Every week, we'll profile a high yield investment fund that typically offers an annualized distribution of 6-10% or more. With the S&P 500 yielding less than 2%, many investors find it difficult to achieve the portfolio income necessary to meet their needs and goals. This report is designed to help address those concerns.

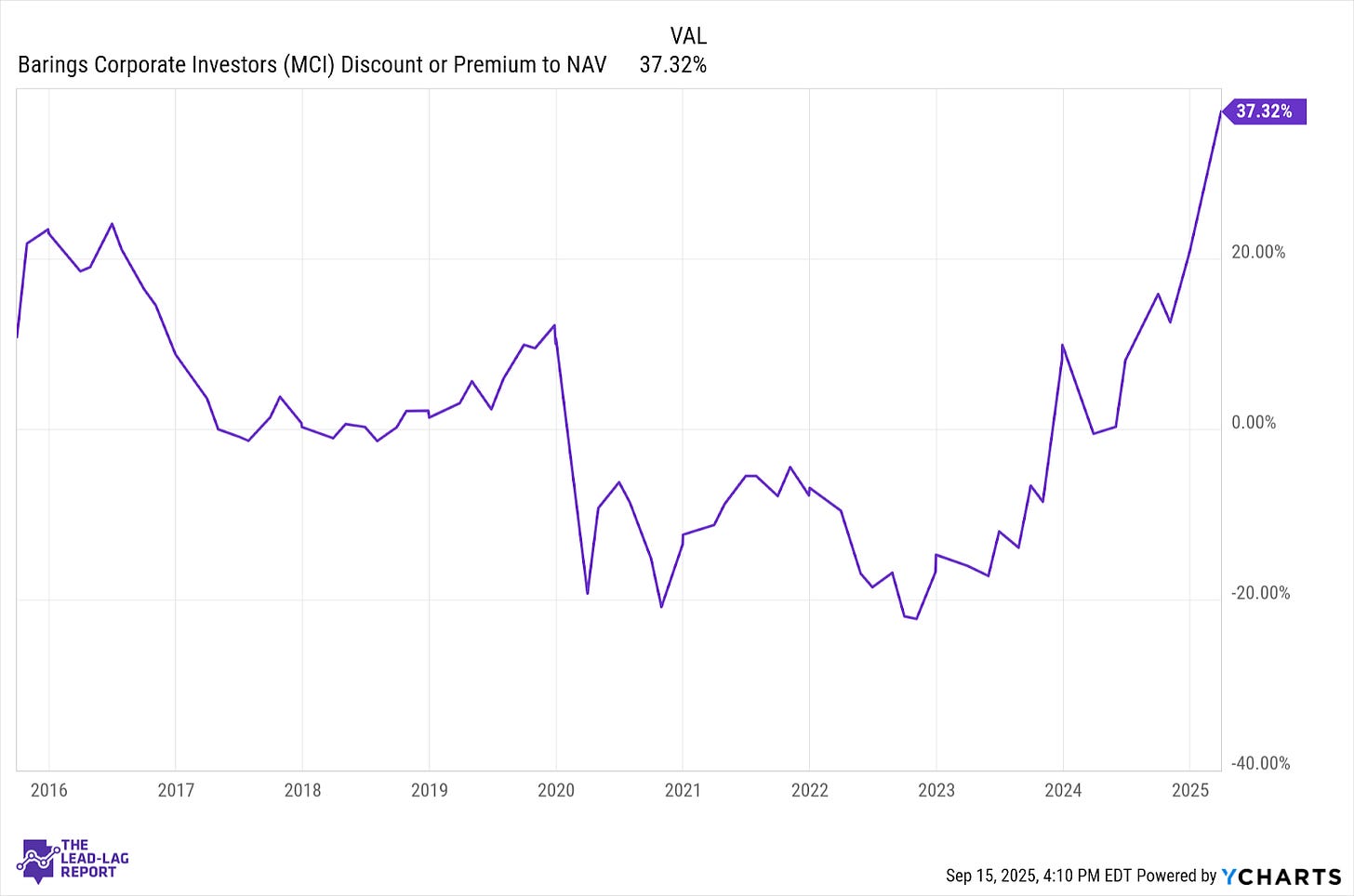

Income investors face a challenging valuation question with closed-end funds trading at premiums. While premium valuations aren't unusual in certain market environments, we're seeing some funds reach extreme levels. The gap between price and value creates mathematical challenges for new investors weighing reliable income against entry point considerations. This valuation tension remains particularly acute in the private debt space where historical outperformance has fueled investor enthusiasm.

Barings Corporate Investors (MCI) presents one of the more dramatic examples of this premium valuation dilemma. The fund has built five decades of experience in privately placed, below-investment-grade debt of U.S. companies with a remarkable track record of resilience during market downturns. Yet with a current premium of 37% above its NAV, investors must question whether even exceptional performance justifies paying such a significant markup. Can MCI's distribution reliability and historical outperformance possibly justify this premium?

Fund Background

MCI seeks income, preservation of capital, and capital appreciation by investing in privately placed, below-investment-grade debt and equity securities of U.S. companies. The fund focuses primarily on senior and subordinated debt instruments with approximately 80% of investments in privately placed securities not registered under the Securities Act of 1933. It utilizes modest leverage to enhance returns while maintaining a predominantly senior secured position in the capital structure.

The fund's conservative approach to below-investment-grade debt stands out from peers. While many high-yield vehicles chase yield at any cost, MCI maintains disciplined underwriting standards focused on first-lien positions with strong covenant protections. This approach has delivered remarkable consistency through multiple market cycles with positive NAV returns every year since 2009. The tradeoff comes through premium pricing, which creates a mathematical challenge for new investors essentially prepaying for one to two years' worth of distributions upfront.

MCI's portfolio emphasizes floating-rate, secured debt instruments, providing insulation from interest rate fluctuations while ensuring higher recovery rates during defaults. The fund generates income through an average coupon of 7.8% across more than 300 holdings with an average bond price of $92.35. This below-par pricing indicates the fund has acquired positions at discounts, improving yield-to-maturity prospects. The focus on senior secured positions (primarily 1st lien) provides structural protection against capital impairment during credit events, explaining the fund's resilience during previous market stress periods.

MCI's consistency reflects management's focus on distribution growth and capital preservation rather than yield maximization. The fund has raised its payout several times over the past few years and this pattern of steady distribution increases while maintaining portfolio quality demonstrates management's commitment to sustainable income rather than chasing yields. The conservative management approach creates a high barrier to entry for new investors through premium pricing, essentially requiring confidence in continued execution excellence.

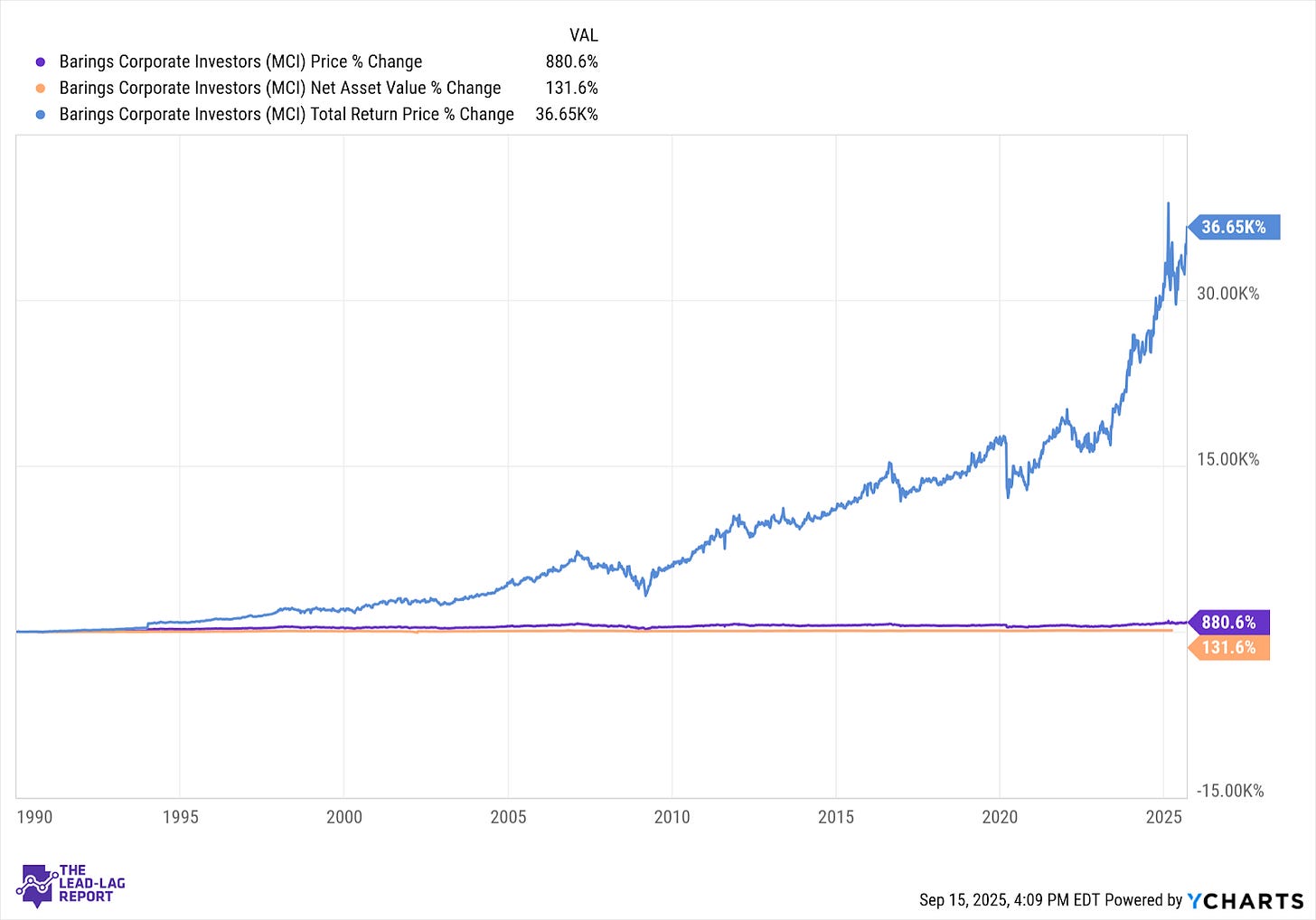

Since its inception back in 1971, MCI has generated an average annual return of around 11-12%.

Over its 50-year history, MCI has outperformed the S&P 500 by approximately 1.6 percentage points annually, demonstrating persistent alpha generation across multiple market cycles. A lot of this has been attributable to the steady demand for private debt and equity investments, especially over the past two years.

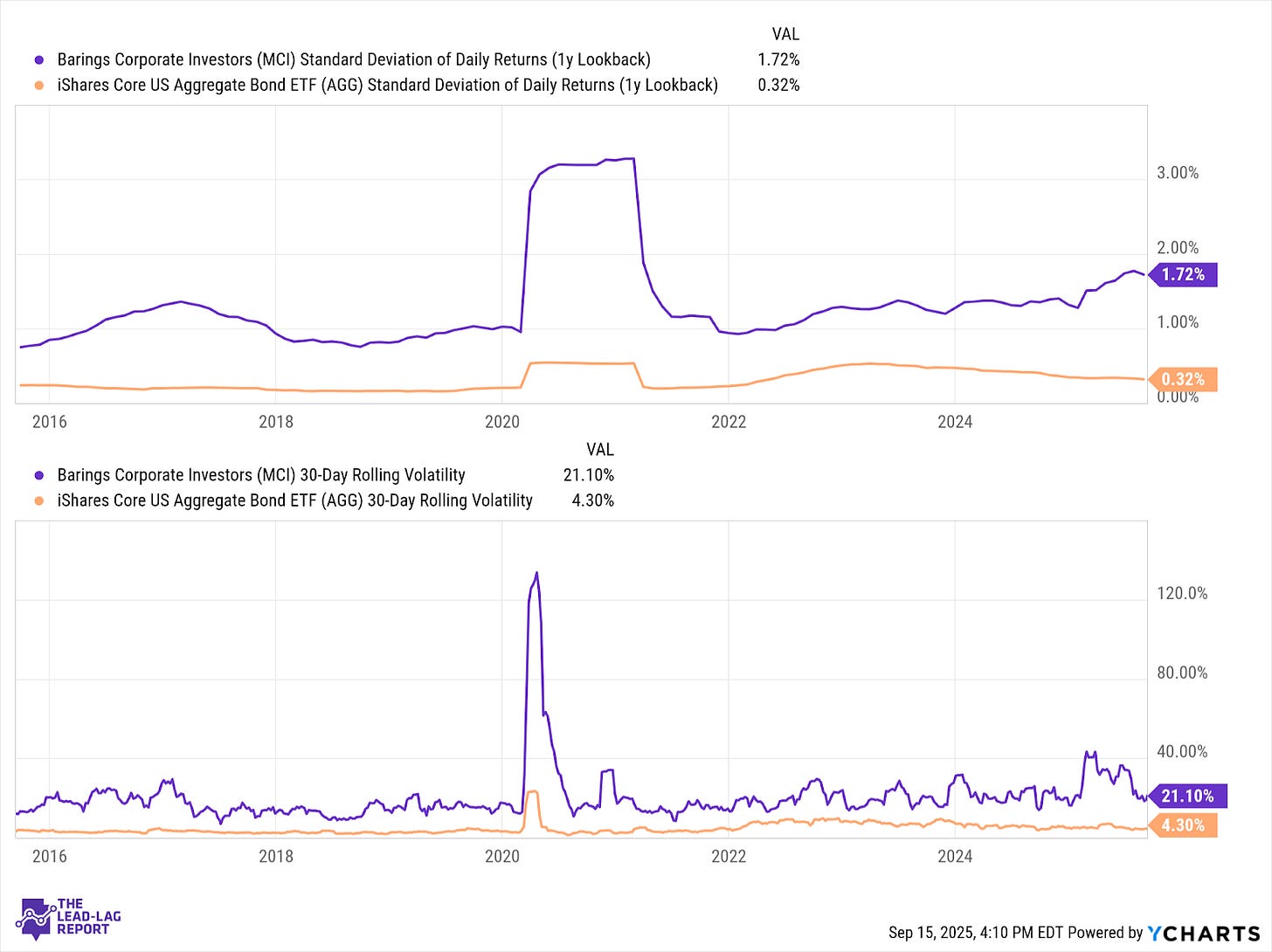

MCI's volatility profile reveals a specific risk signature. The fund's short- and long-term volatility measures are both more than double that of AGG. Despite the added volatility, MCI has done a good job of compensating investors for the risk. Sharpe ratios show that MCI has delivered superior risk-adjusted returns to both the broader bond market and the S&P 500.

The current premium has reached levels that demand serious attention. MCI trades at a 37% premium to its NAV, compared to a 5-year average showing a slight discount of -1.2%. The fund has moved from significant undervaluation (discounts as deep as more than -20% in 2022) to substantial overvaluation in roughly three years. Even with high investor interest in private debt at the moment, current pricing appears very elevated and likely unsustainable long-term.

Macro Environment

The private credit market continues its expansion amid broader shifts in institutional capital allocation. As traditional banks face heightened regulatory scrutiny and capital requirements, the private lending space has absorbed significant institutional capital seeking yield outside public markets. According to recent data, private credit assets under management have grown at a 13.5% compound annual rate over the past decade, reaching approximately $1.5 trillion globally.

This capital influx creates both opportunities and challenges for funds like MCI. The competition for quality deals has intensified, potentially compressing spreads and forcing managers to accept weaker covenant protections. Meanwhile, rising interest rates have placed pressure on leveraged borrowers with default rates ticking upward in certain segments of the high yield market. Leveraged loans have shown modest increases over the past six months, though levels remain below historical averages.

MCI's focus on senior secured positions with strong covenant protection provides some insulation from these pressures. The fund's portfolio of primarily floating-rate instruments has actually benefited from the higher rate environment with income generation improving as rates rose. However, persistent inflation and potentially slower economic growth could create headwinds for portfolio companies, particularly those with weaker balance sheets or in cyclical industries.

The most significant near-term risk appears to be the premium compression potential rather than underlying portfolio deterioration. With yield-hungry investors bidding up many CEF prices, any market dislocation could trigger rapid premium contraction. The fund traded at discounts as steep as -21% in 2022, demonstrating how quickly sentiment can shift. For new investors, timing becomes critical. Paying a 37% premium essentially locks in two years of distributions upfront, creating an unfavorable risk-reward proposition unless the premium proves sustainable over the long-term.

Distribution Policy

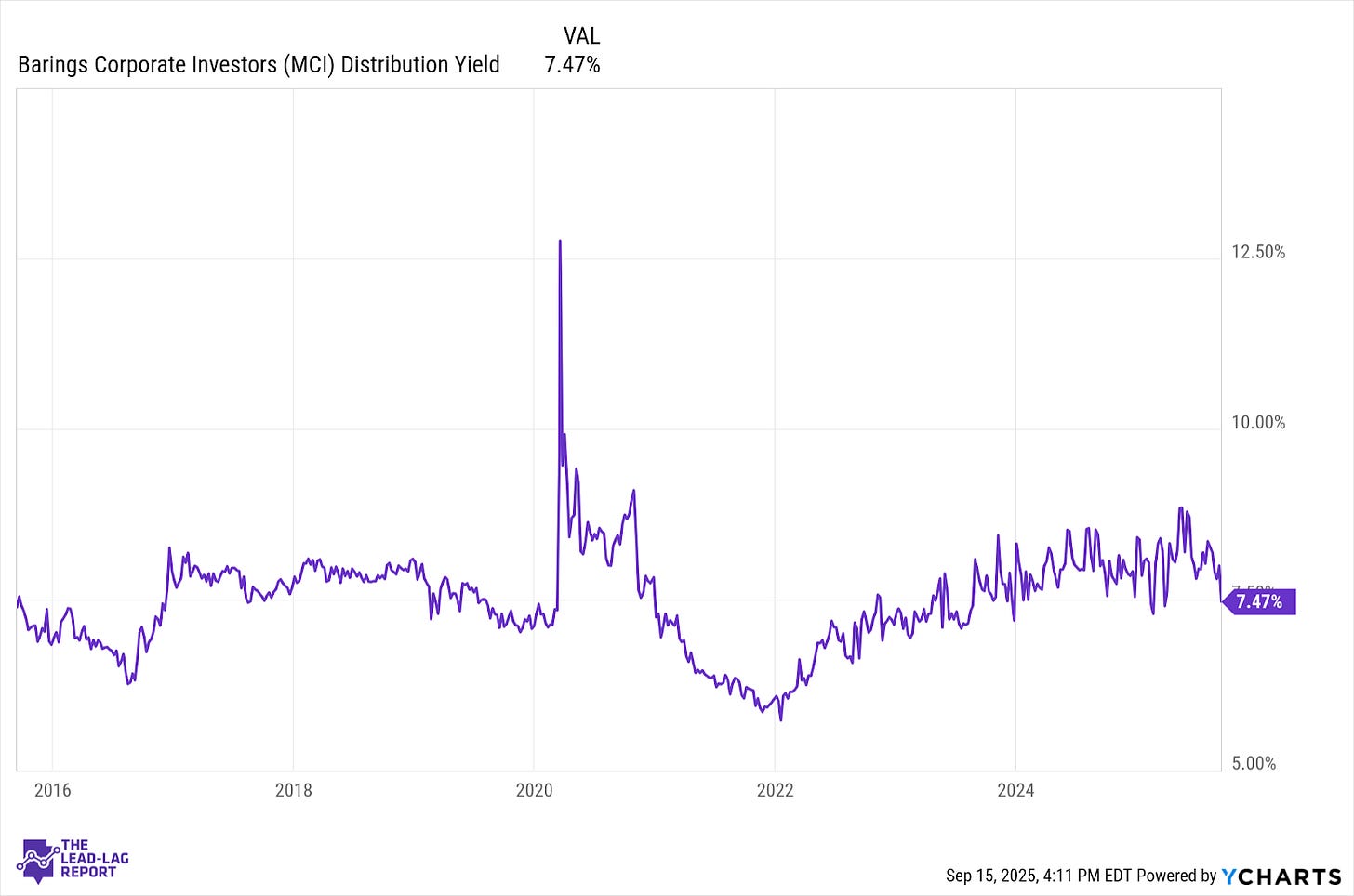

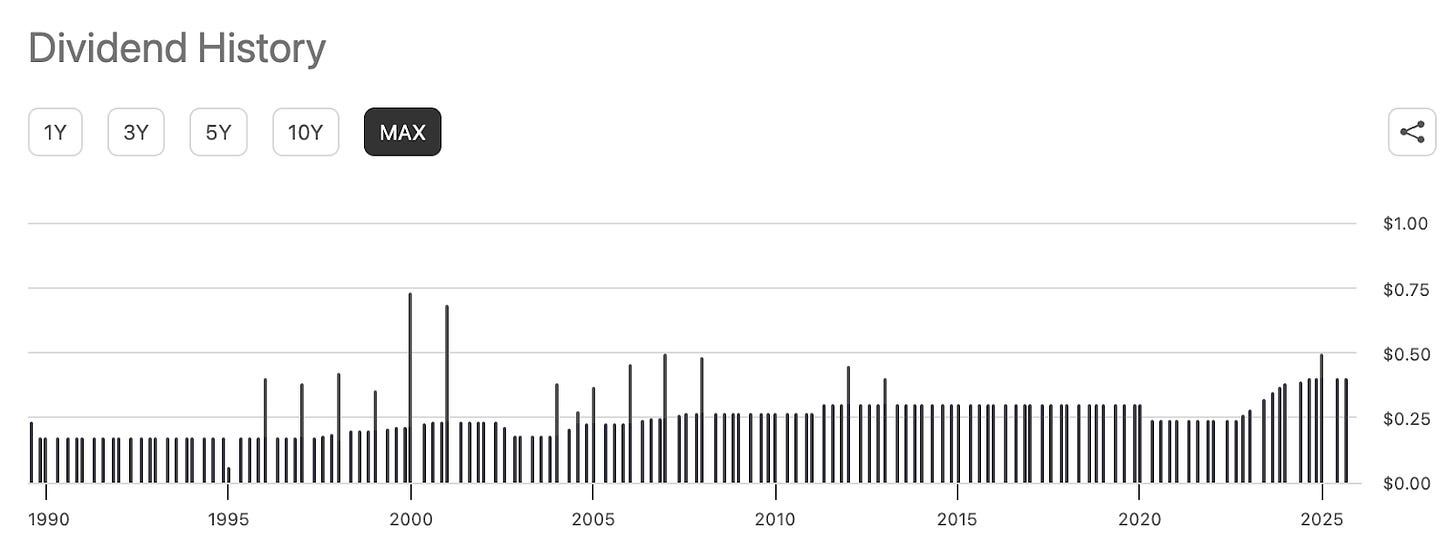

MCI maintains a flexible quarterly distribution policy. The most recent distribution was $0.40 per share or $1.60 per share annually. At current share prices, that translates to a forward-looking annualized yield of 7.0% as of September 2025.

The distribution reliability stands out in today's volatile environment. The fund has raised its payout several times over the past few years, translating to an overall 12% annualized growth rate in dividends per share since 2020. Throughout 2024, MCI supplemented regular distributions with a $0.10 per share special dividend in late 2024, reflecting non-recurring income from that period.

The sustainability question hinges on MCI's income generation capability relative to its distribution requirements. The current coverage ratio suggests adequate coverage from investment income. However, this ratio has had a wide range over the past five years, indicating periods when the fund relied on capital gains or reserves to maintain distributions. The variability reflects the cyclical nature of credit markets and suggests investors should monitor coverage ratios for early warning signs of distribution pressure.

Advantages

MCI's conservative approach to below-investment-grade debt provides remarkable consistency through market cycles, including during major market dislocations.

The fund's portfolio structure emphasizing floating-rate, secured debt instruments (primarily 1st lien) provides insulation from interest rate fluctuations while ensuring higher recovery rates during defaults.

MCI's minimal correlation to the S&P 500 offers genuine diversification benefits for traditional portfolios, particularly during equity market stress periods.

Disadvantages

The current 37% premium to NAV creates significant valuation risk.

MCI's payout ratio has fluctuated significantly over the past five years, indicating periods when the fund relied on capital gains or reserves to maintain distributions, raising questions about long-term sustainability.

The fund's high volatility level creates amplified downside risk if market sentiment shifts.

Final Thoughts

MCI presents a classic investment dilemma, which is a quality fund trading at a questionable price. The fund's fifty-year track record speaks for itself with consistent outperformance and reliable income generation that justifies investor confidence. Management quality appears solid and the underlying portfolio continues generating the cash flows that support the fund's appeal. The minimal correlation to broader equity markets provides genuine diversification benefits that many alternative income vehicles cannot match.

The current premium creates a math problem that's difficult to solve for new investors. Paying $1.36 for every $1.00 of assets changes the risk equation substantially, especially considering the fund traded at a 20%+ discount just two years ago. For current holders, the quality of the underlying fund remains intact despite stretched valuations. Those considering new positions face a different calculation, whether the fund justifies the premium price. Quality income vehicles like MCI often provide better entry opportunities for those willing to wait.

The Lead-Lag Report is provided by Lead-Lag Publishing, LLC. All opinions and views mentioned in this report constitute our judgments as of the date of writing and are subject to change at any time. Information within this material is not intended to be used as a primary basis for investment decisions and should also not be construed as advice meeting the particular investment needs of any individual investor. Trading signals produced by the Lead-Lag Report are independent of other services provided by Lead-Lag Publishing, LLC or its affiliates, and positioning of accounts under their management may differ. Please remember that investing involves risk, including loss of principal, and past performance may not be indicative of future results. Lead-Lag Publishing, LLC, its members, officers, directors and employees expressly disclaim all liability in respect to actions taken based on any or all of the information on this writing.