ECB cut rates by 25 basis points, which was mostly expected. The question now becomes is the central bank about to put its foot on the gas. The market is beginning to price in the possibility of 50 basis point cuts, which is usually a sign that they’re beginning to lose control and need to make a more aggressive correction to policy conditions. While the core inflation rate in the Eurozone is still an elevated 2.7%, the headline rate plunged to 1.7% in September. That gives the ECB more flexibility in being more aggressive if they feel conditions are deteriorating quickly. GDP growth looked like it was picking up somewhat, but it got revised lower as Q2 readings got revised and now it appears that growth isn’t even going to hit 1% annualized for the foreseeable future.