Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: THE FED USHERS IN THE REFLATIONARY TRADE

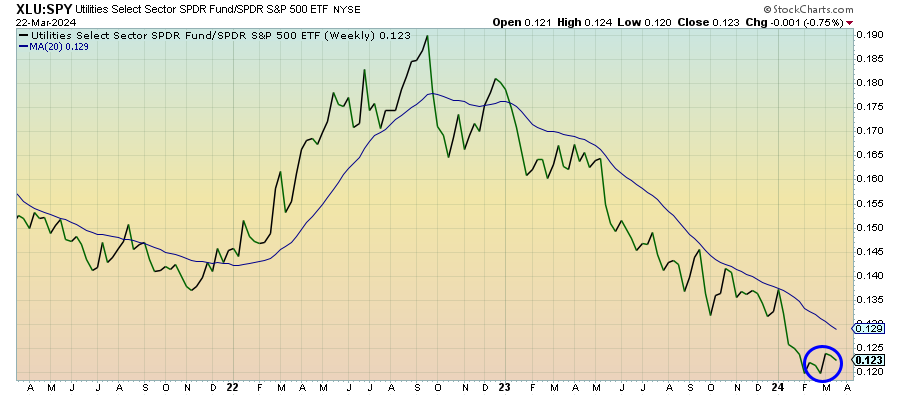

Utilities (XLU) – Issuing A Warning

Utilities are still holding up relatively well here despite the Fed’s implicit acknowledgment that it’s likely to allow inflation to remain above target. A reflationary economy coupled with rate cuts later this year should create a risk-on environment for stocks, but this sector is suggesting otherwise. Given the potential for yen-related volatility this week, it might be right.

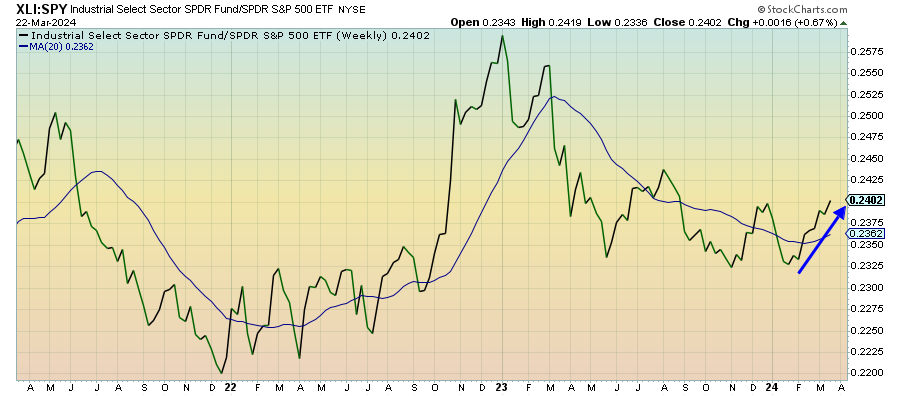

Industrials (XLI) – Extending The Run

Industrials have been steadily outperforming the market for a couple months, but the Fed may have created an opportunity to extend the run. Powell’s announcement last week that rate cuts are still on target should keep investors satisfied and cyclical stocks leading the charge.

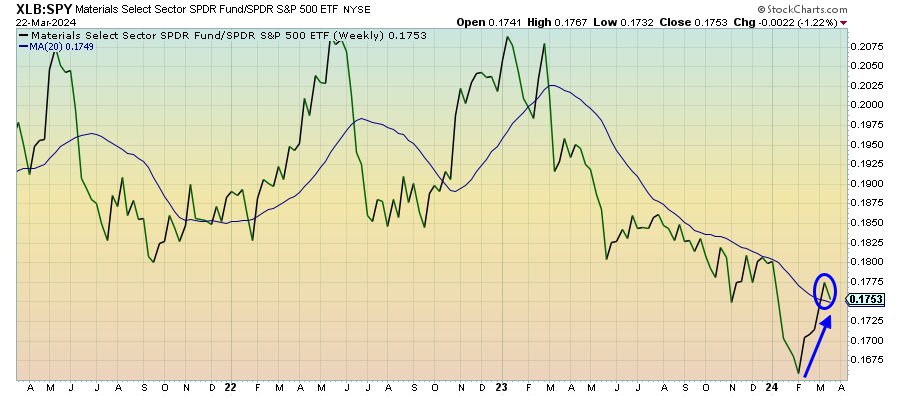

Materials (XLB) – Volatility Is Concerning

Commodities prices have been very volatile over the past several weeks, especially on the metals side. There’s little question that this sector is getting swept up in the latest affinity for cyclicals, but the degree of volatility is somewhat concerning. The Fed’s renewed focus on economic growth should keep giving this group strength, but volatility tends to do a lot of damage quickly as we’ve seen multiple times over the past couple years.

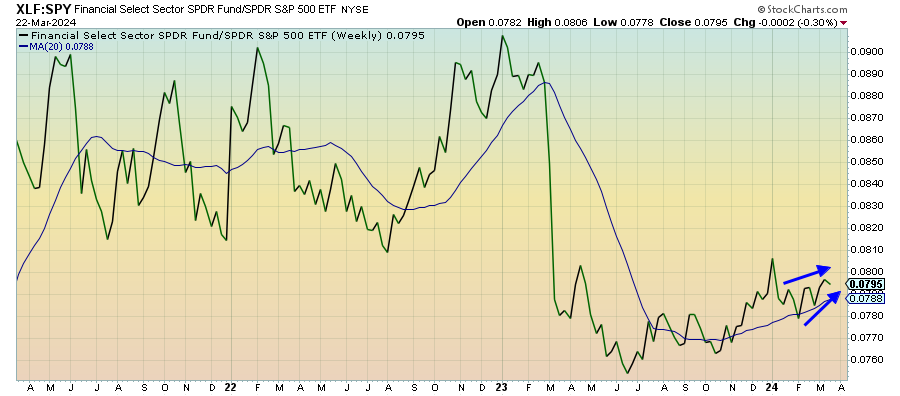

Financials (XLF) – Still Depends On Interest Rates

Financials are still looking fairly healthy as the “stronger for longer” narrative keeps the big banks outperforming. A lot will still depend on the direction of interest rates. Higher rates tend to be bullish for bank stocks, but last week’s move lower in yields could mean that investors are 1) buying into the Fed’s rate cut narrative or 2) starting to shift defensive. Neither one would necessarily be a longer-term positive for financials.

Energy (XLE) – A Lot Of Variables At Play