The November CPI report will top this week’s economic calendar and it’s likely to confirm that inflation is heading in the wrong direction. If expectations are met, the headline rate will hit a 4-month high and the core will remain at its highest level since May. In my view, the disinflationary trend is over and the Fed is going to be limited in what it can do over the next 12 months to ease interest rates. A rate cut next week is probably a done deal, which is understandable given that the Fed Funds rate is currently about 200 basis points above the headline CPI rate. Some normalization of rates is reasonable, but if core inflation is stuck well above the 3% level, while rent and services inflation are still nearly 5%, there’s not much case to be made that the Fed can keep cutting at any significant pace under those kinds of conditions.

Real interest rates right now are about 2%, which is above the historical norm. The last time this happened was just before the financial crisis. Prior to that, it happened just before the tech bubble burst. Those were generational events, so it’s difficult to say whether or not we’re headed towards another similar crash, but it does suggest that a 2% gap between the Fed Funds rate and the inflation rate is probably unsustainable. Either the Fed cuts or inflation has to rise. Given current trends, it seems likely that there will be movement on both ends of the equation to shrink that number.

For as much as we talk about an unsustainable rise in debt levels, elevated inflation and the lower income brackets still struggling to make ends meet, optimism about consumer behavior still seems to be relatively positive. Personal spending and retail sales numbers have been surprisingly resilient for months and the consumer discretionary sector might be the performing area of the stock market right now. Black Friday to Cyber Monday sales were generally regarded as good. Singles Day sales in China earlier this year actually provided some hope for consumer behavior there. Overall holiday sales in the U.S. are expected to be up again in 2024. I don’t know how sustainable the trend is where spending levels and debt levels are both on the rise, but it does suggest that the resilient consumer and resilient economy themes are still intact.

After the 10-year Treasury yield recently dropped by about 30 basis points over the course of just over three weeks, I think it’s worth mentioning that the MOVE index, which measures bond market volatility, dropped to near its lowest level in almost three years. Falling volatility is generally good for asset prices and that was certainly a major contributing factor to what we’ve been seeing in the government bond market. Prior to this current three year stretch, the MOVE index was significantly lower than its current level throughout much of 2021 and 2022. If it can keep moving lower and through that lower range band, it’s reasonable to think that Treasuries could keep rallying even in the face of further stock market gains.

On the political front, it’s also worth noting that President-elect Trump this past week said that he couldn’t guarantee that tariffs wouldn’t impact U.S. consumers. That’s important because it could impact the global economic landscape over the next several years. Trump has rather aggressively threatened tariffs on foreign exporters as part of his economic policy. His public acknowledgement that tariffs could result in higher prices and, by extension, higher inflation (which would very likely be the case) might mean he won’t be as aggressive in enacting tariffs starting next year. That would certainly be a positive for consumers and the global economy in general.

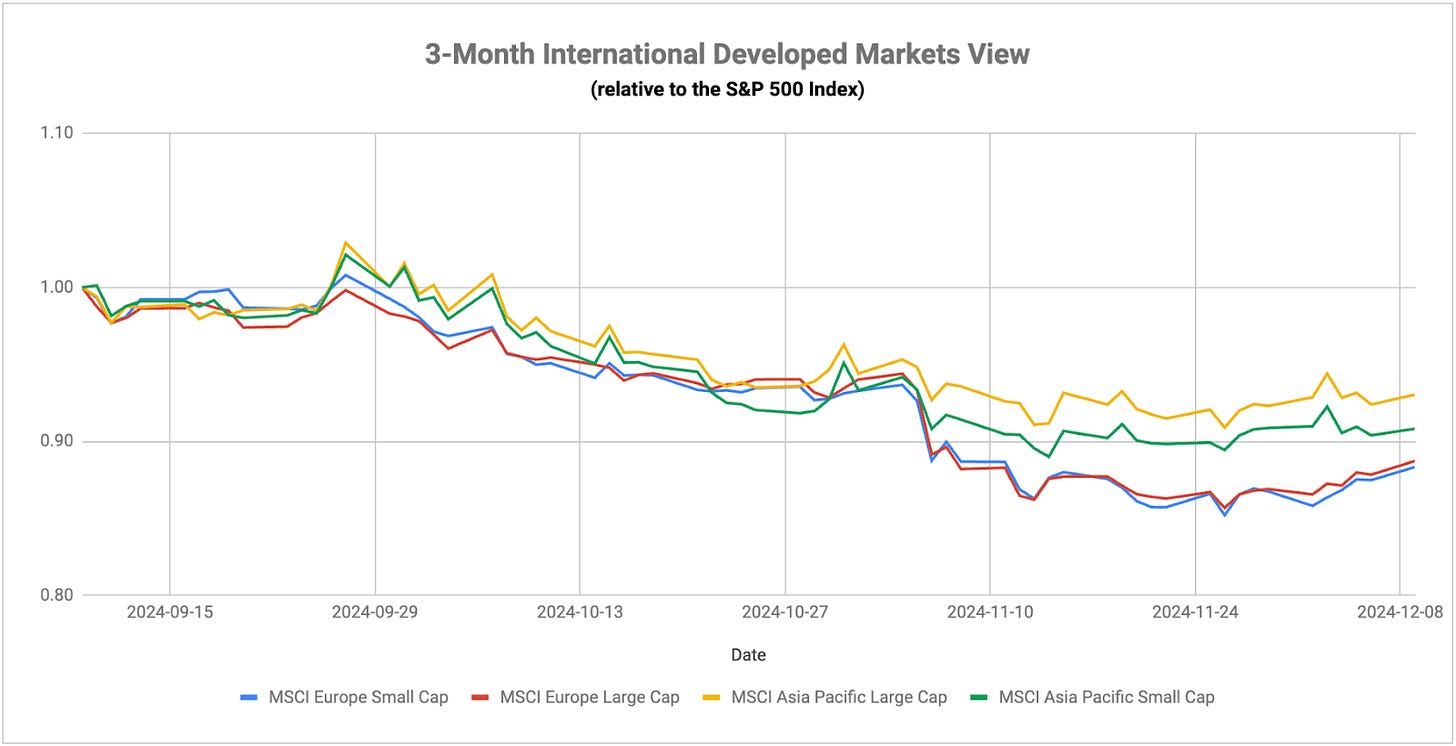

This will be a big couple of weeks for global central banks. Later this week, the ECB is expected to cut rates by another quarter point, which would bring the total rate cut this year to 135 basis points. Europe would seemingly have a stronger case for an extended rate cutting cycle over the next year. The headline inflation rate is at 2.3% and even the core rate is still well below 3%. GDP growth is still running at roughly a 1% rate year-over-year, but the latest economic data is showing contraction in many regions, especially Germany, and that means recession is still very much a risk. With inflation under control for the time being and growth at risk of turning negative, the ECB could take a substantially accommodative stance here to ignite the region’s economy. Any positive effect from further cuts is probably still months away from showing up in actual results, so I expect a slow turnaround.

The Reserve Bank of Australia held interest rates steady this week and has yet to pull the trigger on a single cut yet in this cycle. Australia still has a fairly substantial inflation problem and that’s prevented the central bank from providing any accommodation, but it did offer a bit of a softer tone this week. That means that a cut could squarely be on the table at its next meeting in February. It probably couldn’t come at a better time either. The country’s annualized GDP growth rate has slipped to less than 1% and Australian stocks are up just 9% on the year.