Key Highlights

The Trump administration’s December 18, 2025 executive order materially advanced federal cannabis rescheduling.

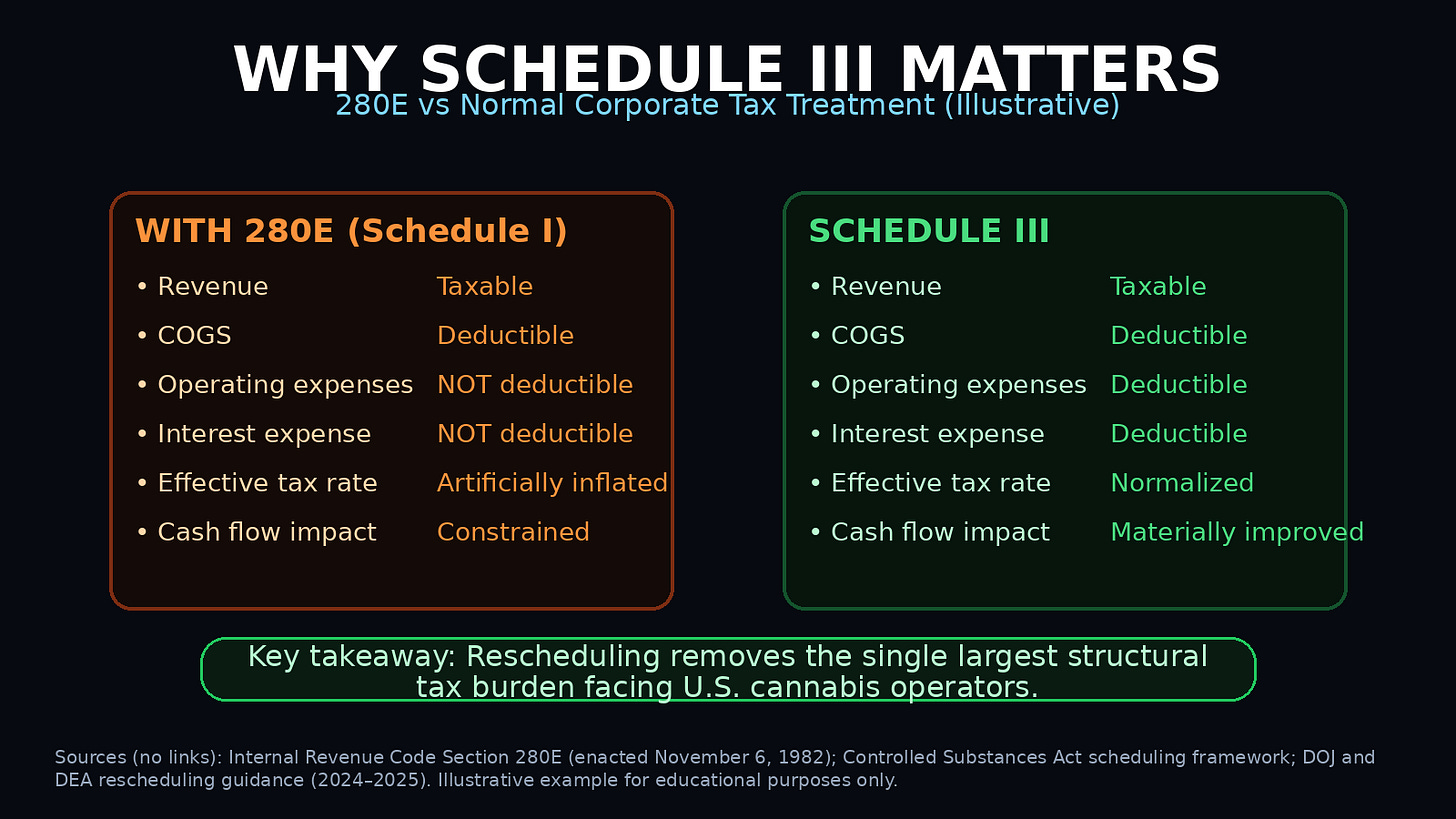

A move to Schedule III would remove 280E tax constraints, reshaping cannabis company cash flows.

Cannabis reform is no longer a purely partisan issue, altering political risk assumptions.

Several U.S. operators are positioned for outsized upside if reform proceeds.

Current equity valuations do not reflect the probability of federal normalization.

The U.S. cannabis industry has spent years trapped in an awkward middle ground. State legalization expanded rapidly, yet federal prohibition continued to impose punitive taxes, restrict banking access, and prevent interstate commerce. The result has been a prolonged bear market for cannabis equities, marked by balance-sheet stress, forced asset sales, and widespread investor fatigue. Ironically, those same pressures have created the conditions for a contrarian opportunity.

That opportunity became more tangible in December 2025, when the Trump administration took the most consequential federal action on cannabis policy in decades. For investors willing to look past recent disappointments, the disconnect between operating fundamentals and equity valuations has rarely been wider.

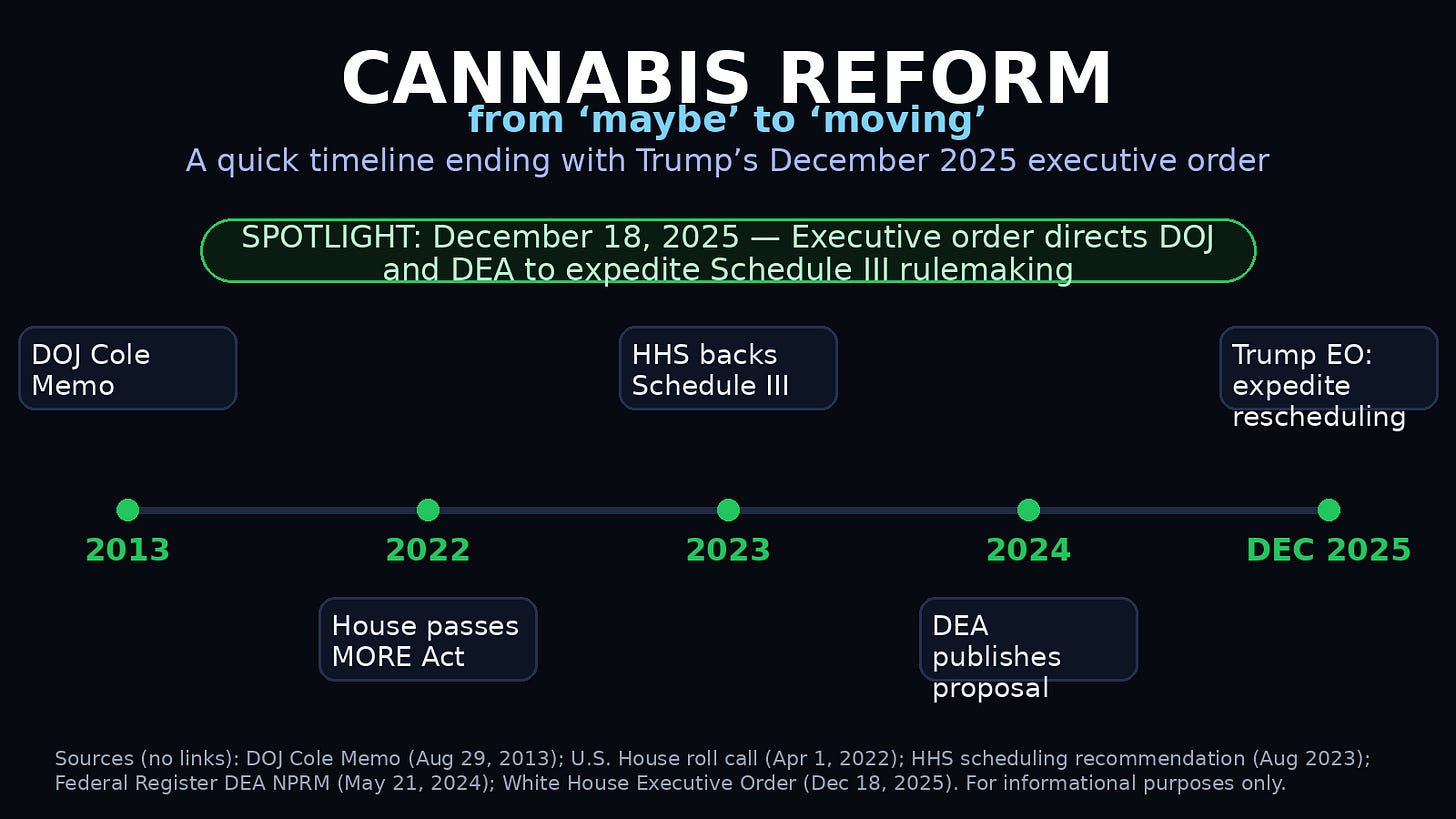

Federal Reform Is No Longer Hypothetical

On December 18, 2025, President Donald Trump issued an executive order directing the Department of Justice to accelerate the administrative process to reclassify cannabis from Schedule I to Schedule III under the Controlled Substances Act.¹ The order instructed the Attorney General and the Drug Enforcement Administration to complete the rulemaking process as expeditiously as possible, reviving an effort that had stalled after the initial proposed rule was published in 2024.¹

While the executive order does not itself legalize cannabis, its implications are substantial. A move to Schedule III would formally acknowledge accepted medical use at the federal level and, most importantly for operators, remove the application of Section 280E of the Internal Revenue Code.² That provision has prevented state-legal cannabis companies from deducting ordinary business expenses, resulting in artificially high effective tax rates and chronic cash-flow pressure.

The political context matters. Cannabis reform has long been framed as a Democratic issue, yet this directive came from a Republican administration, underscoring how detached federal cannabis policy has become from traditional partisan lines.³ At the same time, resistance remains. Several Republican lawmakers publicly criticized the rescheduling effort in early 2026, highlighting that reform momentum, while real, remains contested.⁴

For markets, however, the signal is clear. Rescheduling is no longer a theoretical campaign promise. It is an active administrative process with explicit White House backing. Even partial follow-through would materially improve after-tax earnings, balance-sheet flexibility, and access to capital for U.S. cannabis operators. The companies below are not priced for that outcome.

Four Underappreciated Cannabis Operators

Trulieve Cannabis (TCNNF)