It was another quiet holiday-shortened week for the markets, but a new year brings a fresh outlook. January alone is going to bring the inauguration (or re-inauguration) of a new president and the U.S. government is likely to hit the debt ceiling. Both events could create more volatility for the markets.

A second Trump presidential term will bring with it promises of tax cuts for corporations and high net worth individuals and the potential for significant tariffs on foreign imports. The former could be a tailwind for U.S. equities, as it was following the passage of the Tax Cuts & Jobs Act during Trump’s first term, but the second has the potential to cause some damage. While the latter could create a revenue source for the government and the reshoring of U.S. business, they are ultimately an inflationary cost increase for consumers. If Trump’s threats of 10-25% tariffs on many country’s imports come to pass, it could hit the brakes on a global economy that’s already struggling to grow in many non-U.S. regions of the world.

Don’t be surprised if inflation quickly becomes a larger theme in the new year. We’re already seeing modest accelerations in the United States, Europe, Japan and elsewhere. While these may ultimately prove to be short-term in nature, current macro forces, increased global liquidity and the threat of a more challenging global trade environment are all supportive of the idea that higher inflation could be here to stay. Powell already indicated that the Fed is concerned about rising prices in his latest press conference and that was reflected in the Fed Dot Plot. The market is only pricing in 1-2 rate cuts this year and may be unable to provide much monetary support if inflation remains elevated.

Special Announcement

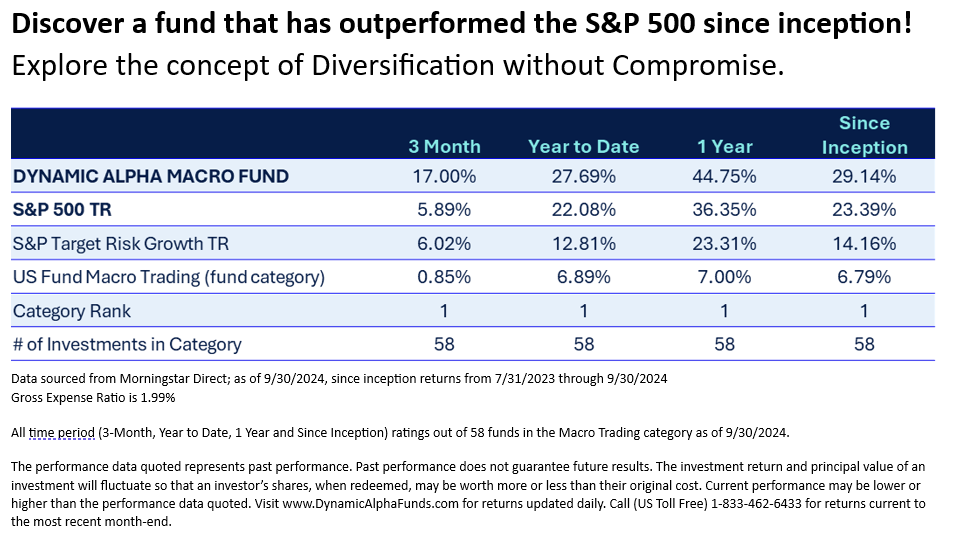

Alternatives often get a bad rap for consistently underperforming the equity markets. Non-correlation is great, but it must also perform…

Enter the Dynamic Alpha Macro Fund (DYMIX).

The Dynamic Alpha Macro Fund (DYMIX) blends two non-correlated strategies: a fundamental global macro approach and a diversified portfolio of U.S. equities. This combination aims to capture returns and minimize risk, and is designed to be an all-weather solution even in unpredictable conditions.

View our Q3 Fact Sheet HERE.

Dynamic Alpha Funds provide:

· Targeted Exposure: Gain access to over 40 liquid markets — including equities, bonds, currencies, and commodities.

· Dynamic Rebalancing: The ability to invest both long and short can help generate alpha and reduce drawdowns during market downturns.

· Diversification: By harnessing non-correlation, we strive to outperform the S&P 500 while managing risk.

Dynamic Alpha Funds is where institutional investors, portfolio managers, and sophisticated individuals come to add true diversification. Learn more about how DYMIX can help protect and grow your portfolio at DynamicAlphaFunds.com.

Disclosures:

All statements provided are for informational purposes only and do not guarantee future performance. No investment product or strategy is guaranteed to generate a profit or prevent a loss.

Request A Prospectus: Investors should carefully consider the investment objectives, risks, charges and expenses of the Dynamic Alpha Macro Fund prior to investing. This and other important information can be found in the Fund’s prospectus and summary prospectus. To obtain a prospectus, please call 1-833-462-6433 or access online at https://regdocs.blugiant.com/dynamic-alpha-macro/ . The prospectus should be read carefully prior to investing.

Important Risks: Investing in mutual funds involves risk, including loss of principal. Risks specific to the Dynamic Alpha Macro Fund are detailed in the prospectus and are linked here: https://dynamicalphafunds.com/performance-2/ . For a complete description of risks specific to the Fund, please refer to Fund’s prospectus.

Relationship Disclosure: Advisors Preferred, LLC serves as Advisor to the Dynamic Alpha Macro Fund, distributed by Ceros Financial Services, Inc., Member FINRA/SIPC. Advisors Preferred and Ceros are commonly held affiliates. Dynamic Wealth Group, LLC serves as Subadvisor to the Fund is not affiliated with the Fund’s advisor or distributor.

©2024 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

DISCLAIMER – PLEASE READ: This is sponsored advertising content for which Lead-Lag Publishing, LLC has been paid a fee. The information provided in the link is solely the creation of Dynamic Alpha Funds. Lead-Lag Publishing, LLC does not guarantee the accuracy or completeness of the information provided in the link or make any representation as to its quality. All statements and expressions provided in the link are the sole opinion of Dynamic Alpha Funds. and Lead-Lag Publishing, LLC expressly disclaims any responsibility for action taken in connection with the information provided in the link.

We may be seeing risks starting to get priced into the bond market as well. High yield credit spreads have been expanding for three weeks and, while that’s not enough to suggest that there’s stress in the system yet, it is a sign that bond investors might finally be turning a little more cautious on conditions. Long-term Treasury yields are near their highest levels of the past year, a result of less anticipated Fed action and the increased likelihood of higher inflation.

In the United States, GDP growth is still healthy and the labor market is still tight. They could still drive risk asset prices higher, but there are a lot of variables that could throw a wrench in the engine.

The Lead-Lag Report is provided by Lead-Lag Publishing, LLC. All opinions and views mentioned in this report constitute our judgments as of the date of writing and are subject to change at any time. Information within this material is not intended to be used as a primary basis for investment decisions and should also not be construed as advice meeting the particular investment needs of any individual investor. Trading signals produced by the Lead-Lag Report are independent of other services provided by Lead-Lag Publishing, LLC or its affiliates, and positioning of accounts under their management may differ. Please remember that investing involves risk, including loss of principal, and past performance may not be indicative of future results. Lead-Lag Publishing, LLC, its members, officers, directors and employees expressly disclaim all liability in respect to actions taken based on any or all of the information on this writing.