2024 is finishing off with the low volume and relatively low volatility environment that’s typical around this time of year, but it’s not coming with the increase in equity prices that many were expecting. The S&P 500 is now about 3% below its high and the Nasdaq 100 is down by 4%, not enough to consider a correction by any means, but enough that we can conclude that investors may be rethinking equity positioning heading into the new year.

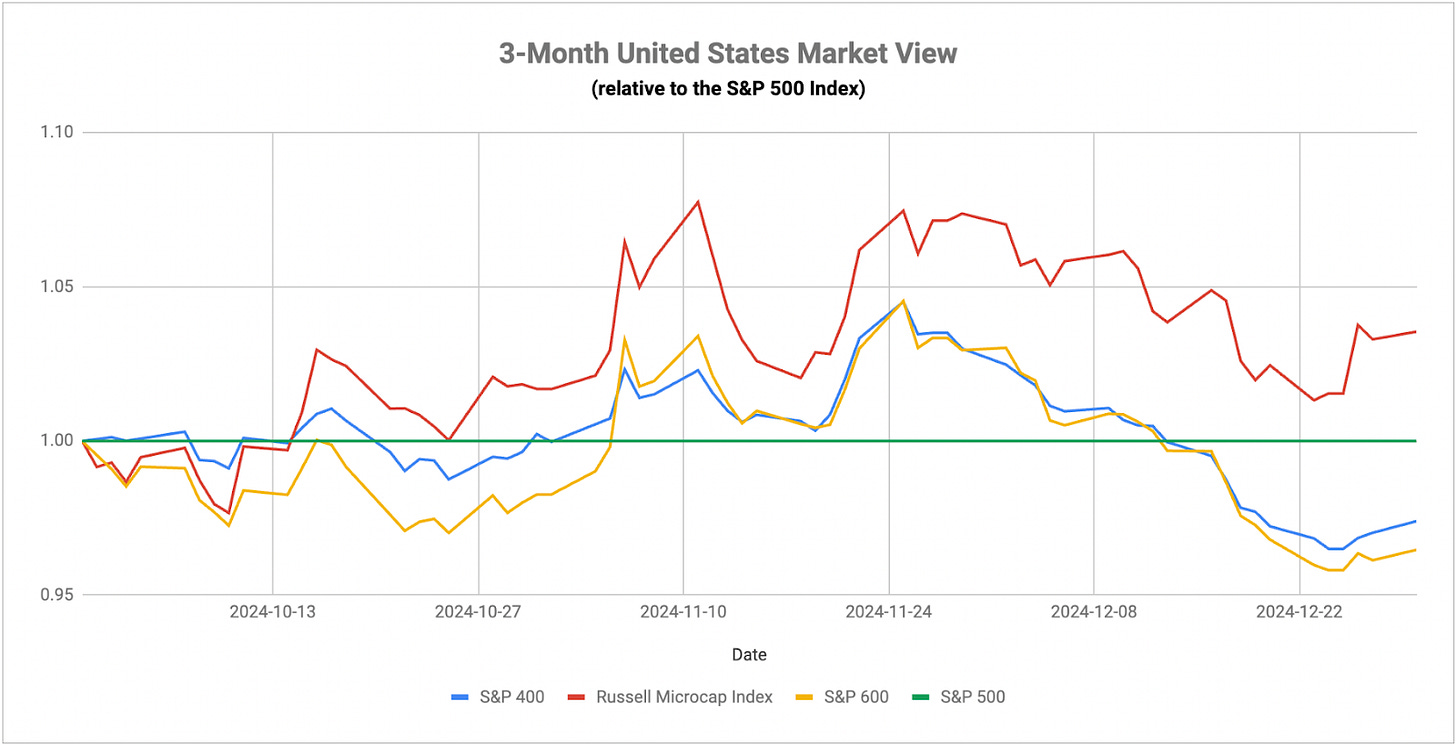

While small-caps and value stocks have made a minor comeback in the past few days, it’s still mega-caps and the magnificent 7 that have dominated over the past month. I think there’s little question that the growthier areas of the market are seeing their valuations get a little overextended, but that hasn’t seemed to change investor sentiment to any major degree lately. As long as GDP growth remains healthy and the labor market remains tight, market bulls are going to be able to make the argument that the macro environment is still positive and there’s a case for stock prices to rise even further in 2025, even though the S&P 500 has delivered back-to-back years of 20%+ gains, a rarity over the past century.

I still believe that inflation is going to be a primary theme for at least the first of 2025 as we see how the Trump administration handles foreign policy, particularly as it relates to tariffs and trade. I’ve said many times that small-caps hold the key here and I think that’s especially true now given that they’re perhaps the proxy of inflation and rate expectations among U.S. equities. Over the past month, they’ve given us a pretty strong indication that inflation is becoming a problem and the likelihood of higher for longer interest rates is going to start putting the squeeze on these companies. Small-cap value is where a lot of the companies at particularly high risk reside and that group has been lagging all year. Investors seem comfortable using mega-caps as a quasi-safe haven in this market and that trend could continue, but persistently elevated rates and inflation are the keys that could pull equities lower in the coming year.

Another big risk factor is what’s happening in the bond market. Long-term bond yields are telling pretty much the same story as small-caps - inflation is becoming a greater threat. The 10-year yield has risen a full 100 basis points over the past three months. The Fed has already dropped the Fed Funds rate from 5.5% to 4.5%. That kind of policy shift has historically resulted in falling long-term rates in a coordinated shift along with the short end of the curve. This time, however, we’re seeing short-term and long-term rates moving in opposite directions. In order to sync up again, either long-term rates would need to make a sharp move lower or short-term rates would need to move higher. Given the current trend on inflation, the latter seems more likely than the former. The futures market is still pricing in another hike at some point in 2025, but I wouldn’t be surprised to see the Fed reverse course and consider rate hikes again over the next 12 months.

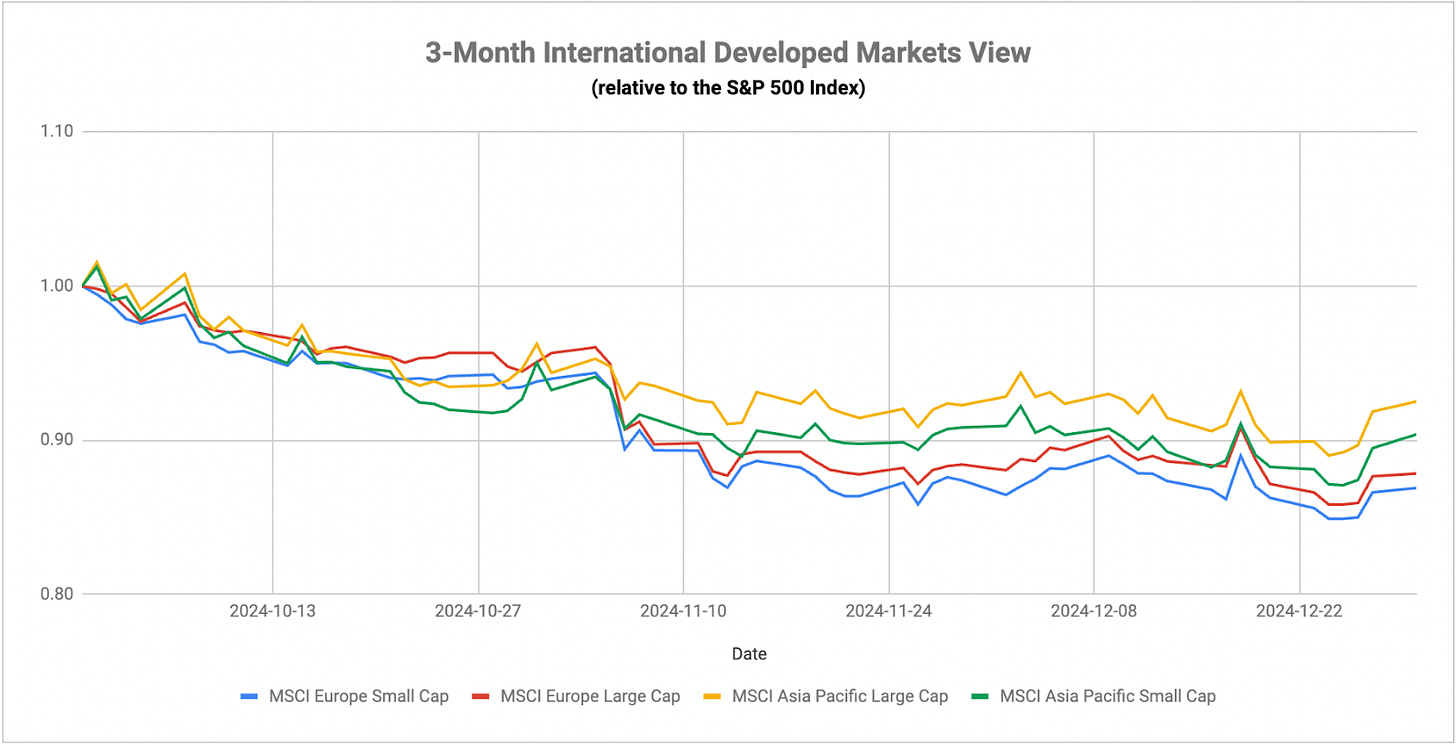

Central bank activity will be a big theme across most economies in 2025. The ECB is likely to cut multiple times in the upcoming year as inflation has remained fairly reliably below the 3% mark, but GDP growth is flailing below a 1% annualized rate. Eurozone GDP growth as a whole has been showing signs of re-accelerating over the past few quarters, but persistent problems in Germany, the region’s largest individual economy, could hamper the chances of a longer-term sustainable recovery.

The Bank of England may be in a tougher spot. It only cut the nation’s benchmark rate by 50 basis points as inflation remains too sticky. The annualized inflation rate has been steadily on the rise since June, but GDP growth has been inconsistent and languishing below the 1% mark. The U.K. looks like it’s in a worse spot in that it never really managed to get inflation under control and now it looks like it’s moving in the opposite direction again.