Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

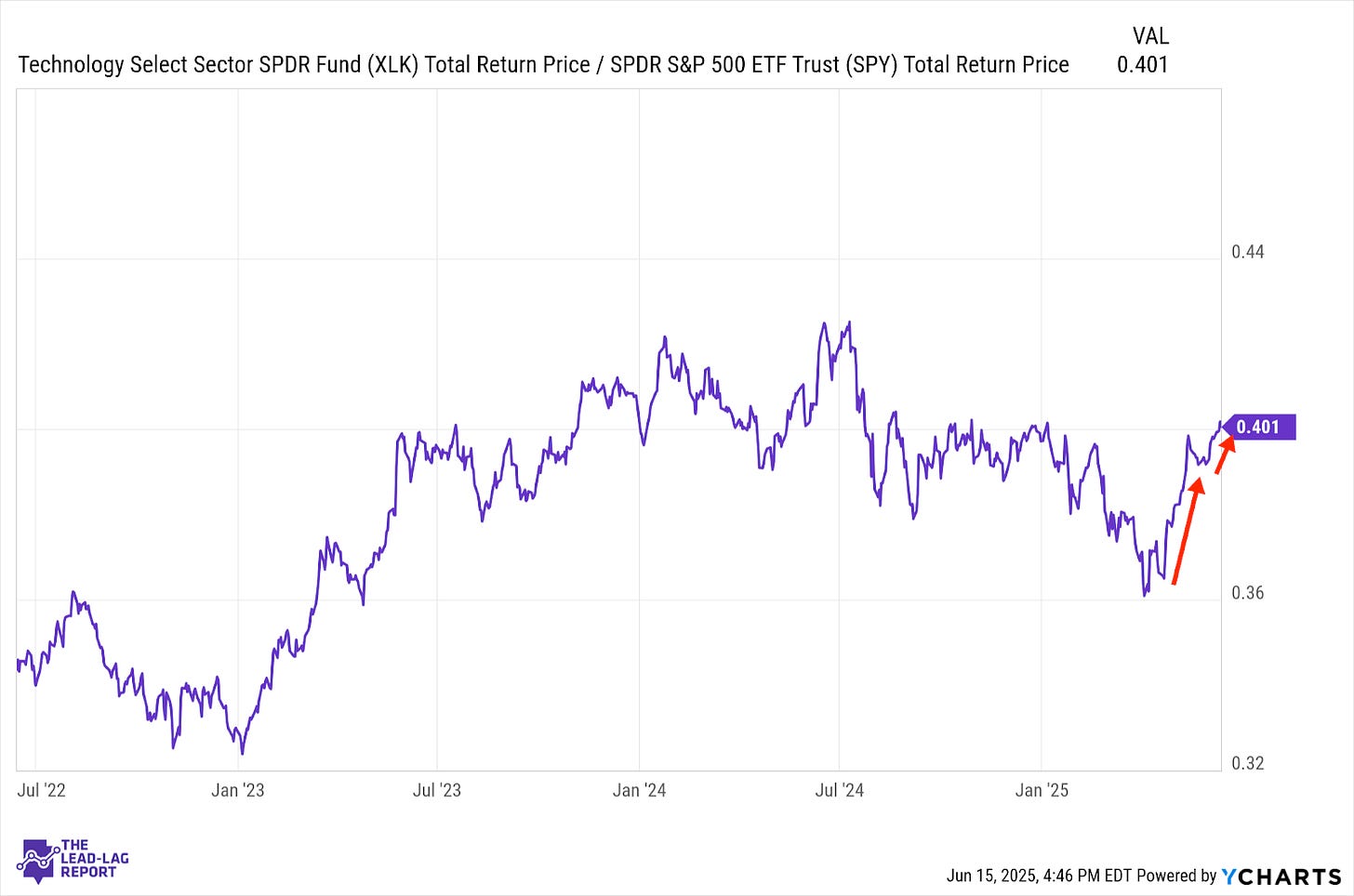

LEADERS: IS THE TECH RALLY A GOOD THING OR WARNING SIGN?

Technology (XLK) – Economy On The Right Path

Despite geopolitical risks, investors continue to remain confident that the U.S. economy is on the right path and that clears the path for risk taking. On that front, there’s a case to be made. GDP growth is expected to rebound in Q2. Inflation appears to still be under control for now. The labor market shows little sign of cracking. Those would be the types of conditions that support a continued expansion.

Energy (XLE) – Short-Term Disruption

The Iran-Israel conflict looks more like a short-term supply shock than a true risk-off event. These types of things tend to be disruptive for a short period of time before tensions cool or facilities get back online. Then conditions and energy prices tend to revert to their pre-event levels. I suspect we’re about to see the same thing happen here as well.

Health Care (XLV) – Worth Watching

Look closely and you’ll see that healthcare is actually doing fairly well despite the backdrop of tech & growth stock outperformance. Granted, it’s a very shallow uptrend, but seeing as how stretches of outperformance have been few and hard to find over the past 2+ years, it’s an interesting development. This sector tends to be a consistent outperformer during down markets, so this ratio becomes one worth watching closely.

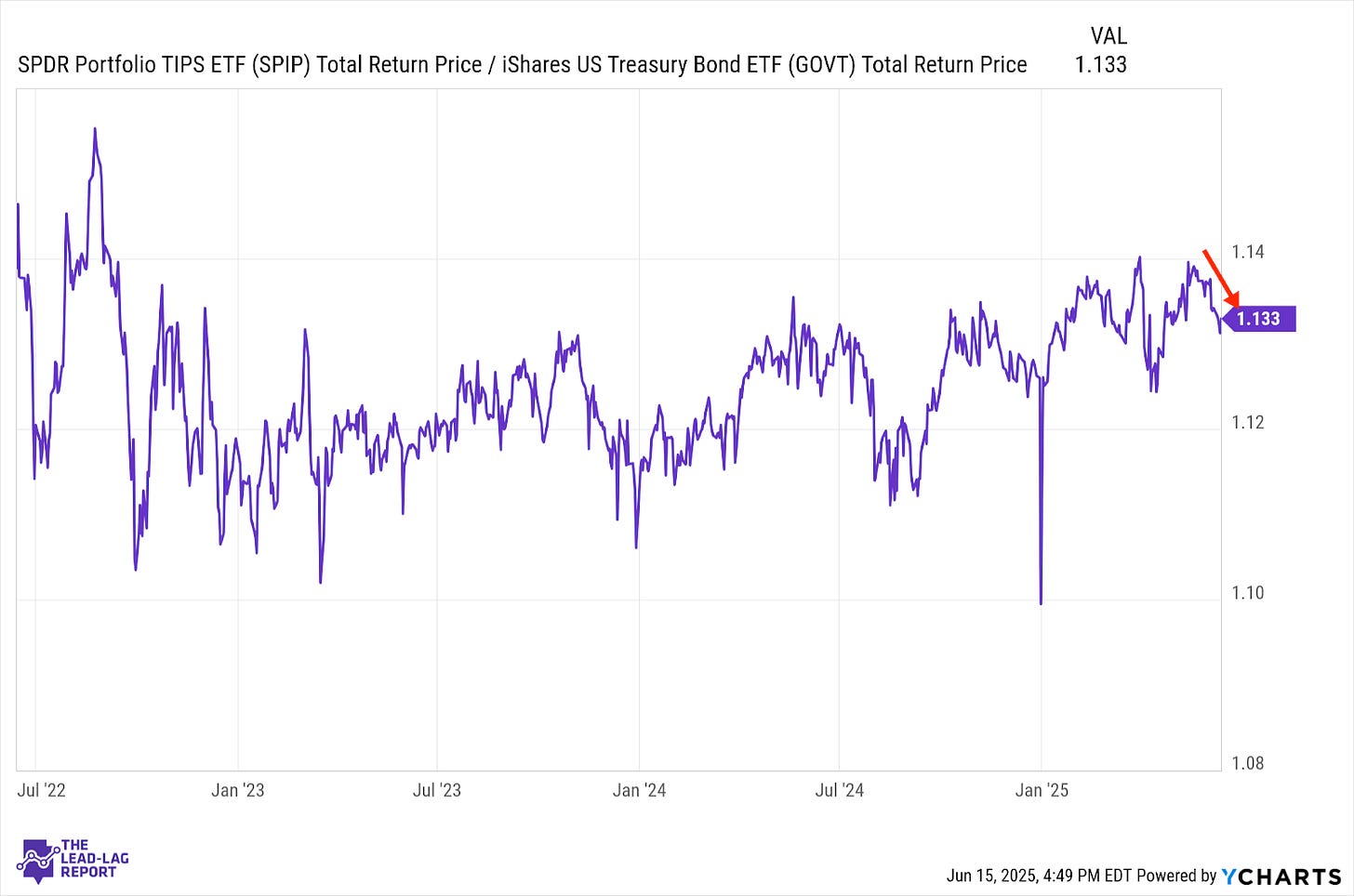

Treasury Inflation Protected Securities (SPIP) – Investors Never Really Priced In Risk

With last week’s CPI and PPI still showing moderation in price growth, investors are pushing inflation concerns to the backburner. Judging by the relative performance of TIPS over the past couple of years, bond investors never really positioned themselves for a tariff-related inflation spike. Perhaps that still comes at some point, but the tenor of the trade war seems more measured and controlled moving forward.

Junk Debt (JNK) – Outperformance Is Shallowing

Junk bonds seem to be running into a ceiling in its performance relative to Treasuries. Outperformance has begun to level off a bit, although lower-rated bonds still seem firmly in favor for bond traders. With inflation contained and growth appearing to rebound, investors are back to showing little concern for credit risk, as they did prior to 2025.

European Banks (EUFN) – An Advantage On Rates