Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: AS TECH FADES, THE DOLLAR BECOMES THE SAFE HAVEN TRADE

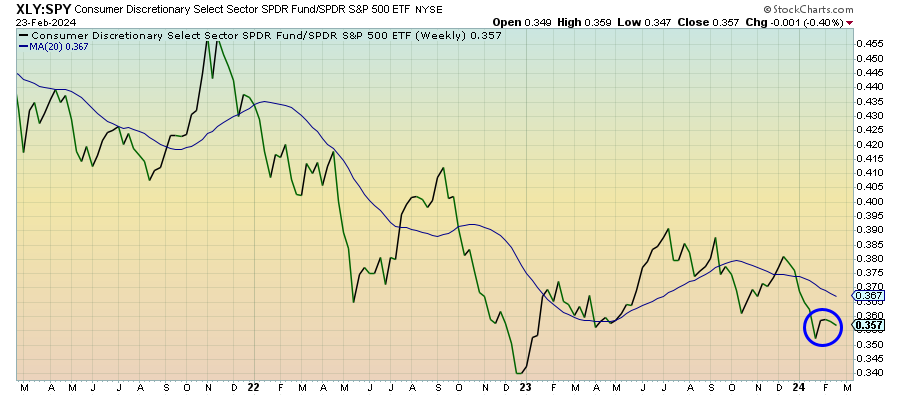

Consumer Discretionary (XLY) – The Consumer Breakdown

The consumer discretionary sector is starting to get pulled down by the underperformance of other growth sectors as interest rates slowly drift higher. The latest retail sales figures don’t necessarily paint an optimistic picture and that’s been confirmed by overall tighter financial conditions for consumers. This week’s personal income & spending figures could be the next evidence suggesting that the consumer is breaking down.

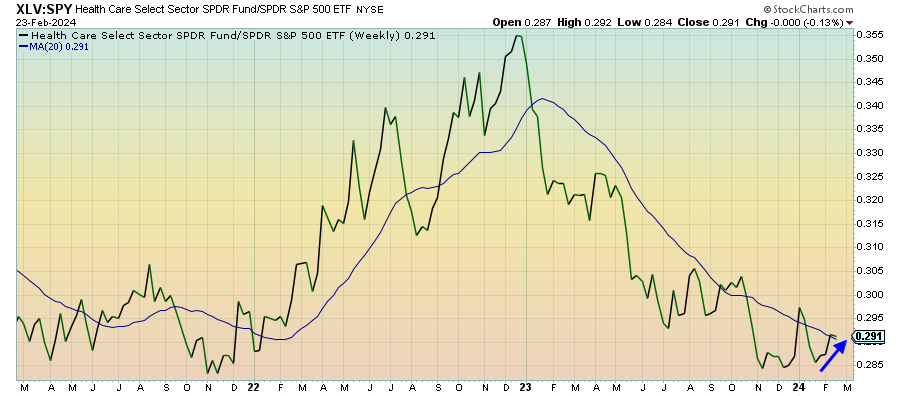

Health Care (XLV) – Outperforming In Multiple Environments

In a market that’s been rotating between growth and cyclicals, it’s impressive that healthcare has become the 2nd best performing sector year-to-date. Even more impressive is the fact that the trend has been rising and incredibly steady since the beginning of November. I think investors are viewing this sector as a cross between defense & growth right now and that’s helped allow it to outperform in different environments recently.

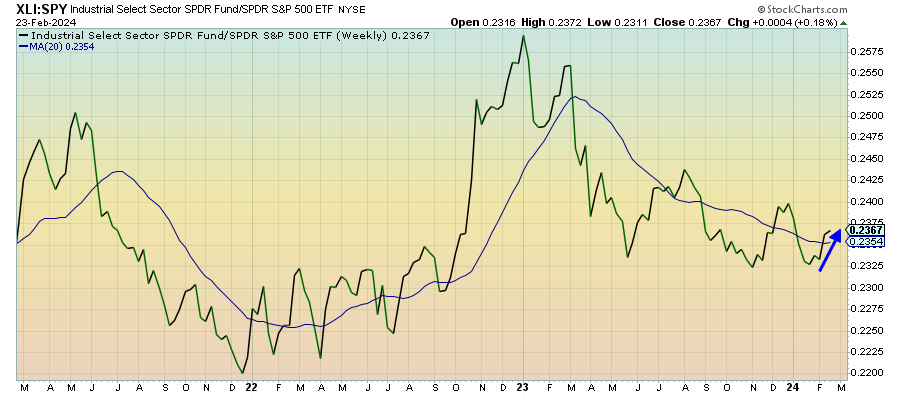

Industrials (XLI) – Grabbing The Leadership Mantle

As rising interest rates and a hawkish Fed have taken some fuel out of the tech rally, industrials have stepped in to pick up the slack. It makes sense. The underlying economic data has been supportive, while the cost of debt used to drive growth becomes higher and higher. Industrials have been underappreciated throughout the last year and the fact that manufacturing may be ticking up a bit here could provide a positive outlook.

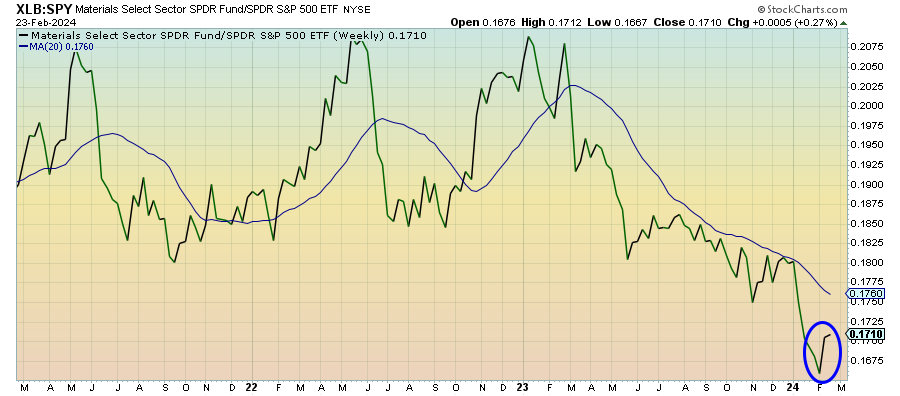

Materials (XLB) – Temporary Bounce, Not Sustainable Uptrend

Materials have experienced a strong rebound in this cyclical recovery, but this may be volatility more than anything. Commodities have made a bit of a comeback in recent weeks, but there’s a very clear lack of demand here that’s impacting the price of everything from natural gas to industrial metals to agriculture. This looks more like a temporary bounce than a sustainable uptrend.

Financials (XLF) – In A Really Tough Spot