With the S&P 500 yielding around 1.2%, income investors are struggling to generate meaningful returns from dividends¹. Chasing higher yields often leads to riskier holdings—such as REITs or MLPs—prone to volatility or payout cuts. In this environment, investors increasingly seek quality dividend payers offering durability rather than excess yield².

The Capital Group Dividend Value ETF (CGDV) embodies this “discipline over yield” philosophy. Despite a modest ~1.3% yield, the fund emphasizes total return and sustainable dividends, appealing to long-term investors disillusioned with traditional high-yield strategies.

Fund Overview: Active Quality Dividend Strategy

Launched in February 2022, CGDV marked Capital Group’s entry into the ETF space³. Backed by its American Funds legacy, it rapidly amassed over $22 billion in assets, underscoring investor confidence⁴. The ETF seeks “income exceeding the average yield on U.S. stocks” while pursuing capital growth through fundamentally sound companies⁵. At least 80% of assets are invested in dividend-paying large-cap stocks, primarily U.S.-based, with up to 10% international exposure⁶. The fund’s expense ratio is a competitive 0.33%, low for active management⁷. It mirrors the long-standing Capital Group Dividend Value mutual fund, a strategy with over two decades of outperformance⁸.

Portfolio Composition: Growth Meets Discipline

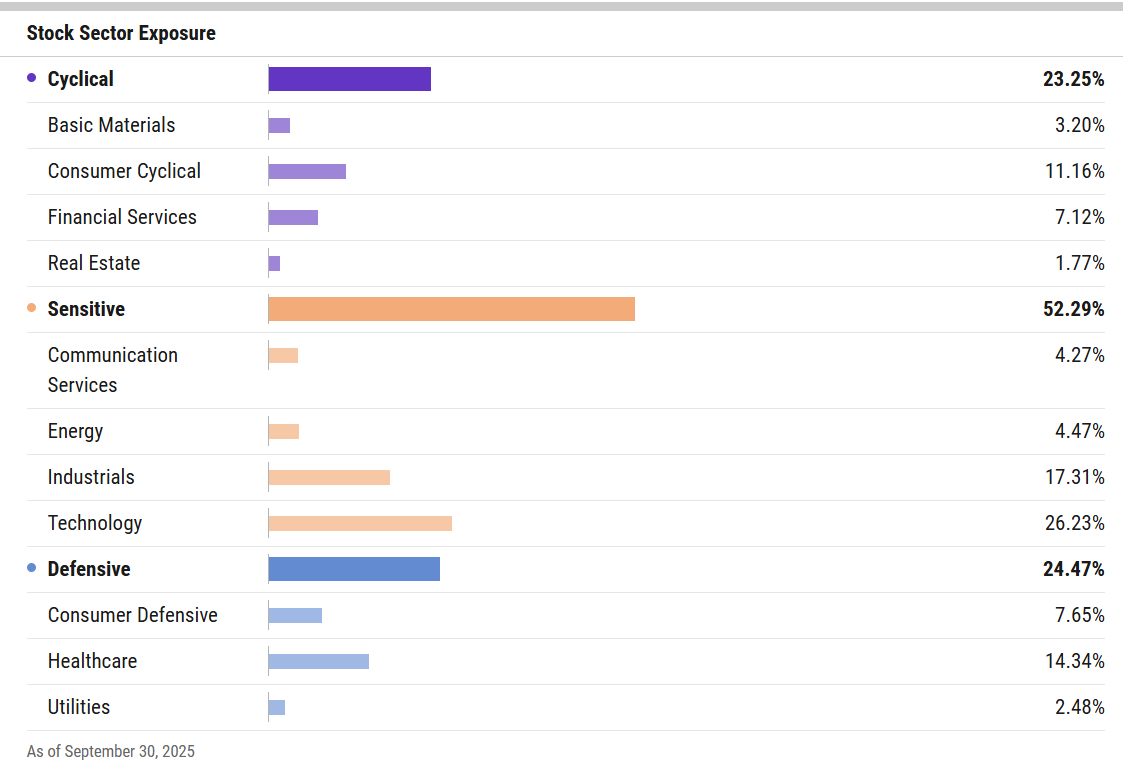

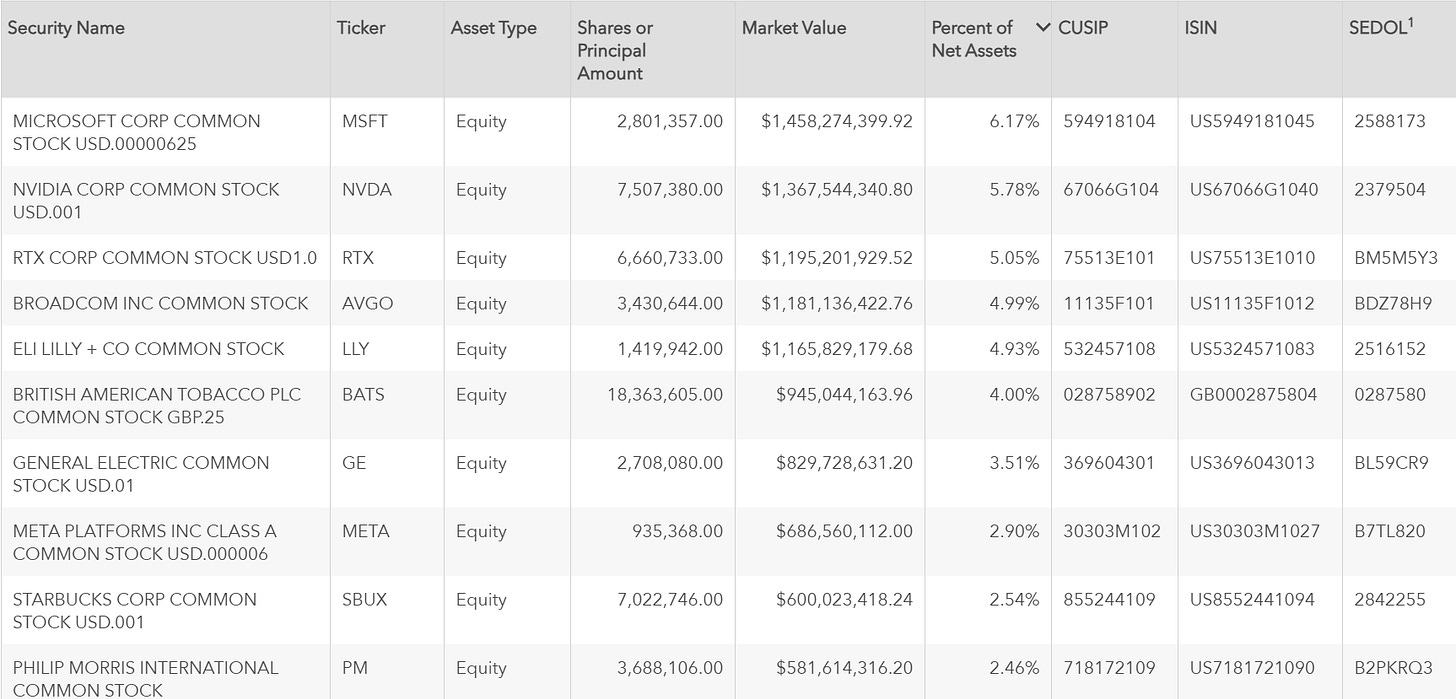

CGDV holds 53 stocks, with its top 10 accounting for 44% of assets, signaling high conviction¹¹. Technology leads sector exposure (~25%), followed by industrials (17%) and healthcare (14%)¹². Traditional defensive sectors like utilities (~2.5%) and real estate (~2%) are minimal—underscoring that CGDV isn’t a “stodgy” income play.

Top holdings include Microsoft, Nvidia, RTX, Broadcom, Eli Lilly, British American Tobacco, GE Aerospace, Meta Platforms, Philip Morris, and Starbucks¹³. The mix blends dividend stalwarts with growth-oriented names, revealing an evolved view of dividend investing: that tech can contribute meaningfully to income portfolios¹⁴.

Performance: Outperforming With Lower Volatility

Since its 2022 inception, CGDV has consistently outperformed benchmarks. As of Q3 2025, it posted an annualized return near 17.8%, surpassing the S&P 500’s 11% and the Russell 1000 Value Index’s 8–9%¹⁸. It also held up better in downturns—losing –8.5% in 2022 versus the S&P’s –18%¹⁹. CGDV’s active strategy enabled it to capture upside during tech-led rallies, while its quality tilt limited drawdowns. Its beta (~0.9) indicates slightly lower volatility than the market²⁰, and its Sharpe and Sortino ratios exceed SPY’s²¹.

Distribution Profile: Modest Yet Reliable