And just like that, the trade war is back on!

Just this week, President Trump announced a 50% tariff on copper imports, a 50% tariff on imports from Brazil and a 35% tariff on Canadian imports. The reasons for the tariffs are quite varied. Copper tariffs are because of national security. Brazil tariffs are because it put former President Bolsonaro on trial. Canadian tariffs are because of fentanyl. The only commonality among the three is that they will all raise costs for American consumers and businesses.

But let’s focus on the copper tariffs for a moment.

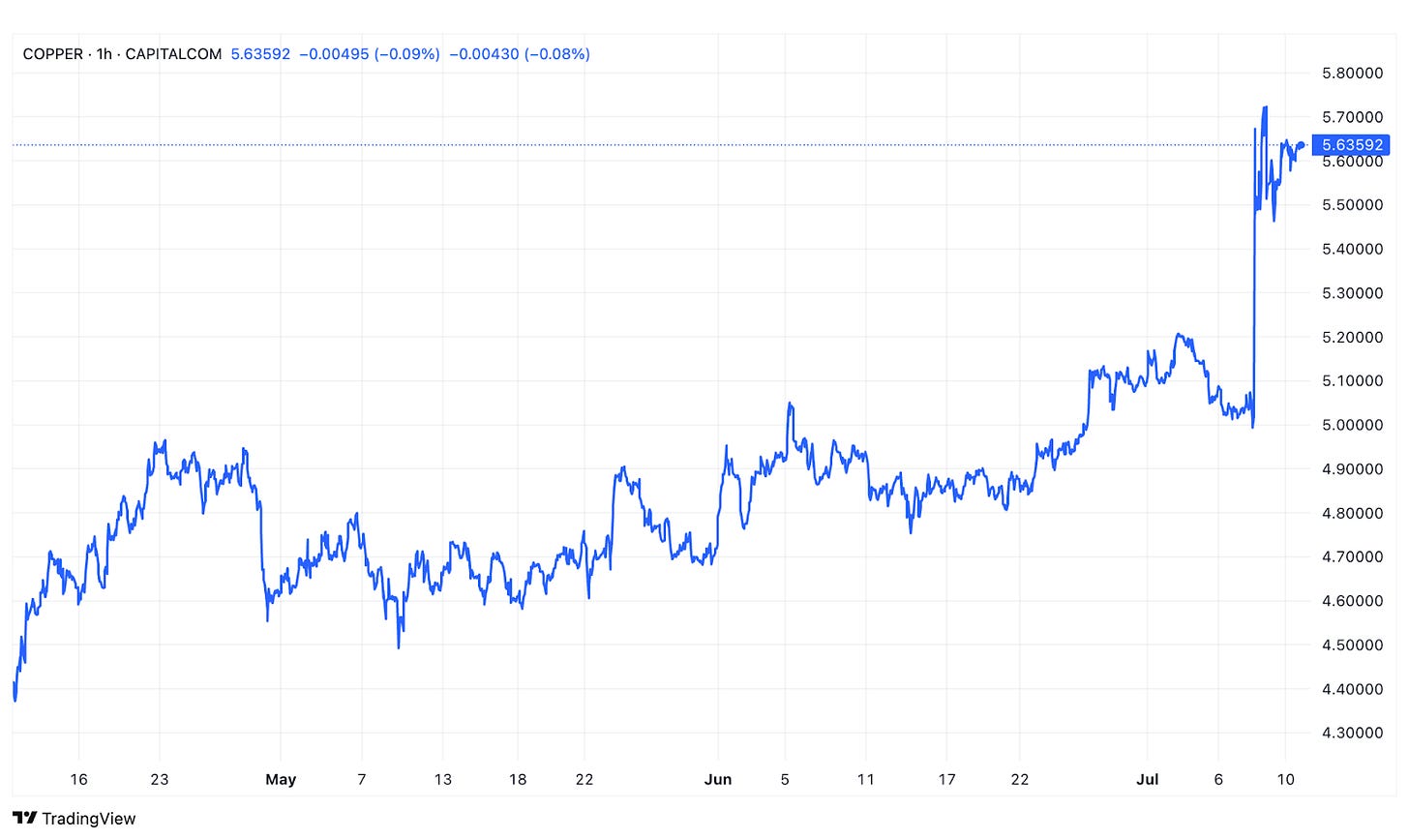

The news of the tariff helped send copper prices to record highs.

The idea that a tariff on copper imports will encourage U.S. production is a complex one. Currently, the United States is only the world’s 6th largest producer of copper with roughly 1.1 million tons produced in 2024, which is actually down about 10% from its peak level in 2022. That means the U.S. only produces about 5% of the world’s copper.

The largest producers are Chile, the Democratic Republic of Congo and Peru, which combined to produce about 11.2 million tons of copper. Even China, which is also a heavy consumer of copper, is ahead of the U.S. at roughly 1.8 million tons. Given the current geographic layout of where the world’s copper is coming from, it’s just not reasonable to think that the U.S. can easily replace what is being imported with what it can produce.

Even in the largest copper producing countries, a supply issue is worsening because existing mines are starting to get stripped of their contents and the search for newer mines has proven challenging. This comes at a time when the demand for copper is expected to surge. Since it’s used in everything from homebuilding to infrastructure to data centers, it’s going to be a key component in the global manufacturing sector for years to come.

A 50% on copper imports, which is where the U.S. gets roughly half of its supply from, could become incredibly burdensome very fast.

Here are a few reasons, however, why it might not be anything to worry about.

They Won’t Be Enacted Until August 1st

Trump’s tariff threats usually come with weeks of lead time. The reason often given is so that the country can negotiate a trade deal in the meantime. While that may sound good in theory, what qualifies as a trade deal or what level of concession would be necessary to avoid the tariff is usually pretty murky. Trump often says that countries should just begin manufacturing in the United States to avoid the tariff, but that’s obviously not going to happen in the next three weeks.

Trump Doesn’t Have A Strong Track Record Of Following Through On Tariff Threats

We’ve seen this multiple times since Liberation Day. Not long after Trump initially announced his planned tariff rates, he began delaying their implementation. They got postponed and/or reduced often enough that the markets largely started ignoring trade war developments because they realized that anything that was announced would probably be modified or delayed within a matter of days.

To date, Trump has signed few actual trade deals and the ones he has signed have mostly been pretty limited. Which is probably why this week…

The Markets Haven’t Really Reacted

The price of copper jumped sharply on the news of the tariff threat, but stocks and bonds have mostly been unmoved. After a bit of a jolt on Monday, equities and fixed income have both been steadily moving higher and are in positive territory for the week through Thursday’s market close. This is consistent with what we’ve seen over the past month or two of the markets paying less and less attention to short-term trade war machinations.

Implications For Investors

Maybe none.

Again, stocks, bonds and gold are all up on the week through Thursday. Small-caps continue to outperform large-caps in the month of July and that’s usually a sign of optimism about an expansionary economy. Tariffs are inherently inflationary and you’d probably expect small-caps to underperform if investors were worried about that.

Volatility never spiked this week. The futures market is pricing in essentially the same rate cut expectations today as they did a week ago, so no real concern about higher inflation on that front.

It’s pretty much just been business as normal. Without any significant escalation, the markets don’t seem terribly concerned.

From a long-term perspective, there’s an easy bull case to be made for copper based on macro alone. The demand for copper is likely to steadily increase for a while, but the supply could begin to dwindle without new sources to draw from.

In the end, Trump tried to make another trade threat to multiple countries and towards one very important commodity market. The markets largely blew it off.

The Lead-Lag Report is provided by Lead-Lag Publishing, LLC. All opinions and views mentioned in this report constitute our judgments as of the date of writing and are subject to change at any time. Information within this material is not intended to be used as a primary basis for investment decisions and should also not be construed as advice meeting the particular investment needs of any individual investor. Trading signals produced by the Lead-Lag Report are independent of other services provided by Lead-Lag Publishing, LLC or its affiliates, and positioning of accounts under their management may differ. Please remember that investing involves risk, including loss of principal, and past performance may not be indicative of future results. Lead-Lag Publishing, LLC, its members, officers, directors and employees expressly disclaim all liability in respect to actions taken based on any or all of the information on this writing.