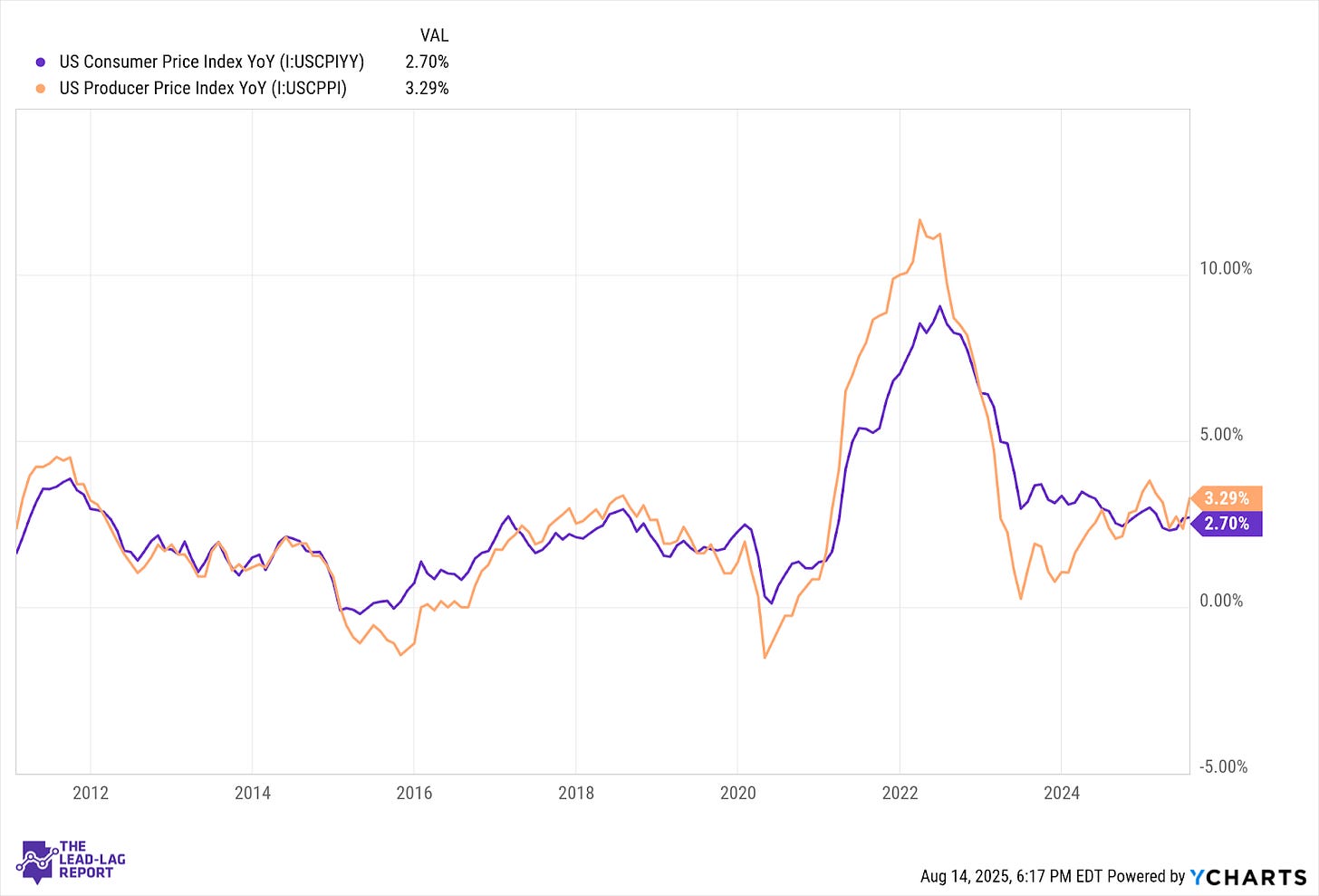

This past week’s highly anticipated inflation reports yielded a mixed bag of results, although I’m guessing most investors only paid attention to one number. The July CPI rose 0.2% month-over-month to an annualized rate of 2.7%. The core CPI rose 0.3% to 3.1% annualized. Both rates are well above the Fed’s 2% target, but the market nonetheless took that as a sign that the Fed now has the all-clear to cut rates in September. On top of that, the market is pricing in an increasing chance that they’ll cut in October and December as well.

The number the market paid less attention to was the producer price inflation (PPI) rate. In July, it rose a blistering 0.9%, way above consensus estimates for a 0.2% increase, to an annualized rate of 3.3%. The monthly increase was the largest since early 2022, but the annualized rate is only at a 5-month high.

I’m in the minority, but I’ve argued that the Fed should continue to consider rate hikes here, not cuts, and the inflation data presents a case-in-point why. Price increases are starting to accelerate again and the Fed loosening monetary conditions at the same time adds fuel to the fire. Granted, rate cuts take a while to get baked into the system, but it’s a dangerous counterintuitive move that the Fed is considering.

Plus, there’s also the why of it. Why does the Fed need to cut rates with the unemployment rate at 4.2% and GDP coming in at 3% in Q2? Is that an economy that really needs a helping hand from the Fed right now?

The market usually looks to the Fed for signals on conditions. Not necessarily economic conditions, but monetary conditions. If we look at the trend of some of the data, including inflation rising and the labor market slowing, you’d think that would favor a decline in stock prices. But we’re seeing rising stock prices and record highs for the S&P 500. Why? Because the market is in love with the idea of rate cuts. Never mind the reasons why the Fed needs to cut rates. They want the cuts!

The July inflation data, however, complicates that narrative.

Are Tariffs To Blame?

This is probably the obvious question. While there’s been a lot of stops & starts and who really knows what’s actually being tariffed and what isn’t at this point, there has been activity to know that it’s been negatively impacting importers.

Just look at the products with the biggest price increases - vegetables, meat and diesel fuel. Those are all import-sensitive commodities (manufacturing broadly also saw big price increases). U.S. companies are likely paying higher prices for these goods & more and it’s starting to bleed through to the data.

Conclusion: Tariffs probably played a significant part in the PPI numbers, but they’re not the sole cause.

Will Higher PPI Lead To Higher CPI?

One would think that the logical answer is yes. There have been a number of anecdotes in this cycle already where companies that have been saddled with higher import costs have passed those costs on to customers.