Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: MARKET BREADTH IS STILL TOO NARROW

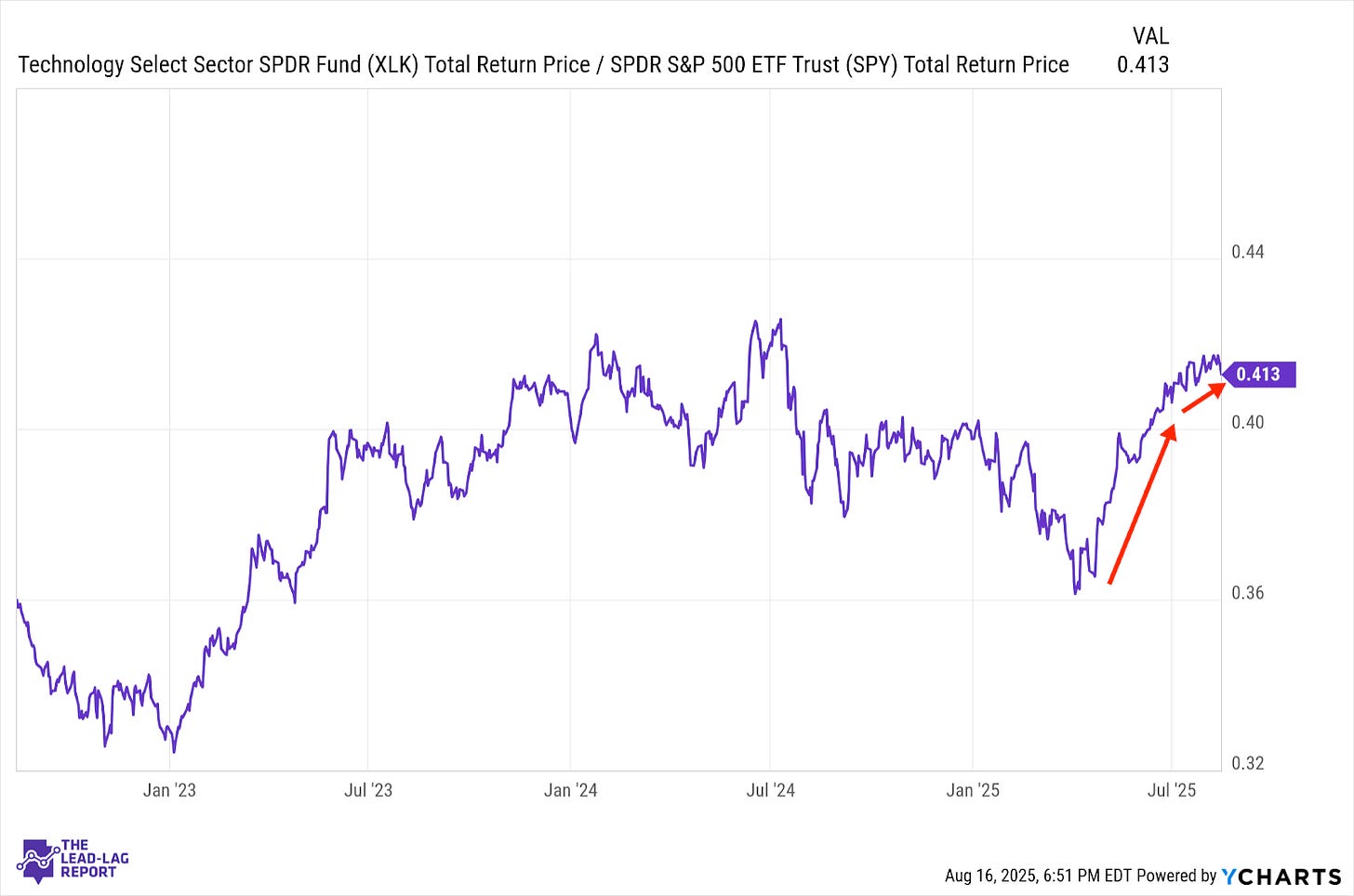

Technology (XLK) – AI Momentum Remains Strong

The tech sector continues to outperform amid the broader market volatility, primarily powered by ongoing AI investment cycles from major players. Nvidia's recent earnings release showed robust data center growth, confirming that enterprise AI spending remains resilient despite macro uncertainties. We feel that while valuations have stretched in some corners of the sector, the fundamental tailwinds from enterprise digital transformation initiatives continue to provide support for the group.

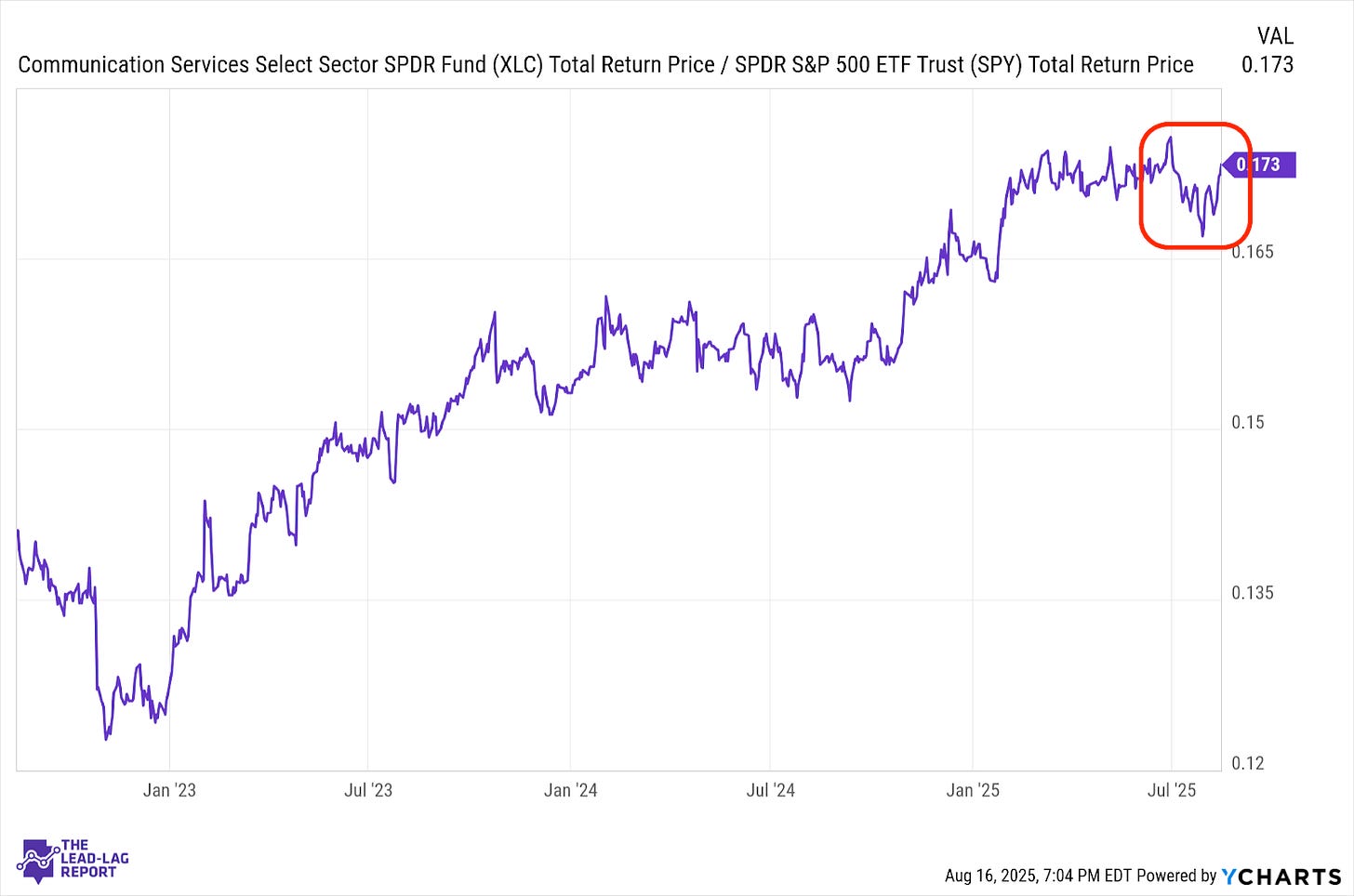

Communication Services (XLC) – Digital Ad Recovery Continues

The sector has found solid footing as digital advertising budgets continue their post-pandemic recovery trajectory. Social media platforms reported better-than-expected user engagement metrics in their latest earnings, while streaming services showed promising subscriber growth and improved profitability. Regulatory headwinds remain a concern for some of the larger players, though their impact has been less severe than initially feared as companies proactively address potential compliance issues.

Long Bonds (VLGSX) – Duration Demand Returns

Long-dated Treasuries have outperformed in recent weeks as inflation expectations moderate and growth concerns return to the forefront. Institutional investors appear to be increasing duration in their fixed income allocations after maintaining defensive positioning earlier in the year. The spread between 30-year and 10-year yields has compressed, reflecting shifting investor sentiment about longer-term economic growth and inflation prospects.

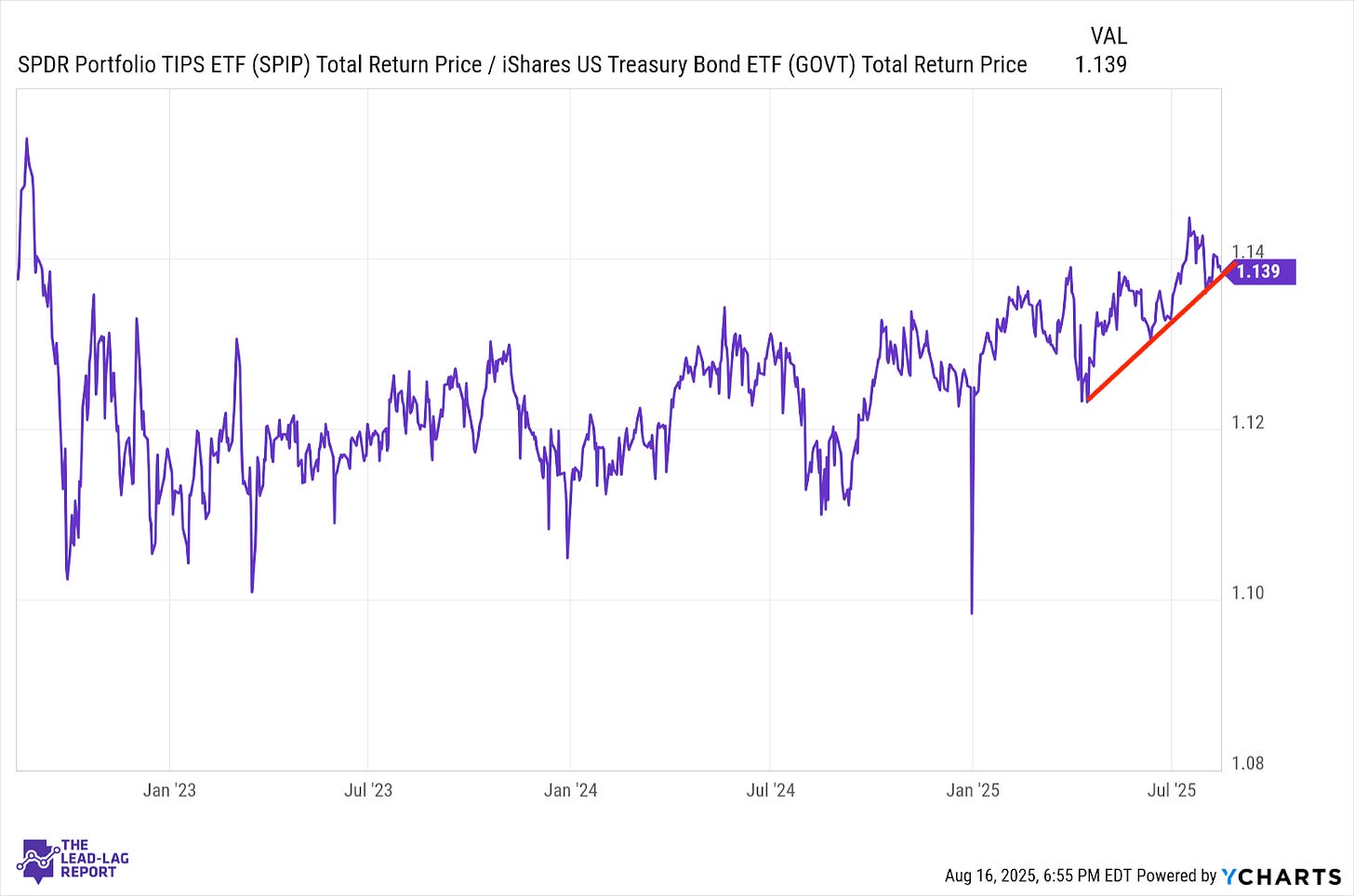

Treasury Inflation Protected Securities (SPIP) – Breakevens Compress

Inflation-protected securities have underperformed nominal Treasuries as market-based inflation expectations have moderated from their earlier peaks. Recent CPI and PCE reports have shown progress in services inflation, contributing to the narrative that the Fed's restrictive policy stance is having the desired effect. The spread between TIPS yields and conventional Treasuries suggests the market expects inflation to continue normalizing toward the Fed's target over the medium term.

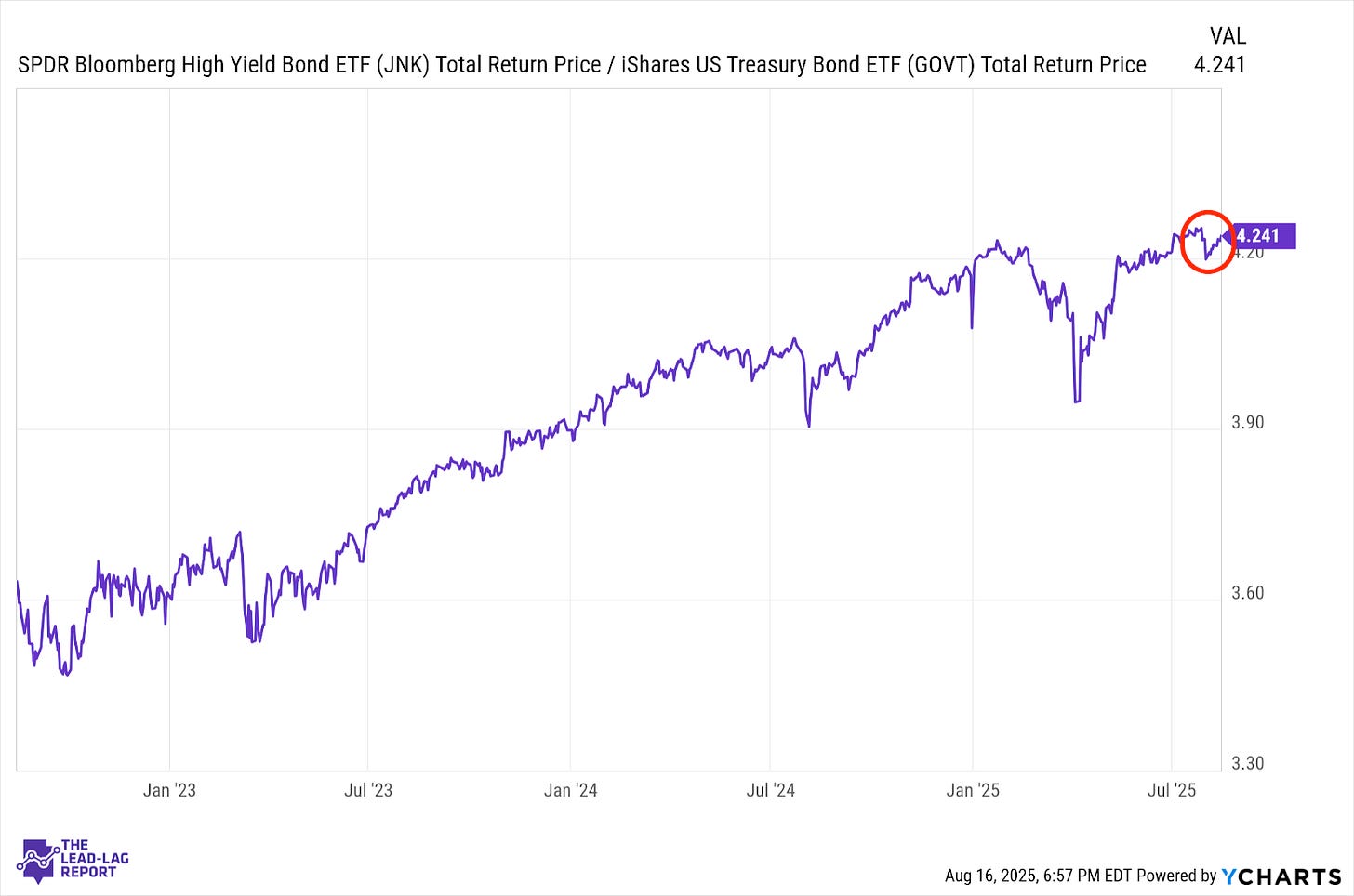

Junk Debt (JNK) – Spreads Remain Resilient

High-yield bonds have maintained their relative strength despite some volatility in equity markets, suggesting credit fundamentals remain sound overall. Refinancing activity has picked up as companies opportunistically address near-term maturities. Default rates remain below historical averages, though there are pockets of stress emerging in sectors facing secular challenges or significant leverage.

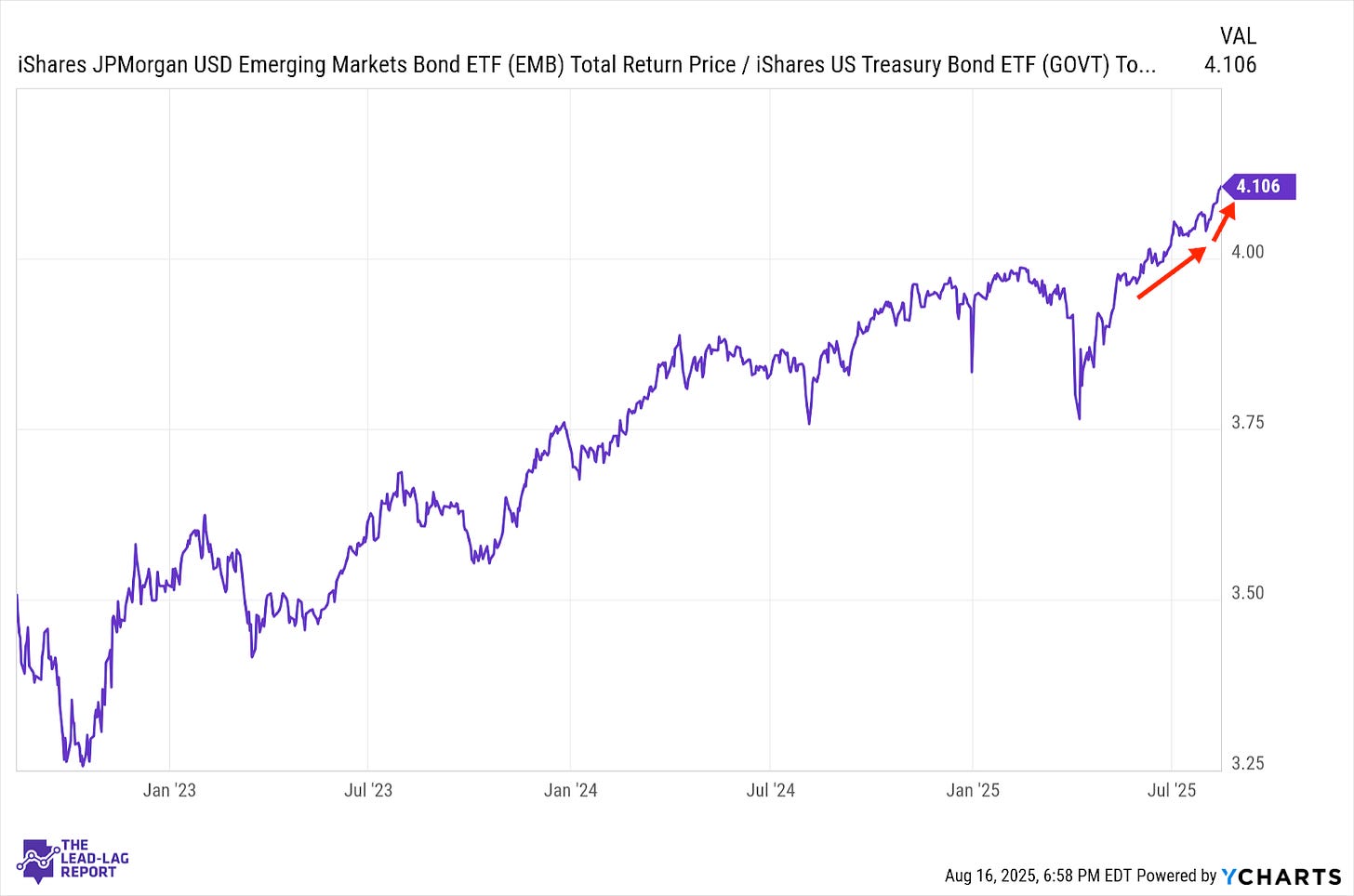

Emerging Markets Debt (EMB) – Selective Opportunities Emerge

Emerging market debt has stabilized after earlier volatility, with spreads settling into a narrower range. Countries with stronger fiscal positions and external balances have outperformed, highlighting the importance of selectivity in the current environment. Local currency bonds have faced challenges from some currency depreciation against the dollar, though carry remains attractive for investors willing to accept the volatility.

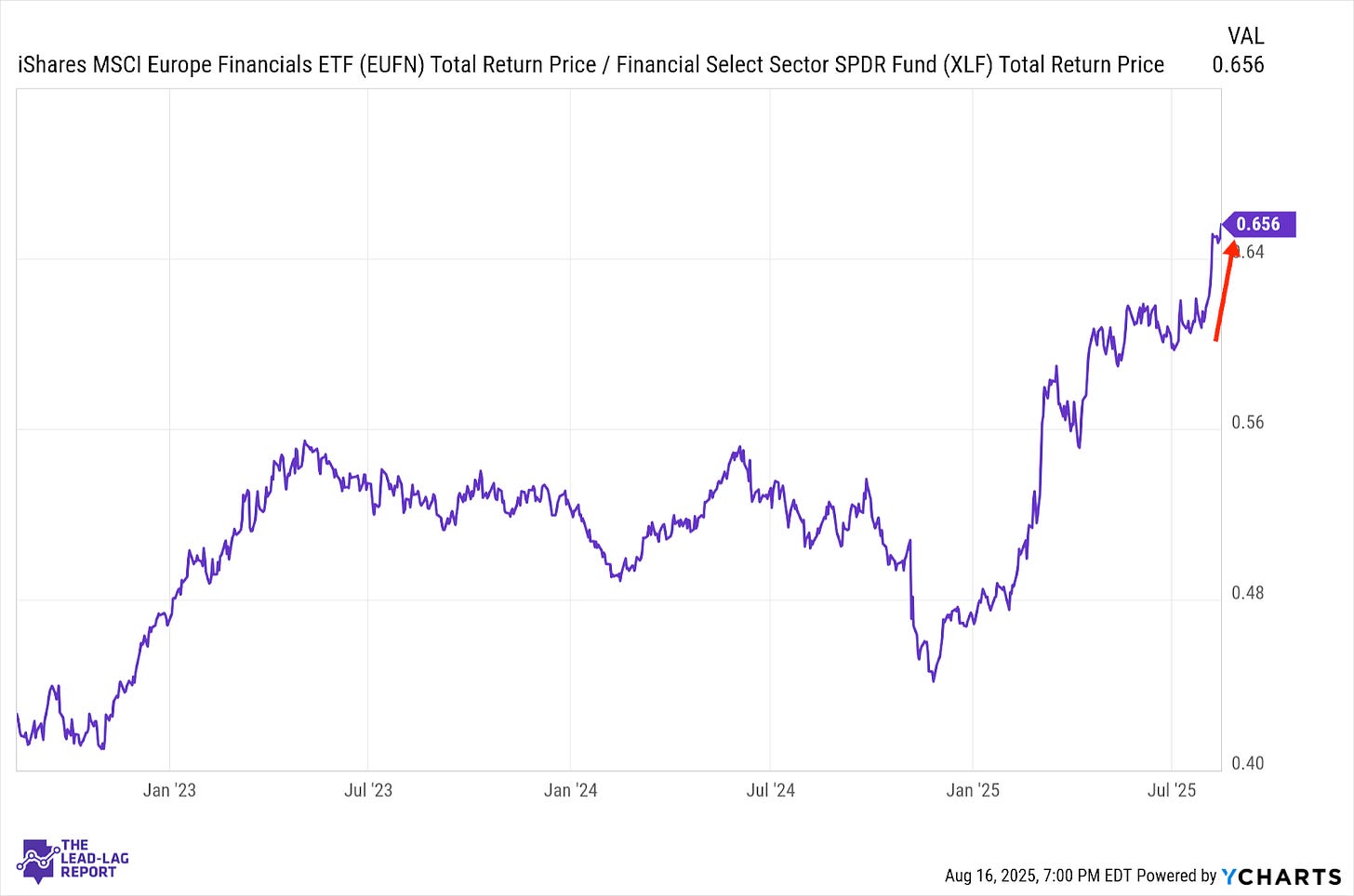

European Banks (EUFN) – Profitability Challenges Persist

European financial institutions continue to navigate a challenging environment as economic growth across the region remains tepid. Net interest margins have improved modestly as the ECB maintains its policy stance, though loan growth has been subdued. Regulatory capital positions remain strong across most major institutions, providing some flexibility for increased shareholder returns through dividends and buybacks despite the uncertain operating environment.

LAGGARDS: LUMBER TELLS A DIFFERENT STORY