Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: HAS THE FED IGNITED A REPEAT OF JULY?

Consumer Discretionary (XLY) – Backed By The Data…For Now

The combination of durable retail sales and spending numbers with lower interest rates are driving a solid rebound in discretionary stocks. While I’m not necessarily a big believer in the strength of retail, there has been enough relatively positive data in the past several weeks that I wouldn’t be surprised if this sector was able to extend its outperformance a little longer.

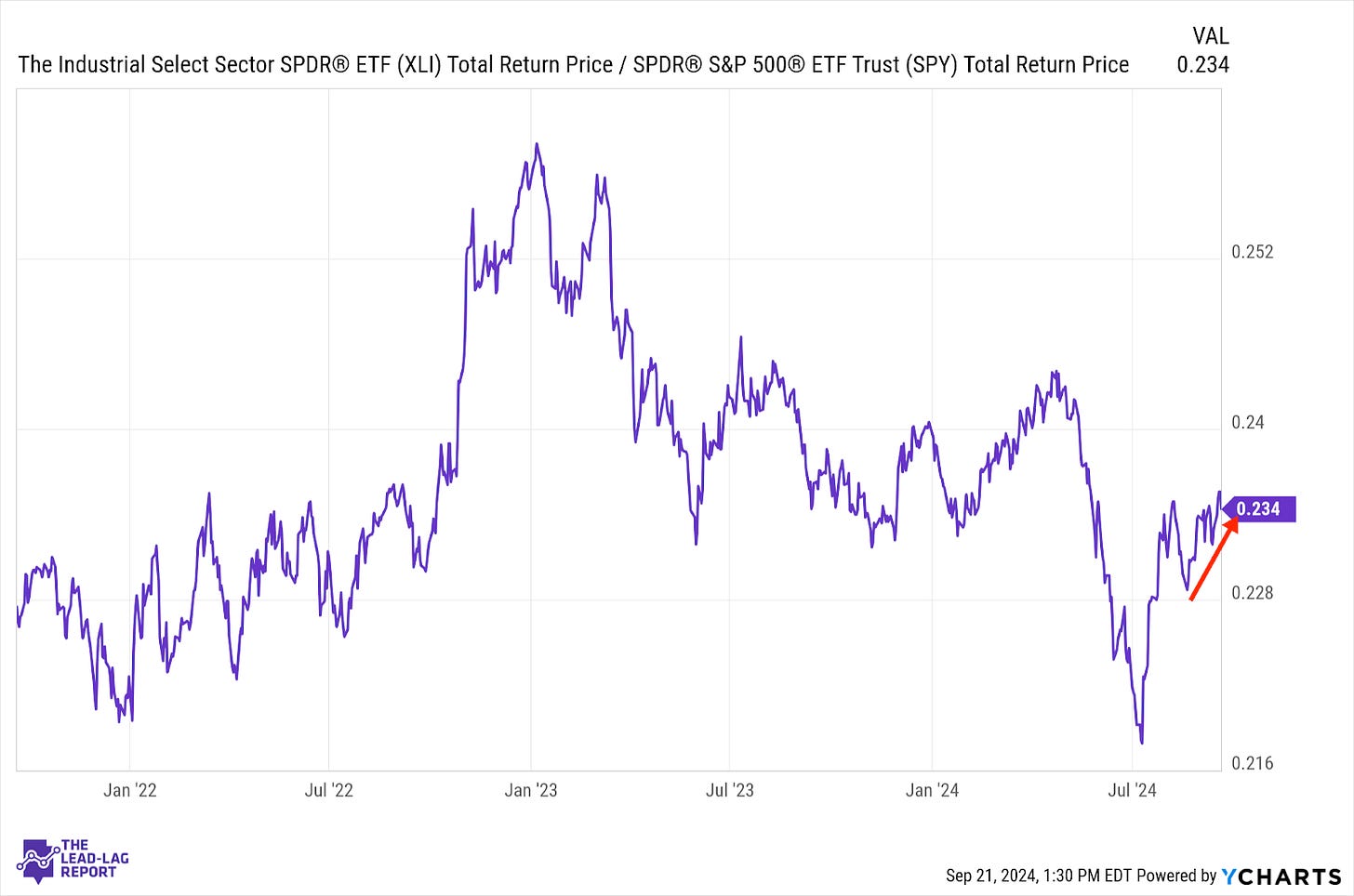

Industrials (XLI) – Getting A Jolt

After a choppy period of sideways movement, cyclicals got a nice jolt from the Fed’s rate cut last week. As we saw a couple months ago, the idea of easing monetary conditions has benefited cyclical sectors the most. Industrials may not necessarily end up as the best-performing group of the bunch (materials and energy may do some catching up in the meantime), there’s a good case that this uptrend could keep moving higher.

Financials (XLF) – Competing Forces

Lower interest rates should help unlock some lending potential for the banks, although they could also negatively impact net interest margins. If the housing market eventually unfreezes, which I think is becoming more likely, the continued upside potential here is meaningful. I suspect this sector will continue to remain volatile as these forces compete with each other.

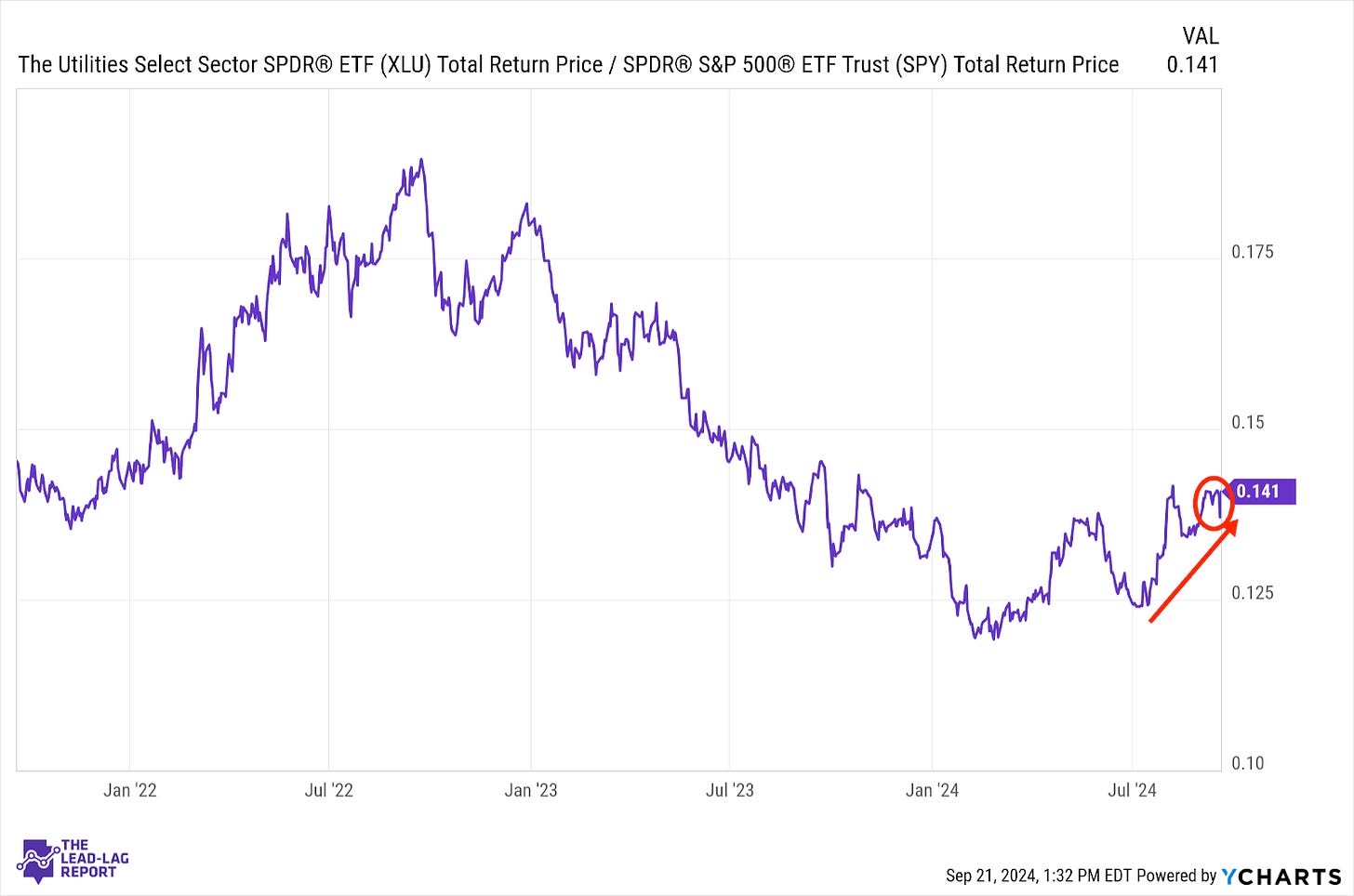

Utilities (XLU) – Resilient Strength

As the S&P 500 hits a new all-time high, it appears to be flying under the radar that utilities is still the best-performing sector this year. Maybe most notable is the fact that the sector snapped back so strongly last Friday. Even as the market takes the recent Fed rate cut as a positive sign, utilities have demonstrated a very resilient strength that isn’t being shaken.

Health Care (XLV) – Not Done Yet

Last week’s oversized rate cut was taken surprisingly well by the markets, which means there wasn’t nearly as much interest in defensive sectors. While the initial reaction was positive, we could very well see some consolidation again in the coming days. Utilities and gold are still strong here, which means sectors like this one could see some lift if underlying risk-off sentiment re-emerges.

Real Estate (XLRE) – Macro Is Concerning