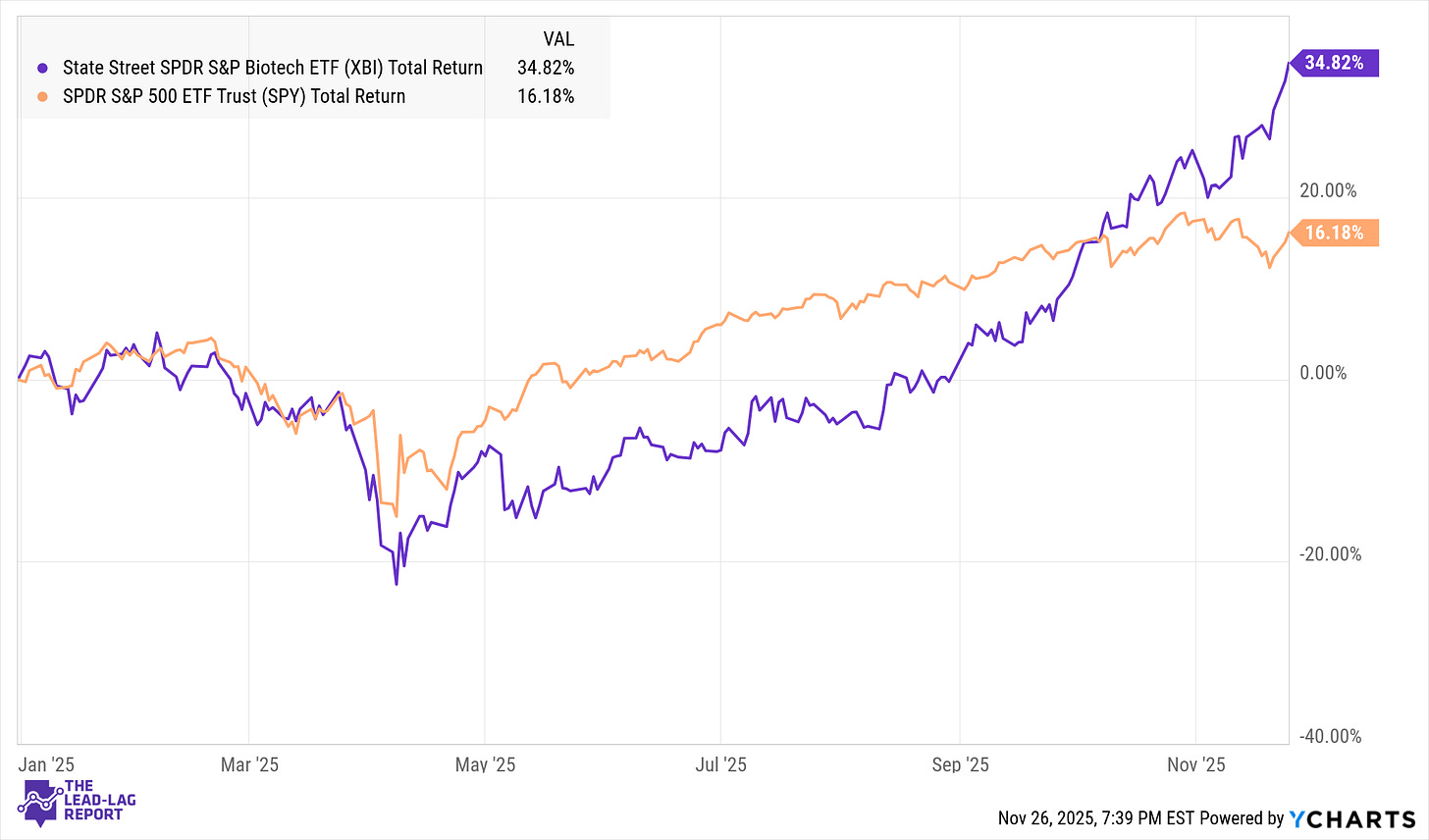

The biotech sector has found its footing again after several difficult years. The equal-weighted S&P Biotechnology ETF (XBI) has staged an impressive rebound, helped by a revival in risk appetite, firmer macro conditions, and a noticeable pickup in dealmaking. Investor sentiment toward innovation had been suppressed through much of the rate-hike cycle, but falling yields and clearer policy signals have brought capital back into the space. The shift has helped push biotech ahead of the broader market, ending a long stretch of relative weakness.¹

Several forces are working in biotech’s favor. First, the broader equity market has turned risk-on, lifting higher-beta segments that lagged during the tightening phase. Second, expectations for an acceleration in mergers and acquisitions have been building for months and are now showing up in completed transactions. Large pharmaceutical companies face looming patent expirations and are reaching for externally developed science to replenish pipelines. A notable example came in November, when Abbott agreed to acquire diagnostic firm Exact Sciences in a deal valued at $21 billion, a premium emblematic of renewed competitive urgency.² Third, the return of lower long-term interest rates has eased pressure on companies that rely heavily on external financing. The pullback in Treasury yields—after briefly touching multi-decade highs in 2023—has historically been a catalyst for biotech outperformance.¹

Valuation Reset and a More Supportive Backdrop

Even with the rally, valuations across the sector remain reasonable given how far prices had fallen. The four-year slump left many companies trading at steep discounts, and by mid-2025 industry observers still described biotech valuations as depressed relative to long-term norms.³ This has created a setup in which improving sentiment can translate quickly into performance. Fund flows, after years of steady outflows, have started to turn as investors reconsider long-duration growth exposures. Biotech has tended to benefit meaningfully during easing cycles, particularly among small-cap names, which were hit hardest during the rate-hike period.³⁴

The macro environment is also more navigable. Borrowing costs have stabilized, and fears of sweeping drug-pricing reforms have tempered. The FDA has kept approval activity at a robust pace, helping reduce uncertainty for companies nearing key regulatory milestones. Meanwhile, pent-up demand for acquisitions is beginning to be released. In the third quarter of 2025, biotech deal value nearly doubled from the prior quarter, reflecting the pressure big pharma faces from one of the largest patent-expiration cliffs in recent memory.¹ Estimates suggest hundreds of billions of dollars in annual revenue across major pharmaceutical companies will come under threat by 2030, with more than $1 trillion in balance-sheet capacity available to support dealmaking.¹ The result is a landscape that encourages consolidation and rewards firms with de-risked assets.

Biotech remains volatile by nature, and not all companies will participate equally in a rising tide. Clinical disappointments, regulatory hurdles, and capital needs can still derail individual stories. Even so, the improving macro backdrop, combined with years of operational discipline forced by the downturn, has left many companies fundamentally stronger. Analysts have noted that the sector now features a broad group of firms whose valuations still do not reflect their underlying progress, particularly in areas where recent clinical or commercial milestones have reshaped long-term outlooks.⁴

Notable Opportunities Within XBI

Within XBI, several companies illustrate the type of undervalued or contrarian setups attracting renewed investor interest.